As President Trump alternates between tariff hikes and pauses, the United States continues to witness rising bond yields despite a decreased inflation risk index. These inconsistencies reveal deeper structural problems related to the US economy’s spending habits.

Steve Hanke, Professor of Applied Economics at Johns Hopkins University, sat down with BeInCrypto to explore the underlying forces driving bond yields to new heights. The economist cited the US fiscal deficit, tariff uncertainty, and Congressional inaction as central contributors to the current economic outlook.

Why Are Bond Yields on the Rise?

Government bond yields have been in a fluctuating frenzy since President Trump started rolling out a largely erratic tariff policy days after assuming office. The policy’s on-again, off-again nature has spurred uncertainty, shaking investor confidence in the American financial system.

The numbers speak for themselves. Since April 30, the US 10-Year Note Bond Yield has risen from 4.17 to 4.43. The unpredictable behavior of a market historically deemed one of the safest and most stable in the world has set off significant alarm bells.

US 10-Year Treasury Bond Note Yield. Source: Trading Economics.

The reasons behind this increase may vary, but they indicate increased uncertainty over geopolitical turmoil and the fear of an economic slowdown. Rising bond yields are typically associated with higher inflation, but the latest CPI Index, revealing an easing inflation rate, has shown that this is not the current trend.

Hanke pointed to certain factors that can explain this unusual relationship.

“Inflation has moderated over the last 2 years. Since bond yields follow inflation, and inflation is declining, the fly in the ointment that explains the rising bond yields must be either sovereign credit risk or a lack of confidence in fiscal management,” he told BeInCrypto.

The United States’ ballooning fiscal deficit can easily explain the plausibility of both scenarios.

The Return of the Bond Vigilantes

In the past, investors have punished the government over unsustainable spending by selling off their bonds, consequently driving up borrowing costs. These “bond vigilantes,” as the economist Ed Yardeni coined them in the 1980s, take action over fear of an economic downturn or a spike in inflation.

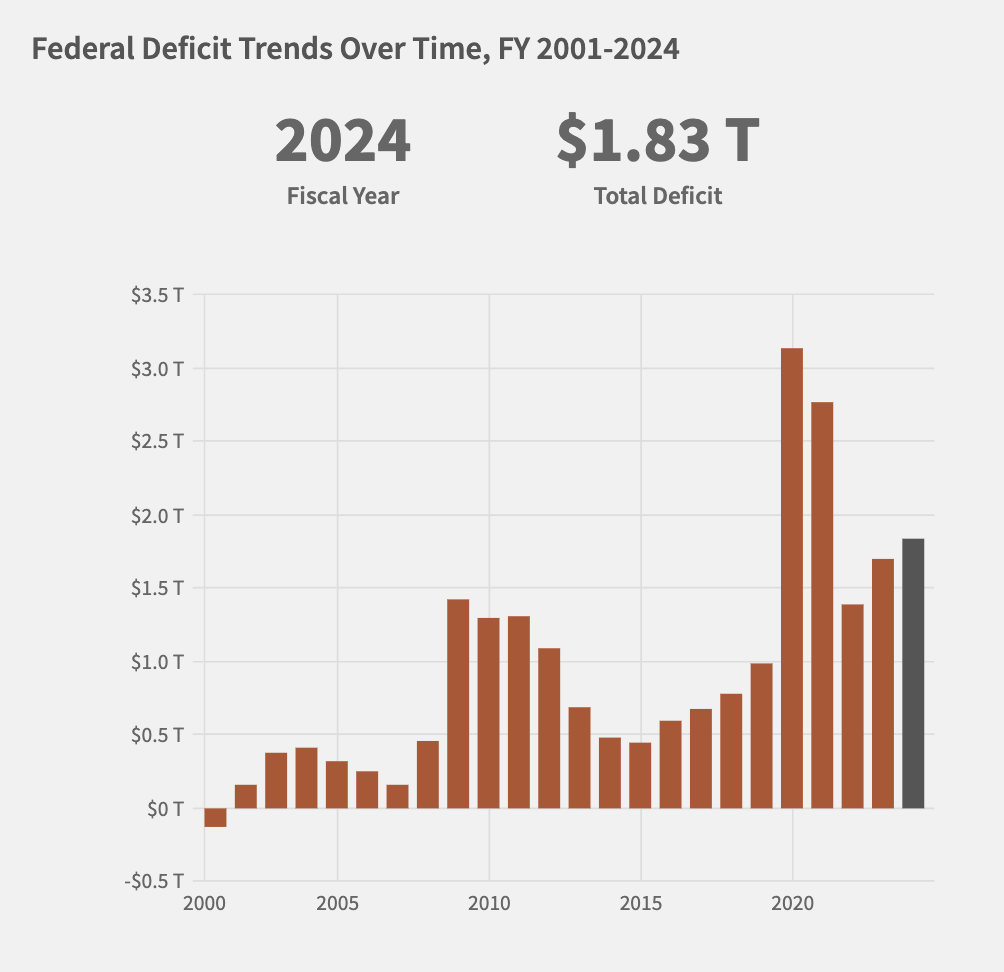

The steep sell-off in the bond market following Trump’s April tariff announcements, combined with the current US economic context, marked by a $36 trillion national debt and a budget deficit of $1.8 trillion, provides ample reason to anticipate the return of bond vigilantes.

