Cango Inc. pivoted from automobile trading to Bitcoin mining and is now targeting 50 EH/s in early 2025. With a growing BTC treasury, Tencent as an institutional investor, and Bitmain links, is this the mining sector’s next dark horse?

A Cango Deep Dive

The following guest post comes from Bitcoinminingstock.io, the one-stop hub for all things bitcoin mining stocks, educational tools, and industry insights. Originally published on Mar. 25, 2025, it was penned by Bitcoinminingstock.io author Cindy Feng.

It’s been a few weeks since our last deep dive into lesser-known names in the Bitcoin mining space. I’ve been a bit quiet—partly because the sector’s been in a slump, but also because I’ve been recovering from a lower-back injury (a reminder to listen to your body and not push it too hard with physical activities).

For the second instalment of this series, I want to talk about Cango Inc. (NYSE: CANG). Why? While the whole mining sector has been taking a beating lately, Cango has had a few strong days, boosted by its share buyback announcement and a non-binding buyout offer.

Bitcoin Mining Stocks Heatmap (live updates)

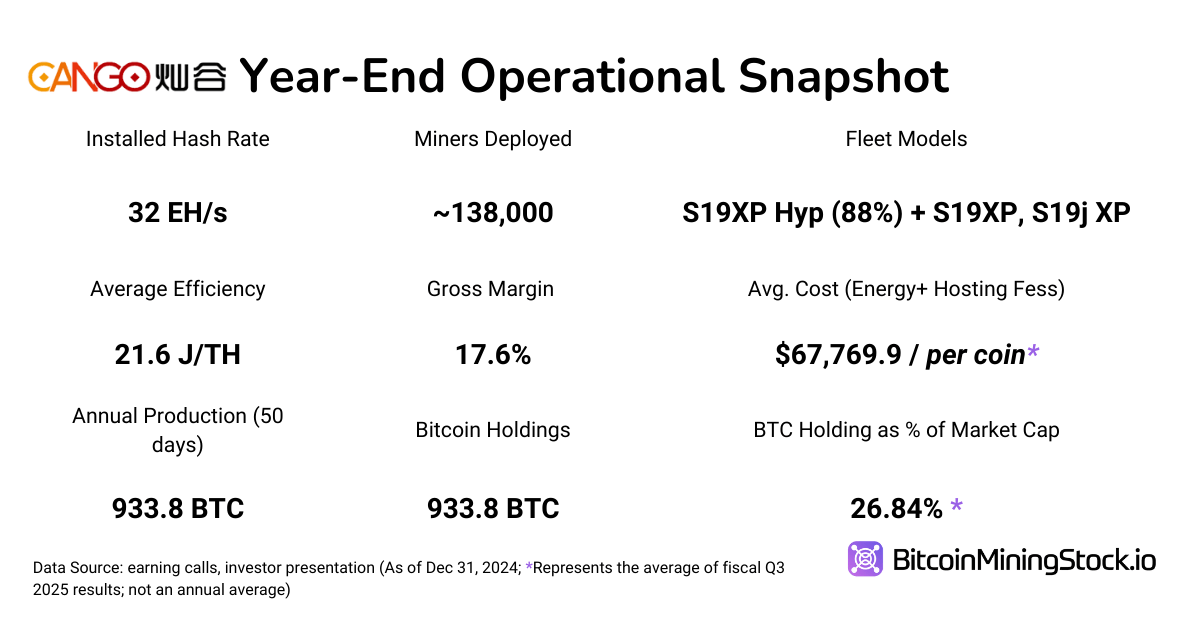

But here’s what really caught my eye: just a few months ago, this was still an automobile trading platform with limited growth potential. Now, it targeting 50 EH/s early this year, with 32 EH/s already online.

So how is this bold pivot playing out? And could Cango quietly become a major player in the space? Let’s dive in.

