[ad_1]

The combined market capitalization of L2 coins and tokens is on an upward trend. After months of stagnant trading, L2 tokens are regaining value.

L2 tokens are starting a recovery, with some of the leading tokens expanding since their September lows. L2 chains remain important in the Ethereum ecosystem and DeFi activity, but have been eclipsed by the meme token craze.

Despite the shift in trader interest, L2 projects continued growing their infrastructure, turning into key features of crypto space. As usual, Arbitrum and Optimism led the recovery in market capitalization.

L2 tokens exit months of sideways trading

L2 tokens are also exiting their lengthy unlocking periods, with diminished selling pressures from unlocks or airdrops. Market capitalization also reflects usage and utility, with funds and liquidity concentrating into the top L2.

Tokens belonging to L2 networks recovered as a whole, reaching a market capitalization of $17B. This value is a fraction of the valuation of meme tokens, which peaked at $120B. L2 projects, however, have much greater longevity and potential for innovation.

Base remains the biggest gainer in terms of reported transactions and efficiency. However, the protocol is tokenless and does not add to the narrative with price growth. Base also has only $2.27B in value bridged, outpaced by Arbitrum with $8.48B and Optimism with $4.8B.

L2 tokens aim to recover their performance, as their tokens slid on average by 13% in the year to date. The loss shrank, however, as top L2 tokens expanded by close to 50% in the past quarter. L2 is not a leading narrative in November, but is making a return and regaining interest.

L2 chains compete for Ethereum data, blobs

L2 chains gained more attention as they compete for space on Ethereum. In the past month, most L2 started paying non-negligible rent to Ethereum, for using either blobs or calldata to secure their own transaction record. L2 can handle extremely fast transactions, but still require access to an Ethereum block to achieve finality and additional security. This demand creates the competitive blob or calldata market.

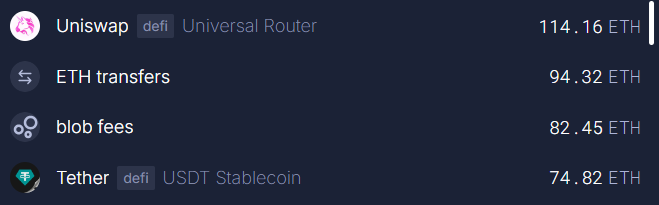

As a result of increased competition, blobs became the third-largest fee burner on Ethereum. Payments for blobs surpassed even the Tether smart contract, and moved closer to fees for all ETH transfers on the network.

Blob fees surpassed Tether in burning ETH with increased competition from L2 in the past week. | Source: Ultrasound Money

Blob fees are constantly positive in the past week, creating emerging competition for blob space. The increased L2 usage also helped slash Ethereum inflation to just 0.32%, as more of the fees get burned. As a result, the Ethereum network will produce a net 500K new tokens per year, instead of more than 900K due to limited burns.

L2 chains can also choose between blobs and calldata, based on their relative cost at the moment. For Ethereum experts, blobs are the preferable solution for L2 chains. Using calldata would crowd out regular users of direct L1 transactions, and make Ethereum too expensive for everyday tasks.

L2 remain largely profitable

L2 tokens gain attention for the ability of the chains to host super-apps and retain some of the earnings. Most L2 have robust profit margins, even after paying rent to Ethereum.

Linea and Base retain the most of their fees and app earnings. Most leading L2 chains are in profit, with the exception of Polygon and Taiko. The chains have automated their shift from blobs to calldata, making the optimal posting schedule if fee conditions are not favorable.

Among tokenized protocols, Arbitrum is the leader, with $95.32K in daily fees. Base is the leader for all protocols, producing $486.18K in fees.

Despite the positive fee performance, L2 are far from the top fat-fee apps and chains. L2 lag behind L1 chains, especially Solana and its ecosystem. Multiple chains and apps outpace L2 networks in terms of fee production. However, the fee schedule is a marker for the viability of L2 chains and their ability to retain the lowest possible gas fees.

Despite the economics of using Ethereum, L2 are successful in scaling and lowering transaction costs for DEX trading and DeFi. L2 tokens may also benefit from the growth of ETH, which recovered above $3,300 and sparked expectations of returning to new highs.

[ad_2]