This is a segment from the Blockworks Daily newsletter. To read full editions, subscribe.

“You don’t need to be a rocket scientist. Investing is not a game where the guy with the 160 IQ beats the guy with 130 IQ.”

— Warren Buffett

Warren Buffett is the most quoted person in the history of this newsletter — a crowning achievement of his seven-decade career that must fill him with pride.

I’ve quoted him so often because he has a lot to say about investing and markets, of course, but also because he expresses himself in folksy, quippy, metaphorical sound bites that are universally accessible.

He’s not dumbing it down for us, though.

As best I can tell, that’s genuinely how he thinks about investing — and there’s a lesson in that: The greatest investor of all time invests mostly by common sense.

Investing is so common sense to him that he believes that anyone can do it:

“It’s not necessary to do extraordinary things to get extraordinary results.”

“If you can detach yourself….from the crowd, you’ll get very rich. You don’t have to be very bright.”

“It doesn’t take brains. It takes temperament.”

This all doubles as excellent life advice, as so many of his investing maxims do:

“It’s good to learn from your mistakes. It’s better to learn from other people’s mistakes.”

“What pond you jump in is more important than how well you swim.”

“You only have to do a very few things right in your life so long as you don’t do too many things wrong.”

Buffett attributes his astounding investment returns to only about a dozen “truly good decisions” that he’s made — about one every five years, on average.

And he lived his life the same way: The sixth-richest man in the world still resides in the house he bought for $31,500 in 1958.

Conversely, his investing process was as simple as the life he led: He doesn’t build financial models, for example, he just reads a lot.

“I probably read five to six hours a day…I read five daily newspapers. I read a fair number of magazines. I read 10-Ks. I read annual reports.”

The compounding knowledge earned from all that reading, he’s explained, allowed him to pounce when an unusual opportunity came along.

“If somebody calls me about an investment…I usually know in two or three minutes whether I have an interest.”

In 2003, for example, he bought the homebuilder Clayton Homes (not just the stock, the whole company) for $1.7 billion after reading its SEC filings and talking to management on the phone (he didn’t visit the company until after he owned it).

In 2008, he turned down a request to rescue Lehman Brothers simply because its financial statements were too complex (a giant red flag for him).

At the height of the subsequent financial crisis, he poured $5 billion into Goldman Sachs after one phone call with its CEO and just a few hours of negotiating terms.

The results, of course, speak for themselves: From 1965 to 2024, Berkshire Hathaway shares rose by more than 5,500,000% — a gravity-defying annual return of almost 20% over 59 years.

By comparison, the total return of the S&P 500 index over that period was “just” 39,000%.

“Buffett’s returns appear to be neither luck nor magic,” an academic study found, “but, rather, reward for the use of leverage combined with a focus on cheap, safe, quality stocks.”

Lately, however, Buffett hasn’t found many stocks that are cheap, safe and quality enough to leverage into — for the first time in two decades, Berkshire Hathaway holds more cash than it does listed equities.

That’s not because Buffett is worried about what politics or tariffs might mean for the stock market: “I never try to profit from the stock market,” he’s said.

But his failure to find good businesses at reasonable prices probably does tell us something about his view of the market as a whole.

Buffett acolyte Chris Bloomstran estimates that with valuations and profit margins currently elevated, investors in the S&P 500 should expect returns of “no higher than 1.1% per year for the next decade.”

If so, going into retirement with a record amount of cash may go down in history as the thirteenth “truly good decision” that Warren Buffett has made — and an instructive one, at that.

“Investing is the greatest business in the world because you never have to swing,” Buffett explains in typical Buffett fashion. “All day you wait for the pitch you like; then, when the fielders are asleep, you step up and hit it.”

With the market rebound over the past month, it looks like he probably won’t see any more fat pitches before he retires at the end of the year — despite all the seemingly bad news on tariffs.

But I’m sure he’d tell younger investors that there will be plenty to look forward to: “Over the long term, the stock market news will be good.”

