Bank of Japan officials are beginning to acknowledge what once seemed outlandish: that cryptocurrencies could one day become a major part of everyday payments in Japan—and perhaps even challenge the yen itself.

While they stress that such a shift won’t happen overnight, the notion that digital assets could reshape the country’s payment landscape is no longer mere speculation; it’s increasingly being treated as a plausible scenario.

At a recent meeting with private-sector partners involved in the BOJ’s central bank digital currency pilot, Executive Director Kazushige Kamiyama said that while Japan still sees high levels of banknote issuance, “usage of notes could fall significantly in the future amid rapid digitalisation.”

Changes in the breakdown of the cashless payment amount and cashless payment ratios by numerator | Source: Japan’s Ministry of Economy, Trade and Industry

It was a nod to what’s becoming increasingly difficult to ignore lately. The country once known for clinging to paper yen has been shifting fast. Government data showed cashless payments jumped to 42.8% of all transactions in 2024, nearly tripling from just over 13% in 2010. Japan even hit its official 40% target a year ahead of schedule.

The Bank of Japan isn’t making any promises just yet. It hasn’t decided whether it’ll actually roll out a digital yen — basically its version of a central bank digital currency — but the pilot program that kicked off in 2023 is now running at full speed.

While BOJ officials aren’t embracing crypto as a replacement for fiat, their growing support for a digital yen suggests they see decentralized assets as a serious contender in the payments space.

Kamiyama says the BOJ needs to consider how to keep the retail payments system “convenient, efficient, accessible universally, while being safe and resilient.” That’s where things get more speculative.

Future where crypto wins

Speaking over the weekend, BOJ Deputy Governor Shinichi Uchida suggested something rarely said aloud by a central banker in Japan: if the BOJ fails in its core duty — price stability — people might stop trusting the yen. And in that case, he warned, another instrument could step in.

In a digitally advanced society, Uchida said, there is “no guarantee that currency issued by the central bank of a sovereign nation will continue to function as a generally acceptable payment instrument.” Although he didn’t drop any names, but he did suggest that cryptocurrencies and stablecoins might eventually step in to fill the gap.

Still, Uchida was careful to say he doesn’t expect cash to disappear “any time soon,” but the fact that he raised the prospect of crypto overtaking the yen — hypothetically or not — says a lot about how the conversation is shifting in central bank circles.

Where things stand now

As of mid-2025, Japan’s economy remains fragile. Inflation has been volatile, hovering just above 2% in recent months. Growth is slow, and the BOJ is still navigating the long tail of post-pandemic stimulus policies.

In that environment, digital payments have gained ground, not just through CBDC discussions, but in the real economy. Local surveys suggest younger consumers are increasingly turning to mobile apps and QR code systems. Crypto use is still modest compared to South Korea or the U.S., but it’s growing.

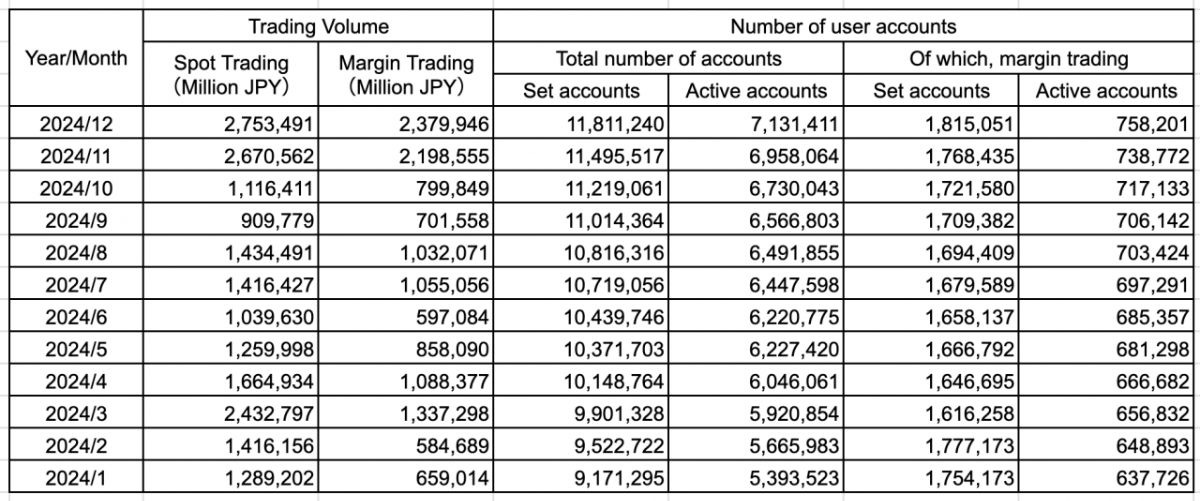

Trading volume of number of Japanese crypto accounts | Source: Bitbank Ventures

According to a report from Bitbank Ventures, there are over seven million active crypto accounts in Japan as of December 2024, up from five million in early 2024. Bitcoin (BTC) and Ethereum (ETH) remain the most commonly held, but stablecoins pegged to the yen or dollar are also gaining traction in cross-border commerce and remittances.

And then there’s regulation. Japan has long had some of the tightest crypto rules in the world. But lately, regulators have shown more flexibility, especially when it comes to stablecoins and their role in payment infrastructure.

You might also like: Japan eyes G7 support to thwart North Korea’s crypto-funded weapons programme

The CBDC question

Even as crypto adoption rises, the BOJ is still very much focused on its own digital offering. The CBDC pilot is still in its active phase, involving tests with major Japanese banks like MUFG, SMBC, Mizuho, along with regional banks and fintech firms.

And while the digital yen isn’t live yet — and there’s still no official launch date — BOJ officials have been speaking out more about why it matters and the role it could play in Japan’s future economy. Uchida called the CBDC a “critical piece of infrastructure” that could help maintain public trust in the yen. Still, he emphasized that demand for cash will likely remain strong. At least in the near term.

Globally, the race is also heating up. The European Central Bank is doubling down on plans for a digital euro. And in the U.S., President Donald Trump’s executive order banning a digital dollar has expectedly pushed the debate forward — by politicizing it. His move, seen by some as an endorsement of crypto and stablecoins, is prompting other central banks to act faster.

For instance, as crypto.news reported earlier, JPMorgan Chase, Bank of America and other major banks are reportedly exploring a shared stablecoin to keep pace with rising competition. One idea reportedly being discussed is to let other banks use the stablecoin. Some regional and community banks have reportedly also explored a separate stablecoin consortium, though details remain unclear.

Japan may not be rushing. But it’s clearly preparing. And that preparation now includes at least entertaining the idea that crypto could become more than just a fringe asset.

Read more: Will the rising Japanese yen affect Bitcoin and altcoin prices?