Company Overview

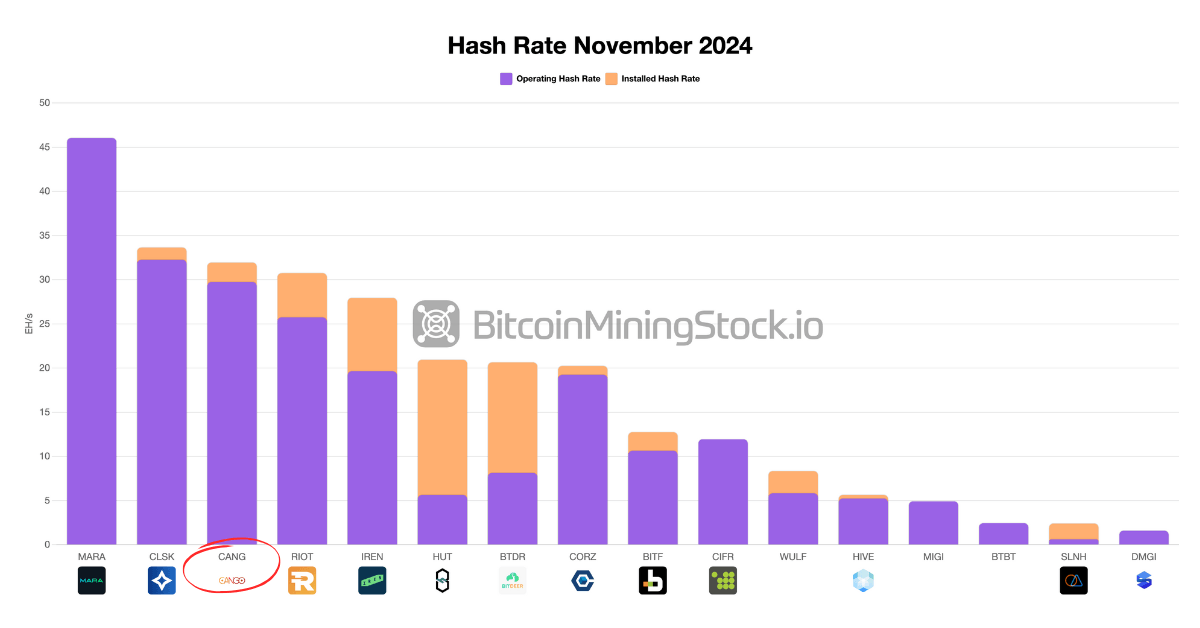

Cango Inc. (NYSE: CANG) began as an Shanghai-based auto financier and later positioned itself as a key player in China’s automobile trading services. By late 2023, the company has shifted its focus from the domestic market to facilitating used car sales from China to developing markets. Then in November 2024, Cango announced its entry into Bitcoin mining, launching operations with 32 EH/s of online hash rate. The scale and immediacy of this move surprised many investors—placing Cango just behind MARA and CleanSpark, and making it the third-largest public Bitcoin miner by deployed capacity at the time.

Overview of Public Miners’ Hash Rate

The mining acquisition deal was for 50 EH/s in total, with the remaining 18 EH/s expected to come online in Q1 2025, subject to the performance criteria outlined in the agreement. Notably, the infrastructure was not built from scratch: Cango acquired operational ASIC fleets directly from Bitmain, and a Bitmain affiliate continues to manage the machines’ operations and maintenance within third-party hosting facilities.

