South Korea’s cryptocurrency market is undergoing a pivotal shift in 2025, moving from a retail-driven boom toward a more institutionalized and regulated framework.

Four policy pillars define this transformation. First, the government plans phased corporate participation. Second, regulators design frameworks for spot Bitcoin ETFs and won-pegged stablecoins. Third, authorities enforce strict measures against unregistered operators and KYC breaches. Fourth, the central bank pauses CBDC development. Instead, it favors bank-led stablecoin pilots.

National Digital Asset Agenda and Legislative Challenges

BeInCrypto previously reported key policy developments under President Lee Jae-myung. The Presidential Committee on Policy Planning designated “building a digital asset ecosystem” as a national policy agenda. This agenda falls under the “innovative economy that leads the world” banner. The Financial Services Commission (FSC) oversees this policy task.

However, specific implementation details remain undisclosed. Currently, only task titles are public. The industry refers to Lee’s campaign pledges for clues about future plans. These pledges include approval of spot ETFs, legalization of security tokens, introduction of domestic won-backed stablecoins.

However, the plan faces uncertainties. The initiative does not rank among the 12 of top emphasized strategic priorities. The FSC’s role faces uncertainty amid potential government restructuring. Implementation requires revising or enacting 951 laws and regulations. The government targets 87% of amendments for National Assembly submission by next year. Although the ruling party holds a substantial majority and opposition leaders also support crypto development, rapid legislative progress is unlikely.

Regional competition adds urgency. The US GENIUS Act has accelerated global adoption of dollar-based stablecoins, raising concerns in Korea about monetary sovereignty. Neighboring hubs are advancing quickly: Japanese firms are building digital asset reserves, Hong Kong has enacted comprehensive stablecoin rules, and Singapore doubled crypto exchange licenses in 2024. BeInCrypto noted these moves will likely intensify Korea’s legislative debates on stablecoin regulation, alongside the gradual expansion of corporate accounts, ETFs, and leverage products on domestic exchanges.

Regulatory Overhaul

On Feb. 13, the FSC unveiled a roadmap to lift the 2017 ban on corporate crypto trading. In H1 2025, nonprofits and public agencies may sell existing holdings; in H2, listed companies and qualified institutional investors can trade on a trial basis. This aligns with global trends and leverages the Virtual Asset User Protection Act (effective July 2024) to protect users and ensure fair markets.

In June, the FSC submitted an implementation plan for domestic spot Bitcoin ETFs and a KRW stablecoin to the Presidential Committee. The roadmap covers custody, pricing, investor protection, and fee reduction. While the current law does not allow spot ETFs, President Lee’s pro-crypto administration supports the reforms.

The Bank of Korea (BOK) has slowed its CBDC project, halting a planned pilot in late 2025. Instead, it backs a “banks-first” stablecoin model and reinforces its cautious stance over time.

“It is desirable first to allow banks, which are under a high level of regulations, to issue won-based stablecoins and gradually expand to the non-bank sector with the experience,” said Yu Sang-dae, BOK senior deputy governor.

Four major Korean banks are actively preparing for KRW-pegged stablecoin issuance ahead of expected legislation. All four banks – KB Kookmin, Shinhan, Hana, and Woori – are scheduled to meet with Circle CEO Heath Tarbert during his visit to Korea next week.

The Ministry of SMEs and Startups proposed amending the venture law to allow crypto firms to register as venture companies, unlocking subsidies, tax incentives, loan guarantees, and government-backed funds.

Enforcement Actions

Enforcement actions underline regulators’ resolve. In February, the Financial Intelligence Unit (FIU) ordered Upbit to halt new customer transactions over AML breaches, including dealings with unregistered foreign exchanges and lax KYC. A Mar. 27 court injunction allowed onboarding to resume pending final ruling.

In May, the Digital Asset eXchange Alliance (DAXA) delisted WEMIX for the second time, citing disclosure failures and a $6.6 million theft, causing a 60% overnight price drop.

Authorities also pressed Google and Apple to remove unregistered exchange apps.

Crypto taxation remains politically sensitive. A 20% capital gains tax, postponed to Jan. 2027, may be delayed further due to incomplete systems and the 2026 local election climate.

Market Dynamics and Growth Outlook

KRW’s Role in Crypto. Source: Kaiko.

KRW is the world’s second-most traded fiat in crypto, reaching $663 billion year-to-date volume — about 30% of global fiat-crypto activity. Nearly one-third of Korean adults hold digital assets, double the U.S. adoption rate.

