[ad_1]

Post-halving, Bitcoin (BTC) miners face a squeeze as rewards drop and costs soar. Can innovative strategies and market dynamics help them stay profitable?

The Bitcoin halving is an event built into the Bitcoin protocol that occurs approximately every four years. It results in the reduction in the reward miners receive for adding new blocks to the blockchain. The latest halving, which took place in April 2024, slashed the block reward from 6.25 BTC to 3.125 BTC.

This event, central to Bitcoin’s deflationary nature, impacts the supply of new Bitcoins and reverberates throughout the Bitcoin mining industry and the broader crypto market, introducing a mix of challenges and opportunities.

This article will examine the post-halving world and how the Bitcoin mining sector can adapt.

Table of Contents

Squeeze on miners: understanding the challenges

Reduced rewards

One of the immediate impacts of the halving was the cutting down of profit margins for miners. By slashing miners’ block rewards, the halving directly impacted their earnings since they started receiving fewer coins for their efforts.

At the time of writing, the dollar value of Bitcoin’s block reward was about $215,000, with the cryptocurrency priced at about $68,800 per coin. However, before that, Bitcoin mostly traded around the $60,000 level, meaning a typical block reward would have been worth less than $200,000.

In a conversation with crypto.news, Manthan Dave, co-founder of Ripple-backed crypto custody platform Palisade, stated that the reduced rewards could cause smaller and less profitable mining operations to close shop or force them to join up with others.

In his opinion, such a scenario could lead to a greater centralization of the Bitcoin network since fewer and much larger participants would be involved in running it.

“Everyone is feeling the squeeze post halving…We will see smaller, less efficient mining setups struggle or collapse. Consolidation will continue, sparking fears about centralization.”

Manthan Dave, Palisade co-founder

Bitcoin price dynamics: impact on the mining ecosystem

Post-halving, miners needed Bitcoin prices to be high for the potential profits to justify the significant energy costs associated with mining. In such a case, new miners would be encouraged to join the network, while existing ones may be motivated to expand their operations and enhance energy efficiency.

On the other hand, dropping Bitcoin prices could quickly push miners into losses, a situation that could force less efficient miners out of the market and reshape the mining sector in the process.

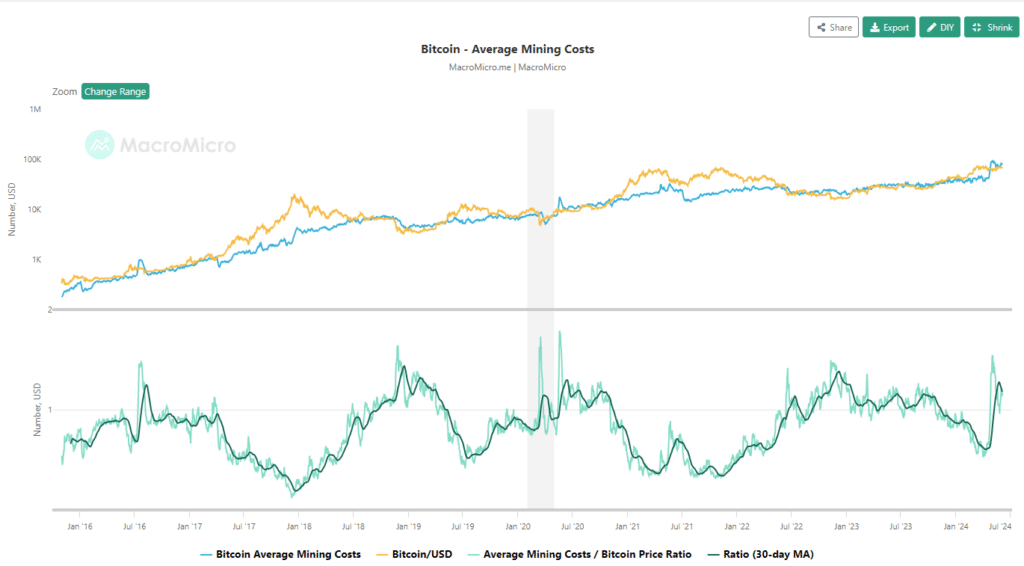

The latest figures from market analyst firm MacroMicro provide a snapshot of the sometimes unsustainable mining costs. Their data shows that as of June 3, the average Bitcoin mining cost was about $78,115, against a Bitcoin price of $68,804.

Average mining cost for Bitcoin | Source: MacroMicro

It means that the average mining costs to Bitcoin price ratio was about 1.14, which may have translated into slim pickings for many BTC mining operations.

According to a recent CoinShare survey, a portion of less profitable mining machines are expected to be shut down. Furthermore, some miners are expected to relocate to regions where they can access cheaper electricity.

For instance, a Feb. 7 Bloomberg report indicated that about 21 BTC miners had struck deals with the Ethiopian government to move their operations to the East African country.

Increased competition

Following a halving event, competition among miners often intensifies as they vie for a smaller pool of rewards. This means miners with more efficient operations, access to cheaper energy sources, or economies of scale may have a competitive advantage over their counterparts.

