[ad_1]

On Monday, MakerDAO officially launched the Spark Tokenization Grand Prix, an ambitious competition to onboard up to $1 billion of tokenized assets, particularly focusing on short-duration US Treasury Bills.

The competition is an initiative by SparkDAO, a subDAO of MakerDAO. It is designed to assess participants’ ability to supply liquidity, align with MakerDAO’s vision, and introduce novel solutions within the decentralized finance (DeFi) ecosystem. The submission deadline is September 20, 2024, giving participants just over a month to finalize their proposals.

OpenEden’s Compliance-Driven Approach to MakerDAO’s Tough Criteria

In a governance post, Steakhouse Financial, a treasury management firm and a strategic finance core unit of MakerDAO, provided details about a competition. The firm pointed out that the competition would evaluate products based on their legal structure, cost efficiency, and liquidity provisions.

Additionally, they stressed the necessity for strategic alignment with MakerDAO’s goals. Moreover, they focused on products capable of offering attractive yields and the required liquidity for frequent rebalancing.

Read more: How To Invest in Real-World Crypto Assets (RWA)?

Several prominent real-world assets (RWA) industry players, including Securitize, OpenEden, and Superstate, have entered the competition. Each of these firms has outlined unique strategies that highlight their commitment to meeting MakerDAO’s liquidity and capital efficiency criteria.

Jeremy Ng, co-founder of OpenEden, expressed his confidence in the performance of the firm’s flagship product, TBILL. According to him, TBILL’s consistency in delivering high quality and exceptional liquidity will make it an attractive option for DAO treasury managers. He also noted that OpenEden’s regulatory compliance will position it as a strong contender in the competition.

“Regulatory compliance is a key consideration for DAO treasuries. We operate a licensed fund management company in Singapore that oversees the BVI-registered fund backing the TBILL tokens. Obtaining (and maintaining) this status is no mean feat. It requires the manager to undergo a rigorous, ongoing assessment of its capabilities by the Singapore financial regulator, including audits, financial reporting, etc.,” Ng explained to BeInCrypto.

Superstate’s Tactics: Leveraging DeFi Expertise to Boost DAI Stability

Superstate, led by CEO and founder Robert Leshner, is another notable entrant in MakerDAO’s Spark Tokenization Grand Prix, with its primary offering, USTB. In an email to BeInCrypto, Fig Gown, the Protocol Relations Lead at Superstate, revealed that its proposal to MakerDAO focuses on integrating USTB into MakerDAO’s ecosystem to enhance the stability of DAI — MakerDAO’s flagship stablecoin.

Apart from USTB’s appealing yield, low fees, and daily liquidity, Gown also emphasized the transparency of USTB’s underlying holdings. These holdings can be monitored through the company’s website or with on-chain pricing using a Chainlink oracle. This transparency, along with the upcoming real-time viability through Chainlink’s Proof of Reserves, ensures that MakerDAO can uphold high levels of liquidity and stability for DAI.

“With deep DeFi and traditional capital markets experience, Superstate brings the expertise to support and develop the industry-specific needs Maker and other protocols may have. By onboarding to Superstate, Maker and its SubDAOs will gain access to current and future products issued by Superstate Inc. and integrations that develop through partnerships with other protocols to expand the utility of USTB and future products,” Gown added.

Securitize’s Vision for Tokenized Treasuries in DeFi’s Future

Securitize, another key player in the RWA industry, has also confirmed its participation. In the competition, it will collaborate with BlackRock’s BUIDL, the largest tokenized treasury fund to date.

Carlos Domingo, Securitize’s CEO and co-founder, expressed his excitement about participating in the Spark Tokenization Grand Prix. Furthermore, he noted that Securitize’s involvement with MakerDAO and other DAOs showcases the growing recognition of tokenized treasuries as a key component of treasury management in DeFi.

“The crypto market is currently around $2.5 trillion, but stablecoins make up about $150 billion, and treasuries only make up $2 billion. You’ll start to see a shift more in line with the traditional finance world, where you have $2 of treasuries per each dollar of actual cash. As more of these DAOs put their funds into these tokenized treasury products, we’ll start to see a rush into the market which will only make our current growth increase exponentially,” Domingo told BeInCrypto.

MakerDAO’s Spark Tokenization Grand Prix adds to the growing list of DAOs and DeFi projects interested in tokenized assets. BeInCrypto previously reported that in June, the Arbitrum STEP Committee recommended diversifying 35 million ARB tokens ($24.5 million) from the Arbitrum DAO Treasury into six selected tokenized treasury products. Additionally, in July, Ethena, the entity behind the synthetic dollar token USDe, allocated some funds from its reserve fund to yield-generating RWA offerings.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

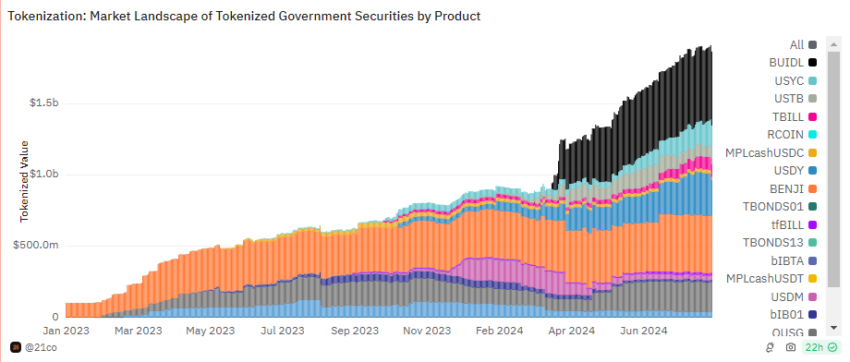

Total Market Value of Tokenized US Treasury Products. Source: Dune/21co

According to a recent report by a 21.co analyst, the impact of this trend among DAOs and DeFi projects is expected to drive the tokenized US treasury market to reach $3 billion by the end of 2024. This prediction also aligns with the market’s 200% growth rate. 21.co data reveals an increase in this segment’s value from $592.63 million to $1.86 billion year-to-date.

[ad_2]