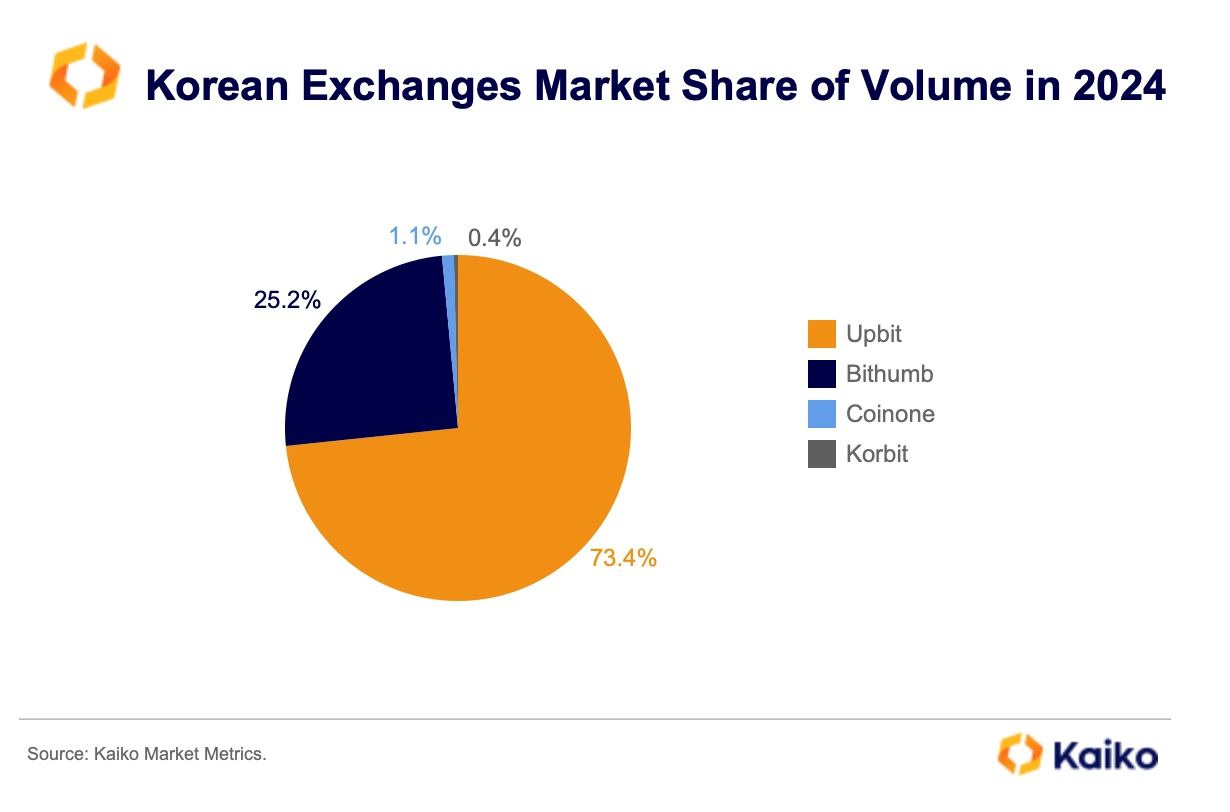

Upbit holds 69% of the domestic market as of February, while Bithumb has rebounded to 25% ahead of its plan to list on KOSDAQ in late 2025. Bithumb’s private shares are up 131% this year to 238,000 won, while Upbit operator Dunamu’s rose 33% to 240,000 won, valuing it at 8.26 trillion won. Both peaked in July before moderating.

Smaller rival Coinone, with 3% share, sold 10% of assets to fund operations — the first sale under new May guidelines for regulated liquidation. Coinone has posted three years of operating losses and cut staff, fueling acquisition speculation.

MAIN PLAYERS IN KOREA’S CRYPTO MARKET. Source: Kaiko

The kimchi premium — Korea’s price gap vs. global markets — swung sharply: above 10% in February, negative by late July, then stabilizing at 2–3% in August. Analysts tie this to liquidity shifts under tighter compliance.

Infrastructure and overseas expansion are advancing. Kaia, a merged venture of Klaytn and Finschia, each respectively started by the country’s top tech giants, Kakao and Naver, aims to be Asia’s first compliant Layer-1 blockchain. Dunamu is expanding into Vietnam, boosting Korea’s global reach.

Geopolitically, South Korea plays a key role in countering North Korean crypto theft. On Jan. 14, it joined the U.S. and Japan in a joint statement warning that DPRK actors stole over $600 million in 2024 to fund weapons programs.

“South Korea’s ability to pair strict compliance with market innovation makes it a unique test case for global regulators,” said Park Ji-hoon, Seoul-based fintech policy analyst.

Outlook

The base-case scenario includes finalizing the ETF framework, launching the bank-led stablecoin pilot, and expanding corporate trading. These could repatriate capital, deepen liquidity, and improve asset quality via stricter listings. Risks include overregulation, prolonged legal disputes (e.g., Upbit), offshore migration from heavy FX rules, and contagion from token delistings.

Key performance indicators for 2026: ETF legalization, stablecoin rollout, FIU’s Upbit ruling, Bithumb IPO results, and adoption of Kaia and blockchain gaming projects.

South Korea’s strategy — tightening compliance while fostering innovation — could cement its role as a crypto-financial hub. By channeling domestic capital into regulated markets and supporting infrastructure growth, it aims to balance investor protection with market expansion. The next year will be critical in determining if this balance holds and Korea’s global influence grows.

The post Being National and Institutional: Korea’s Pivotal Crypto Shift in 2025 appeared first on BeInCrypto.