[ad_1]

Both gold and Bitcoin (BTC) have their niche roles in investing. Gold has little practical use besides jewelry and certain specialized electronics, while Bitcoin has virtually none (pun intended). That said, investors still seek them out, primarily as an alternative to fiat currency. Furthermore, both assets have surged recently, setting their respective price records in 2024. However, is it better to invest in gold or Bitcoin? We’ll try to find out in this article.

Why would anyone invest in gold or Bitcoin?

Now that’s a good question.

Both financial assets remain in an awkward position in today’s economy. While the gold standard was vital to global finances from the 1870s to the 1920s, and gold was used as a currency for millennia, you probably won’t see a vendor accept a piece of gold as payment today.

On the other hand, Bitcoin is a relatively novel asset that promises to replace the current system ruled by excessive centralization and regulation by central banks and governments. It has yet to fulfill that promise, though: despite a growing number of vendors accepting it, the vast majority of the world still conducts business with fiat currencies.

Seemingly in defiance of logic, both assets are experiencing staggering demand, with gold setting a record high of nearly $2,441 on May 20, 2024, and Bitcoin exceeding $73,000 in March 2024.

So, why is that?

Investors perceive gold and Bitcoin as safe-haven financial instruments in the case of a failing dollar or an incoming recession. In fact, both assets remain attractive, particularly because they are “immune” to government interventions.

Unlike fiat currency, which you can always print more of, both gold and Bitcoin are limited in supply and thus have the potential to act as a hedge against inflation.

Gold and Bitcoin as inflation hedges

Gold has built a reputation for doing well when the economy doesn’t. In fact, gold has historically been used to store value. The logic behind gold’s ability to counter inflation is that investors turn from stocks to gold when the economy is under threat, increasing demand and price. Once the economy recovers, demand for gold falls as investors return to stocks, creating an “inverse” trajectory.

Despite being several millennia younger than its shinier counterpart, Bitcoin has some similarities to gold in this “inverse trajectory” aspect. After all, its supply is similarly finite, and its allure also increases when conventional assets like stocks decline. The COVID-19 pandemic sort of validated this role, as the price of Bitcoin soared during the global crisis and peaked in November 2021.

Gold vs. Bitcoin

It might seem unfair to compare a commodity almost as old as civilization to a digital currency that gained traction only several years ago. Still, in their competition to occupy the position of the premium hedge against inflation, they show crucial differences that can help us decide which one we prefer.

1. Price volatility

Having thousands of years to stabilize your price tends to favor gold. On the other hand, Bitcoin’s price remains notoriously unstable, as is the price of all cryptocurrencies.

