As blockchain adoption accelerates, scalability is becoming one of the ecosystem’s most pressing challenges. With the growth of decentralized applications (dApps), smart contracts, and higher transaction volumes, blockchains must scale to handle global demand. Two main approaches have emerged to address this: Layer-1 and Layer-2 scaling solutions.

Layer-1 (L1) refers to the base protocol layer of a blockchain, such as Bitcoin or Ethereum, while Layer-2 (L2) refers to protocols that operate on top of Layer-1 to enhance throughput, reduce fees, and offload congestion. This guide explores how both layers contribute to the future of blockchain infrastructure.

In this guide:

- Layer-1 scaling solutions

- Resolving layer-1 limitations

- Layer-2 scaling solutions

- Types of layer-2 solutions

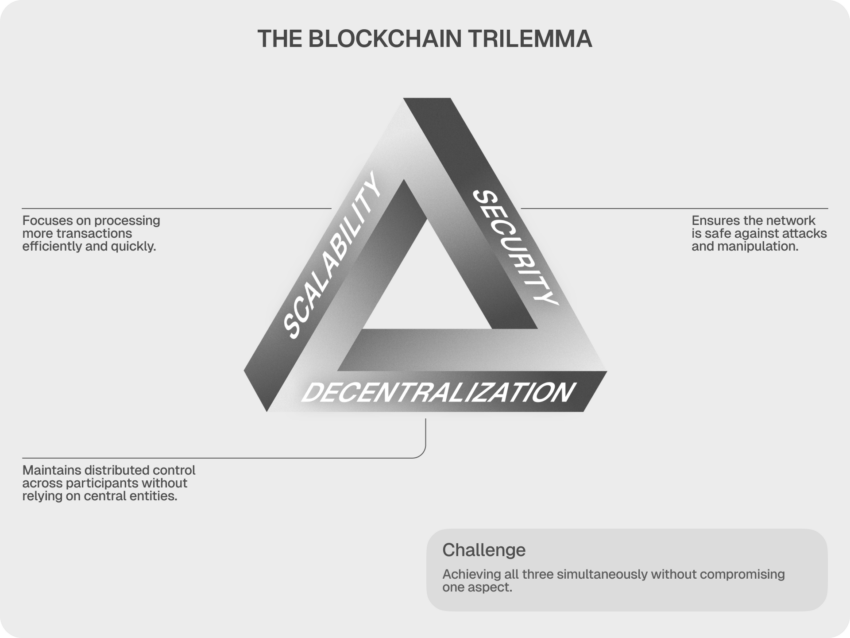

- What is the blockchain trilemma?

- Layer-1 vs. layer-2: major differences

- The future of scaling

- Frequently asked questions

Layer-1 scaling solutions

Layer-1 (L1) scaling involves directly improving the base blockchain protocol to increase performance and capacity. This could mean modifying consensus mechanisms, adjusting block sizes, or implementing new features like sharding. Key examples of L1 Blockchains include:

- Cardano, Solana, Avalanche: Compete as scalable Layer-1 networks with native design improvements.

- Bitcoin: Optimized for decentralization and security, but limited in throughput.

- Ethereum: Transitioned from Proof-of-Work (PoW) to Proof-of-Stake (PoS) to improve scalability and energy efficiency.

Layer-1 scaling solutions improve the blockchain layer’s foundation to facilitate scalability improvements. This offers a wide range of ways to increase the scalability of blockchain networks.

Layer-1 solutions, for instance, can enable direct modifications to protocol rules to increase transaction capacity and speed. Likewise, layer-1 scaling solutions can provide greater capacity for accommodating additional data and users.

Layer-1 scaling techniques

- Block size and block time adjustments: Larger blocks and shorter block intervals allow more transactions per second (TPS), but can impact decentralization.

- Consensus mechanism upgrades: Moving from PoW to PoS reduces energy use and allows faster finality.

- Sharding: Divides network state into smaller parts (“shards”) processed in parallel. Used by Ethereum 2.0, Zilliqa, Polkadot.

Advantages

- Scalability would be the most obvious advantage of layer-1 blockchain solutions. Layer-1 blockchain solutions necessitate protocol modifications for enhanced scalability.

