The world of cryptocurrency, often seen as a realm of innovation and rapid growth, is unfortunately no stranger to controversy and legal battles. Yet, few incidents have captured the public’s attention with such raw intensity as the recent development involving Haru Invest. A shocking turn of events saw a man receive a five-year prison sentence for a brazen act of violence against the CEO of a crypto firm, committed not in a dark alley, but within the confines of a South Korean courtroom during a trial. This isn’t just a headline; it’s a stark reminder of the high stakes and deep emotions often intertwined with financial disputes in the digital asset space.

A Glimpse into the Haru Invest Incident: What Happened in Court?

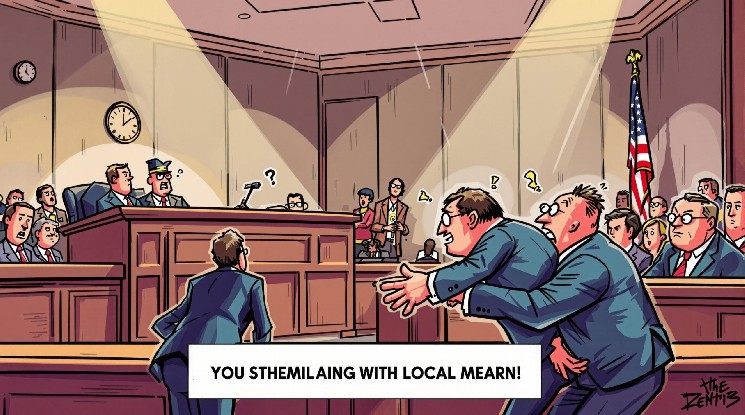

On August 28, 2024, the Seoul Southern District Court became the scene of an unprecedented attack. As reported by Yonhap News, a man identified only as Kang, in his 50s, attended a hearing as an observer. The focus of the hearing was Lee, the CEO of crypto deposit service provider Haru Invest, who was facing serious allegations of embezzling a staggering 1.4 trillion won (approximately $1.02 billion) worth of digital assets. In a shocking act, Kang allegedly stabbed Lee in the neck with a weapon during the proceedings.

This violent outburst sent shockwaves through the courtroom and the broader crypto community. The immediate aftermath saw Kang apprehended, and Lee reportedly sustained injuries. The incident underscored the volatile atmosphere surrounding high-profile crypto fraud cases, where investors, often feeling wronged and desperate, can resort to extreme measures.

The Legal Aftermath: Why Was the Haru Invest Sentence Upheld?

Following the initial ruling, which sentenced Kang to five years in prison, an appeal was lodged. However, the Seoul High Court, after careful deliberation, upheld the original verdict. This decision reinforces the gravity with which the South Korean legal system views such acts of violence, especially within the sanctity of a courtroom.

The court’s decision sends a clear message: while public sentiment regarding alleged financial misconduct can run high, resorting to violence is unacceptable and will be met with severe legal consequences. The legal process, despite its perceived slowness or frustrations for victims, remains the only legitimate avenue for seeking justice and resolution.

Understanding the Context: The Haru Invest Embezzlement Allegations

To fully grasp the intensity surrounding this incident, it’s crucial to understand the backdrop of the Haru Invest case itself. Haru Invest was a prominent crypto deposit service, attracting users with promises of high yields on their digital assets. However, in June 2023, the platform abruptly suspended withdrawals, citing issues with a service partner. This immediately sparked fears among its users, leading to allegations of a ‘rug pull’ or massive embezzlement.

Key points regarding the embezzlement allegations include:

- Magnitude: The alleged embezzlement involved 1.4 trillion won, impacting a significant number of investors.

- Nature of Business: Haru Invest operated as a centralized crypto yield platform, taking custody of user funds and promising returns, which inherently carries risks if not managed transparently and securely.

- Investor Impact: Thousands of investors, many of whom had entrusted their life savings or substantial portions of their wealth to the platform, faced devastating losses. This financial ruin often fuels intense anger and frustration, leading to calls for swift justice.

- Legal Action: The CEO, Lee, and other executives were subsequently arrested and charged, leading to the ongoing trials that culminated in the courtroom stabbing incident.

The ongoing legal proceedings against Haru Invest executives highlight the growing global scrutiny on crypto firms and the increasing demand for accountability in an industry that has, at times, operated with less regulatory oversight than traditional finance.

Challenges and Lessons for the Crypto Ecosystem

The Haru Invest incident, and the broader context of its alleged fraud, underscores several critical challenges facing the cryptocurrency ecosystem:

1. Investor Protection: The lack of robust regulatory frameworks in some jurisdictions leaves investors vulnerable to scams and mismanagement. While regulations are evolving, incidents like this emphasize the urgent need for comprehensive investor protection mechanisms.

