[ad_1]

While there has been no shortage of excitement when it comes to Bitcoin (BTC) ever since the beginning of the final quarter of 2023, the 7 days of trading that started on February 26 have, in many ways, been particularly eventful.

After holding close to the $51,000 level for multiple weeks, the world’s foremost cryptocurrency suddenly took to the skies and rose more than $10,000 in but a few days to find itself only $4,000 below its all-time high price by Monday, March 4.

The sudden and strong rise bolstered the already significant optimism present in the crypto market but also caused many traders to worry if Bitcoin is nearing a major correction as profit-taking opportunities grow better and better.

Machine Learning algorithm predicts BTC price

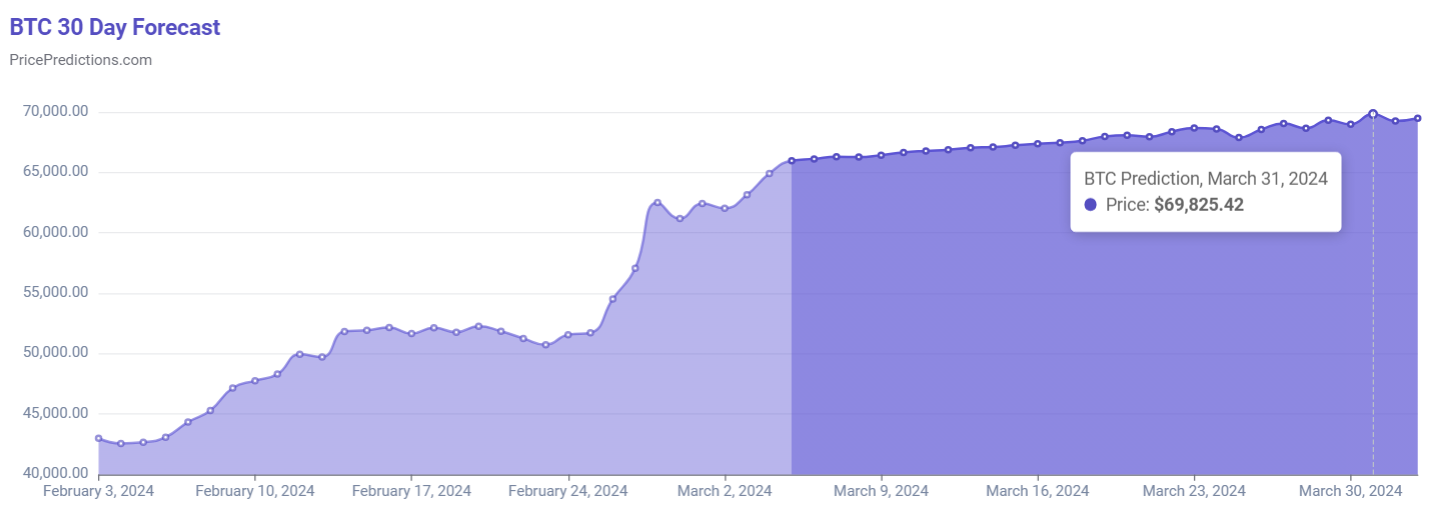

The AI-driven machine learning predictive algorithms of a platform specializing in projecting future prices – PricePredictions – estimate that Bitcoin bulls have a stronger case than bears.

While BTC will stop surging with the speed observable in the latest 5 days, the coin is set to continue the uptrend and steadily rise to $69,825.42 by March 31, 2024.

Even such a slowing down of growth would lead BTC to rise above its previous all-time high price with approximately three weeks to spare before the upcoming halving event – an event that historically saw Bitcoin surge tenfold and, sometimes, as much as a hundredfold.