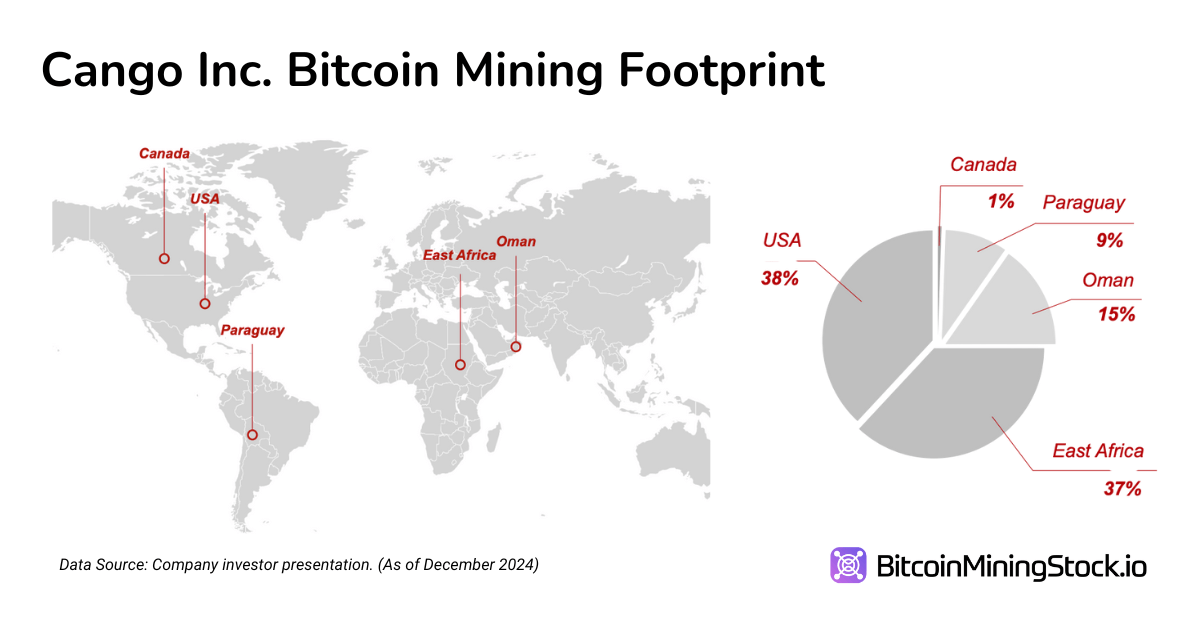

According to company disclosures, Cango has its fleet mainly hosted in the U.S.,East Africa, Oman and Paraguay – which keeps it clear from China’s ongoing crypto restrictions.

Financial Highlights

Revenue & Profitability Transformation

The impact of Cango’s pivot to Bitcoin mining is clearly reflected in its latest financial results. In Q4 2024, the company reported revenue of RMB 668 million ($91.5 million), a 414% YoY increase. This growth was almost entirely driven by Bitcoin mining, which accounted for 98% of total revenue. In contrast, the automobile trading segment, once Cango’s core business, just contributed RMB 15 million ($2.1 million) – a signal that this legacy segment is effectively being phased out.

Despite the revenue surge, profitability remains a key issue. Cango posted a gross margin of 17.6% in Q4—significantly below peers with similar operational scale. For comparison, CleanSpark, which operates in a comparable hash rate range, reported a 57% gross margin during the same period. This suggests that Cango’s cost structure is far from optimized. Reliance on third-party hostingand exposure to higher energy costs are two major attributors.

The company’s average Bitcoin production cost stood at $67,769 per BTC(cash cost includes energy and hosting fees). This figure places Cango toward the higher end of the cost curve among large public miners we track – many of whom report all-in costs in the $50K range. Until Cango secures lower-cost infrastructure or negotiates more favorable hosting terms, its margin profile is likely to remain under pressure, even if revenue growth continues.

Balance Sheet & Liquidity

Cango entered 2025 in a strong liquidity position, reporting RMB 2.5 billion ($345 million) in cash and short-term investments as of December 31, 2024 – up from RMB 1.7 billion ($232.9 million) the previous year. This substantial reserve provides a meaningful buffer for continued expansion and cushions against potential volatility in Bitcoin markets. However, the company’s total liabilities also rose sharply, increasing 126% YoY to RMB 1.88 billion ($258 million). This rise was primarily driven by accrued expenses and other current liabilities tied to its mining acquisition and related operations.

While Cango currently has enough liquidity to fund near-term growth, the pressure now shifts to improving operational margins. Without stronger cash flow generation, the company may eventually need to seek external capital, risking equity dilution or increased leverage.

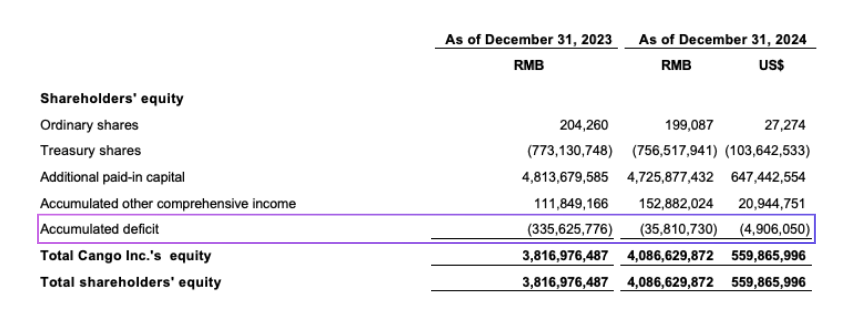

A closer look at the equity structure highlights these trade-offs. Shareholders’ equity increased 7.1% YoY to RMB 4.09 billion ($559.9 million), largely due to the company’s RMB 299.8 million ($41.1 million) net income in 2024. This return to profitability helped reduce the accumulated deficit from RMB (335.6) million to RMB (35.8) million, strengthening the balance sheet and partially restoring retained earnings.