Let’s check the charts.

Stocks are up, but estimates are down:

It’s reassuring that stocks are back to where they were before “Liberation Day,” but that doesn’t mean nothing’s happened. Per Torsten Slok, earnings estimates are significantly lower, which means stocks are significantly more expensive.

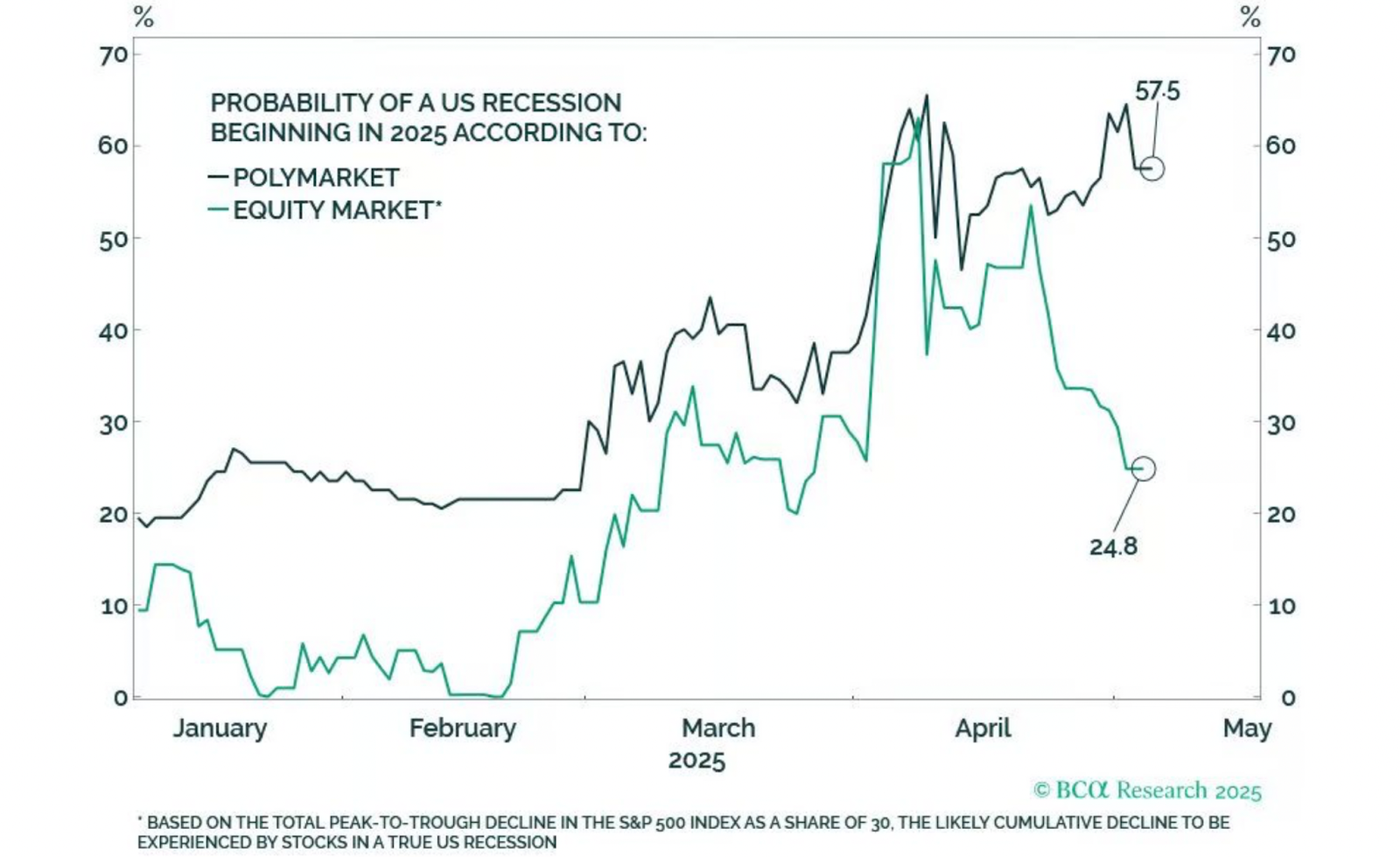

Stock market vs. betting market:

Polymarket odds suggest a US recession is still slightly more likely than not, but BCA Research estimates that the stock market is pricing in just a 25% probability now.

