[ad_1]

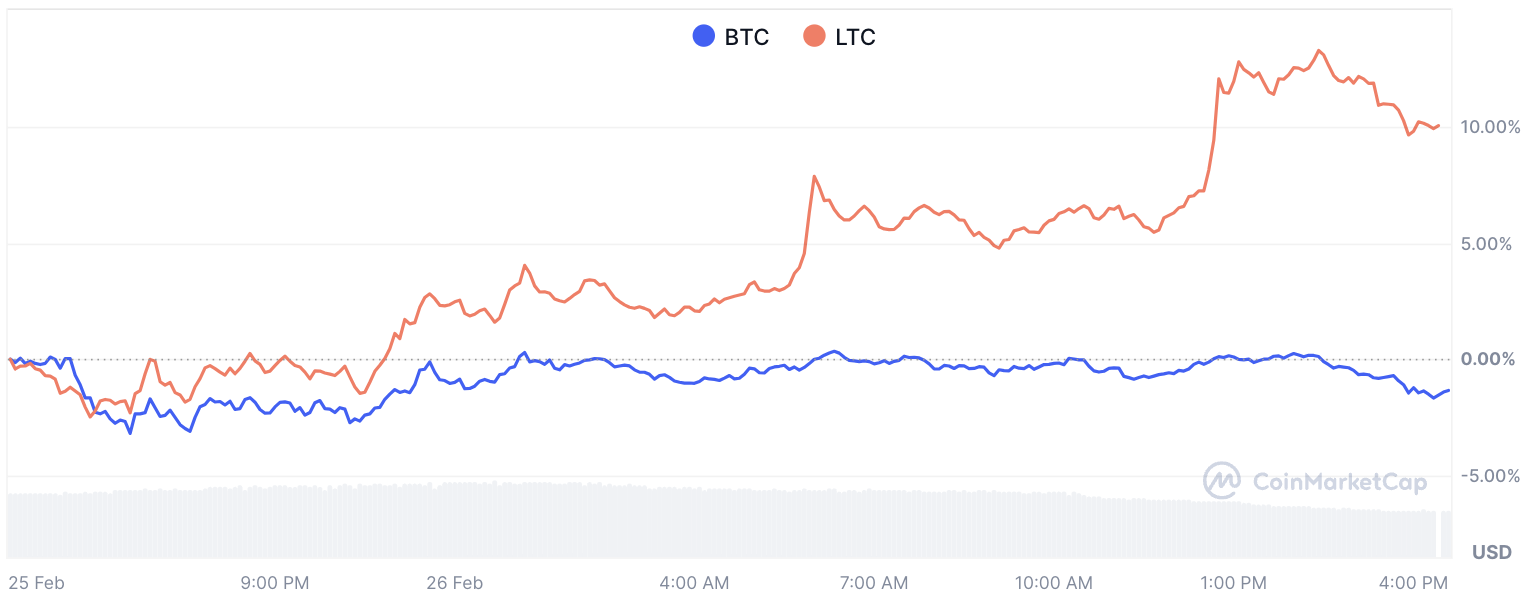

Not all pullbacks are created equal, and Litecoin (LTC) is proving that today. As the cryptocurrency market just survived another round of massive and very painful corrections and billions worth of liquidations, the price of Bitcoin (BTC) lost almost 10% and fell as low as $85,000.

Alternative cryptocurrencies, including Litecoin, were not spared and experienced an even more severe decline during these days. However, as the dust settled and assets began to recover a bit, the price of Bitcoin recovered 3.93%, bringing it back to $89,400.

Meanwhile, Litecoin saw a recovery of nearly 20%, going from a low of $106 to $123.7 in just a day and a half.

