In the shadow of downtown skyscrapers, Alex watches as yet another old real estate property is renovated into luxury condos. Having lived in the neighborhood his entire life, he has seen it transform from a community of small homes to an area dominated by high-rises and exclusive properties.

Institutional investors and high-net-worth individuals have reaped the most gains from these developments. Meanwhile, people like Alex have no choice but to remain on the sidelines, unable to afford the soaring property costs.

Currently, financial inequality is swiftly increasing worldwide. The rich are getting richer, while the poor are getting poorer. The financial system is structured in such a way that wealth generation is predominantly reserved for the affluent.

How Tokenization Can Democratize Wealth Creation

Consequently, the broader populace has scant opportunities to invest in high-value assets like real estate or fine art. This paradigm exacerbates wealth disparity.

According to a Statista report, the top 10% of earners in the United States possess 67 percent of the nation’s wealth. In stark contrast, the bottom 50 percent own just 2.5%.

Read more: What Are Tokenized Real-World Assets (RWA)?

Wealth Distribution in the US in Q1 2024. Source: Statista

Tokenization, however, could dramatically reshape the financial sector. Alex and others like him could own a piece of the properties for the first time, reshaping their community. This technology promises to democratize investment, allowing more residents to benefit financially from the growth and changes in their neighborhoods.

In an interview with BeInCrypto, John Patrick Mullin, co-founder of MANTRA—a layer-1 blockchain dedicated to the tokenization of real-world assets (RWAs)—explains how this technology is transformative.

“Tokenization is a powerful catalyst for democratizing wealth creation and dismantling historical barriers to retail investment in high-value real world assets,” Mullin told BeInCrypto.

Furthermore, by fractionalizing these assets and tokenizing them on-chain, MANTRA seeks to level the playing field for individuals with limited capital. The principle behind this innovation is straightforward yet transformative. Illiquid assets such as real estate or fine art are tokenized into digital tokens, each representing a fractional interest in the asset.

“Illiquid assets are made more accessible by being tokenized as digital tokens, with each individual token representing a fractionalized interest in the larger real estate or fine art asset,” Mullin adds.

Read more: Where To Buy Tokenized or Fractionalized Real Estate and Art

This shift from exclusive ownership to fractionalized investing allows for a more equitable distribution of wealth. Several investors can pool resources to purchase portions of a high-value asset, thereby holding a stake in potentially lucrative markets previously dominated by the wealthy. Mullin emphasizes that this method of fractional ownership is integral to fair wealth distribution.

Challenges With Tokenization

Despite RWAs’ potential to democratize investment, challenges remain. Particularly, there is the risk of tokenization merely becoming another tool for the affluent to consolidate wealth. Mullin notes the importance of inclusive practices and strong regulatory frameworks in addressing this.

“We implement several measures to eliminate gatekeeping and mitigate this risk,” Mullin states.

These measures include establishing regulations for investor due diligence, educating diverse investor populations to promote participation, and implementing transparent governance models prioritizing all stakeholders’ interests.

Moreover, the blockchain technology underpinning this innovation adds another layer of transparency and security. It makes on-chain data available for anyone to analyze, which helps promote fairness and eliminate malpractices like insider trading. This openness is essential for fostering trust among a broad base of investors.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

Additionally, education and accessibility are critical for the widespread adoption of tokenized RWAs, particularly among underserved communities. A comprehensive strategy that includes educating potential investors about the opportunities and risks associated with RWAs and supportive infrastructure can enhance participation.

Lastly, tackling regulatory challenges remains a crucial step toward a stable environment for tokenization. Mullin anticipates key developments, particularly increased compliance across jurisdictions. These developments will be fueled by legal frameworks that foster a more stable environment for tokenization.

The Current State of the RWA Market

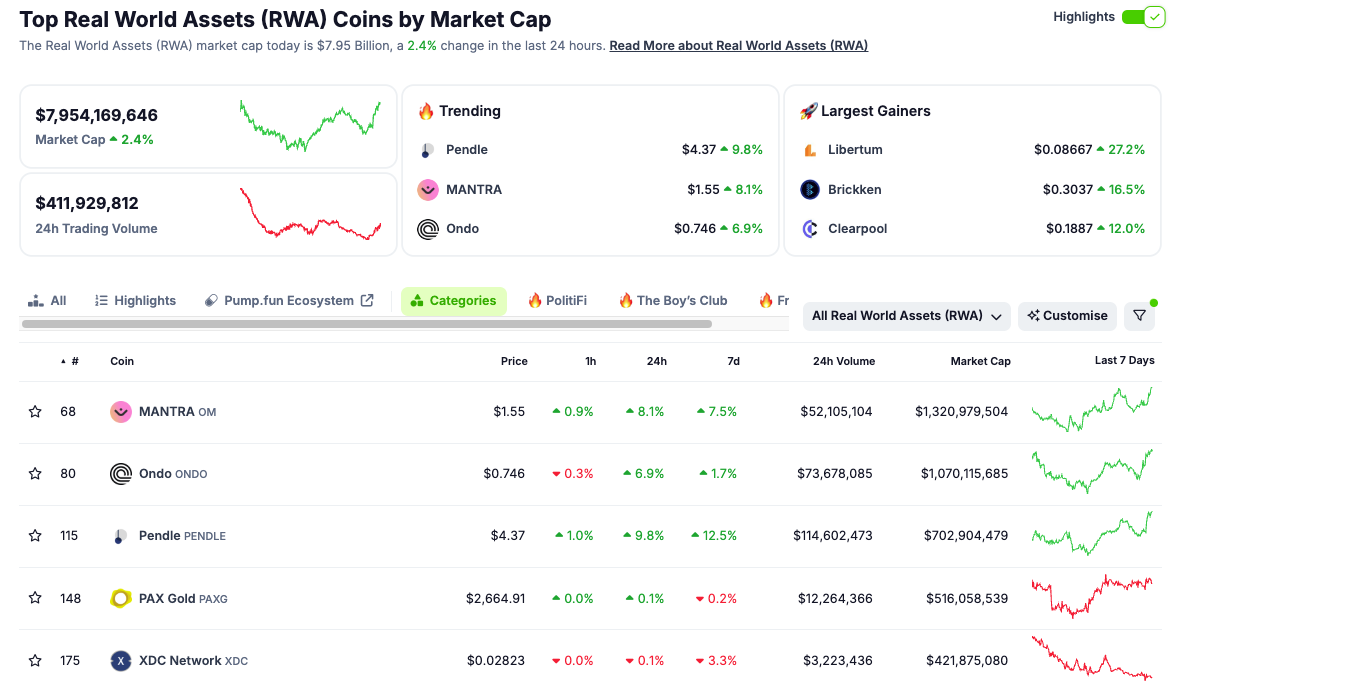

In 2024, the market response to RWAs has been notably positive, with interest from major institutional players such as BlackRock, Fidelity, and Franklin Templeton. According to CoinGecko, the market capitalization of RWA crypto tokens is nearing $8 billion.

Read more: How To Invest in Real-World Crypto Assets (RWA)?

Top RWA Coins by Market Cap. Source: CoinGecko

Also, the tokenized government securities market alone has surpassed $2.14 billion. These data illustrate the growing acceptance and integration of RWAs into the broader financial ecosystem.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

Indeed, the tokenization of RWAs stands out as a potentially revolutionary force in the financial market. It can bridge the gap between traditional and decentralized finance, thus offering a more inclusive and equitable economic future.

“Tokenization may well be the final piece in the puzzle for equitable wealth distribution,” Mullin concludes.