However, the $144 million stock-based component of the $400 million mining machine acquisition significantly impacted equity structure. It expanded total equity but also diluted existing shareholders as the sellers, now equity holders, collectively own approximately 40% of the company post-transaction. This ownership shift is reflected in the decline of additional paid-in capital from RMB 4.81 billion to RMB 4.73 billion, pointing to a redistribution of equity rather than fresh capital inflow.

Lastly, while the company repurchased 996,640 ADSs for $1.7 million, the buyback’s impact on total equity was negligible. It does, however, suggest that management sees the stock is undervalued, though current capital allocation remains firmly focused on scaling the mining operation.

Valuation Modelling

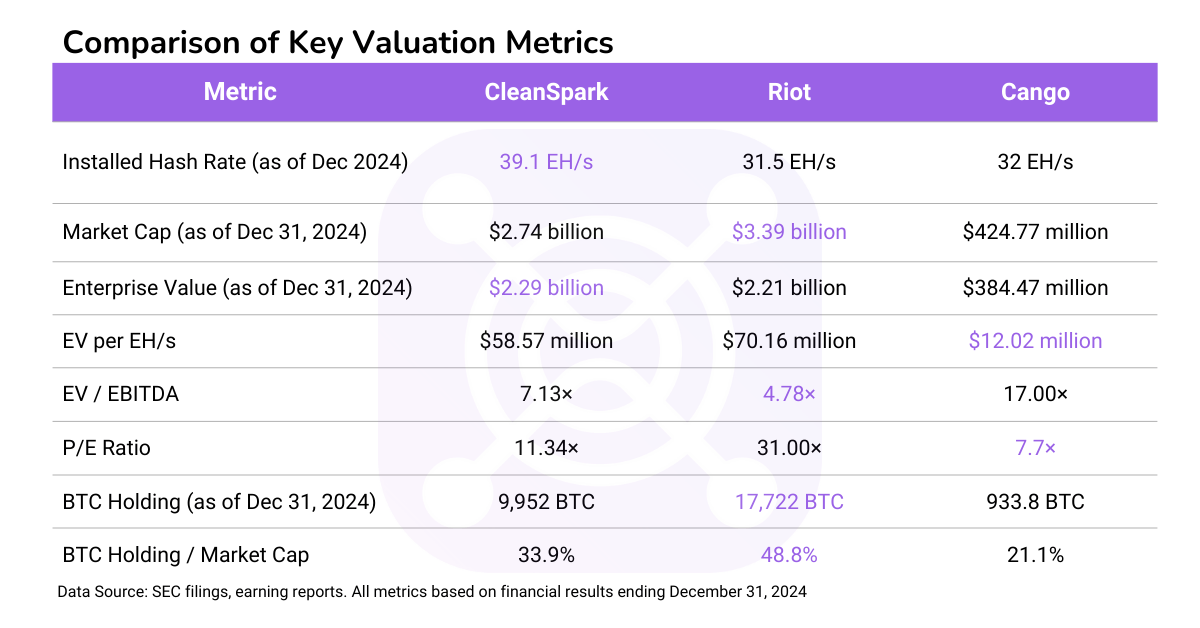

A critical step in understanding Cango’s worth is to benchmark it against similar scale Bitcoin miners (e.g.,CleanSpark, Riot). As of Dec 31, 2024, Cango’s market cap stands at $424.77 million).

- Enterprise Value (EV): $229.2 million (Market Cap + Debt – Cash & Cash Equivalent- BTC Holdings).

- EV/EBITDA Ratio: 17x ($384.47M/$22.8M)

- P/E: 7.7x

- P/S: 2.87x (very moderate market optimism about revenue)

- BTC Holding / Market Cap: 21.1%

Mining Operations & Efficiency

Cango deployed 32 EH/s by December 2024 and is expected to expand to 50 EH/s in Q1 2025. Projection of Bitcoin production in 2025:

- Production rate in Q4 2024: 933.8 BTC in just 50 days (November-December 2024).

