[ad_1]

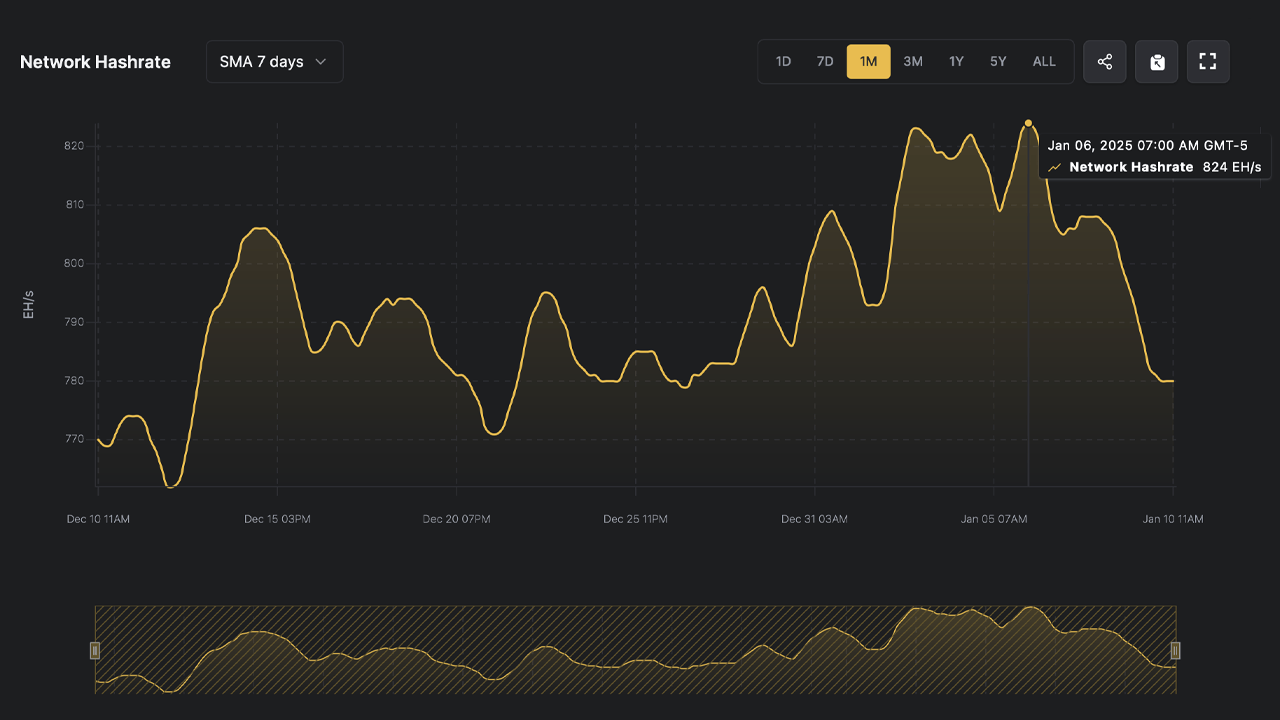

Bitcoin’s network has seen a noticeable shift in its computational capacity, shedding around 44 exahash per second (EH/s) in the past four days.

Tough Terrain for Bitcoin Miners

The network’s hashrate, which reached a peak of 824 EH/s, has now settled at 780 EH/s, based on the seven-day simple moving average (SMA). This reduction, equivalent to 44,000 petahash per second (PH/s), aligns with a drop in hashprice—the projected earnings in either U.S. dollars or bitcoin (BTC) per petahash—which fell from $59.29 to $53.41.

The global hashrate has lost 44 EH/s since Jan. 6, 2025.

The diminished revenue stems from bitcoin’s 3.9% decline against the U.S. dollar over the last seven days. As a result, block intervals have slightly slowed to an average of 10 minutes and 2 seconds, potentially prompting a minor difficulty adjustment on Jan. 12 at block height 878,976. However, the anticipated adjustment, a decrease of 0.3% to 0.4%, may offer miners only limited relief.

Thus far, miners have accrued $409.13 million, including $5.65 million in transaction fees according to theblock.co stats. With a high-priority fee currently at 4 satoshis per virtual byte (sat/vB), equivalent to $0.53 per transaction, miner earnings from fees remain subdued. Bitcoin’s network activity also reflects a slower pace compared to last year, processing just 292,213 transfers on Jan. 1, with the highest daily total to date recorded on Jan. 9 at 534,013 transfers.

For bitcoin miners, these developments present an intricate puzzle. The combined pressures of falling hashprice, reduced transaction volumes, and minimal fee revenue intensify the challenge of maintaining profitability. Many miners await the forthcoming difficulty adjustment, hoping it will ease some of the strain. Yet, the modest scale of the adjustment is unlikely to counterbalance the mounting operational burdens.

[ad_2]