Following Ethereum’s (ETH) recent ETF approval, the price has seen a steady incline. Is there more room for growth?

BeInCrypto looks at how institutional interest and key market trends are shaping a bright future for ETH.

Technical Outlook for Ethereum

Ethereum (ETH) currently trades at $3,902, demonstrating robust bullish momentum. The price is well above the Ichimoku cloud and the 100-day EMA (currently at $3,175), indicating sustained upward pressure.

ETH/USDT (1D). Source: TradingView

Support levels are established at $3,575 and $3,400, while resistance levels are identified at $4,134 and $4,390. The formation of higher highs and higher lows confirms the bullish pattern.

Increased trading volumes during price surges reflect strong buying interest, reinforcing the bullish sentiment.

Analyzing Ethereum On-Chain Data

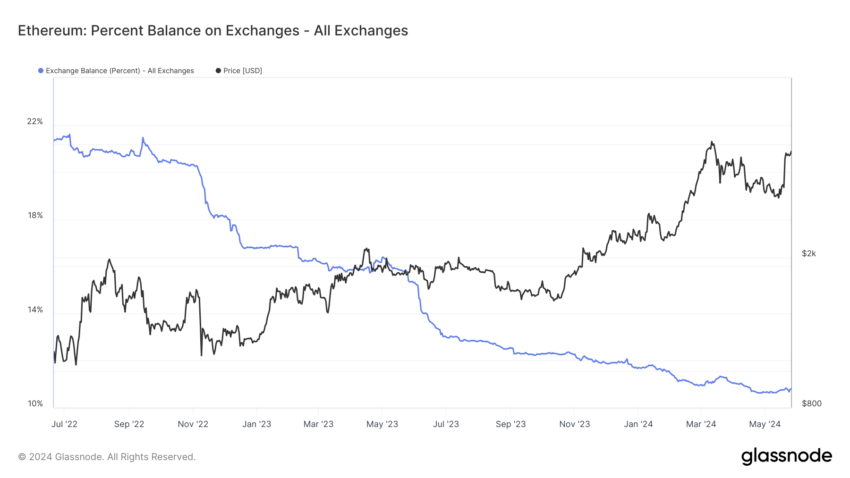

The percentage of Ethereum held on exchanges has decreased dramatically to below 11% by May 2024. This trend indicates a significant shift towards long-term storage and staking, reducing the immediate supply available for trading and selling pressure.

ETH Percent Balance on Exchanges. Source: Glassnode

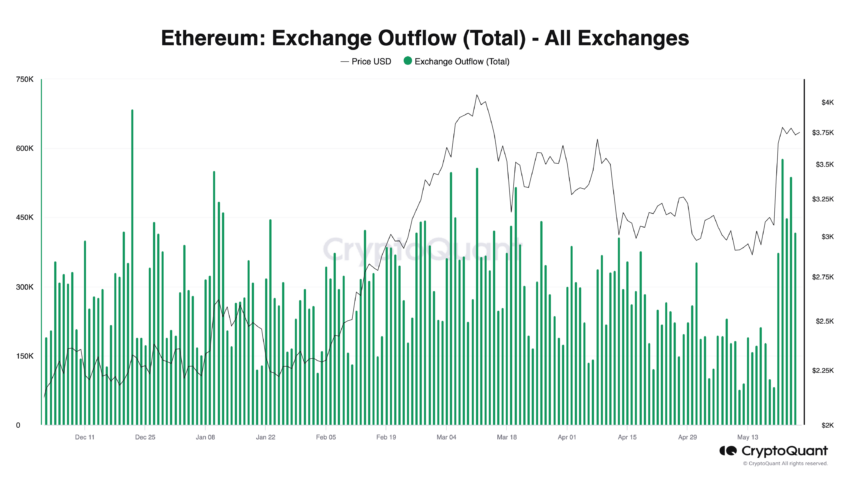

Following the news of the SEC approving the spot ETFs for Ethereum, there was a noticeable increase in outflows. This regulatory approval has likely bolstered investor confidence, leading to significant ETH withdrawals from exchanges to private storage.

The approval of spot ETFs generally implies an increased legitimacy and mainstream acceptance of the asset, encouraging investors to hold onto their Ethereum in anticipation of higher future prices.

As more ETH is moved off exchanges, the circulating supply on these platforms diminishes. With less ETH available for trading, the potential for supply shortages increases. A reduced supply on exchanges can lead to upward price pressure. When demand remains constant or increases while supply diminishes, prices are likely to rise. This scenario is conducive to a bullish market outlook for Ethereum.

The behavior of moving Ethereum off exchanges into private wallets is a strong indicator of long-term investor confidence. This action reflects a positive sentiment towards ETH’s future value, particularly reinforced by the SEC’s approval of spot ETFs. It contributes to a bullish outlook as the overall market perceives the reduced supply and increased holding as signals of potential price appreciation.

Ethereum: Exchange Outflow. Source: CryptoQuant

The number of addresses holding at least $1 Million in Ethereum has steadily increased. This trend indicates growing confidence among large holders and institutional investors, suggesting long-term stability and positive market sentiment.

Ethereum: Number of Addresses with Balance ≥ $1M. Source: Glassnode

The increasing number of addresses holding at least $1 Million in ETH strongly indicates that institutional investors are actively buying Ethereum. This trend is driven by the growing confidence among these large holders in Ethereum’s future prospects. The SEC’s approval of spot ETFs has likely played a significant role in this development, providing a regulated and attractive investment vehicle for institutions.

Institutional investors’ entry into the Ethereum market brings a level of credibility and stability. These entities are known for their rigorous investment strategies and long-term commitments. Their participation suggests a positive outlook for Ethereum, both in terms of price appreciation and its role in the broader financial ecosystem.

Finally, as more institutional investors accumulate ETH, the market will likely see reduced volatility and increased support for higher price levels. This growing institutional interest also fosters innovation and development within the Ethereum ecosystem, further solidifying its position as a leading blockchain platform.

Strategic Recommendations for ETH

Bullish Outlook: As more institutional investors accumulate ETH, the market will likely see reduced volatility and increased support for higher price levels. This growing institutional interest also fosters innovation and development within the Ethereum ecosystem. Further solidifying its position as a leading blockchain platform.

Long-Term Accumulation: Institutional accumulation indicates strong confidence in Ethereum’s future value, reducing market volatility and supporting price increases. Gradually accumulate ETH during market dips to benefit from long-term price appreciation.

Monitor Key Technical Levels: Understanding support and resistance levels helps optimize entry and exit points, enhancing trading strategies. Set buy orders near key support levels ($3,575 and $3,400) and consider profit-taking at resistance levels ($4,134 and $4,390) or HODL.