- January-February 2025 update: 1,010.9 BTC mined, confirming an approximate 500 BTC/month pace at 32 EH/s.

- Scaling projection: If 32 EH/s produces ~6,000 BTC annually, then 50 EH/s should yield ~8,500 BTC, assuming a linear scaling model.

This projection is a best-case scenario, excluding all variables- especially the network difficulty. In reality, rising global hash rate and increased mining competition may push network difficulty higher, which would reduce Cango’s BTC output and affect revenue forecasts. The company’s exposure to such fluctuations is material, given that nearly all of its revenue is now tied to mining.

Fleet efficiency is another area of concern. Cango reported an average of 21.6 J/TH, consisting of:

- 90% S19XP Hyd. models (water-cooled, efficient).

- 10% older models (higher power consumption, less competitive).

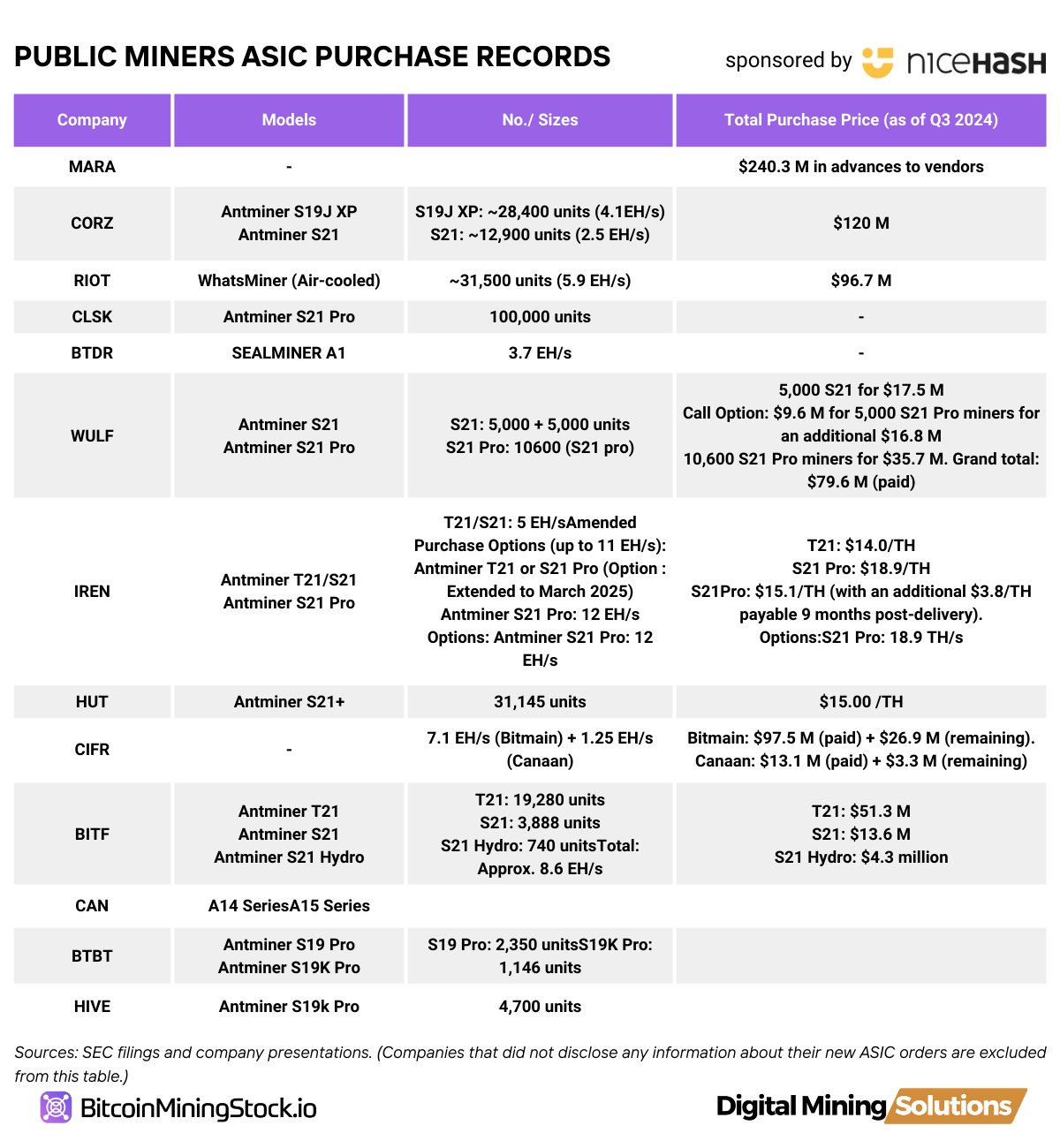

