[ad_1]

Will Bitcoin drop below $90K as global markets decline due to the HMPV virus threat and the U.S. market weakens amid reduced rate-cut expectations?

The crypto market has dropped by 6.15% in the past 24 hours, returning to $3.36 trillion. This downturn includes a significant 5.60% decline in Bitcoin, which has lost its $2 trillion mark valuation.

As Bitcoin dips below the $100,000 mark, market fear intensifies, driving the Fear and Greed Index down to 54. With rising liquidations and a sudden shift into a bearish trend, Bitcoin’s decline signals a possible pullback to $90,000.

Bitcoin Price Analysis

The 4-hour Bitcoin chart shows a failure to break above the $102,557 supply zone, leading to a sharp pullback below the $96,000 mark.

Currently, Bitcoin is trading at $95,846, breaking below its 200-EMA line on the 4-hour chart. This has caused a significant pullback in the 4-hour RSI, reflecting increased selling pressure.

Additionally, the downturn in the 20-EMA line suggests upcoming bearish crossovers between the average lines. Overall, technical indicators signal a bearish outlook amid the ongoing crypto market crash.

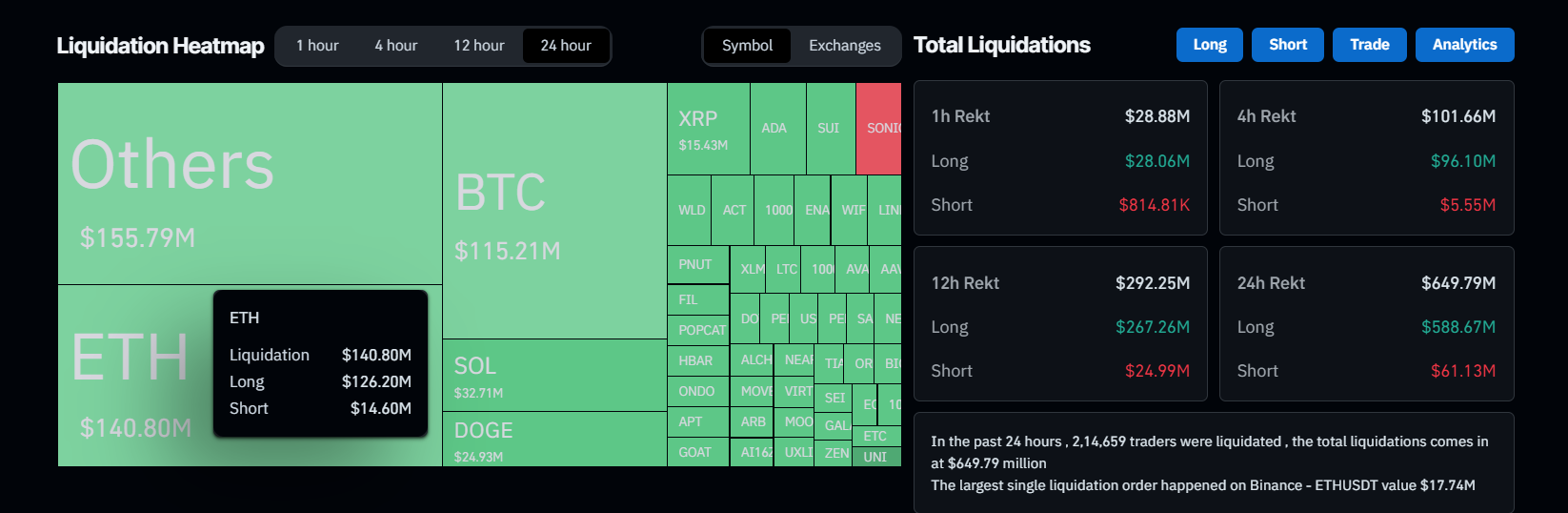

Crypto Market Bleed $650 Million

During the pullback, the crypto market has lost nearly $650 million over the past 24 hours. This constitutes $588.24 million in long liquidations, with just $61.13 million on the short side.

The most significant single liquidation order occurred on Binance in the ETH-USDT pair, amounting to $17.74 million.

Crypto Liquidations

Derivatives Turn Bearish

As the pullback continues, Bitcoin’s derivatives data analysis reveals a 3.85% drop in its open interest to $62.80 billion. The long-to-short ratio has turned bearish, now standing at 0.9421. In addition, the OI-weighted funding rate has risen to 0.076%, up from 0.0044%.

