You’re watching Ethereum climb again, but the hesitation is real. After months of slow movement, it’s right to question whether Ethereum is a good investment in 2025. The network has moved past key upgrades like Pectra, but momentum only showed up recently. If you’re still unsure where ETH fits into your portfolio, this breakdown covers what you need to know.

In this guide:

- Is Ethereum a good investment choice?

- Cases in support of investing in Ethereum

- Cases against investing in Ethereum

- Are investors currently buying, selling, or holding ETH?

- Will Ethereum outperform Bitcoin in 2025?

- Things to consider before investing in Ethereum

- What are the institutional players doing with ETH?

- What are analysts predicting for Ethereum in 2025?

- Ethereum in 2025: buy, hold, or avoid?

- Frequently asked questions

Is Ethereum a good investment choice?

After months of low volatility and underperformance, Ethereum has finally started showing signs of strength in May 2025. The recent price breakout, steady growth in staking participation, and a completed upgrade cycle have pulled investor attention back in.

Ethereum in 2025 sits in a transition zone. It isn’t a speculative bet like meme tokens, but it hasn’t yet regained the dominance it held during previous cycles. That creates a different kind of opportunity — one that depends less on hype, more on conviction.

Can Ethereum’s roadmap deliver sustained demand across L2s, stable incentives for holders, and growing institutional relevance? If you’re looking for near-term flips, Ethereum is likely not the buy for you. However, if you’re tracking network resilience, supply mechanics, and usage growth, ETH still fits into a long-term allocation strategy.

How is the ETH price action looking?

Ethereum is currently trading at $2,645.44, marking a significant recovery from its April lows near $1,400. This upward movement reflects a renewed interest from investors, particularly following the successful implementation of the Pectra upgrade, which enhanced transaction speeds and reduced costs.

Ethereum price action: TradingView

If you want to look at this mid-to-long-term, do note that the trading volume is decent (not high) and there is a bullish divergence to be seen in relation to the relative strength index. This, in simpler terms, suggests that ETH might still have the legs to move higher, with $2,850 being a crucial level to breach. If these levels are breached, we can even expect a near-term high of $3,444 for ETH.

Cases in support of investing in Ethereum

Based on current data and market developments, here are the key factors supporting the investment case for Ethereum in 2025:

ETH supply is shrinking

Since EIP-1559, Ethereum has been burning a portion of transaction fees. In 2025, issuance remains lower than burn, meaning the total supply is slowly declining. For long-term holders, this tightening supply can support price upside.

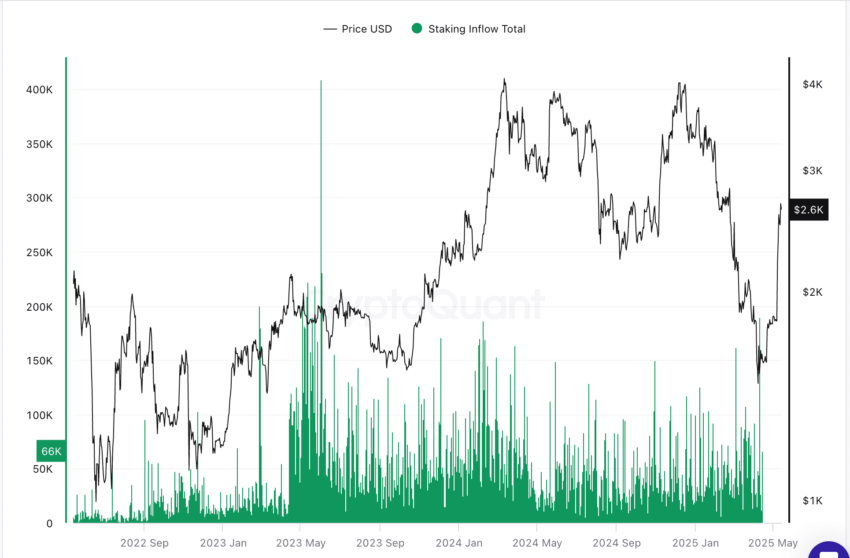

Staking activity is strong

Ethereum’s validator participation rate hit 99.7% in Q1 2025. That’s a sign the network is stable, healthy, and trusted. For investors, consistent staking = reliable yield and security.

