[ad_1]

Q1. You spent years building institutional relationships at the TON Foundation. What inspired you to co‑found Affluent, and how has your TON experience shaped your vision for a DeFi super‑app on Telegram?

DeFi has gone too far, exposing users to the raw technology while deterring ordinary people from accessing savings with a simple click. Affluent sets out to abstract away these complexities and put savings in every Telegram user’s pocket.

After my time at TON Foundation, I realized that there are three essential ingredients that we need to kickstart DeFi on TON: a distribution channel, institutional backing, and a one-click solution. We set out to align these three requirements, and, so far, we’ve successfully built a one-click deposit vault and institutional borrowing infrastructure. We’re now focused on integrating our vaults into native Telegram distribution channels.

TON has already proven through its tap-to-earn era that Telegram’s reach and social mechanics can deliver real distribution. Our vision is to take this further by distributing real financial utility to the messenger application’s one billion users.

Q2. Affluent aims to make DeFi as simple as “one‑click” yield on Telegram. How did you identify Telegram as the ideal interface for mass adoption, and what challenges did you face in translating traditional DeFi UX into a chat‑based flow?

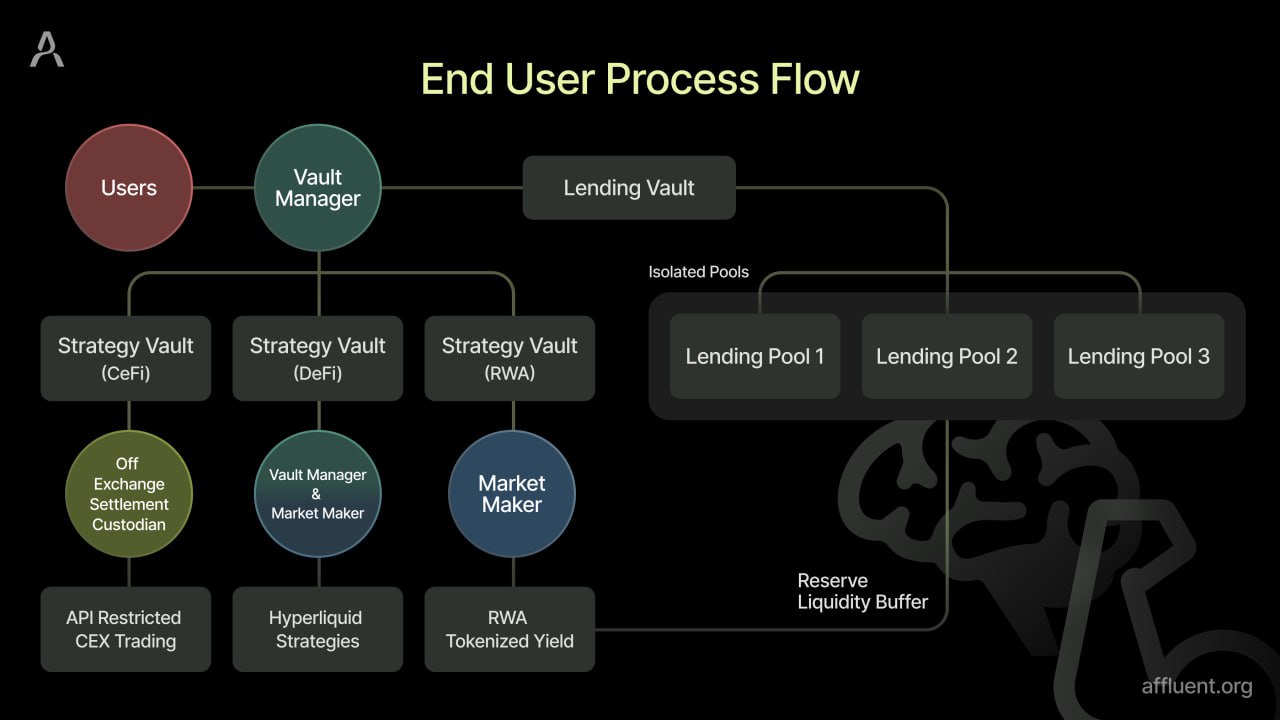

It’s no secret that Telegram is transforming into a super app, providing users with an experience that goes beyond just sending messages. At the core of every super app are financial applications that power everyday utilities like payments and savings. In many parts of the world Telegram is already the primary messenger. We want to provide the financial infrastructure to meet these users’ need for a true one-click savings solution. The main challenge we faced was abstracting away the countless confusing steps required to navigate DeFi. We solved this by creating a vault architecture that is managed by a dedicated vault manager, providing users with an intuitive, user-friendly experience.

Q3. The Strategy Vault and Vault Manager are the core of Affluent’s differentiated approach. Can you walk us through how these vaults balance automated smart‑contract allocations with human portfolio oversight?

The Vaults enforce a set of rules that strictly define the permissible actions of the Vault Manager. This structure strikes the right balance between automation and human judgment, enabling Vault Managers to apply risk management and active oversight as part of their curation process.

Q4. At launch you’re supporting tgBTC, tokenized gold (XAUT0), and tokenized RWAs. How do you decide which assets and lending markets to integrate, and what due‑diligence processes underpin those choices?

We assess which assets have the highest demand for collateralization, enabling institutions and advanced users to maximize their capital efficiency. This, in turn, benefits retail users as the yield increases on the stablecoins and other assets that they have deposited into the vaults. Securing robust, manipulation-resistant price feeds is a critical part of our due diligence and risk management process. We ensure sufficient on-chain liquidity for each asset, and, if the market depth is not sufficient, we source price feeds directly from the origin.

Q5. Many DeFi protocols tout full automation; Affluent blends algorithms with expert management. How do you determine when to rely on smart contracts versus on‑chain or off‑chain human intervention to optimize yields and manage risk?