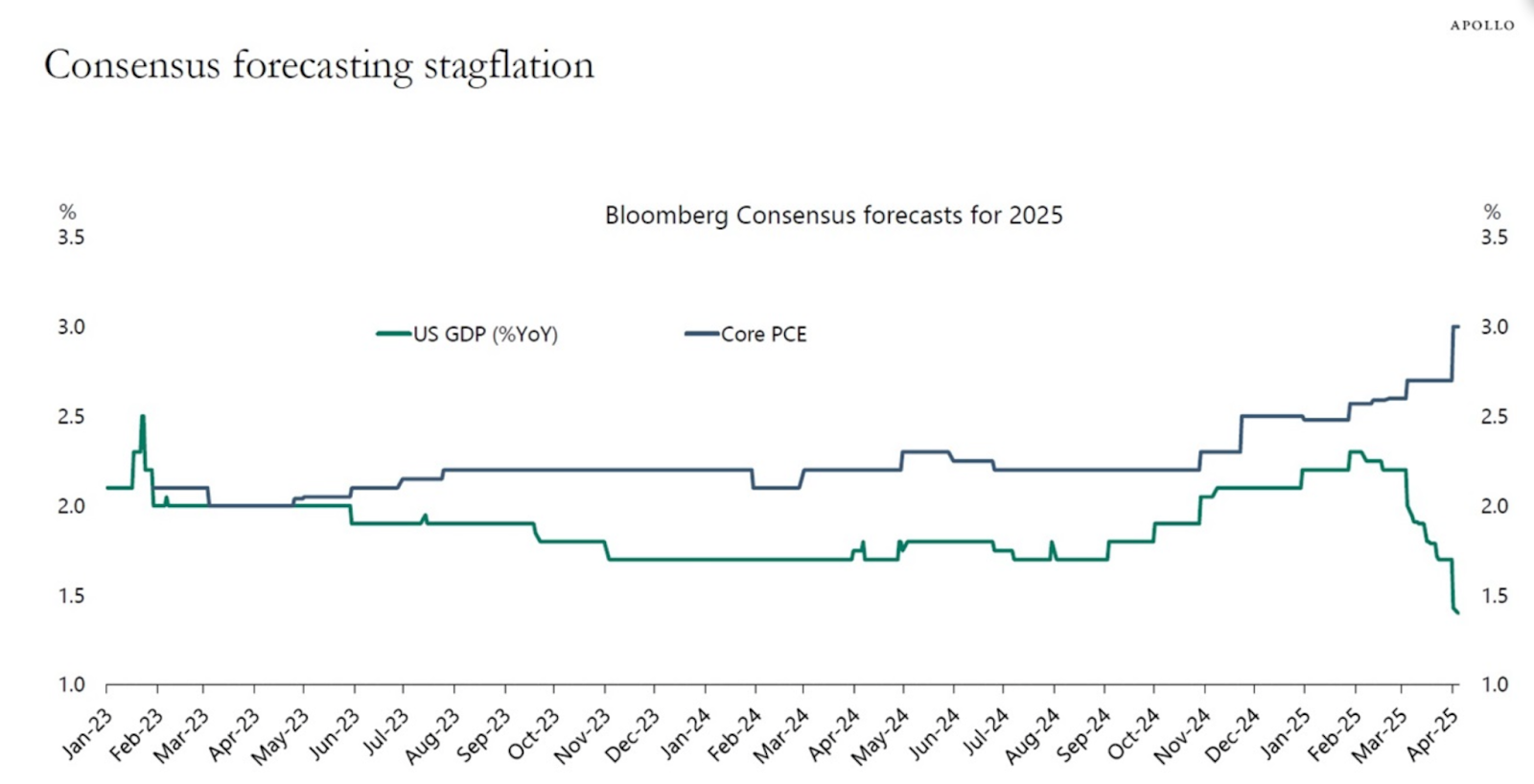

Economists are pricing in stagflation:

Torsten Slok notes that rising inflation and falling GDP estimates indicate that stagflation is coming. At the FOMC presser this week, Fed Chair Jerome Powell seemed to agree: “If the large increases in tariffs that have been announced are sustained, they’re likely to generate a rise in inflation, a slowdown in economic growth and an increase in unemployment.”

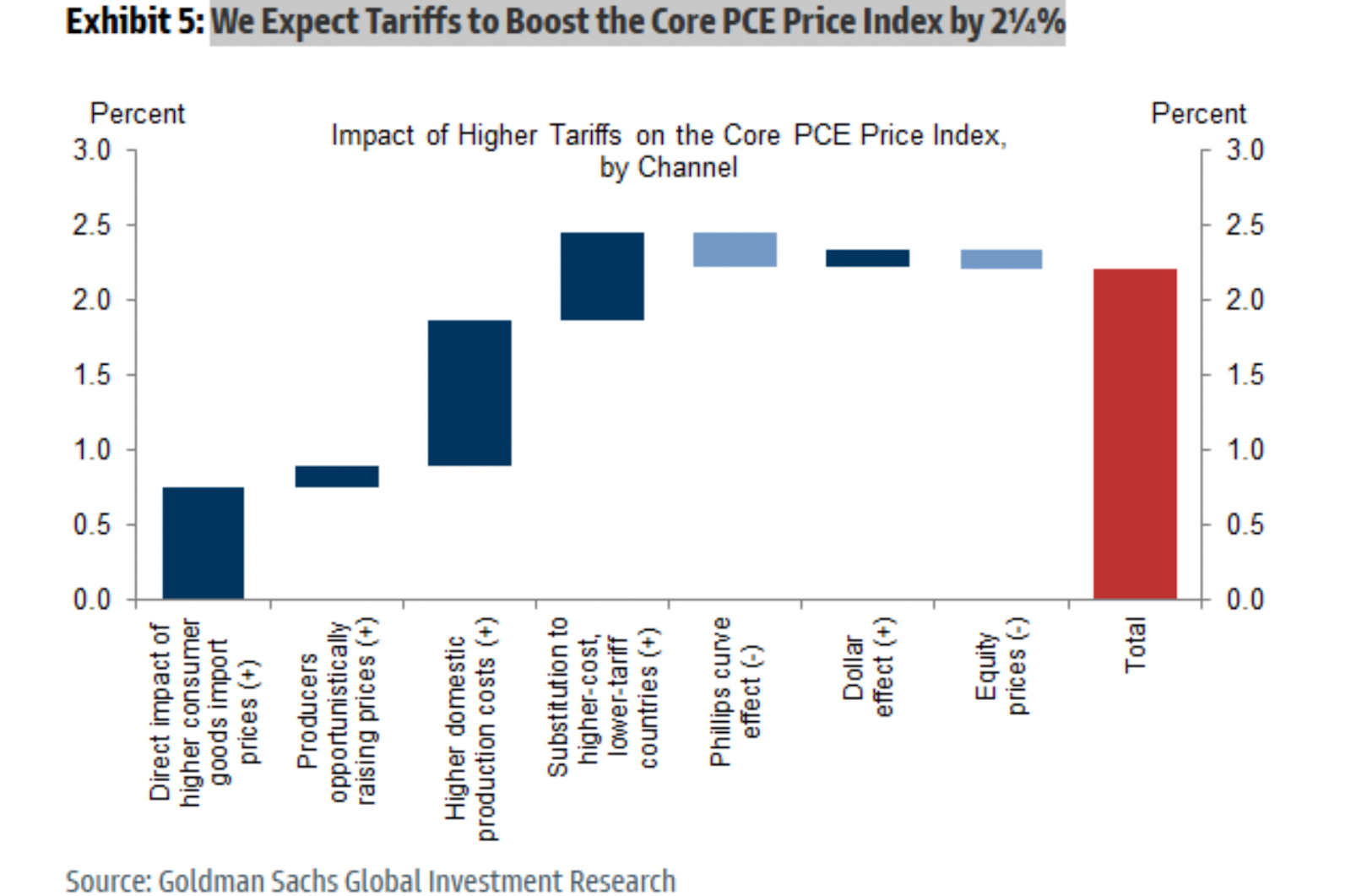