- A layer-1 blockchain protocol provides decentralization and security with high scalability and economic viability.

- Layer-1 enhances ecosystem development. In other words, layer-1 scaling solutions could incorporate new tools, technological advancements, and other variables into the base protocols.

Disadvantages

- Requires hard forks or protocol upgrades

- Slower to deploy due to governance and coordination complexity

Resolving layer-1 limitations

Even with upgrades, Layer-1 blockchains face scalability ceilings. Bitcoin’s PoW mechanism limits throughput, and Ethereum faced high gas fees during congestion. Two notable solutions are:

- Proof-of-Stake (PoS): Replaces miners with validators who stake tokens. Used in Ethereum, Cardano, and Tezos.

- Sharding: Breaks the blockchain into parallel-processing shards. Ethereum 2.0 and Polkadot utilize sharded designs to boost throughput.

These approaches aim to address the blockchain trilemma: the trade-off between scalability, decentralization, and security.

Improvements to the consensus protocol

Some consensus mechanisms are more efficient than others. PoW is today’s consensus protocol on popular blockchain networks such as Bitcoin. PoW is secure, but it can be slow. As a result, PoS is the consensus mechanism of choice for most new blockchain networks. This is an important factor in the layer-1 vs. layer-2 blockchain debate.

PoS systems don’t require miners to solve encryption algorithms using a lot of computing power. Instead, network participants use PoS to process and verify transaction blocks. Ethereum will transition to a PoS consensus algorithm, which is to increase the network’s capacity while enhancing decentralization and preserving network security.

Sharding

Adapted from distributed databases, sharding has become one of the most popular layer-1 scaling solutions. Sharding is the process of breaking up the state of the whole blockchain network into separate sets of data called “shards.” A task that is easier to handle than seeking all nodes to take care of the whole network.

The network processes these shards in parallel, allowing for the sequential processing of multiple transactions. In addition, each network node is assigned to a specific shard rather than maintaining a complete copy of the blockchain. Each shard sends proofs to the mainchain and shares addresses, general states, and balances with other shards using cross-shard communication systems. Along with Zilliqa, Qtum, and Tezos, Ethereum 2.0 is a prominent blockchain protocol currently investigating shards.

Layer-2 scaling solutions

Layer-2 (L2) refers to technologies built on top of Layer-1 blockchains to improve scalability without altering the underlying protocol. They process transactions off-chain and post final results back to the base layer, relieving pressure on the main network.

The primary aim of layer-2 scaling is to employ networks or technologies that operate on top of a blockchain protocol. An off-chain protocol or network could help a blockchain network achieve increased scalability and efficiency.

Layer-2 scaling solutions facilitate the delegation of data processing tasks in support architecture more efficiently and flexibly. As a result, the core blockchain protocol does not experience congestion, making scalability possible. Key examples of L2 protocols include:

- zkSync, Starknet: Use zk-rollups to batch thousands of transactions with cryptographic proofs.

- Lightning Network (Bitcoin): Enables near-instant micropayments via payment channels.

- Optimism & Arbitrum (Ethereum): Use optimistic rollups to scale Ethereum without compromising security.

Advantages

- One of the most significant advantages of a layer-2 solution is that it does not affect the performance or functionality of the underlying blockchain to degrade the network’s overall performance.

- Layer-2 solutions, such as state channels and Lightning Network, expedite the execution of multiple micro-transactions. This is because it doesn’t undergo minor verifications or pay unnecessary fees to conduct such transactions.

Disadvantages

- Layer-2 has a negative impact on blockchain connectivity: One of the most significant issues in blockchain right now is the lack of interconnectivity between different blockchains (for example, you cannot connect with someone on Ethereum if you are on Bitcoin). This is a highly problematic matter. With layer-2, it can exacerbate this issue by limiting interconnectivity within a network, as layer-2 users are restricted to the protocols of the solutions they employ, which is becoming a challenge.

- Privacy and safety issues: As you may have observed in the preceding section, various solutions offer varying levels of security and privacy. However, none of the solutions provides the same level of security as the major chains, so depending on your priorities, you should give it some thought.