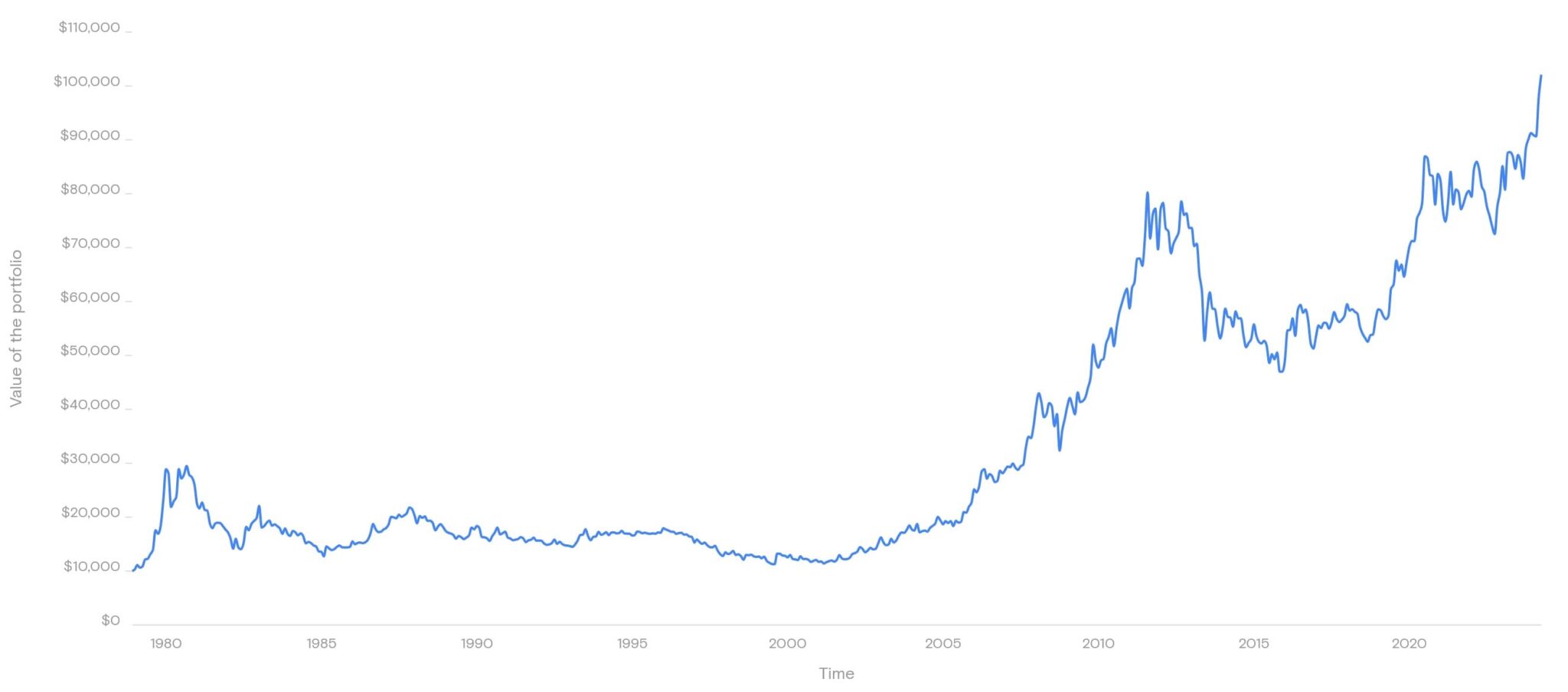

According to Curvo, in the last ten years, the gold spot price index provided an annual return of 6% on average, with a relatively steady curve on the performance chart.

