[ad_1]

Sales of non-fungible tokens (NFTs) have dipped once more, marking the third consecutive week of decline, with a 14.97% decrease compared to the previous week. Leading the charge in this week’s sales from March 23 to March 30, Bitcoin NFT transactions amassed $82.61 million, despite experiencing a 3.8% drop from the previous week’s figures.

Despite Sales Downturn, NFT Market Attracts More Participants in Recent Week

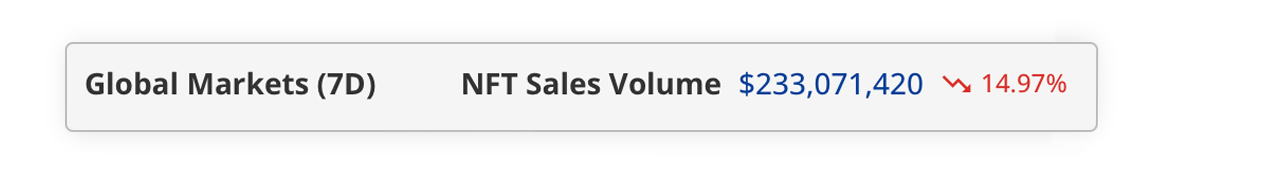

Over the last week, the NFT market’s sales volume reached $233,071,420, marking a decrease of just under 15% from the previous week’s figures. According to Cryptoslam.io data, this downturn hasn’t deterred the influx of participants, with the number of buyers rising by 25.61% and sellers increasing by 21.75%. In total, the market saw about 1,916,438 transactions, with Bitcoin leading in total sales value.

Bitcoin’s contribution to NFT sales was $82.61 million, experiencing a slight decrease of 3.8%. Close on its heels, Ethereum‘s sales barely exceeded $73 million, reflecting a 26.39% dip from the preceding week. Following these two leaders, Solana registered sales of $46.61 million, with Polygon and Mythos Chain trailing at $7.3 million and $7.16 million, respectively. Notably, while most top blockchains faced declines, Mythos Chain saw a slight sales increase of 0.92%.

This week’s standout NFT collection was Uncategorized Ordinals, generating $20.4 million despite a 43% drop in sales. The BRC-20 NFT collection followed, amassing an impressive $13.24 million, marking an increase of 759.91%. Other notable collections included Mad Lads and Bored Ape Yacht Club (BAYC). The highest-priced NFT sale belonged to Ethereum’s Arcade.xyz Vault Key, fetching $346,089 just five days ago.

Amid these fluctuating market conditions, the rise in participant numbers and the resilience of certain blockchains highlight a complex and evolving market landscape. While Ethereum, Solana, and others are adjusting to these shifts, the diverse performance of various collections—from stability in some to significant growth in others—points to a market that is continuously adapting and evolving.

What do you think about this week’s NFT sales data? Let us know what you think about this subject in the comments section below.

[ad_2]