[ad_1]

Yen, the third-most traded fiat currency in foreign exchange markets, has fallen flat against Bitcoin.

The Japanese yen crashed to a 34-year low as authorities struggled to stem hyperinflation in the economy. According to Bloomberg, Japan’s sovereign fiat money suffers mainly due to a difference between local interest rates and U.S. Federal Reserve rates.

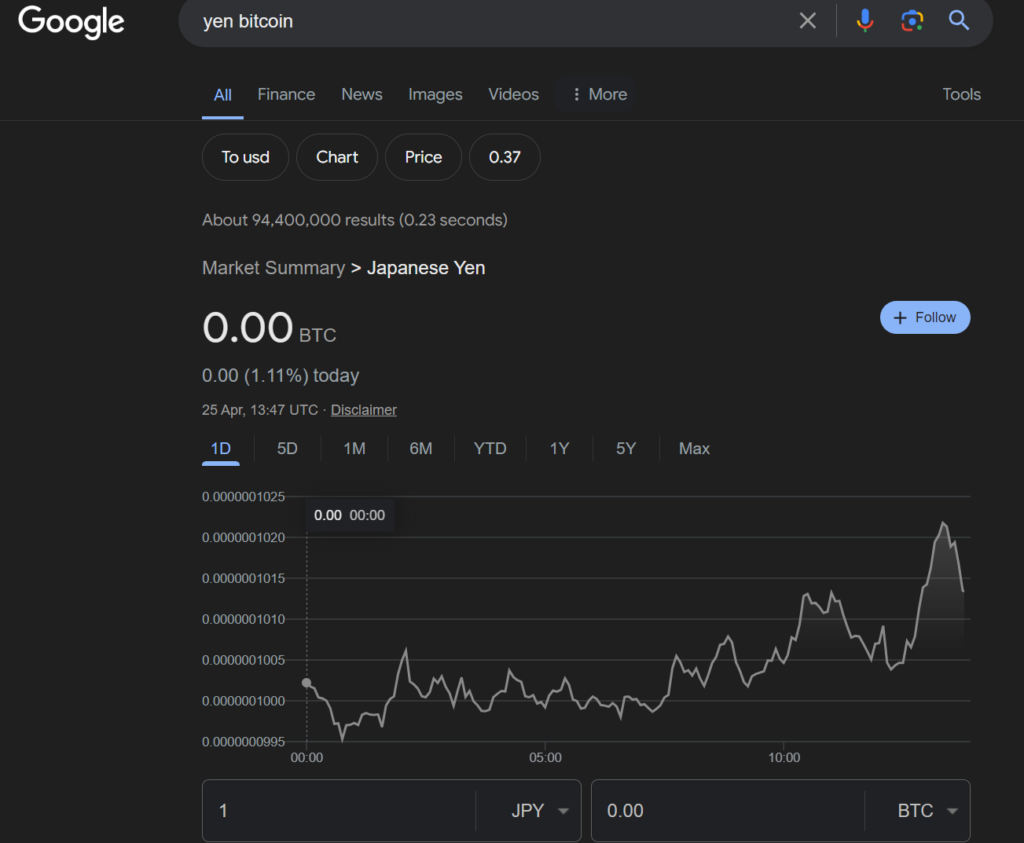

While the Japanese government navigates this conundrum, Bitcoin (BTC) has outstaged the yen in direct monetary value. On April 25, Google Finance showed that one Japanese yen equaled zero BTC.

Japanese yen against BTC chart | Source: Google Finance

In February, BTC rallied against several fiat currencies and achieved all-time highs in some 14 countries as the industry buoyed off euphoria from the newly approved spot BTC ETFs.

You might also like: Glassnode: Bitcoin’s issuance rate sinks lower than gold’s after fourth halving

Crypto community reacts to Bitcoin-yen

Following the news, much of the sentiment on social media praised Bitcoin as “sound money” and innovation capable of fostering financial freedom from the global traditional economic bubble.

Users reiterated what BTC maxi Michael Saylor describes as “Bitcoin’s superior design,” a nod to Satoshi Nakamoto’s system that ensured that only 21 million BTC would exist.

It is impossible to exceed this cap as it is hard-coded into BTC’s blockchain. A halving ensures that inflation is controlled by reducing the number of new tokens in circulation. The halving occurred last week, with Bitwise CIO Mat Hougan opining that the event would largely benefit BTC’s market value in the long term.

Same for dollar https://t.co/VOJFZXPypr

— Ivan Sherbakov (We’re hiring!) (@sherbakov_btc_) April 25, 2024

Read more: Bitwise CIO: Bitcoin halving is ‘buy the news’ event

[ad_2]