Types of layer-2 solutions

Nested blockchains, state channels, and sidechains are all examples of solutions for scaling at the layer-2 level.

Rollups

Rollups batch transactions and submit them as a single proof to L1. The most popular rollup designs are Zero-Knowledge (ZK) and optimistic rollups. Both take a different approach to securing the blockchain’s state.

A zk-rollup is a layer-2 scaling solution that batches transactions off-chain and uses zero-knowledge proofs to verify their validity on-chain, ensuring high security and fast finality with minimal data posted to the base layer.

An optimistic rollup, by contrast, assumes transactions are valid by default and only verifies them if someone submits a fraud proof during a challenge period. The key difference lies in verification: zk-rollups prove correctness upfront using cryptographic proofs, while optimistic rollups rely on economic incentives and a delay window for fraud detection.

Nested blockchains

Essentially, a nested blockchain is a blockchain within, or rather, on top of, another blockchain. The nested blockchain typically comprises a primary blockchain that establishes parameters for a more extensive network, with executions occurring within an interconnected network of secondary chains.

On top of a mainchain, many blockchain tiers can be built, each with its own parent-child connection. The parent chain delegates tasks to child chains, which then complete them and returns the results to the parent.

Unless there is a need for dispute resolution, base blockchain does not participate in the network functions of subsidiary chains. This model’s work distribution reduces the processing load on the mainchain, which exponentially improves scalability. The OMG Plasma project illustrates layer-2 nested blockchain infrastructure, which is used on top of the layer-1 Ethereum protocol.

State channels

A state channel enables bidirectional communication between a blockchain and off-chain transactional channels, enhancing transactional capacity and speed. A state channel does not cause validation by layer-1 network nodes. Rather, it is a network-adjacent resource isolated via multi-signature or smart contract mechanisms.

When transactions are finalized on a state channel, a final “state” of the channel and its changes are written on the underlying blockchain. State channels include Liquid Network, Ethereum’s Raiden Network, Celer, and Bitcoin Lightning. In a trilemma tradeoff, the state channels give up a portion of their decentralization for greater scalability.

Sidechains

A sidechain is a transactional chain adjacent to a blockchain, typically used for bulk transactions. Sidechains use a consensus mechanism independent of the main chain, and users can optimize them for speed and scalability. The primary function of the main chain in a sidechain architecture is to maintain overall security, validate batched transaction records, and resolve disputes.

Sidechains are different from state channels in several fundamental ways. First, sidechain transactions are not private between participants; they are recorded publicly on the blockchain. Additionally, sidechain security breaches do not affect the main chain or other sidechains. The infrastructure of a sidechain is typically built from the ground up, so establishing one could require significant effort.

What is the blockchain trilemma?

The scalability trilemma refers to a blockchain’s ability to balance three organic properties that constitute its core principles: security, decentralization, and scalability.

The trilemma states that a blockchain can only possess two of the three properties, never all three simultaneously. Consequently, the current blockchain technology will always need to sacrifice one of its fundamental properties for its functionality. Bitcoin is a prime example of this; while its blockchain has optimized decentralization and security, it has offered scalability.

Most importantly, no cryptocurrency is currently capable of achieving the maximum of all three features. In other words, cryptocurrencies prioritize two or three features to the detriment of the remaining one.

Many developers are diligently working to solve the blockchain trilemma, with some techniques and ideas already implemented that aim to solve the scalability problem. Depending on their level of blockchain implementation, these concepts and techniques manifest as either layer-1 or layer-2 solutions.

A wide range of blockchains can process thousands of transactions per second, but they do so at the expense of decentralization or security. Most blockchains today sacrifice one:

- Ethereum aims to balance all three via layer-2 rollups and sharded PoS.

- Bitcoin maximizes security and decentralization at the expense of scalability.

- Solana prioritizes scalability and performance but reduces decentralization.

No blockchain has fully solved the trilemma, but innovations at both Layer-1 and Layer-2 continue to push boundaries.

