Welcome to our institutional newsletter, Crypto Long & Short. This week:

- Josh Olszewicz of Canary Capital on equities, liquidity and crypto’s early — but still tentative — signs of a bullish turn.

- Joshua de Vos analyzes ten major blockchain ecosystems and trends to watch in 2026.

- Top headlines institutions should pay attention to, curated by Francisco Rodrigues

- “Solana’s Risk Appetite Returns” in Chart of the Week

Thanks for joining us!

-Alexandra Levis

Expert Insights

Markets at Highs, Crypto Still Waiting

– By Josh Olszewicz, head of trading, Canary Capital

Macro & equity backdrop

Broader equity markets continue to print all-time highs (ATHs). Equal-weight indices (i.e., RSP) are showing notable strength alongside new ATHs in the S&P 500, while QQQ also appears poised to challenge highs. Sector leadership remains broad, with energy, commodities, defense, aerospace, biotech/pharma and small caps leading. The primary drag within equities continues to be the Magnificent 7, with relative weakness outside of Google, Amazon and Tesla.

Rates, liquidity, and the fed

Following today’s unemployment report, which came in slightly stronger than expected, market-implied rate odds for the January FOMC meeting have shifted decisively into the “no cut” camp. This aligns with the Fed’s recent emphasis on labor data over inflation. That said, the broader inflation narrative remains increasingly dovish. Real-time inflation metrics from Truflation have fallen below 2.0%, while inflation nowcasts from the Fed show month-over-month declines in the PCE Price Index, the Fed’s preferred inflation gauge, dating back to October.

Looking ahead, President Trump’s yet-to-be-named replacement for Fed Chair Jerome Powell is widely expected to initiate a rate-cutting cycle beginning in the second quarter . Importantly, total Fed assets have started to rise again after the formal end of quantitative tightening late last year, signaling renewed liquidity entering the system.

Crypto relative performance & rotation risk

Many trades have been working, most notably gold and silver, which paradoxically remains one of the largest headwinds for bitcoin $BTC$97,654.92 and ether $ETH$3,370.58. Capital may eventually rotate back into crypto, but timing remains uncertain. For now, the crypto market risks feeling like Waiting for Godot, stuck in anticipation of a breakup that never arrives.

Two of the more actionable trades currently appear to be Metaplanet and Monero. Metaplanet, often viewed as the Japanese MicroStrategy (MSTR) analog, has completed a bearish-to-bullish reversal after an 82% drawdown from its June highs. In contrast, MSTR itself continues to flounder near lows, with no clear technical evidence of a durable bottom. Monero $XMR$712.55, which often trades inversely to bitcoin, has formed a decade-long ascending triangle and appears poised for higher prices, particularly as the privacy-coin narrative has recently gained traction. Zcash’s developer exodus may further push capital into other privacy coins, providing a bullish tailwind for $XMR.

Bitcoin technicals & structure

A potential catalyst for broader crypto recovery is a developing bearish-to-bullish reversal in $BTC. Price has been forming an Adam (V) & Eve (U) style double bottom, which can also evolve into an inverted head-and-shoulders or an ascending triangle. Each of these patterns carries a measured-move target toward the $100k+ region. Previously, downside risk was centered on a potential high-timeframe bear flag breakdown, but that threat appears to have faded following aggressive tax-loss harvesting into year-end 2025. That said, $BTC ETF flows remain firmly negative, with another ~$700 million in outflows this past week.