Staking inflow: CryptoQuant

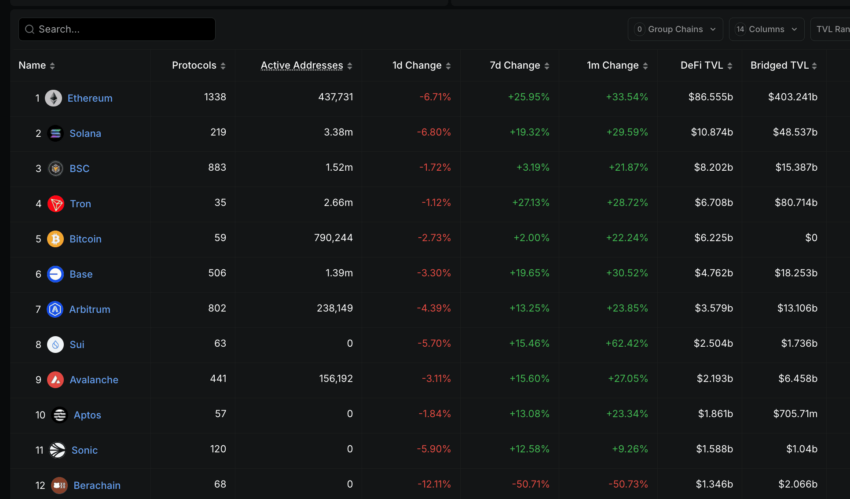

Ethereum still leads DeFi

With $51.9 billion in total value locked, Ethereum remains the main platform for lending, stablecoins, and on-chain trading. If you believe in on-chain finance, ETH is still the base asset.

Layer-2s are growing, and ETH benefits

As of May 2025, Ethereum-based layer-2s like Arbitrum and Optimism have secured over $42 billion in value. Even if most activity moves to rollups, ETH still settles the final layer and captures the demand.

Institutions now have a way in

The SEC approved spot Ethereum ETFs in May 2024. They haven’t matched Bitcoin’s numbers, but they’ve opened the door for funds, family offices, and advisors. More access is synonymous with more potential buyers.

The Pectra upgrade landed smoothly

Rolled out in early 2025, Pectra made staking more flexible and sped up parts of the network. No drama, no delays. Execution like that builds trust, which matters when real capital is on the line.

Ethereum leading DeFi: Defillama

Those were the positive cases demonstrating that ETH may be a good investment in 2025. Now for the flip side.

Cases against investing in Ethereum

Not every trend favors Ethereum right now. These are the key risks and concerns that continue to weigh on investor decisions.

Year-to-date underperformance

As of May 14, 2025, Ethereum trades at $2,650.82, marking an 18.2% decline from its December close of ~$3,240. In contrast, Bitcoin is up 6.5% YTD, and even Solana has held flat. This performance gap has led to portfolio reshuffling, as capital seeks stronger momentum plays. For investors, ETH currently lacks short-term conviction signals.

Uncertain regulatory classification in the US

The SEC has not definitively classified Ethereum as a commodity or a security. In early May 2025, Chair Gary Gensler noted that Ethereum’s proof-of-stake model “raises questions” about whether staking rewards qualify as investment contracts. This regulatory grey zone keeps major U.S. funds cautious and may delay broader institutional inflows.

Fragmented user experience

On-chain activity still suffers from high gas fees (often $3–$12 per transaction) and poor interoperability between rollups. Despite L2 adoption, most users still navigate fragmented bridges, RPC switching, and multiple wallets. For investors, poor UX limits retail adoption, which directly affects usage-driven demand for ETH.

Rising competition from faster chains

High-speed chains like Solana (850K DAUs) and Sui (350K DAUs) continue to attract developers and users by offering low fees and near-instant finality. Ethereum L1, in comparison, sees ~400K DAUs with higher latency and cost.

This puts Ethereum at risk of losing market share, which impacts the long-term demand for ETH as a gas asset.

Roadmap execution delays

Ethereum’s Pectra upgrade shipped in Q1 2025, but the next milestones — Verkle Trees and Single-Slot Finality — are now pushed to late 2025 or 2026. These were originally targeted for Q3 2025. Delays mean slower improvements in scalability and UX — two critical levers for ETH’s long-term value.

