[ad_1]

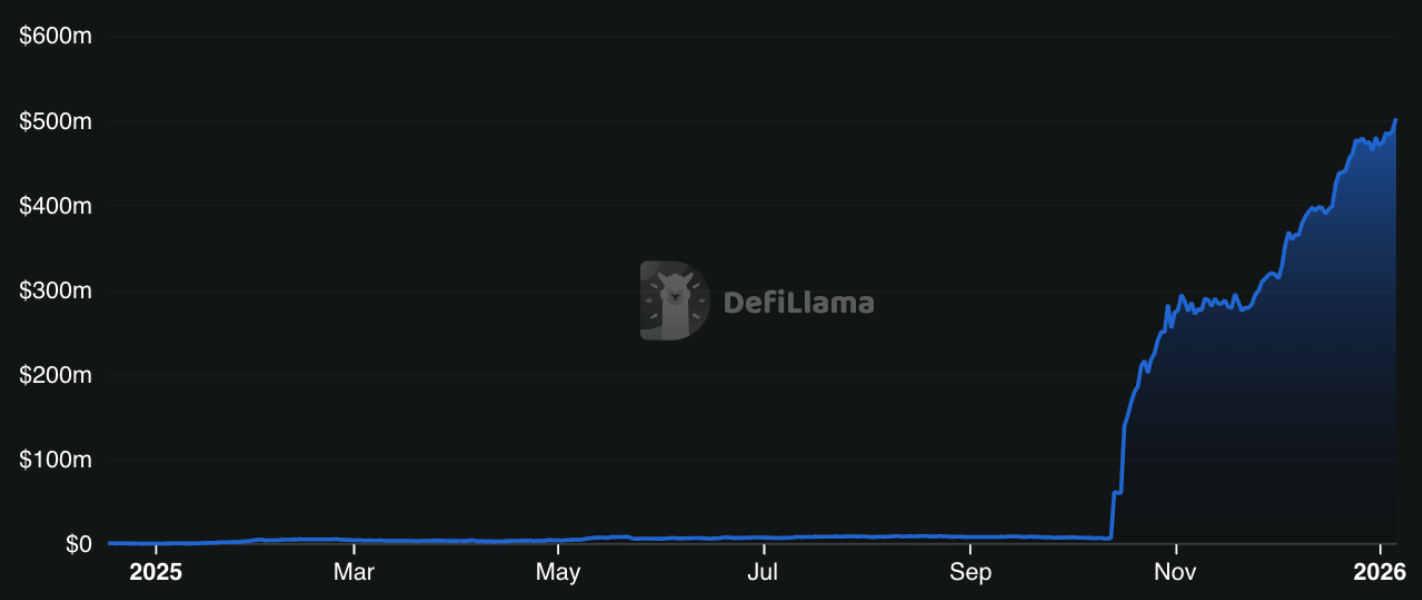

Ink, an Ethereum Layer 2 network developed by centralized exchange Kraken, has crossed $500 million in total value locked (TVL), marking a sharp acceleration in on-chain activity after nearly a year of relatively flat growth.

According to DefiLlama data, Ink’s TVL stood at nearly $503 million on Tuesday, Jan. 6, up about 3% over the past 24 hours. The move places Ink among the larger emerging blockchains by TVL, following a steep climb that began in October 2025.

Ink TVL

The growth represents a major shift for the network, which had less than $10 million in TVL for much of its early life following its mainnet launch in December 2024.

The surge follows Ink’s October 2025 launch of Tydro, a lending protocol built as a white-label deployment of the open-source decentralized finance (DeFi) platform Aave, as previously reported by The Defiant.

At press time, Tydro’s total market size stands at $737.5 million, with $443.8 million available to borrow and $293.7 million currently borrowed, according to the protocol’s dashboard.

Tydro also holds about $446.6 million in TVL, up 34% on the month, according to DefiLlama. The next-largest protocol, Nado, holds roughly $40.8 million, while Velodrome has about $14 million locked.

The increase was also likely aided by the recent rise in Ether (ETH), which is up about 8% over the past week to $3,197.

Moreover, some of the increase could be tied to speculation around Ink’s planned token launch. Kraken has previously said it plans to integrate the INK token into its core products, with an airdrop slated for eligible users through its Kraken Drops program, though details have not yet been disclosed.

While liquidity on Ink has surged, user activity has moved in the opposite direction. Daily active users peaked at just over 157,000 in March 2025 before steadily declining through the rest of the year. Currently, Ink has about 49,000 daily active users, according to Token Terminal.

Ink Daily Active Users

[ad_2]