https://www.tradingview.com/x/3C0H83GB/

Positioning, derivatives & on-chain signals

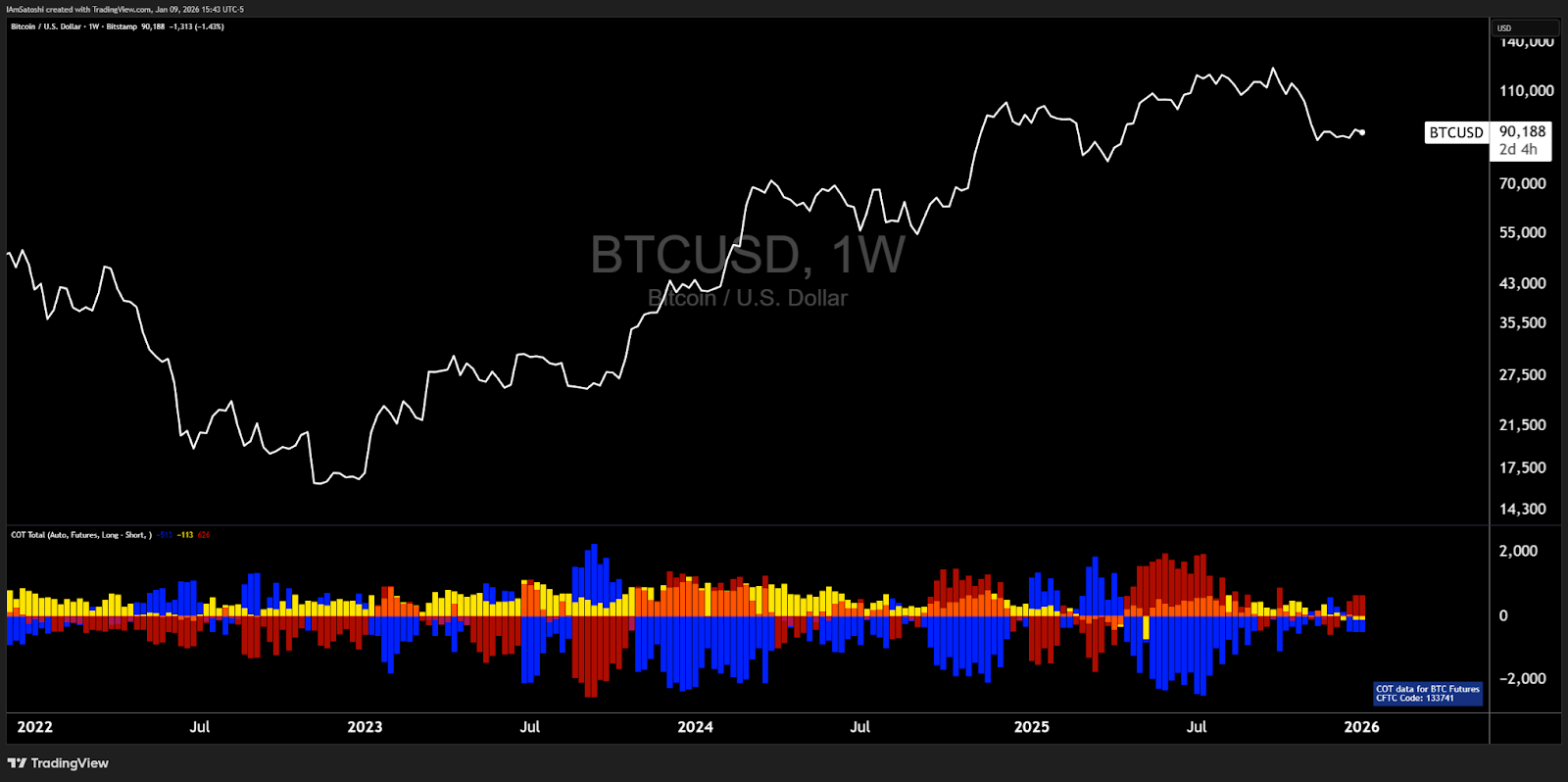

Additional, albeit modest, bullish confluence is emerging from positioning data. Derivatives funding rates across crypto exchanges and CME Commitment of Traders (CoT) data both suggest early signs of a bullish shift. Traders remain net bearish, while commercial participants retain a bullish bias, an imbalance that could fuel sharp upside if shorts are forced to cover.

Commercial miners, which had been neutral to bearish in recent weeks, have now flipped bullish. Meanwhile, hashrate has declined sharply since mid-October. Hash ribbons (30- and 60-day moving averages of hash rate) printed a bearish cross in late November, a signal historically associated with $BTC weakness. However, both hashrate and hash ribbons are attempting to stabilize just as price appears to be consolidating, setting the stage for a potential inflection point over the next few weeks.

https://www.tradingview.com/x/mzLzQpeJ/

Headlines of the Week

– Francisco Rodrigues

The cryptocurrency market’s “infrastructure phase” of institutional adoption appears to be well underway, with major financial institutions now setting the building blocks necessary for their continued involvement. As finance steps in, crypto lobbies Washington to protect its model.