Bitcoin Derivatives

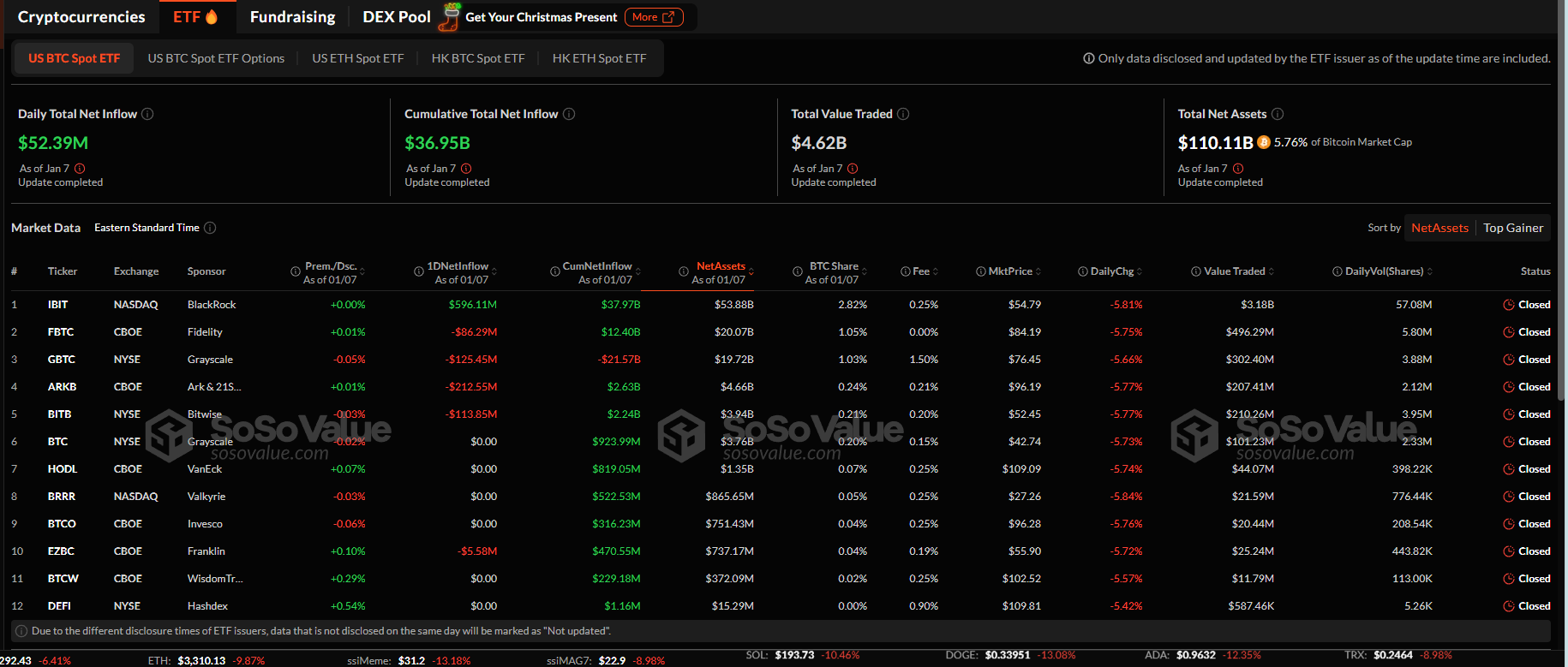

BlackRock Continues to Buy Bitcoin

Amid the sharp pullback, the daily total net inflow in the U.S. Bitcoin spot ETF stood at $52.39 million. On the positive side, BlackRock remains bullish, with an inflow of $596.11 million. Meanwhile, the ARK and 21Shares Bitcoin ETF saw outflows of $212.55 million.

Bitcoin ETFs

Surging U.S. Treasury Yields Weaken Rate Cut Expectations

Amid fears of the HMPV virus crashing global markets, strong economic reports from the U.S. have emerged as a key bearish catalyst.

On Tuesday, U.S. Treasury yields spiked, with the 10-year yield rising 6.8 basis points to its highest closing level since April 2024, currently standing at 4.684%. The 30-year yield also increased 7.3 basis points, reaching its highest closing level since November 2023.

Currently, the U.S. 10-year bond stands at 4.678%, and the 30-year Treasury bond stands at 4.914%. As strong economic data impacted the Nasdaq and S&P 500, bearish effects spread across the crypto market.

Moreover, the bearish narrative has been reinforced as the likelihood of federal interest rate cuts in 2025 declines due to strong job openings.

BTC Price Targets

As the pullback phase intensifies, immediate support is at $95,119. Given the declining global market conditions due to the HMPV virus threat, liquidations in the crypto market are likely to escalate.

If the $95,000 support level breaks, a retest of the $92,654 support level is likely. Meanwhile, the downward trend in the RSI line signals a potential buy-the-dip opportunity at these critical support levels.

[ad_2]