Federal Deficit Trends Over Time. Source: US Treasury.

For Hanke, the results of a recent Treasury auction illustrate the extent of dissatisfaction with the United States’ fiscal mismanagement.

“Last month’s ten-year Treasury auction was a disaster. It saw virtually no central bank or primary dealer buying,” he said.

The lack of demand for US economic debt increases fears over steeper borrowing costs and signals that investors are becoming worried about the government’s ability to manage its finances.

That said, Hanke stated that the decreasing amount of money circulating in the economy concerns him even more than the bond sell-off.

Beyond Bond Yields: The Money Supply Crisis

Though a bond sell-off suggests rising interest rates, Hanke suggested that solely focusing on this misses a larger, more systemic issue. What is even more concerning is a reduced money supply.

Commercial banks are the biggest contributors to the amount of money circulating in the economy. However, lending has slowed considerably recently.

“Today, commercial bank credit at a snail’s pace: 2.3% per year. That, and the fact that overall money growth is only 4.1%, indicate that a serious slowdown in the US economy is baked in the cake,” Hanke told BeInCrypto.

The economy slows when less money circulates, making it harder for businesses to get loans and consumers to spend. This situation worsens if government spending is seen as unsustainable, further eroding economic confidence, especially when it fails to compensate for insufficient private sector lending.

Though some translate this lack of confidence into the erosion of US dollar dominance, Hanke discarded the gravity of these claims.

How Secure Is the Dollar’s Future?

Persistent volatility in the US Treasury market, combined with recent moves by G7 nations to reduce their reliance on the dollar, has raised concerns about long-term damage to its dominance.

According to Hanke, these are wild exaggerations.

“Since the 7th century BC, there have only been fourteen dominant international currencies. As this timeline suggests, it’s very hard to knock a dominant international currency off its throne. This suggests that all challengers to the dollar, be it the euro, Japanese yen, Chinese yuan, or the yet-to-be-delivered BRICS currency, will find they face a very difficult task. Indeed, even though there is constant talk about de-dollarization, it simply hasn’t happened, as the dollar is the cleanest dirty shirt around,” he said.

Hanke argued that instead of focusing on fluctuating bond yields, attention should focus on addressing the underlying cause: outsized spending. In his view, this responsibility lies not with Trump but with Congress, which has consistently neglected its responsibility in this matter.

Addressing Chronic US Spending

The United States has a long history of periods with significant government spending, often driven by wars, economic recessions, or social programs.

In recent decades, factors like rising healthcare costs, entitlement programs, and increased defense spending have also contributed to the extent of the American fiscal deficit.

Given that this problem is demonstrably chronic, Hanke argues that Congress must create a dedicated Committee to address the issues at heart.

“Congress should enact a statutory Fiscal Sustainability Commission that will actively engage the American people and propose a range of spending reductions and tax reforms necessary to reduce debt-to-GDP to a reasonable and sustainable level. The Commission’s recommendations should receive a guaranteed vote in Congress. Such a Commission should be included in the Budget Reconciliation bill,” he explained.

However, Hanke also acknowledged that Congress has historically refused to act prudently and promptly.

Breaking the Gridlock: The Case for a Constitutional Remedy

Political gridlock often creates a deep divide over how to collectively address the difficult choices required to curb federal expenditures, hindering effective fiscal policymaking.

To curb the problem, Hanke suggested a Constitutional Amendment that would effectively impose long-term fiscal discipline on Congress.

“The only thing that will constrain Congress to avoid unsustainable spending in the future is a Constitutional Amendment,” he said, adding, “Therefore, Congress needs to pass H. Con. Res. 15 that re-enforces Congress’ responsibility and states’ rights to propose such a Fiscal Responsibility Constitutional Amendment under Article V of the Constitution. This should also be included in the Budget Reconciliation bill.”

As the American economy continues to navigate the compound problems of rising bond yields, economic slowdown, and fiscal deficits, the current situation indicates that even short-term solutions aren’t sufficient fixes to systemic problems.

The future course of the United States hinges on the current government and its congressional constituents, who must choose between decisive action and continued uncertainty. Their decision will inevitably have a profound impact on the nation’s future.

Steve H. Hanke is a Professor of Applied Economics at Johns Hopkins University. His most recent book, with Matt Sekerke, is Making Money Work: How to Rewrite the Rules of our Financial System, and was released by Wiley on May 6.