[ad_1]

Bitcoin is facing a tough battle at a critical resistance zone following a sharp correction. With weakening volume and a bearish retest in play, lower prices could be on the horizon.

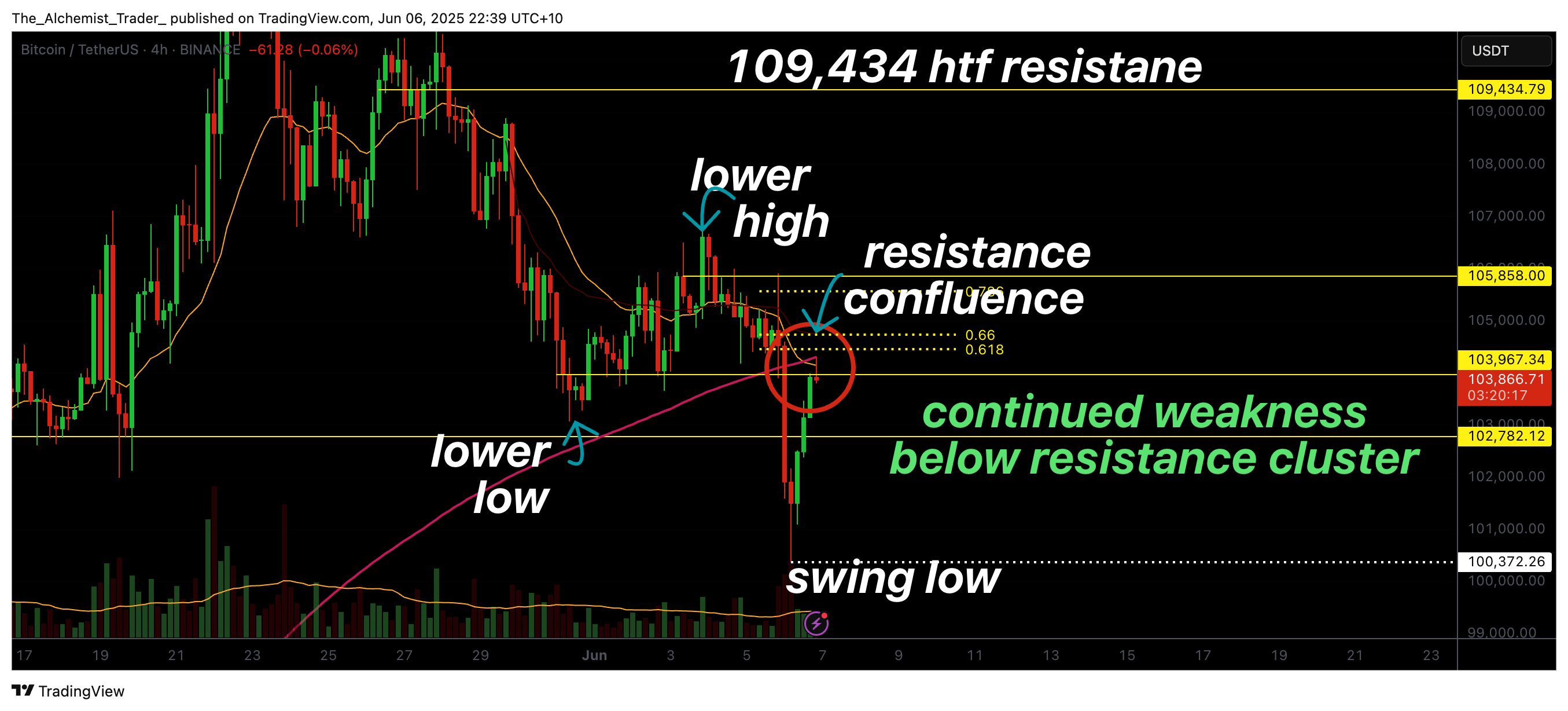

In the past 24 hours, Bitcoin (BTC) has seen a notable correction that has shifted the local market structure. After breaking below key levels, BTC has bounced back into a strong resistance cluster, but is now struggling to reclaim it.

The confluence of several technical factors at this zone suggests that this could be a bearish retest, signaling a potential continuation to the downside unless bulls step in with significant volume.

Key technical points

- Major Resistance Cluster: $103,000 level aligned with the 200 Moving Average, daily resistance, and the 0.618 Fibonacci retracement.

-

Bearish Market Structure: Clear lower high and lower low now established.

Volume Weakness: Bounce into resistance is occurring on low volume, indicating lack of bullish conviction. - Rejection Probability: Current region acting as strong resistance, hinting at further downside unless reclaimed.

- Trend Shift Confirmation: Failure to break above $103K will confirm bearish structure on local timeframes.

BTCUSDT (4H) Chart, Source: TradingView

Bitcoin’s recent bounce has taken price directly into a dense resistance zone that includes the 200 MA, a daily horizontal resistance at $103,000, and the golden ratio (0.618 Fibonacci). Historically, such confluence levels are difficult to break without strong conviction and volume, both of which are currently absent.|

Volume analysis shows that the rally into this resistance zone has occurred on declining buy-side interest, raising red flags for a bullish continuation. Without a sudden spike in volume, this setup resembles a textbook bearish retest, a common pattern in downtrending markets, where price revisits former support turned resistance before continuing lower.

You might also like: AAVE price bounces from $240 as whales accumulate, but momentum shows signs of weakness

Market structure has now clearly shifted into a bearish state. The recent correction not only broke prior swing lows but also confirmed a new lower high with this failed push. This means that unless the $103,000 level is reclaimed and held with strength, the trend remains tilted to the downside.

What to expect in the coming price action

If Bitcoin fails to reclaim the $103,000 resistance cluster with strong volume in the near term, another leg down becomes increasingly likely. Traders should watch for signs of a confirmed lower high forming, which could signal a move toward deeper support levels.

Read more: Bitcoin leads crypto market slump as Trump and Musk trade punches

[ad_2]