- Morgan Stanley files for bitcoin, ehter and solana ETFs: Morgan Stanley has filed with the U.S. Securities and Exchange Commission (SEC) to launch spot bitcoin, solana, and ether exchange-traded funds.

- Lloyds Bank completes UK’s first gilt purchase using tokenized deposits: The transaction used blockchain-based bank deposits to instantly settle the bond purchase and was executed with the help of Archax and Canton Network.

- Barclays invests in stablecoin settlement firm as tokenized infrastructure advances: Ubyx is building a clearing system designed to let tokenized bank deposits and regulated stablecoins move between institutions at par.

- Coinbase pushes back against banks to keep rewarding users for holding stablecoins: Coinbase is signaling potential opposition to the CLARITY Act to preserve its stablecoin rewards program, arguing it would stifle competition and harm consumers.

- Stand With Crypto advocacy group sees nearly 700,000 new members ahead of 2026 election: The Coinbase-established organization Stand With Crypto reported an increase in its signups of 675,000 last year. It now has about 2.6 million U.S. members.

Research Report

State of the Blockchain 2025

– By Joshua de Vos, Research Lead, CoinDesk

The 2025 crypto market was defined by a widening gap between activity and price performance. Across most major ecosystems, usage expanded while tokens struggled to reflect that progress. This pattern was consistent across Bitcoin, Ethereum and the large alternative Layer 1s, and it points to a shift in where value is being captured.

Data from our State of the Blockchain 2025 report makes this clear. Total value locked (TVL) increased in native terms in seven of the eight ecosystems covered. Daily activity rose in four. Over the same period, base layer fees declined across all eight. App-level revenue moved in the opposite direction. Aggregate quarterly app revenue increased from roughly $3.9 billion in the first quarter to more than $6 billion by quarter four. Layer 1s continue to dominate market capitalisation, but they now capture a much smaller share of economic value.

Ethereum’s ether $ETH$3,370.58 sits at the centre of this shift. $ETH underperformed on price in 2025, yet ecosystem fundamentals strengthened. TVL increased, stablecoin supply expanded and decentralized exchange (DEX) volumes grew. Despite this, Layer 1 revenue fell sharply as execution and activity migrated to rollups, while application revenue remained broadly stable. Value did not leave the ecosystem. It changed where it accrued to. Institutional flows, particularly via digital asset treasuries, became a more important driver of $ETH price dynamics as fee-based valuation weakened.

Solana followed a somewhat similar trajectory. On-chain usage remained elevated across memecoins, payments, DePIN and AI-related activity. Stablecoin market capitalisation expanded sharply and proprietary AMMs accounted for roughly half of DEX volume by year-end. Market structure improved, even as price volatility continued. Regardless, throughput and activity alone were not enough to drive token performance.

BNB Chain stood out last year by converting infrastructure upgrades directly into execution quality. Faster finality and lower fees translated into strong application-level revenue growth. Perpetual DEXs dominated volumes, and price performance reflected monetisation at the application layer rather than base layer fee capture.

Bitcoin moved along a different path. Institutional ownership continued to rise through ETFs and public treasury companies, with combined holdings approaching 13% of supply. Miner revenue remained heavily dependent on block subsidies, with transaction fees contributing a minimal share. This increased the relevance of BTCFi and Bitcoin Layer 2s that generate sustained on-chain activity and fee demand.

Across ecosystems, incentive-driven growth faced greater scrutiny. In ether lending, monolithic protocols retained dominance while modular markets slowed following risk events. In other areas, volume concentration raised questions around durability. Capital allocation became much more selective over the year.

The direction of travel is becoming clearer. Application-level monetisation, capital efficiency and institutional utility now play a larger role in determining relative performance across crypto markets.

For all the insights, read the full report:

https://www.coindesk.com/research/state-of-the-blockchain-2025

Chart of the Week

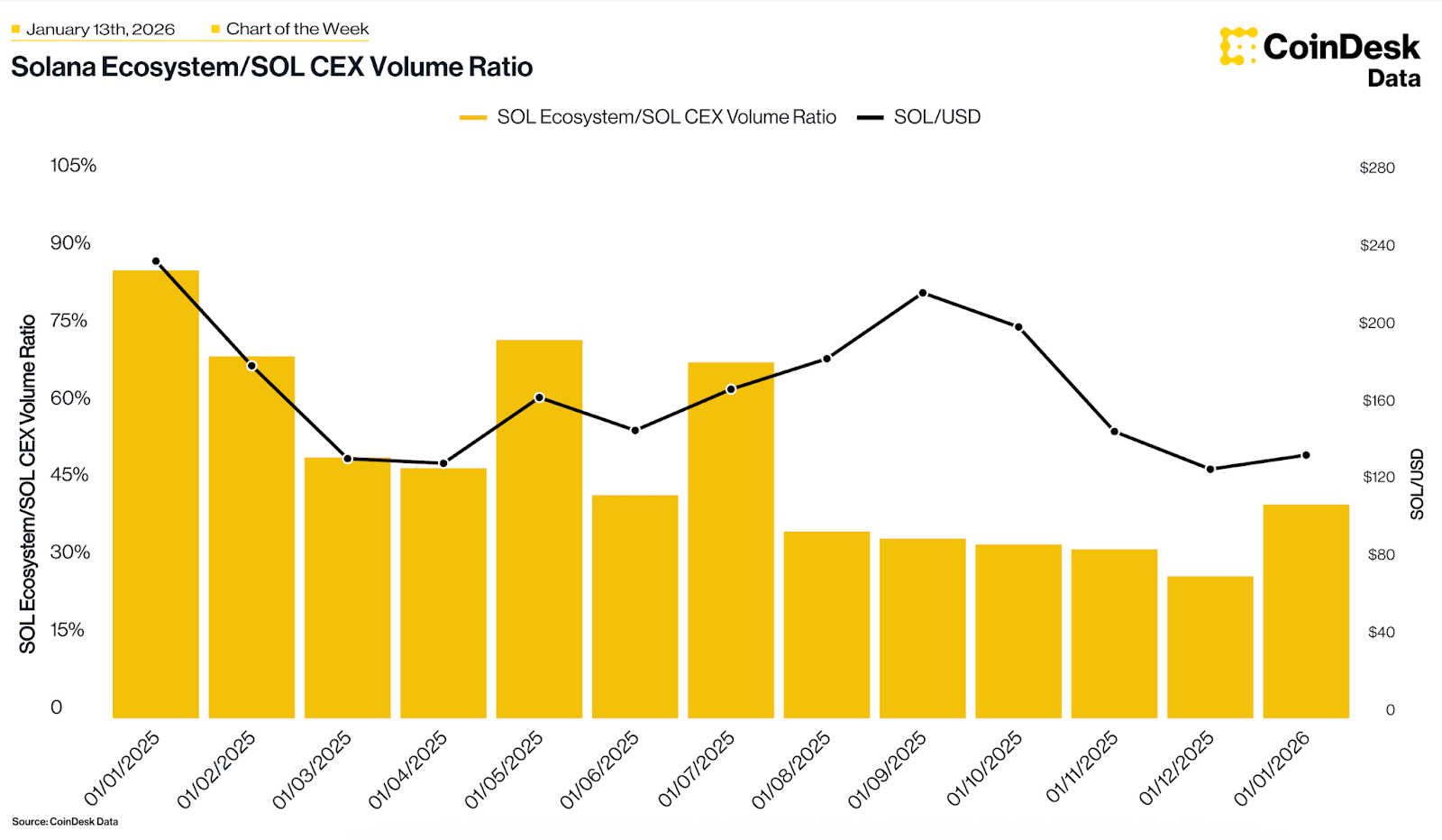

Solana’s Risk Appetite Returns

The ratio of solana ecosystem token volumes over $SOL volumes on centralized exchanges has jumped over 40% this month — a six month high. This indicates early signs of interest within the higher beta assets on Solana. This shift is validated by the month-to-date outperformance of ecosystem leaders like PENGU (27%) and RAY (21%) against $SOL (10%), signaling that investor appetite has started to move down the risk curve toward the network’s internal economy and “multiplier” plays while the base asset provides a stable floor.

Listen. Read. Watch. Engage.

- Listen: Katie Stockton of Fairlead Strategies breaks down why bitcoin is behaving more like a risk asset than a safe haven.

- Read: Global digital assets: December ETF and ETP review and 2025 recap in partnership with ETF Express and Trackinsight.

- Watch: Polygon Labs acquires Coinme and Sequence for $250M.

- Engage: Select CoinDesk indices and rates are now available on TradingView. Explore the crypto markets with CoinDesk Indices.