In contrast, top miners have already begun transitioning to S21 series hardware, which offers significantly better performance and energy efficiency.

My Annual Mining Report shows that majority of large public miners placed orders for the S21 series within the first nine months of 2024.

If Cango wants to remain competitive, it may need to replace older machinesand consider migrating from third-party hosting to self-operated infrastructure, which could improve margins over time by reducing hosting fees and energy costs. Without such improvements, its higher production cost—already around $67,769 per BTC—could erode profitability in a tightening market.

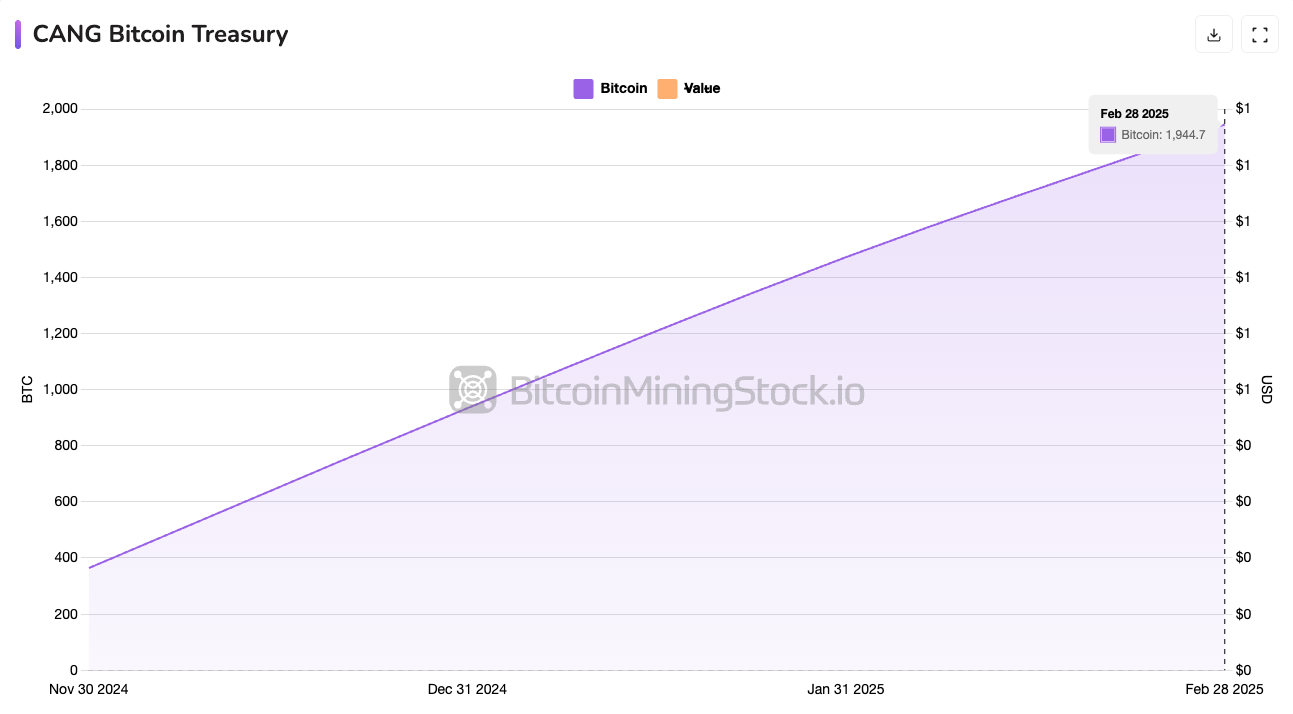

Bitcoin Treasuries

Cango has clearly adopted a “Mine & Hold” strategy, opting to retain its Bitcoin rather than liquidate for near-term cash. As of December 2024, the company held 933.8 BTC (~$85 million at year-end prices). By February 2025, that figure had more than doubled to 1,944.7 BTC, confirming active accumulation.