This heightened competition could pressure less efficient miners to optimize their operations or exit the market altogether.

However, Manthan Dave believes that players in the Bitcoin mining space affected by increased competition wouldn’t necessarily leave the sector altogether. He thinks they could refocus their energy on mining and minting other cryptocurrencies.

“Miners that are exiting the Bitcoin ecosystem due to cost reasons are unlikely to exit crypto itself,” Dave noted. “They are likely to reuse their hardware and switch to mining on other chains or redeploy capital into other operations such as staking.”

You might also like: How inflation, interest rates and the stock market affect Bitcoin’s price

Network hashrate and mining difficulty adjustment

When profit margins drop and force some mining operations to shut down or readjust, it invariably affects Bitcoin’s network hashrate. The network hashrate is the total computational power dedicated to mining and processing Bitcoin transactions.

Generally, when Bitcoin’s price rises, the hashrate also increases as mining becomes more profitable, drawing in more participants and boosting computational power. Conversely, if the hashrate falls, miners shut down their equipment because they can no longer make profits.

According to Blockchain.com, the current hashrate is 612.99 EH/s, which is still below the all-time high seven-day moving average of 629.75 EH/s recorded in April, 2024.

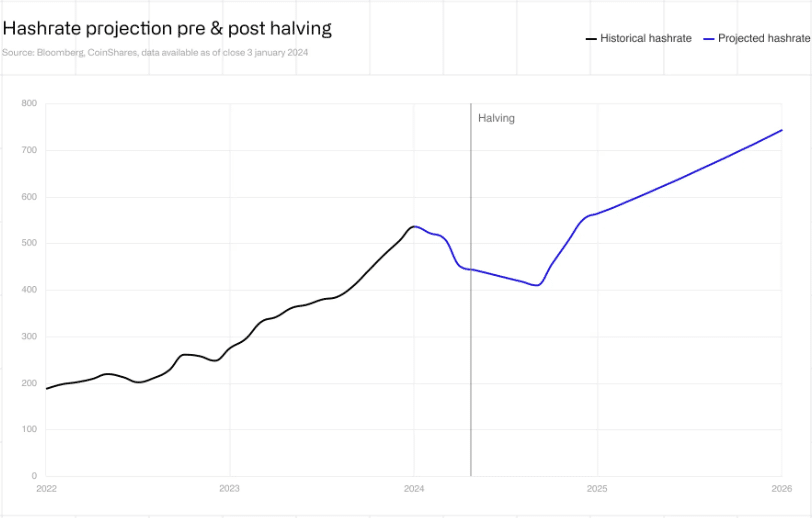

However, the CoinShare report we quoted earlier predicted that the Bitcoin hashrate could reach 700 EH/s by 2025.

Bitcoin post-halving hashrate projection | Source: Blockchain.com

The Bitcoin protocol also has a built-in difficulty adjustment mechanism that usually kicks in to either make it harder or easier to mine BTC, depending on the prevailing situation.

This adjustment occurs approximately every two weeks and is based on the time it took to mine the previous 2016 blocks. It aims to maintain an average block time of about 10 minutes at all times.

Possible remedies

Jurisdictional arbitrage

Experts believe that jurisdictional arbitrage, which is the practice of taking advantage of differences in regulations, laws, and costs between different countries or regions, could be a viable strategy for miners seeking to optimize their operations.

Palisade co-founder Manthan Dave notes that jurisdictional arbitrage could also be a significant lever for new entrants into the Bitcoin mining sector, given the considerable difficulty and capital intensity involved in starting such operations.

“Jurisdictional arbitrage is a strong lever to pull for new entrants, considering it is already quite difficult and capital intensive to get started,” Dave pointed out. “Regulatory clarity in a jurisdiction where electricity costs are low can open up opportunities for new companies to launch mining operations.”

Different regions offer varying levels of regulatory clarity and incentives, which could influence where miners choose to set up their operations. For instance, countries with low electricity costs and favorable regulatory environments should become attractive hubs for mining activities after the halving.

Regulatory clarity can also provide a significant advantage, reducing uncertainties and allowing miners to plan long-term investments.

There has been a noticeable influx of mining operations in regions like Texas, Kazakhstan, and the aforementioned Ethiopia, where electricity is relatively cheap and regulatory frameworks are conducive to mining.

Conversely, industry watchers expect strict regulations and high energy costs in other areas to drive miners to relocate and, in the process, reshape the global distribution of mining power.

You might also like: Bitcoin bubble no more: billionaires catching up to crypto FOMO

Diversification and adaptation

In the face of halving-induced pressures, analysts also expect diversification to become a pivotal strategy for miners.

It can take several forms, from expanding into other cryptocurrencies to integrating additional revenue streams, such as offering cloud mining services or leveraging excess heat from mining operations for other industrial purposes.

For instance, some miners, such as Texas-based Lancium, have ventured into renewable energy projects, transforming excess energy into Bitcoin.

Others, like Bitfarms, are exploring vertical integration, encompassing everything from mining hardware production to setting up dedicated energy facilities.