It might get worse than that:

Analysts at Goldman Sachs estimate that tariffs will raise inflation by a whopping 2.25%.

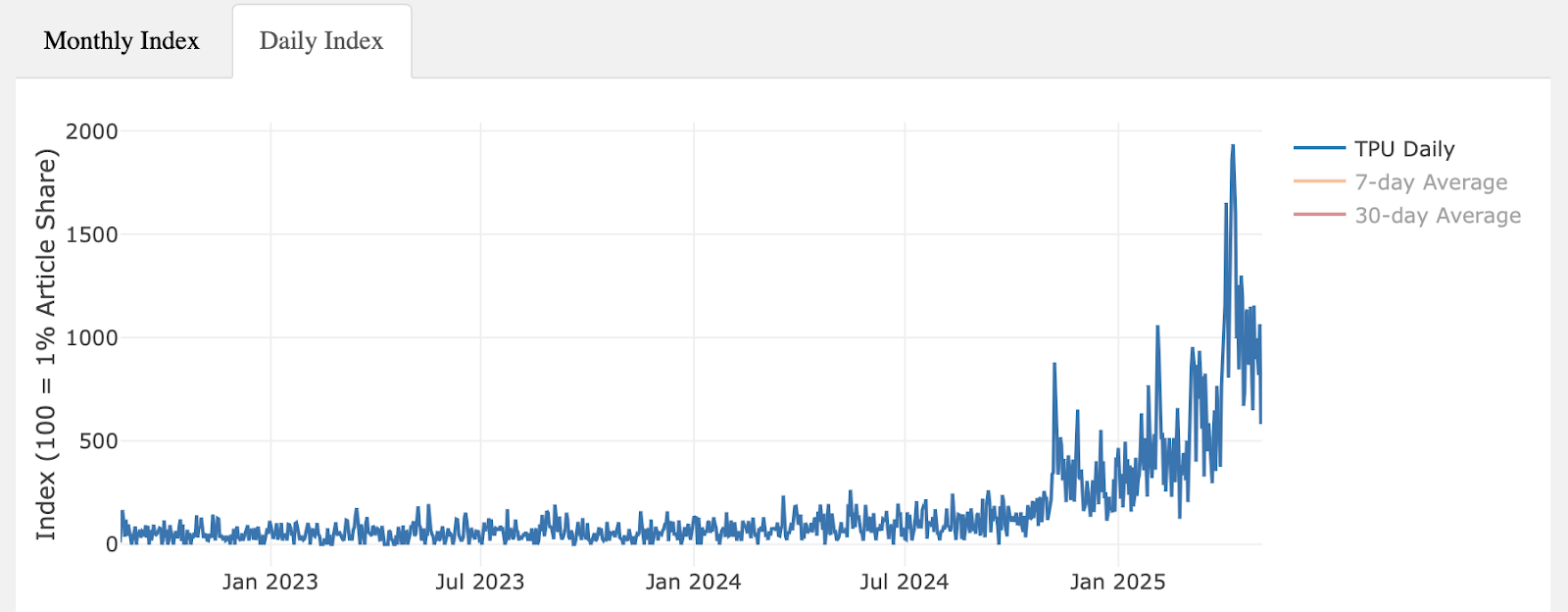

Trade policy is less uncertain, I guess:

Markets are said to hate uncertainty, and despite all the contradictory headlines, the Trade Policy Uncertainty index is down — so maybe that’s why stocks are up?