2. Due Diligence: For individuals, the onus is increasingly on them to perform extensive due diligence before entrusting funds to any crypto platform. This includes scrutinizing whitepapers, team backgrounds, security audits, and regulatory compliance.

3. Emotional Impact of Financial Loss: The sheer scale of financial losses in major crypto frauds can have profound psychological and emotional impacts on victims, sometimes leading to desperate or violent reactions, as seen in the Haru Invest case.

4. Security in Legal Proceedings: High-profile financial crime trials, especially those involving significant public outrage, require enhanced security measures to protect all participants, including defendants, prosecutors, and observers.

Actionable Insights for Navigating the Crypto Landscape Safely

While the Haru Invest case is a grim reminder of risks, it also offers crucial lessons for both new and seasoned crypto investors:

- Diversify Your Portfolio: Never put all your funds into a single high-yield platform, regardless of how attractive the returns seem.

- Research Thoroughly: Before investing, research the project team, their track record, security audits, and community sentiment. Look for red flags like anonymous teams or overly aggressive marketing.

- Understand Custody: Be aware of whether a platform takes custody of your assets. Self-custody (using your own hardware or software wallets) reduces counterparty risk, though it comes with its own responsibilities.

- Stay Informed on Regulations: Keep an eye on regulatory developments in your region. Stricter regulations often lead to greater investor protection.

- Beware of Unrealistic Returns: If an investment promises returns that seem too good to be true, they almost certainly are. High returns often come with commensurately high risks.

- Seek Professional Advice: For substantial investments, consider consulting with financial advisors or legal experts who specialize in digital assets.

The Broader Implications for South Korea’s Crypto Future

South Korea has long been a significant hub for cryptocurrency adoption and innovation. However, it has also grappled with numerous high-profile crypto-related frauds and collapses. The Haru Invest incident, coupled with the tragic courtroom attack, will undoubtedly add pressure on regulators to strengthen oversight and investor protection measures.

This event could lead to:

- Stricter Enforcement: Increased vigilance and harsher penalties for crypto-related financial crimes.

- Enhanced Security Protocols: Review of security measures in courtrooms for high-profile financial cases.

- Public Education: Greater efforts to educate the public about the risks associated with certain types of crypto investments.

Ultimately, the aim is to foster a safer and more transparent environment for legitimate crypto innovation, while simultaneously weeding out bad actors and protecting vulnerable investors.

Conclusion: A Stark Warning from the Haru Invest Saga

The South Korean court’s decision to uphold the five-year sentence for the man who stabbed the Haru Invest CEO is a powerful testament to the rule of law, even amidst the intense emotions stirred by financial devastation. This shocking incident serves as a stark warning about the potential human cost of large-scale crypto fraud and the critical importance of upholding legal processes. While the digital asset space continues to evolve, this case firmly reminds us that accountability, security, and adherence to legal norms are paramount for its sustainable growth. For investors, it’s a sobering call to exercise extreme caution and diligence, understanding that even in the pursuit of financial gains, personal safety and legal recourse must never be undermined by desperation or violence. The Haru Invest saga is a pivotal moment, shaping perceptions and reinforcing the need for a robust, secure, and just crypto ecosystem.

Frequently Asked Questions (FAQs)

Q1: What was Haru Invest accused of?

A1: Haru Invest, a crypto deposit service, was accused of embezzling approximately 1.4 trillion won ($1.02 billion) worth of digital assets from its users. The platform abruptly suspended withdrawals in June 2023, leading to widespread allegations of fraud.

Q2: Who was stabbed during the Haru Invest trial?

A2: Lee, the CEO of Haru Invest, was stabbed in the neck by a man identified as Kang during a court hearing at the Seoul Southern District Court on August 28, 2024.

Q3: What was the sentence for the assailant?

A3: The man who stabbed the CEO, Kang, was sentenced to five years in prison. The Seoul High Court upheld this original verdict upon appeal.

Q4: Why is this incident significant for the crypto industry?

A4: The incident highlights the extreme emotional and financial stakes involved in crypto fraud cases. It underscores the importance of investor protection, regulatory oversight, and the need for robust security measures during high-profile legal proceedings. It also serves as a warning against resorting to violence, emphasizing that legal channels are the proper recourse for justice.

Q5: What lessons can investors learn from the Haru Invest case?

A5: Investors should prioritize thorough due diligence, understand the risks of centralized yield platforms, consider self-custody of assets, diversify portfolios, and be wary of unrealistic returns. It also emphasizes the importance of understanding the legal and regulatory landscape of crypto investments.

Share Your Thoughts and This Article!

The Haru Invest incident is a stark reminder of the complexities and challenges within the crypto world. We encourage you to share this article with your network on social media to spark important conversations about investor safety, legal accountability, and the future of digital assets. Your insights and discussions are vital for fostering a more secure and transparent crypto ecosystem.

To learn more about the latest crypto market trends, explore our article on key developments shaping Bitcoin price action.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.