[ad_1]

Bitcoin continues to hold around the $108,000 mark, consolidating within a narrow range after a sharp rally from April lows. Price action suggests strength, but momentum has cooled slightly, setting the stage for a critical few days ahead.

Technical Analysis

The Daily Chart

On the daily chart, BTC remains above both the 100-day and 200-day moving averages, which are located in the $90,000 – $96,000 range, and have also crossed bullishly in recent weeks. The RSI sits around 63, showing that the rally isn’t yet overheated but is nearing the upper range.

A healthy consolidation around the $108,000 level could serve as a base for another leg up, provided bullish momentum holds and volume supports a breakout.

The 4-Hour Chart

The 4-hour chart shows a rising channel structure, and despite a recent breakdown of the lower trendline, the price has convincingly defended the horizontal support level at $106,000. This area has now become an intraday support zone.

The RSI is around the neutral 50 level, suggesting balanced momentum after a brief correction. A clean break and close above $109,000 and a return inside the channel could trigger a push towards the $112,000–115,000 range, while any breakdown below $106,000 might open the door for a short-term pullback toward the $102,000–$100,000 region.

Sentiment Analysis

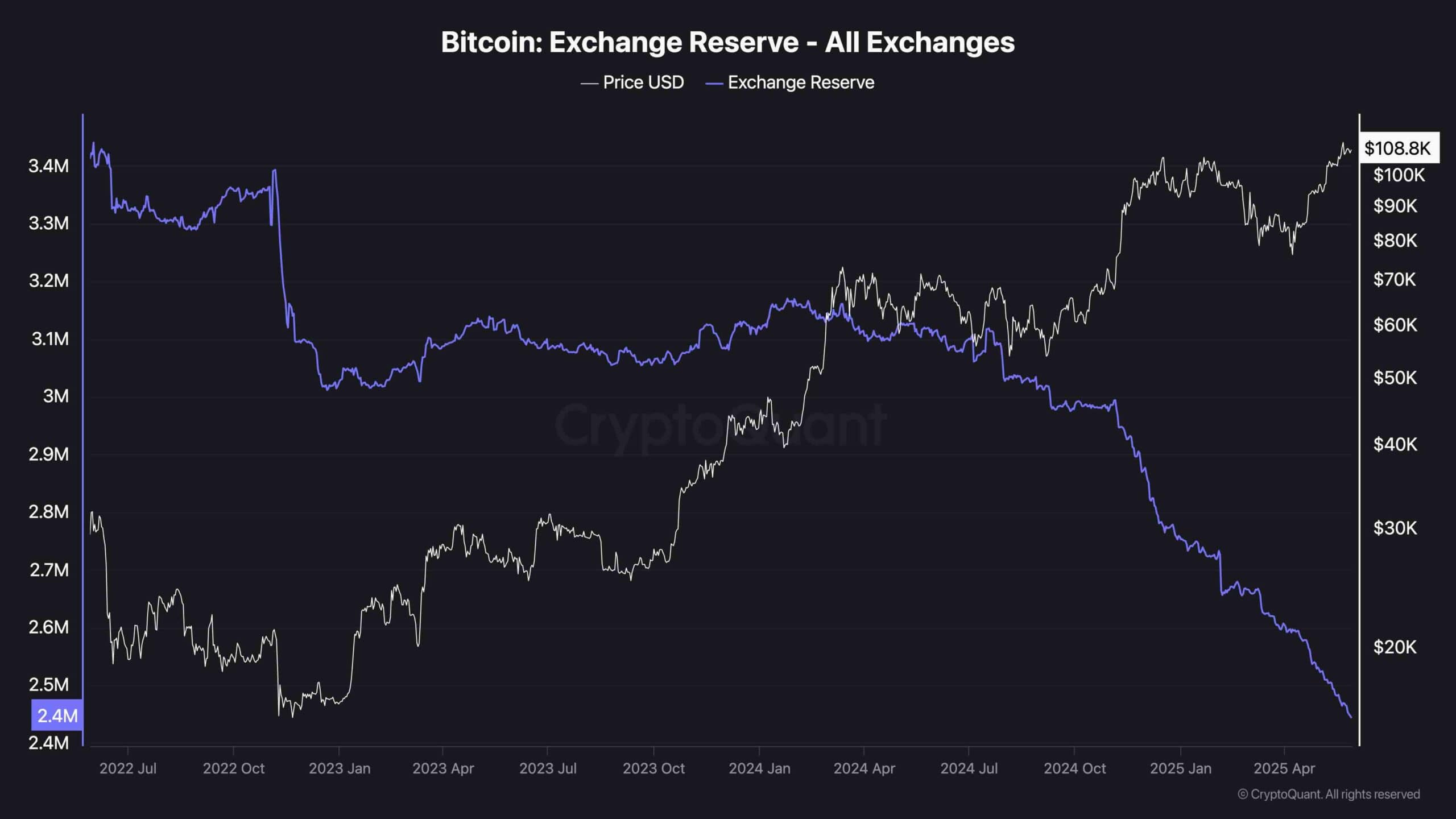

Exchange Reserve

On-chain data continues to support a bullish bias. Exchange reserves are at their lowest level in years, now sitting around 2.4 million BTC. This sustained and aggressive decline reinforces the idea that investors are moving BTC off exchanges, likely for long-term storage, reducing sell-side liquidity.

With supply tightening and price climbing, the conditions remain ripe for higher valuations, especially if macro conditions stay favorable and demand from institutional channels remains strong.

[ad_2]