Limited institutional commitment

As alluded to previously, Ethereum ETFs were approved in 2024, but have attracted just $2.1B in AUM, compared to $14.5B for Bitcoin ETFs. Major custodians like Fidelity and Schwab still don’t offer ETH staking at scale. Institutional demand is growing, but still lags, limiting ETH’s upside compared to BTC in allocation-heavy portfolios.

Are investors currently buying, selling, or holding ETH?

It’s mid-May 2025, and Ethereum (ETH) is trading at approximately $2,604.84. This reflects a recent uptick in price, mostly led by investor behavior. On-chain data shows:

Exchange netflows indicate selling pressure

On May 12, 2025, Ethereum experienced a net inflow of 178,900 ETH to exchanges, the largest daily inflow recorded this year. Such significant inflows to exchanges often suggest that investors are preparing to sell their holdings.

Institutional outflows from Ethereum ETFs

On May 12, 2025, Ethereum ETFs saw $17.6 million in net outflows, led by funds like FETH and ETHE. It’s not a massive exit, but it signals some hesitation from institutional players after ETH’s recent run. The move suggests a short-term de-risking, not a full retreat.

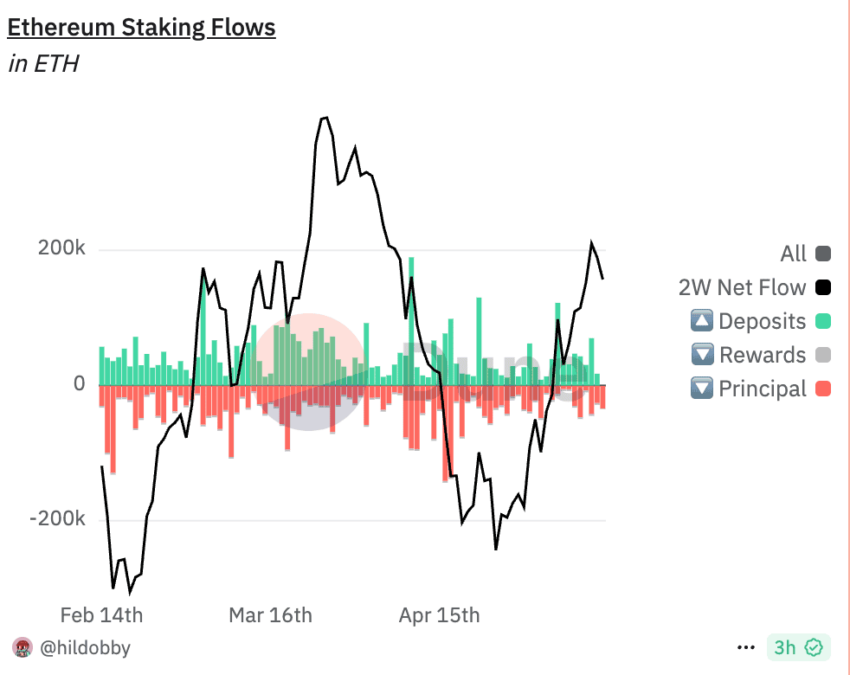

Staking inflows tell a different story

Even as some funds trimmed exposure, ETH staking is climbing. Over the past week, inflows into staking contracts have picked up — a sign that many holders are leaning long, choosing to lock in yield rather than exit.

Ethereum staking flows: Dune

One whale is betting heavily against ETH

On May 1, 2025, a large wallet boosted its short position to 10,000 ETH — about $18.4 million — by borrowing another 4,000 ETH. That’s not a casual move. It suggests that at least some big players are positioning for downside.

Will Ethereum outperform Bitcoin in 2025?

As of mid-May 2025, Ethereum trades at $2,620, while Bitcoin sits near $104,000. ETH is still lagging BTC’s year-to-date gains, down around 20% versus Bitcoin’s +11%. But the momentum may be turning.

The ETH/BTC ratio, long in decline, has started to bounce. Open interest in ETH futures is climbing. These aren’t hype signals — they’re signs of re-engagement from serious capital.

That said, ETH is still coming from behind. Outperformance isn’t a guarantee, but it’s certainly back on the table.

Things to consider before investing in Ethereum

If you’re evaluating whether Ethereum is a good investment in 2025, you need more than hype. While the narrative is shifting, investors still face structural and strategic considerations that could affect returns.

Ethereum remains volatile

Daily price swings of 3–5% are common, with sharp moves often triggered by macro news, ETF flows, or network activity spikes. Short-term entry points carry risk. Investors need to size accordingly or commit long-term.