We want to bring trustless asset management into the mainstream. While asset management is driven by experts exercising human judgment, our architecture eliminates the need for trust assumptions – creating the optimum environment for growth. Risk-adjusted yield is only meaningful when risk management responds dynamically to changing conditions, and our protocol is built to do exactly that.

Q6. Your roadmap speaks equally to retail “sticky” savings and deep institutional liquidity. How do you align those two segments’ needs, and what product features ensure both feel at home in Affluent?

Retail users want passive solutions that are simple and convenient. Our Vaults are built to deliver exactly that. In contrast, institutions and advanced users demand control over variables. They can manually execute strategies with the assurance that the pools they engage with are isolated, minimizing the risk of contagion.

Q7. Security is paramount for custodyless yield. What are Affluent’s key smart‑contract audit processes, on‑chain risk checks, and insurance or backstop mechanisms to protect users’ funds?

We are audited by one of the top security firms in the space, Trail of Bits. Whenever new features are introduced, such as the recent Strategy Vaults and Request for Quotation (RFQ) functionality, we conduct incremental audits to maintain comprehensive protocol coverage. Our developers also ensure that the protocol accounts for points of failure that can potentially arise from TON’s asynchronous environment.

Q8. You’ve introduced Affluent Points as engagement rewards ahead of a token generation event. How will AP accrual translate into token allocation, governance rights, or other on‑chain utilities?

Our community is our greatest strength, and, while we’re still ideating our token allocation strategy, it will be our early supporters that are rewarded most.

Q9. Affluent is tapping into TON’s growing DeFi landscape. How can third‑party developers and partners compose with your Strategy Vaults, and what incentives exist for ecosystem‑wide integration?

Soon, third-party developers and partners will be able to launch their own Vaults, and the pool creation process will become fully permissionless. In the early stages, we are maintaining oversight to bootstrap liquidity, grow the user base, and establish a robust Vault Manager ecosystem.

Q10. As you bring tokenized real‑world assets and lending to Telegram, how are you navigating global regulatory frameworks around asset tokenization, KYC/AML, and institutional participation?

Our services are non-custodial by design, and emerging regulatory frameworks are beginning to address the requirements for such models. Within TON’s ecosystem, partners like Elliptic already provide analytics and compliance solutions. We plan to work with these partners to ensure institutional participants have the confidence to deploy capital.

Q11. The space includes money‑market protocols, CeFi super‑apps, and other chat‑based fintech bots. What do you see as Affluent’s unique moat, and how do you plan to stay ahead as competitors innovate?

Our proprietary RFQ allows Vault Managers to work with market makers to swap assets in a fully trustless manner. This unlocks a range of yield strategies without compromising the non-custodial nature of the service. We already offer one-click looping, and soon we will introduce additional Strategy Vaults that generate yield through delta-neutral trading strategies on popular decentralized exchanges. With partners like LayerZero, we can also bring custom assets into Telegram’s Web3 ecosystem, giving us flexibility beyond the native assets available in TON’s ecosystem.

Q12. Affluent will be one of the first protocols to support TON‑wrapped Bitcoin on Telegram. What other upcoming TON assets or partnerships are you most excited about integrating, and how will they enhance Affluent’s value proposition?

Yes, we are actively working on bringing DeFi use-cases for TON-wrapped Bitcoin to the Web3 ecosystem in Telegram. This has important second order effects. While many retail investors perceive Bitcoin as out of reach due to unit bias, they can still earn yield on assets that larger Bitcoin holders want to borrow. We are also excited about the upcoming Tokenized Telegram Bond. This will unlock new capital efficiency for institutional investors while providing yield opportunities for retail users. We believe that accelerating the growth of assets recognized by traditional financial institutions, rather than long tail assets, will be the gateway for Telegram to evolve into a true financial super app.

Q13. DeFi still intimidates many newcomers. Beyond UI simplification, what educational or community initiatives is Affluent launching to build trust and guide users through the protocol’s capabilities?

We are focused on localization efforts and will run regular in-person educational seminars on DeFi and Affluent in Seoul, South Korea. We will also ensure this content is distributed online for our global users. It is important that founders and the team put their names and faces forward, especially for a financially sensitive product like money markets. To earn users’ trust, we are putting our reputation on the line and guiding their on-chain journey through informative sessions and educational content.

Q14. Looking to the next 6–12 months, what are your top milestones (TVL targets, institutional partnerships, new asset launches)? Which metrics will you be watching to know you’ve successfully turned Telegram into a “financial super‑app”?

From a metrics perspective, we are highly focused on how much of the protocol’s TVL is composed of stablecoins and their utilization rate. Unlike other L1 ecosystems that focus on native token TVL for trading and speculation, we believe that high stablecoin utilization will unlock meaningful yield opportunities for Telegram users who want to use Affluent as their primary savings app inside Telegram. We are also pursuing institutional partnerships with RWA issuers, major asset management protocols on EVM, and the launch of BTCFi.

Q15. Finally, when you look back in five years, how do you hope Affluent will have transformed both DeFi and the broader Telegram ecosystem? What legacy are you aiming to build?

There is a competitive darwinian race unfolding in DeFi. We believe that only projects with robust risk management and strong security will survive to lead the mass adoption of on-chain financial planning. Affluent is built to do exactly that, while simultaneously abstracting away DeFi’s complexities and putting decentralized savings in every pocket. Our aim is to build a lasting legacy by bringing users on-chain who become habitual, repeat users of a trustless money markets app. Many projects building for Telegram chase unrealistic total addressable markets, often claiming they are building for a billion users. Our near-term goal is sharper: bring the next million users on-chain and keep them there.

[ad_2]