MicroStrategy’s almost 300% premium to its bitcoin holdings is unsustainable, the report said.

The positive effects of the company’s recent stock split are wearing off and the launch of options on spot bitcoin ETFs will also lessen demand, Steno said.

The report noted that during the 2021 crypto bull market MicroStrategy’s premium hovered below 200%.

MicroStrategy’s (MSTR) current premium relative to its bitcoin (BTC) stack is unlikely to last, Steno Research said in a report Friday.

“This conviction is reinforced by the diminishing effects of MicroStrategy’s recent stock split,” analyst Mads Eberhardt wrote, adding that the launch of options on spot bitcoin exchange-traded funds (ETFs) in the U.S will also lessen the motivation for investors to hold the stock over these ETFs.

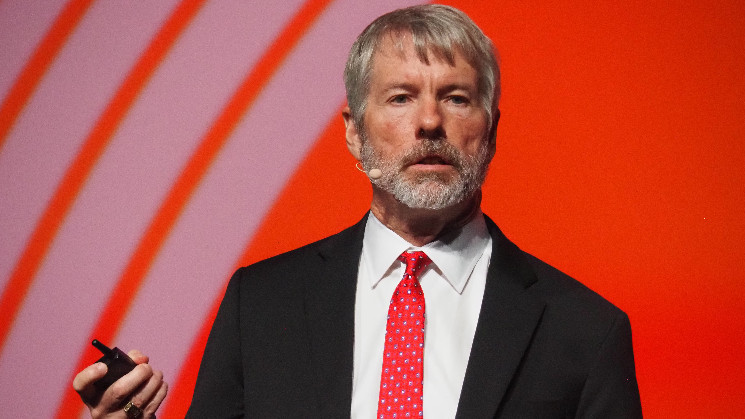

The software company founded by Michael Saylor carried out a 10-for-1 stock split in August, a move that according to Steno has contributed to the recent rally.

Steno noted that the company’s premium relative to its bitcoin horde has recently surged to almost 300%.

This suggests that the firm’s valuation is “diverging significantly from a straightforward calculation of its asset and and business fundamentals,” the report said.

As regulators become more favorable to bitcoin and crypto in general, investors may choose to hold bitcoin directly instead of MicroStrategy stock, Steno said. If Donald Trump is re-elected this regulatory trend is expected to continue.

Bitcoin is expected to perform strongly this quarter and into 2025, which means that an “even higher buying demand would be required to sustain MicroStrategy’s current premium,” the note said.

MicroStrategy’s existing premium is unsustainable, especially given the fact that during the 2021 crypto bull market it was below 200% for most of the time, the report added.

The stock recently hit a new all-time high, having surged over 240% year-to-date.

Read more: MicroStrategy Touches New Highs as Trading Volume Relative to Nvidia Surges