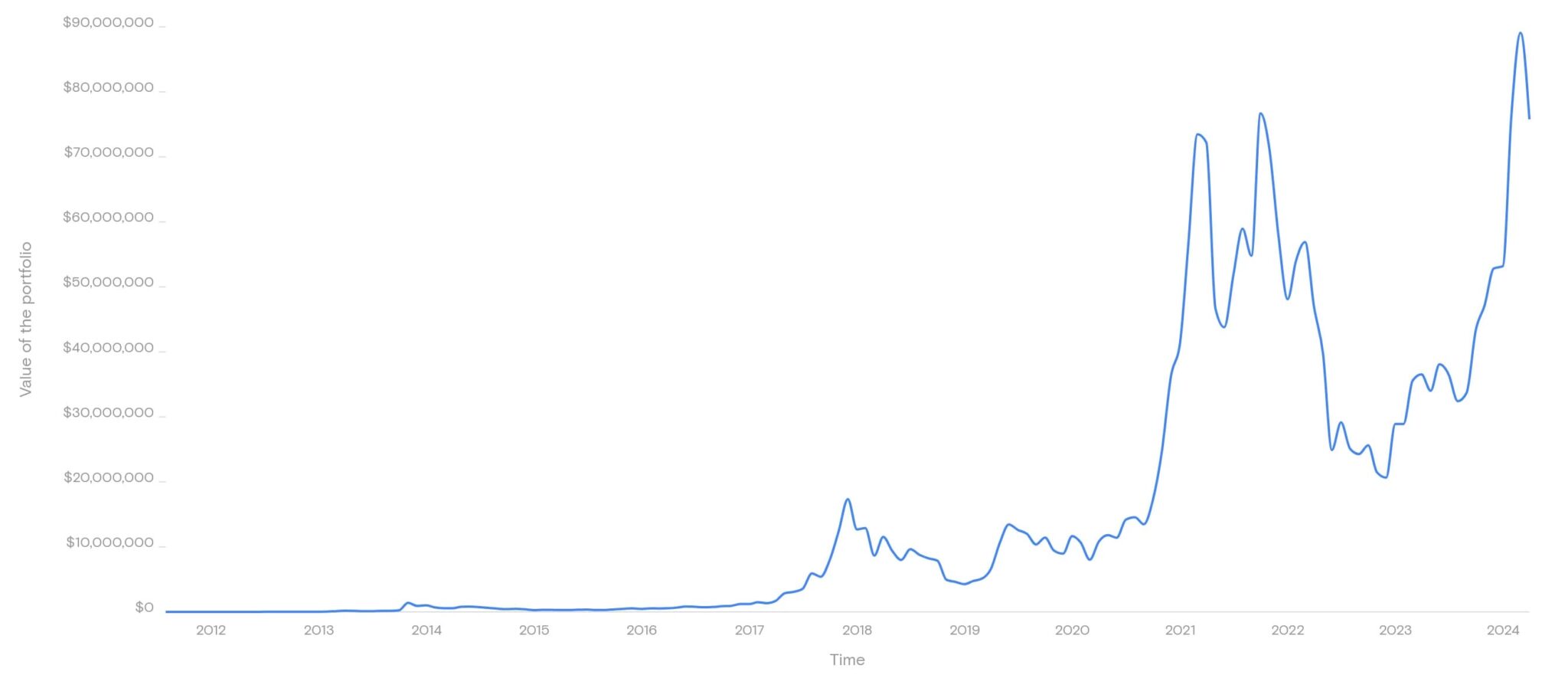

On the other hand, the same source provides data that shows that Bitcoin returned 63.3% yearly on average for the last decade, but the price varied wildly, with extreme dips and spikes in its price that reflect “crypto winters” and rushes in demand.

As Bitcoin gets further integrated into the global economy, its price will likely grow due to increased demand. While this price appreciation is not relevant to its ability to act as a hedge against inflation, it is definitely attractive to long-term growth investors.

2. Safety & regulations

As an established commodity and value keeper, gold is impossible to counterfeit. As it is usually stored in banks, it is also extremely difficult to steal. Carrying gold across the border requires permission from the authorities, and you can generally purchase gold from registered dealers and brokers only. Storing physical gold as an investor, however, is not an ideal solution due to safety concerns.

Bitcoin is similarly hard to counterfeit due to blockchain technology and commonly available ledgers that can track transactions and keep precise records. It remains decentralized and thus easier to make transactions with, but there are no regulatory bodies to ensure customer safety and prevent clandestine activities. In fact, storing Bitcoin is best with dedicated crypto wallets.

3. Application & utility

Gold has almost no utility outside the jewelry industry and very niche applications, such as in specialized electronics. Therefore, its demand remains tied to its value storage and inflation hedge purposes. This lack of utility suits the fact that its price is independent of economic cycles, but it also means that gold does not benefit from global economic growth.

Likewise, Bitcoin also has limited utility. It still has no use outside its speculative investment and as a digital currency. That said, several emerging technologies could see more use for Bitcoin, especially within the fintech and decentralized finance (DeFi) domains. There are no guarantees for this, however, and until these technologies fully develop, Bitcoin will likely stick to its current role.

Is it better to invest in gold or Bitcoin – the bottom line

Gold’s historical role has cemented its position as a value storage and a hedge against inflation. On the other hand, Bitcoin will need more exposure to history before its volatility gets low enough and investors’ trust matches that of gold.

On the plus side, Bitcoin’s volatility leaves room for price appreciation, and in the last ten years, the famous cryptocurrency has provided significant returns for its investors on average. Historical performance of this scale, however, should not be trusted as an indicator of the future.

Experts still recommend that gold positions in serious investing portfolios be limited to 10% of total portfolio value. If you invest in Bitcoin for similar purposes, a 10% cap could also apply to the cryptocurrency.

Conversely, stocks, particularly the S&P 500 index, are better than either gold, silver, or cryptocurrency and remain the safest hedge against inflation in the long run. At least until cryptocurrency passes a couple of decades’ test of time and potentially proves otherwise.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

[ad_2]