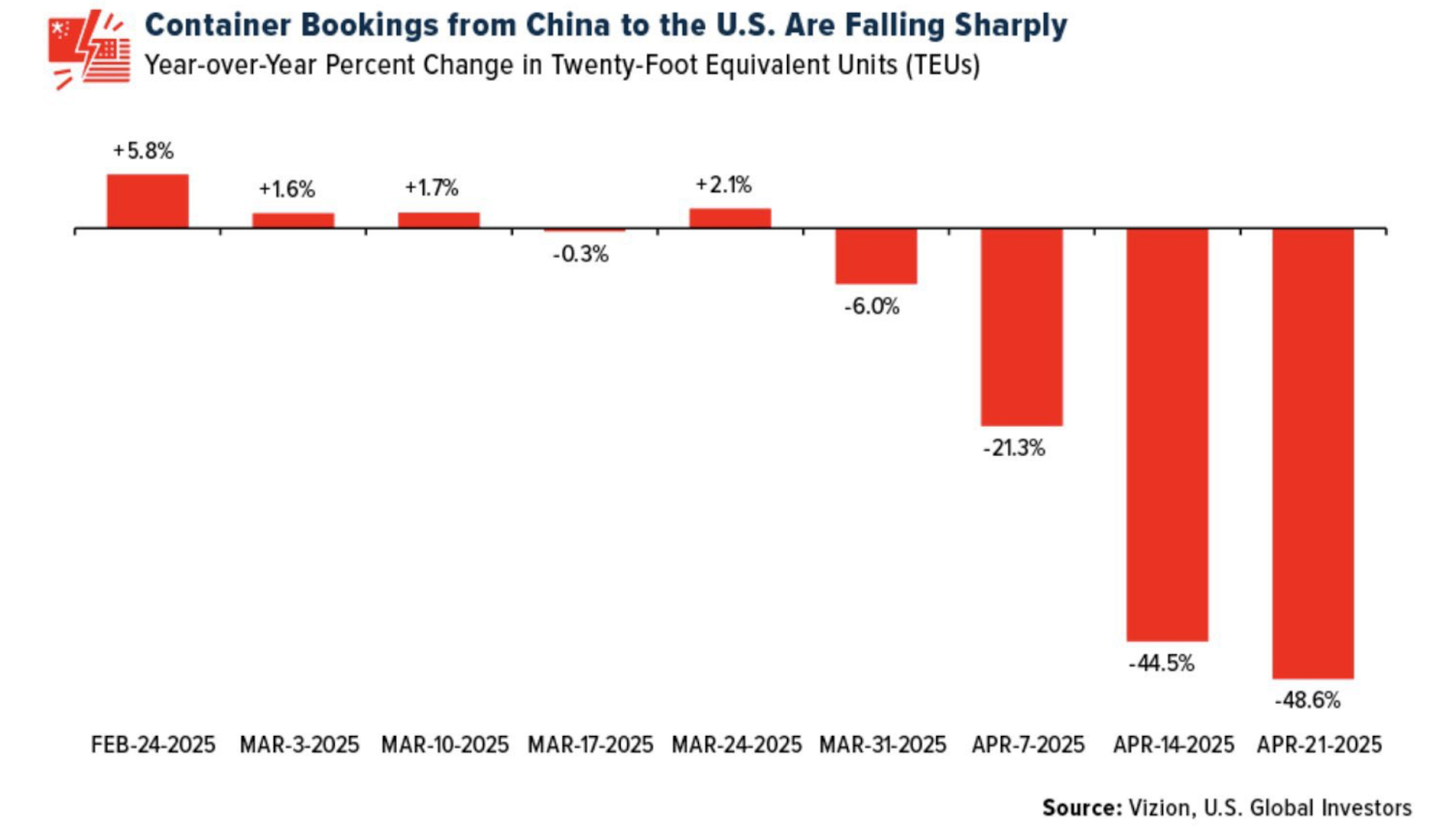

Actual trade is down, too:

Container bookings from China to the US are down 49% year over year. President Trump said that’s a good thing because no trading means “we lose less money.” But he appears to want some level of trade with China — he posted this morning that the current 145% tariff rate could fall to 80% and suggested that he’s leaving it up to Treasury Secretary Scott Bessent to negotiate a deal when he meets with China this weekend in Switzerland.