Bitcoin technical analysis

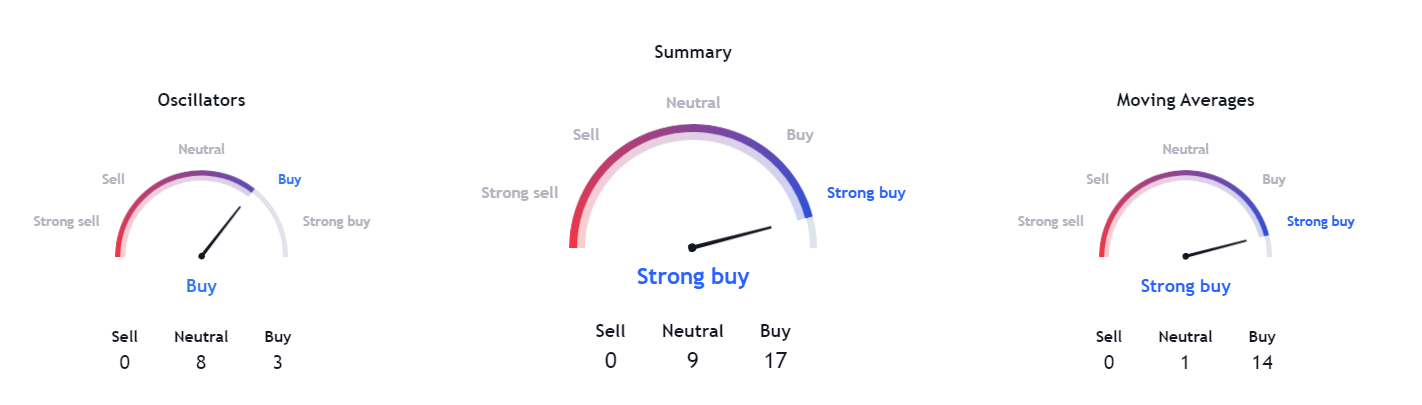

Technical analysis (TA) of Bitcoin, as provided by TradingView, is also highly bullish when it comes to the world’s premier cryptocurrency.

Bitcoin’s daily, weekly, and monthly performance all lead to similar results, and the coin retains a “strong buy” rating across the timeframes. According to moving averages, BTC is also a “strong buy,” and oscillators rate it ever so slightly lower as a “buy.”

Bitcoin price chart

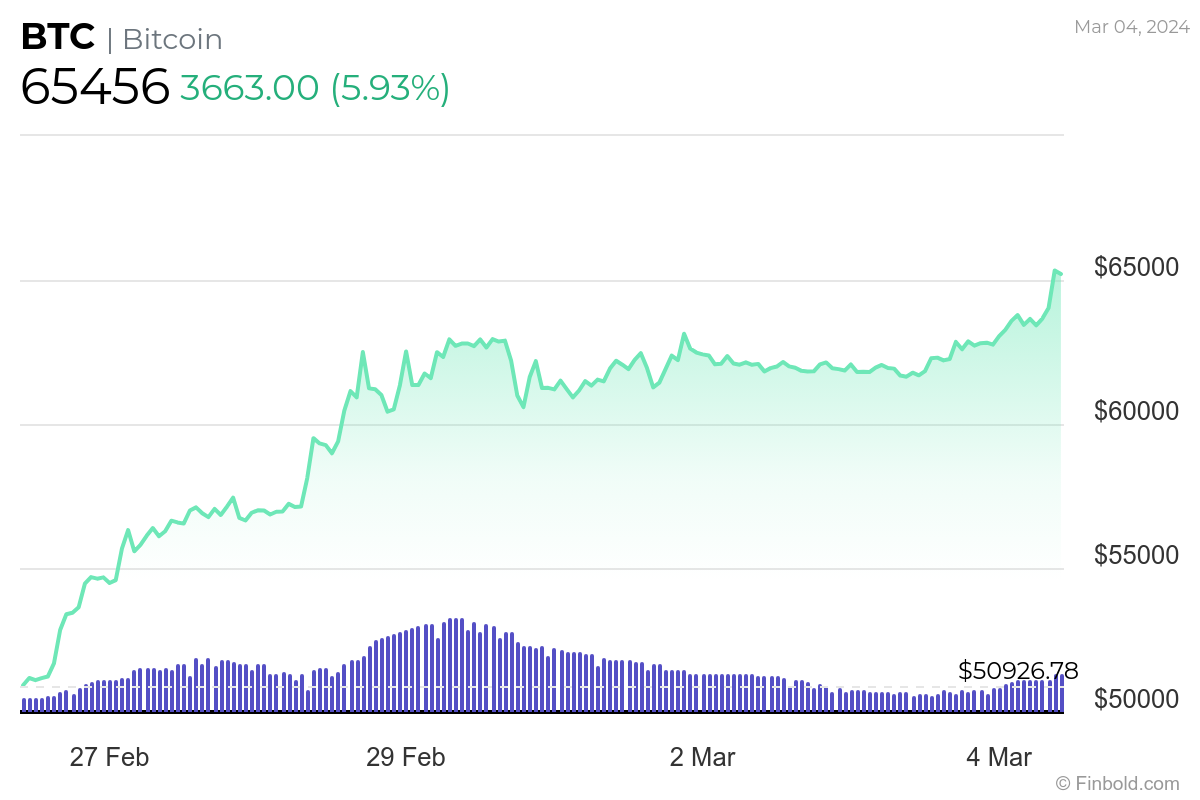

While Bitcoin’s price in the coming weeks remains entirely speculative, what is certain is that the coin has been doing exceptionally well since January 1, as it rose 47.32%.

The total rise becomes even more impressive once the brief and strong downturn in the immediate aftermath of the approval of nine spot BTC exchange-traded funds (ETFs) is accounted for.

Still, one of the most exciting episodes for Bitcoin started on February 26 as the cryptocurrency surged as much as 27.19% in the seven days leading up to Monday, March 4.

Finally, the last 24 hours of trading have also witnessed a significant price spike that saw BTC rise 5.93% and race above $65,456 amidst an increasingly euphoric sentiment, institutional buying demand, and overall historical gains linked to Bitcoin’s halving event, which are putting the asset on track to cross its lifetime highs of $69,000, as forecast, before March is out.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

[ad_2]