Is MARA mining, HODLing, or Banking? With 15% of its Bitcoin treasury out on loan, MARA Holdings is starting to look like a shadow bank.

MARA Deploys 15% of Bitcoin Treasury in Lending Strategy

The following guest post comes from Bitcoinminingstock.io, the one-stop hub for all things bitcoin mining stocks, educational tools, and industry insights. Originally published on July 18, 2025, it was penned by Bitcoinminingstock.io author Cindy Feng.

It has been a while since I last covered MARA Holdings (NASDAQ: MARA) and its Bitcoin treasury strategy. Yes, it still holds the crown for the largest hash rate among public Bitcoin miners. Yes, it also has the biggest stack of Bitcoin on its balance sheet. But honestly, nothing was compelling enough to take a deeper look in recent quarters.

Many investors question why MARA’s share price lags behind Bitcoin, the very asset it’s supposed to proxy. And those doubts aren’t unfounded – MARA’s operational inefficiencies, volatile profitability, and at times opaque management communication have dulled investor enthusiasm.

Until this week, when a company press release sparked my interest.

“MARA Leads $20 Million Investment in Two Prime to Advance Institutional Bitcoin Yield Strategies and Expands SMA to 2,000 BTC”.

Around the same time, an X user made a bold claim – that MARA is becoming a Bitcoin-powered shadow bank. That framing stuck with me. If valid, this changes how we view MARA entirely: it’s not just as a mining company with a fat treasury, but a yield-generating financial engine – like a digital-native bank. I decided to dig in.

$MARA is building a shadow bank powered by Bitcoin.

In Q1 2025, they had ~47,531 BTC on the balance sheet. Instead of selling into the market, they lent out ~14,269 BTC to institutions, up 37.5% QoQ.

That’s already 30% of their treasury, generating a 5–9% yield, similar to… pic.twitter.com/QrYVcjBVFq

— Cryptovicci 🌐 (@cryptovicci) July 15, 2025

BTC Lending Strategy – From Experimental to Scalable

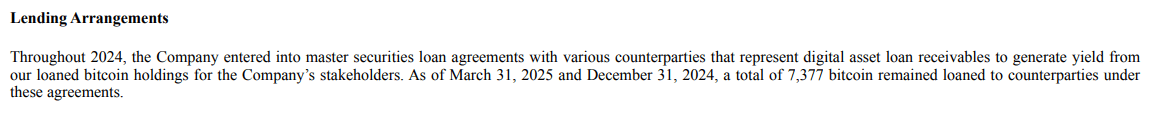

I first heard about MARA’s Bitcoin lending activities in late 2024. During that interview, executives downplayed the scope – describing it as small-scale and cautious. That made sense. Counterparty risk in this space is real, and the ghost of collapsed crypto lenders like Celsius still haunts investor memory. But then in 2025, MARA became more vocal about its Bitcoin lending.

page 9 & page 10 from Q1 2025 SEC Filing

Let’s walk through what has changed – drawn directly from MARA’s SEC filings:

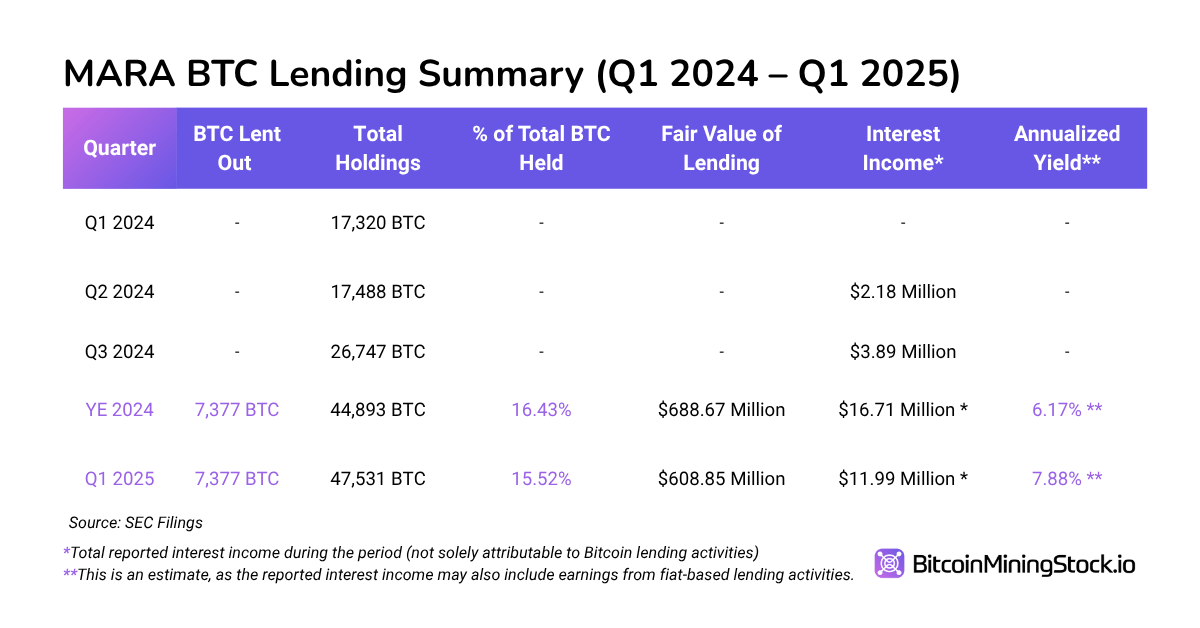

A total of 7,377 Bitcoin were loaned to counterparties as of December 31, 2024 and March 31, 2025. Meanwhile, the percentage of MARA’s Bitcoin treasury loaned out represents ~ 15.52% of their total holdings.

