[ad_1]

Bitcoin price stands at $103,997 to $104,281 over the last hour as of June 1, 2025, with a market cap of around $2.06 trillion. During the past 24 hours, the leading crypto asset has recorded a trading volume of $15.8 billion within an intraday range of $103,127 to $104,947 per bitcoin, reflecting a narrow consolidation phase after a notable but modest correction.

Bitcoin

The hourly chart shows bitcoin entering a consolidation pattern between $103,127 and $104,947, with volume slightly increasing on green candles. This indicates early-stage accumulation and a possible shift in short-term sentiment. Technical patterns suggest the formation of an inverse head and shoulders — a bullish reversal pattern — hinting at a potential breakout above the $104,900 to $105,000 zone. If confirmed with strong volume, this could serve as an entry point for short-term traders. However, any breakdown below $103,000 would invalidate the bullish thesis and suggest further downside risk.

BTC/USD 1-hour chart via Bitstamp on June 1, 2025.

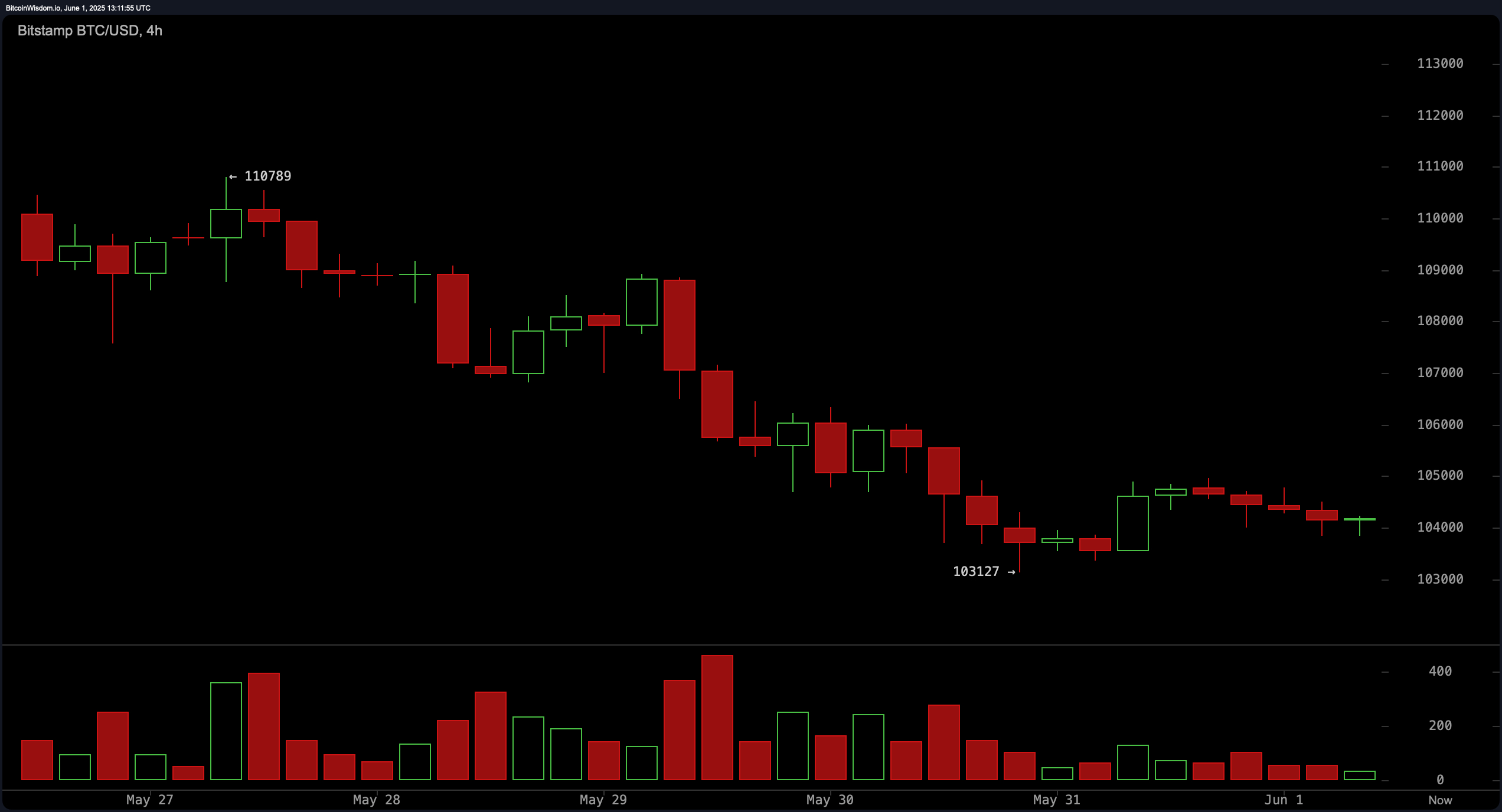

Bitcoin’s 4-hour chart portrays a clear downtrend, originating from the recent high of $110,789 and descending to the $103,127 low. This timeframe reflects a classic bearish structure marked by lower highs and lower lows. The volume profile further supports this, showing peaks during large red candles indicative of panic selling or forced liquidations. Nevertheless, the price action around the $103,000 level hints at potential bottoming, with a break above $105,000 necessary to confirm any reversal. Failing to reclaim this level could result in renewed selling pressure.

BTC/USD 4-hour chart via Bitstamp on June 1, 2025.