Unclear tax treatment in multiple regions

ETH staking rewards are still taxed as income in several jurisdictions, including the U.S. and Germany, with few clarifications on treatment for long-term locked assets. This affects net returns for investors who plan to hold or stake over longer periods.

Scaling still depends on external rollups

Despite L2 growth, Ethereum itself still struggles with direct high-throughput usage. Most scaling improvements are driven by rollups like Arbitrum and Optimism, not the base chain. Investors relying on ETH utility growth need to watch if rollup consolidation translates into base-layer demand.

Layer-2 competition is heating up

Many L2s, though built on Ethereum, are now launching native tokens and incentives, which can divert attention away from ETH itself. This may dilute ETH’s role as the primary value accrual asset of its own ecosystem.

Ethereum’s strength is tied to roadmap execution

With Verkle Trees, single-slot finality, and statelessness still pending, much of Ethereum’s upside depends on future delivery. Investors should track technical progress, not just price action.

What are the institutional players doing with ETH?

If you’re asking if Ethereum is a good investment in 2025, institutional behavior offers part of the answer. Capital is cautious, but movement is happening — selectively.

Ethereum ETFs are regaining inflow momentum

On May 13, 2025, net inflows into Ethereum ETFs totaled $13.5 million, led by Grayscale’s mini-Ether fund at $7.4 million. For investors, this signals that regulated capital is re-entering ETH exposure, particularly through compliant vehicles.

Abraxas Capital recently acquired over 240,000 ETH

The asset manager added 242,652 ETH (approx. $561 million) to its holdings in a single week, one of the largest institutional moves this year. Large-scale accumulation supports the view that Ethereum is being positioned as a strategic long-term asset, not just a speculative trade.

Ethereum staking is becoming institution-ready

Distributed validator tech is being integrated into institutional custody platforms, allowing ETH staking without compromising compliance or decentralization. This makes ETH more attractive to funds seeking passive yield from on-chain assets.

Staking-linked ETFs are in active development

Multiple filings are underway for Ethereum ETFs that include staking yield. Final approval is pending, but some issuers anticipate product launches by Q4 2025. If cleared, this opens up new yield-bearing ETH exposure for retirement accounts and fund structures.

So far, Ethereum in 2025 is seeing selective but meaningful traction from institutional investors.

Drop in ETH addresses withdrawing from exchanges: CryptoQuant

What are analysts predicting for Ethereum in 2025?

When you’re evaluating whether Ethereum is a good investment in 2025, analyst forecasts offer useful context, but no consensus. Projections vary widely, shaped by each analyst’s take on roadmap execution, market cycles, and regulatory outcomes. Here’s how it breaks down.

Julian Hosp projects ETH at $11,111, based on potential ETF inflows and long-term conviction around Ethereum’s role in crypto infrastructure. This reflects a high-conviction view tied to regulatory wins and adoption momentum.

Michaël van de Poppe sees Ethereum closer to $3,000, suggesting that ETH may move sideways unless BTC enters a strong macro trend. This aligns with cautious expectations, especially for investors tracking short-term performance.

Taki Tsaklanos, an independent analyst, expects a wide band between $2,500 and $7,500, dependent on risk-on sentiment and breakout confirmations across L1 ecosystems. For investors, this is a watch-and-react scenario tied to broader market momentum.

Fred Schebesta forecasts ETH between $5,710 and $7,996, long-term, based on technical charting and sentiment metrics. The call sits in the optimistic-but-grounded range, assuming continued upgrade delivery.

Standard Chartered revised its 2025 target to $4,000, down from $10,000, citing dilution from layer-2s as a value headwind. From an investment perspective, it’s a reminder that usage doesn’t always translate to direct ETH demand.

Finder panel (50+ fintech experts) averaged out at $5,770, citing ETF infrastructure, staking demand, and Ethereum’s resilience as key factors. This represents the market’s institutional midpoint; bullish, but not euphoric.

Ethereum in 2025: buy, hold, or avoid?

If you’re still asking whether Ethereum a good investment in 2025, the answer is that it depends on your time frame. Short-term? Volatile. Long-term? The fundamentals are stronger, and upgrades are being delivered. Ethereum in 2025 isn’t early-stage anymore but if you are an investor who tracks usage, staking, and roadmap progress, ETH still likely earns its place in your portfolio.