[ad_1]

Solana-based lending protocol Kamino is drawing criticism after preventing users from refinancing their positions through Jupiter Lend.

The update, first flagged by Blockflow Labs founder Pradyuman Verma, blocks refinancing by blacklisting Jupiter Lend’s on-chain address for its recently launched Refinance tool, preventing users from unwinding positions through that address.

In an X post on Tuesday, Dec. 2, Verma called the change “openly ignoring open-finance principles,” adding that Kamino is “essentially pushing users into negative APYs just to keep Kamino profitable.”

Following Verma’s post, Jupiter core contributor Kash Dhanda wrote on X that a “major Solana DeFi team manually blacklisted Jupiter Lend and prevented users from using our Refinance tool,” without naming Kamino directly.

Just last week, Jupiter introduced Refinance, a tool that allows users to shift on-chain loans from other protocols without slippage while offering better rates.

As of press time, neither Kamino nor Jupiter Lend have made public statements about the blocked address, and both teams didn’t respond to The Defiant’s requests for comment.

Heated Competition

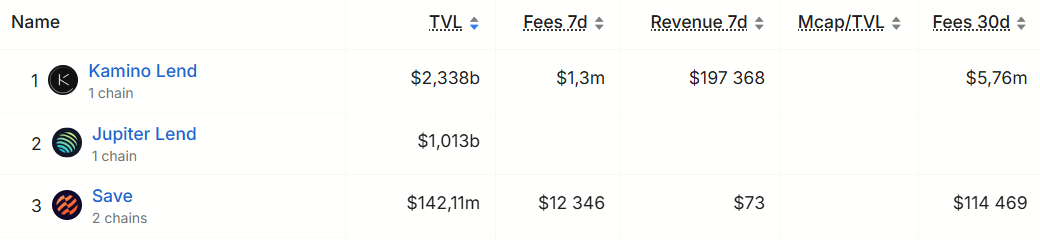

The controversy comes as Jupiter Lend expands in the Solana lending market. According to DefiLlama, the total lending sector on Solana is standing at roughly $3.7 billion in total value locked, with Kamino controlling over 60% of the market’s share.

Top Solana lending protocols. Source: DefiLlama

Jupiter Lend’s TVL topped $1 billion for the first time just today, Dec. 3, supported by steady inflows since the protocol launched in late August.

Jupiter Lend’s TVL. Source: DefiLlama

In a follow-up to Verma’s post, Samyak Jain, co-founder of DeFi liquidity protocol Fluid, which provides liquidity to Jupiter Lend, wrote that “quite a few Kamino users” reached out to Fluid and complained that they were “earning very low yield.”

To help them earn a better APR without deleveraging, Fluid offered an alternative, but, as Jain put it, Kamino “literally added a check for their users to stay locked in.”

In another follow-up, Kyle Samani, managing partner at crypto VC firm Multicoin Capital, which lists Kamino in its portfolio, suggested that “at least two obvious considerations” for the blacklisting are that “kamino users are choosing kamino, and not jup/fluid” and that “kamino developers may not want to implicitly underwrite jup/fuid SCs.”

Kamino’s TVL. Source: DefiLlama

The update also came as Kamino — the second-largest DeFi protocol in the Solana ecosystem by TVL — has seen its dollar-denominated liquidity falling in recent months. Per DefiLlama, the protocol’s TVL dropped from a peak of $3.71 billion in early October to $2.33 billion at press time, a decline of nearly 30% in just two months.

Despite the controversy, Kamino’s native token KMNO is up 2.5% on the day, while Jupiter Lend’s JUP token is up about 5%, as the broader market continues its recovery rally that started yesterday.

[ad_2]