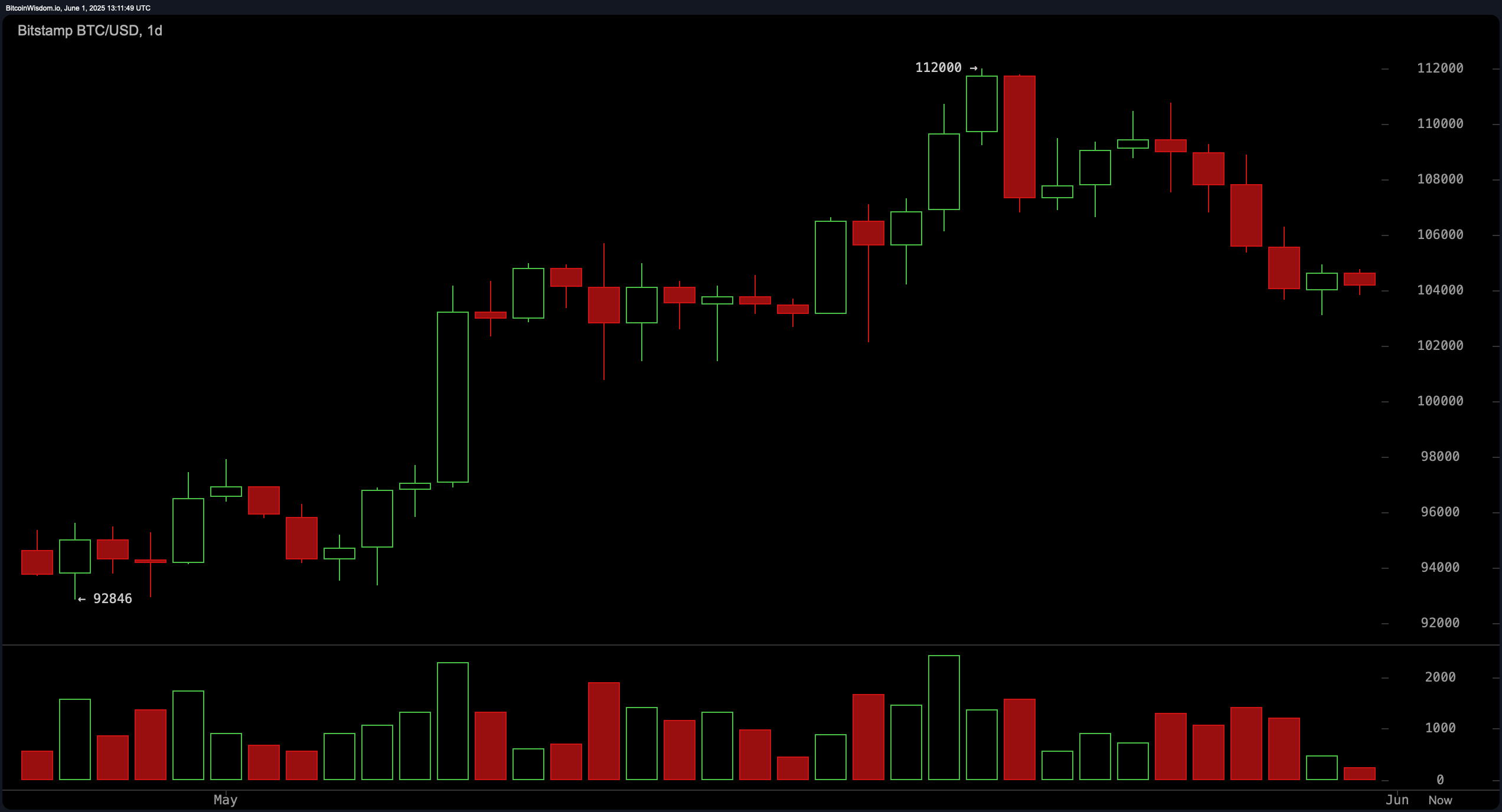

On the daily chart, bitcoin exhibits a broader uptrend from approximately $92,846 to a peak near $112,000, now followed by a clear pullback to the current $104,000 area. While this retracement appears orderly, the presence of a bearish engulfing candle at the top and successive red candles with lower highs underscore market hesitancy. Volume during the sell-off has notably declined, implying profit-taking rather than panic. Traders are advised to watch for a bullish reversal pattern with increased volume in the $102,000–$104,000 zone before initiating new long positions.

BTC/USD 1-day chart via Bitstamp on June 1, 2025.

Oscillator indicators present a mixed but cautious outlook. The relative strength index (RSI) reads 50, signaling neutrality, while the stochastic oscillator is also neutral at 22. The commodity channel index (CCI) stands at -61, reinforcing the non-committal stance. However, momentum reads -7,624 and the moving average convergence divergence (MACD) level is 1,843 — both suggesting bearish signals and highlighting the lack of immediate bullish momentum. Other oscillators, such as the average directional index (ADX) at 25 and the Awesome oscillator at 2,809, reinforce the neutral stance across the board.

The configuration of moving averages (MAs) adds depth to the technical landscape. The exponential moving averages (EMAs) and simple moving averages (SMAs) on the 10, 20, and 30-periods reflect short-term bearishness, with all but the 30-period EMA suggesting negative signals. In contrast, the 50, 100, and 200-period EMAs and SMAs all indicate positive signals, illustrating long-term bullish support. This divergence between short- and long-term signals highlights a consolidation phase within a larger uptrend, a pattern often observed during healthy market corrections.

Bull Verdict:

If bitcoin confirms a breakout above $105,000 with strong volume—especially completing the inverse head and shoulders on the hourly chart—momentum could shift in favor of buyers. Combined with long-term moving averages pointing upward and signs of accumulation at support, the groundwork for a bullish reversal appears to be forming. This would open the door for a retest of the $110,000–$112,000 range in the coming sessions.

Bear Verdict:

Without a decisive breakout above $105,000, bitcoin remains vulnerable to further downside. Sell signals from the momentum indicator and moving average convergence divergence (MACD), along with short-term moving averages trending lower, indicate persistent selling pressure. A breakdown below $103,000 would invalidate bullish patterns and could accelerate losses toward previous support zones below $100,000.

[ad_2]