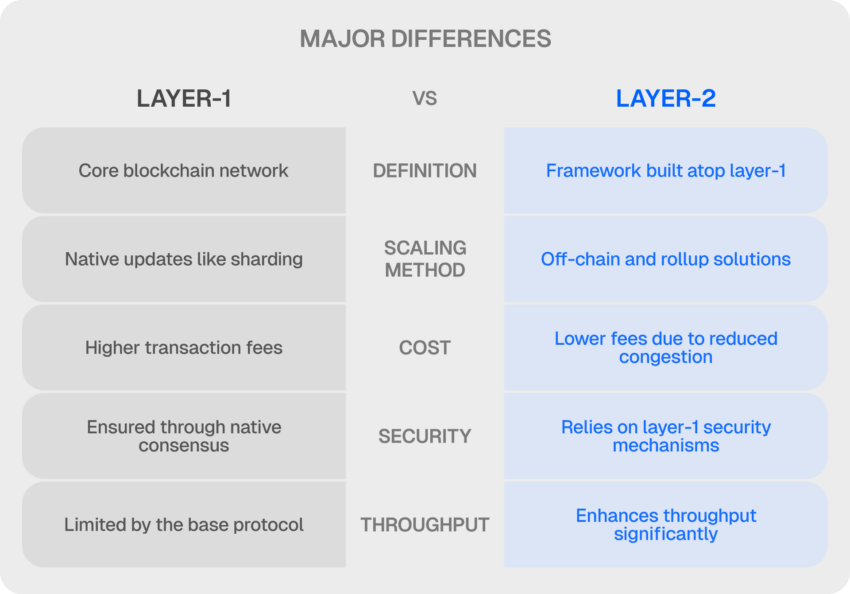

Layer-1 vs. layer-2: major differences

The fundamental outline of layer-1 and layer-2 scaling solutions provides the proper basis for distinguishing between them. Here are some of the key distinctions between layer-1 and layer-2 scaling solutions for blockchains.

1. Definition

Layer-1 scaling solutions modify the blockchain protocol’s base layer to achieve the desired enhancements. For instance, the block size can adjust to accommodate more transactions, or users can alter the consensus protocols to improve speed and efficiency.

Layer-2 scaling solutions function as off-chain solutions that share the load of the primary blockchain protocol. Specific information processing and transaction processing tasks are delegated to layer-2 protocols, networks, or applications by the mainnet of a blockchain protocol. The off-chain protocols or solutions complete the designated task and report the outcome to the main blockchain layer.

2. Method of operation

With layer-1 blockchain networks, the actual scaling method focuses on modifying the core protocol. With layer-1 scaling solutions, you must change blockchain protocols. Therefore, you would not be able to immediately scale back the modifications if the transaction volume drastically decreases.

In contrast, layer-2 scaling solutions function as off-chain solutions that operate independently of the primary blockchain protocol. Off-chain protocols, networks, and solutions report only the ultimate results required by the immediate blockchain protocol.

3. Types of solutions

In the case of layer-1 blockchain solutions, consensus protocol enhancement and sharding are two prominent types of solutions. Scaling of layer-1 includes alterations to block size or block creation speed to ensure the desired functionality.

Regarding blockchain layer-2 scaling solutions, there is virtually no restriction on the solutions that can be implemented. Any protocol, network, or application can be a layer-2 solution off-chain for blockchain networks.

4. Quality

Layer-1 networks serve as the definitive source of information and are ultimately accountable for transaction settlement. On layer-1 networks, a native token is used to access the network’s resources. Another essential characteristic of layer-1 blockchain networks is innovation in consensus mechanism design.

Layer-2 networks provide the same functionality as layer-1 blockchains, plus additional characteristics. For example, layer-2 networks boost throughput and programmability whilst lowering transaction costs. Each layer-2 solution has its own method for remapping transactions to their respective base layer.

The future of scaling

Layer-1 and Layer-2 solutions both play essential roles in scaling blockchain networks. Layer-1 focuses on foundational integrity and protocol-level changes, while Layer-2 delivers practical scalability improvements without burdening the base chain.

Understanding how these layers interact is key to evaluating modern blockchain ecosystems, whether you’re a developer building applications or an investor assessing scalability roadmaps.