The bottom line with all these strategies is to not only enhance profitability but also possibly contribute to the resilience of mining operations.

Spot Bitcoin ETFs: a game-changer in market dynamics

Market watchers also view the introduction of spot Bitcoin ETFs as having the potential to influence the dynamics around Bitcoin significantly. The products offer a new avenue for investment and have attracted institutional investors, who may end up providing a stabilizing effect on the Bitcoin market.

“Spot Bitcoin ETFs are a game-changer; they make it easy for institutions and investors to hold Bitcoin for the long term without the need for managing private keys. This consistent buy pressure will counteract the sell pressure from miners, leading to a more stable and bullish Bitcoin market.”

Manthan Dave, Palisade co-founder

Furthermore, the increased accessibility and legitimacy brought by ETFs could lead to reduced volatility, a long-standing issue within the crypto market. A more stabilized market could mean better prices and, inevitably, better profit margins for miners.

Analysts have also suggested that ETFs can potentially impact investor sentiment, instilling greater confidence and encouraging more substantial capital flows into Bitcoin. This influx of institutional money can provide the liquidity needed to support market stability, benefiting not just investors but miners as well.

Sharing his insight on the topic, Manthan Dave noted that in the long term, ETFs will raise confidence in crypto and reduce the overall market’s volatility. He mentioned that the launch of an Ethereum ETF remains to be seen, which will certainly bring new capital due to Ethereum being more ecologically viable than Bitcoin because of its much lower energy consumption. However, he cautioned that it is also likely to draw capital out of the Bitcoin ETF as investors seek to diversify.

You might also like: Bitcoin’s path to $150,000: how likely is it?

Runes to the rescue?

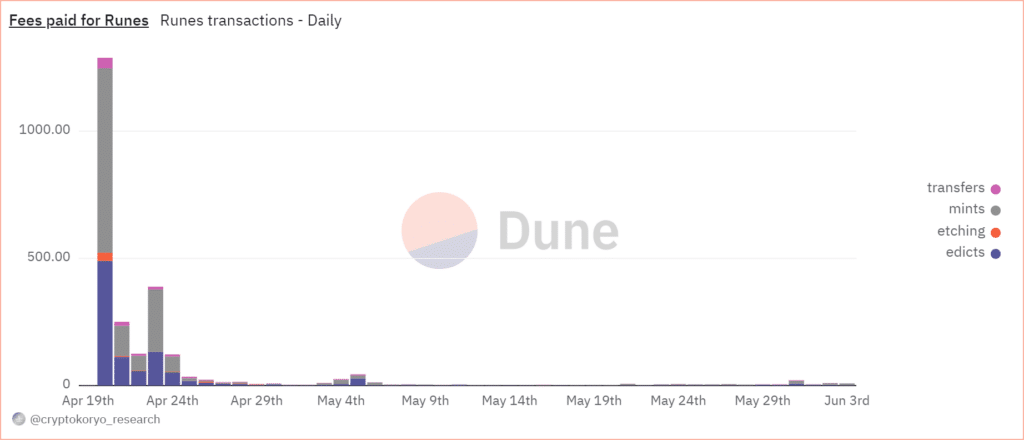

Another interesting case for BTC miners post-halving has been the launch of the Runes protocol on the Bitcoin network. The protocol, whose introduction coincided with the fourth Bitcoin halving event, helps create fungible tokens on the Bitcoin network by using its block spaces more efficiently than the BRC-20 protocol.

It came as a blessing of sorts for BTC miners. The increased transaction volume from Runes etchings helped maintain miner revenue for a while, with miners raking in a total of 2,253 BTC in fees in just the first two weeks following the Runes launch.

Fees paid for Runes | Source: Dune

Data from Dune Analytics from around that time showed that more than 80% of transactions on the Bitcoin network were Runes-related, with actual BTC transactions dropping to less than 20% of the total.

The increased number of transactions meant increased network fees, which translated to more money for miners. However, the windfall seems to have been short-lived, with subsequent figures from Dune indicating that the number of Runes transactions has been consistently dwindling.

Forecasting the future: Bitcoin’s trajectory

Predicting Bitcoin’s price trajectory post-halving involves analyzing various market trends and factors. Historically, Bitcoin’s price has experienced significant appreciation following halvings, driven by reduced supply and increased demand.

However, the current landscape presents unique challenges, including macroeconomic factors and evolving regulatory environments. Industry experts have offered a range of perspectives on Bitcoin’s future.

Some foresee continued growth fueled by increasing adoption and technological advancements. Others have cautioned against potential pitfalls, such as regulatory crackdowns and market saturation.

Regardless, the long-term outlook for Bitcoin and the mining ecosystem remains optimistic, with experts like Manthan Dave expecting the price of BTC to get close to the $100,000 mark before 2025.

“Looking at what’s on the horizon, it is likely that we will see Bitcoin teasing $100,000 by the end of this year,” predicted the Palisade co-founder.

Read more: What is Bitcoin Pizza Day? Celebrating a milestone in cryptocurrency history

[ad_2]