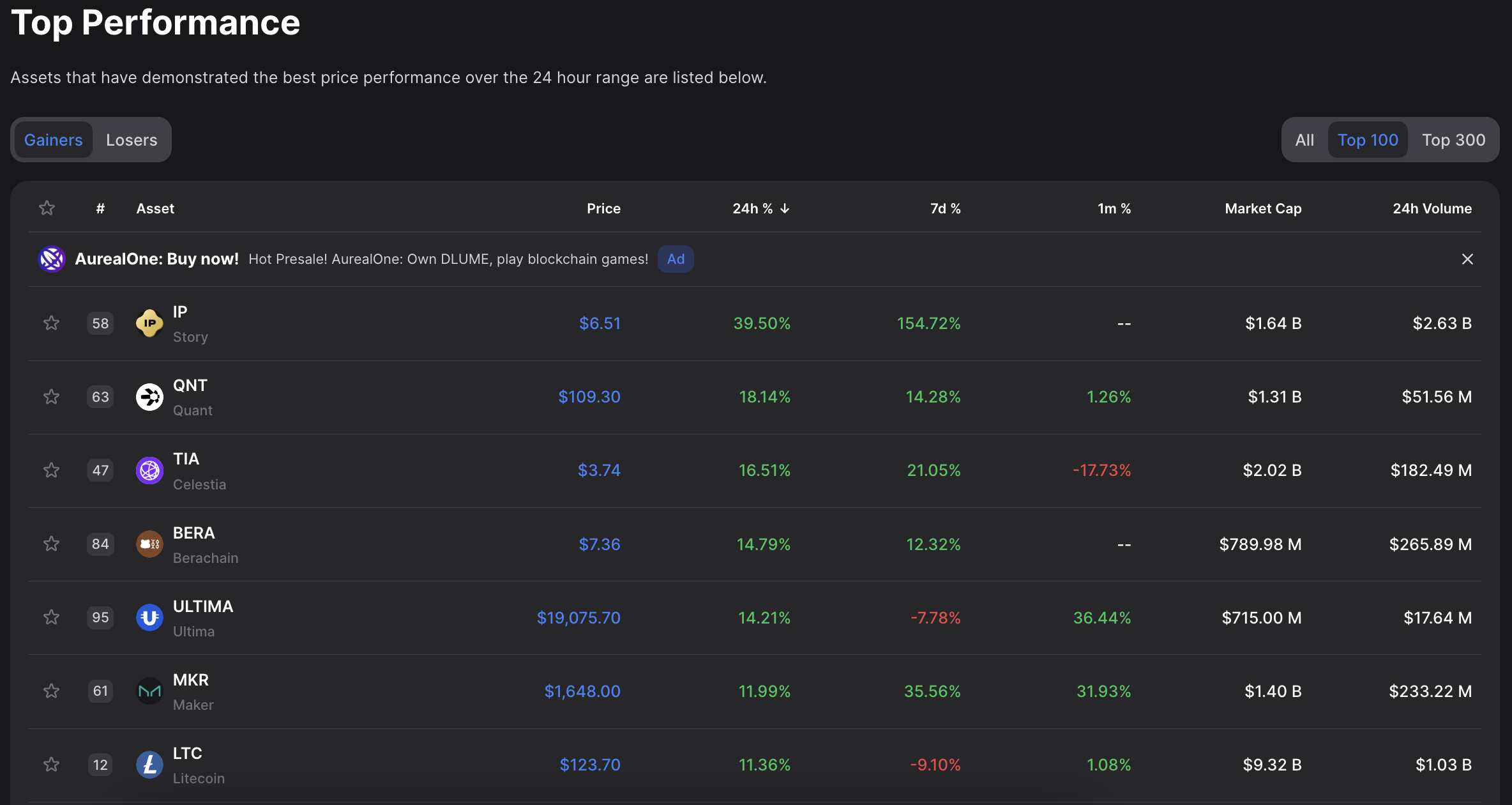

As a result, the coin that was created in 2013 as an alternative to BTC – and, let’s face it, not a “shiny new coin” that everyone likes – has made it to the top performers list of the entire market in the last 24 hours.

Why Litecoin?

Well, if Bitcoin can be considered an alternative to gold and is often compared to the precious metal even by the likes of Fed head Jerome Powell, Litecoin in its turn is perceived as the “crypto silver.”

In the common perception of crypto market participants, LTC, despite being a “dino coin,” is still perceived as an asset that is more fundamental than your average meme coin.

Add to this the ETF narrative that has recently emerged for this alternative cryptocurrency. With all the recent filings and approval from the SEC, experts are giving the Litecoin ETF an 80% chance of approval.

If indeed approved and shipped to the market, LTC may see the effect Bitcoin saw after the launch of exchange-traded funds, when “Boomer” investors put their money into established assets.

With the “digital silver” label on it, Litecoin has a pretty solid base from which to hit this target audience.

[ad_2]