Historical performance data for miners is now available in our premium features.

This treasury approach gained further visibility when Cango was added to the Bitwise Bitcoin Standard Corporations ETF on March 18, 2025—an ETF that tracks public companies holding 1,000 BTC or more. Inclusion signals institutional recognition and could increase visibility among crypto-aligned investors.

Following the previous assumption, Cango could mine ~ 8,500 BTC in 2025. Coupled with existing holdings, its treasury could be ~9,500 BTC by year-end. By then, its Bitcoin holdings could reach nearly $1 billion if BTC hits $100K, which potentially places Cango among the largest public BTC holders in the world, rivalling established mining firms and potentially reshaping its valuation narrative.

While this strategy aligns with a long-term bullish view on Bitcoin, it introduces liquidity and balance sheet risks. If Bitcoin prices drop significantly, Cango may be forced to sell BTC at unfavorable prices or rely on external financing to fund operations – especially since the company’s mining business is still margin-sensitive and capital-intensive.

Non-Binding Buyout Offer: A Hidden Bitmain Play?

On March 14, 2025, Cango received a non-binding buyout offer from Enduring Wealth Capital Ltd. (EWCL). Little information is known about this investment management company incorporated in the British Virgin Islands, but key individuals from EWCL have links to Bitmain, the world’s largest ASIC manufacturer.

This raises some speculation:

- Is this an attempt to separate Cango’s Bitcoin mining business from its Chinese corporate origins? Given China’s 2021 mining ban, a structure separation could reduce regulatory risks and allow Cango to operate more freely.

- Is Cango effectively becoming a Bitmain-backed mining proxy? The company bought the whole fleet from Bitmain’s existing operations, with Bitmain affiliates continuing to operate and maintain those machines post-acquisition. Now, Bitmain-linked personnel are behind a buyout attempt.

If the deal goes through, Cango could have direct access to Bitmain’s ASIC supply, reducing hardware costs and boosting Cango’s competitive edge, but may also see changes in ownership structure that affect existing shareholders. Investors should closely watch whether the deal materializes and what terms it includes, as it could fundamentally alter Cango’s corporate structure.

Final Thoughts

Cango’s aggressive pivot into Bitcoin mining has fundamentally reshaped its corporate identity. It’s no longer an automobile platform company with moderate growth prospects – it now ranks among the largest Bitcoin miners by hash rate. It has a stack of BTC sitting on the balance sheet, which aligns with the emerging “Bitcoin Treasury” trend.

That said, the story is still under development. Core questions remain around operational efficiency , the stability of Bitcoin prices, and how effectively Cango can deploy its liquidity to optimize cost structures. For example, transitioning from third-party hosting to self-mining infrastructure, as companies like MARA have done, could significantly improve long-term margins. The recent non-binding buyout offer from the entity linked to Bitmain also adds intrigue. If deeper integration with Bitmain materializes, it could grant Cango access to discounted ASIC hardware and accelerate fleet upgrades,

Yet challenges persist. Despite holding $345.3 million in cash and short-term investments, which could cover roughly 1.13 years of operations at current burn rates, the aging fleet, primarily composed of second-hand S19 XP Hyd. models, faces faster depreciation. As peers shift to S21 series machines, Cango may find itself at an efficiency disadvantage if it doesn’t keep pace. Fleet depreciation could further erode already thin gross margins, especially considering the Q4 report didn’t account for these costs.

Notably, Cango’s leadership team brings a strong financial background, and its shareholder base includes Tencent as a top-11 holder – a fact often overlooked by Western investors. However, its headquarters in China continues to pose regulatory and geopolitical risks, particularly as the mining ban in China remains in place.

Anyone interested in CANG should monitor the following key factors:

- Bitcoin production cost relative to peers

- Depreciation and turnover of older mining fleet

- Liquidity and volatility of BTC holdings under a “HODL” strategy

- Impact of China-based operations on future strategic flexibility

- Outcome of the buyout offer and potential connection with Bitmain

Whether Cango can establish itself as a key player in the sector, only time will tell.