Even more interesting is the yield. MARA earned nearly $16.71 million in interest in 2024. In Q1 2025, the company generated $11.99 million, implying an annualized yield of ~7.88%*, which is competitive with traditional private credit or structured lending yields.

*This is an estimate, as the reported interest income may also include earnings from fiat-based activities.

Is the Shadow Bank Label Fair?

Let’s revisit the X user’s thesis:

“MARA is monetizing their treasury without liquidating it, creating a recurring revenue stream that mirrors Net Interest Margin (NIM) in banking. It’s not just a miner. It’s not just a HODLer. It’s becoming a Bitcoin-native bank.”

“Shadow bank”, what smart wording. After all, MARA is a non-bank institution and stays outside traditional banking regulations. However, its lending business is already operating like a shadow bank in spirit. It lends out capital (Bitcoin), generates recurring yield (paid in Bitcoin), and retains the underlying principal as a long-term appreciating asset.

What’s unique here is that the interest is paid in Bitcoin – so MARA is growing its stack passively while still keeping price exposure. It’s a compounding mechanism that few public companies can replicate.

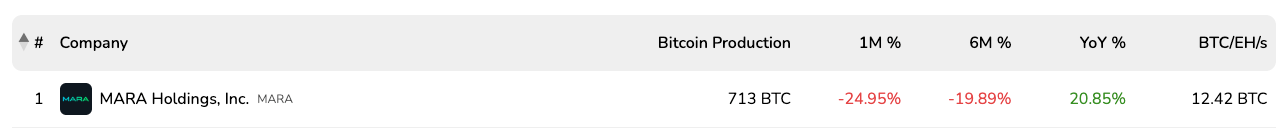

Even better, MARA continues to mine new Bitcoin daily (>20 BTC per day), meaning its yield-generating base is always being replenished.

MARA reported mining 713 Bitcoin in June 2025

However, MARA is not a full-on shadow bank, as only ~15.5% of its holdings are being loaned out. Even if that ratio eventually expands to 100% of their holdings (which is very unlikely), the book value is not massive, unless the BTC price appreciates multiples over time.

Also, the counterparty risk remains and MARA hasn’t disclosed exactly who’s borrowing these BTC or what collateral arrangements are in place. But with tools like the SMA structure and statements from management pointing to careful selection of counterparties, there seems to be a risk-aware approach in place.

Page 29 from Q1 2025 SEC filing

Treasury Valuation Lens: You Might Be Getting the Mining Business “for Free”

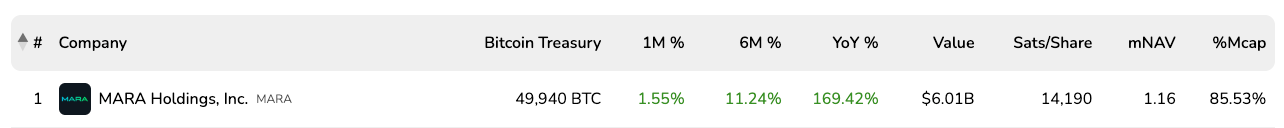

As of June 30th, 2025, MARA reported 49,940 BTC on its balance sheet. At a BTC price of ~$120,370 (07/16/2025), that translates to a treasury worth ~$6.01 billion.

Track live Bitcoin treasury metrics.

MARA’s market cap on the same day was $7.02 billion.

Now let’s calculate the Enterprise Value (EV):

EV = Market Cap + Total Debt – Cash & Equivalents – Fair Value of BTC

(EV = $7.02B + $2.71B – $0.19B – $6.01B = $3.52B)

That means the entire MARA business – hash rate infrastructure, facilities, financial arm, everything – is being valued at just $3.52 billion.

Such a discrepancy opens a provocative idea:

MARA’s BTC stack has become so large relative to its equity valuation that everything else – its infrastructure, mining ops, lending platform, and future upside – are effectively deeply discounted.

In other words, investors may be buying into the BTC exposure and getting the mining business at a heavy discount*.

*With the increase in BTC holdings and price appreciation, MARA’s enterprise value could potentially be marginal.

Final Thoughts

MARA Holdings has long been criticized as an “inefficient miner” even though they’re the largest at scale. Given the rapid rise of its BTC lending operation, it’s charting new territory.

With currently ~15% of its Bitcoin treasury deployed to generate recurring yield, and interest income paid in-kind, the company is starting to build what looks like the foundation of a BTC-native credit business.

Is it a shadow bank? Not by regulatory standards. But conceptually, yes – it’s already behaving like one.

There are certain risks, particularly around counterparty exposure and Bitcoin volatility. For investors who understand the implications, that presents an intriguing setup. At current prices, you are effectively buying MARA’s Bitcoin and getting its mining and lending business at a heavy discount.

This dynamic reframes how we evaluate MARA. It’s no longer just a speculative mining play. It’s turning into a yield-generating Bitcoin financial platform, and the market may not be fully pricing that in yet.