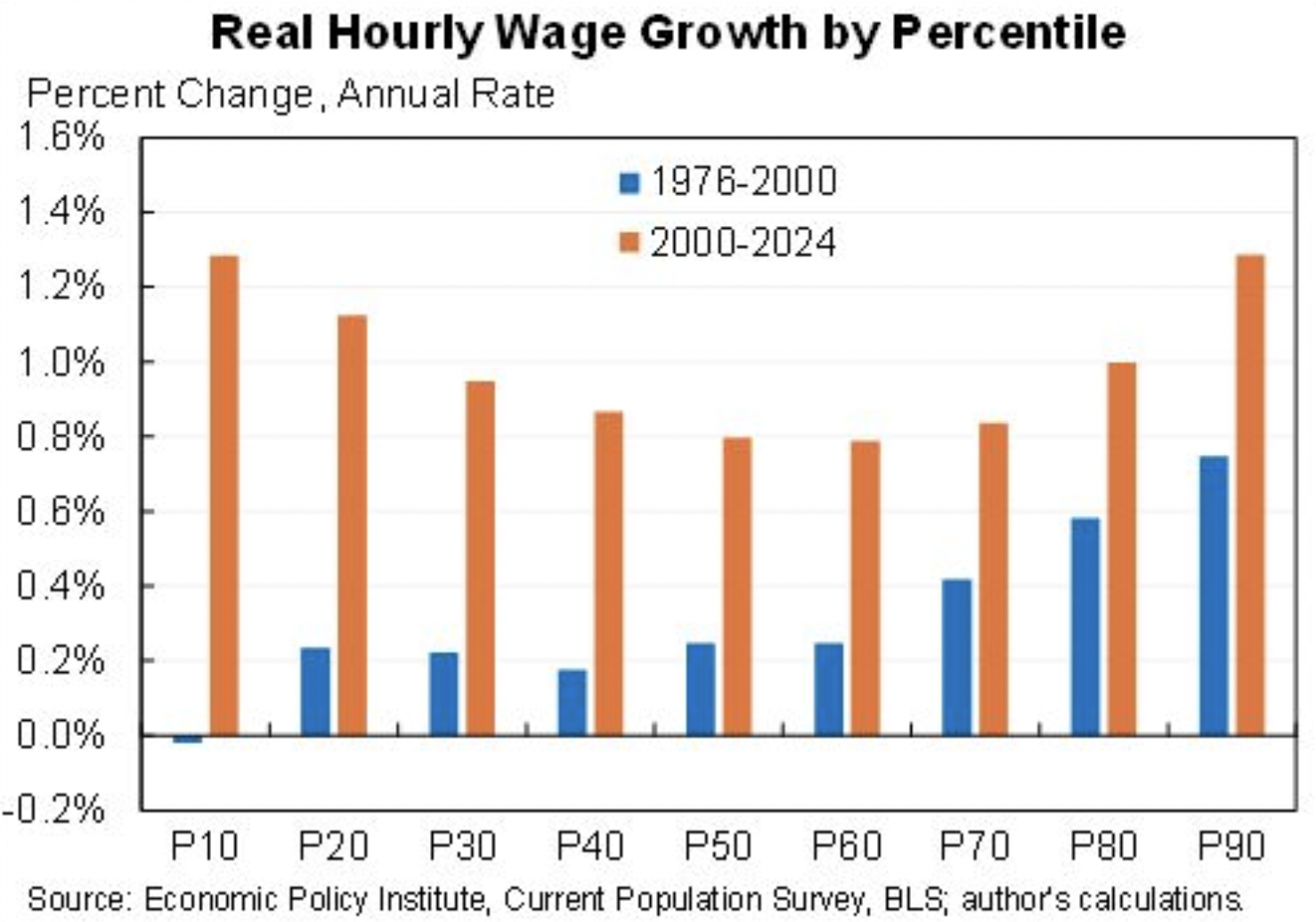

Trading with China has been good for us:

Jason Furman notes that US wages grew faster in the 24 years after China joined the WTO (the orange bars) than in the 24 years before (the blue lines). Most surprisingly, wage growth has been far more equitable in those two decades of globalization than they were before.

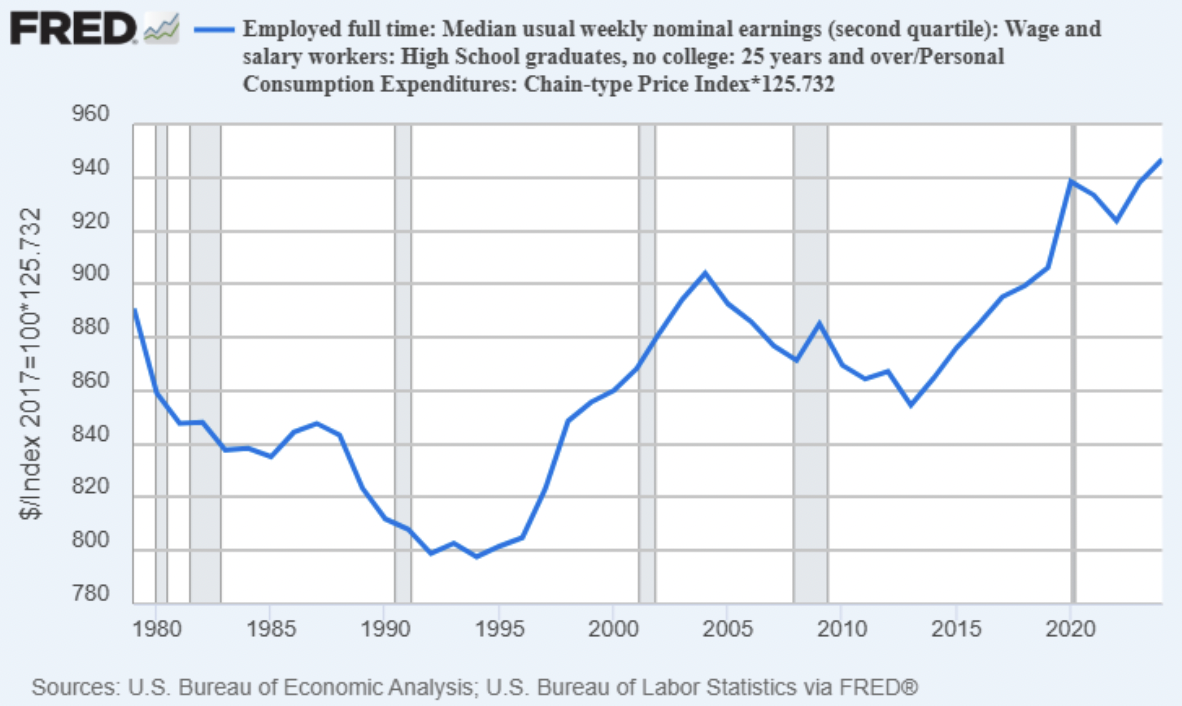

Trading with China has been good for us (2):

Jeremy Horpedahl digs a little deeper and finds that the real (i.e., inflation adjusted) earnings for high school graduates without a college degree are higher than they have been in at least 50 years (and I’m guessing probably ever, but the Fed data doesn’t go back any further than that). It seems to be getting even better, too: The Wall Street Journal this week reported about a high school junior who’s received an annual $70,000 job offer because his school offers welding classes.

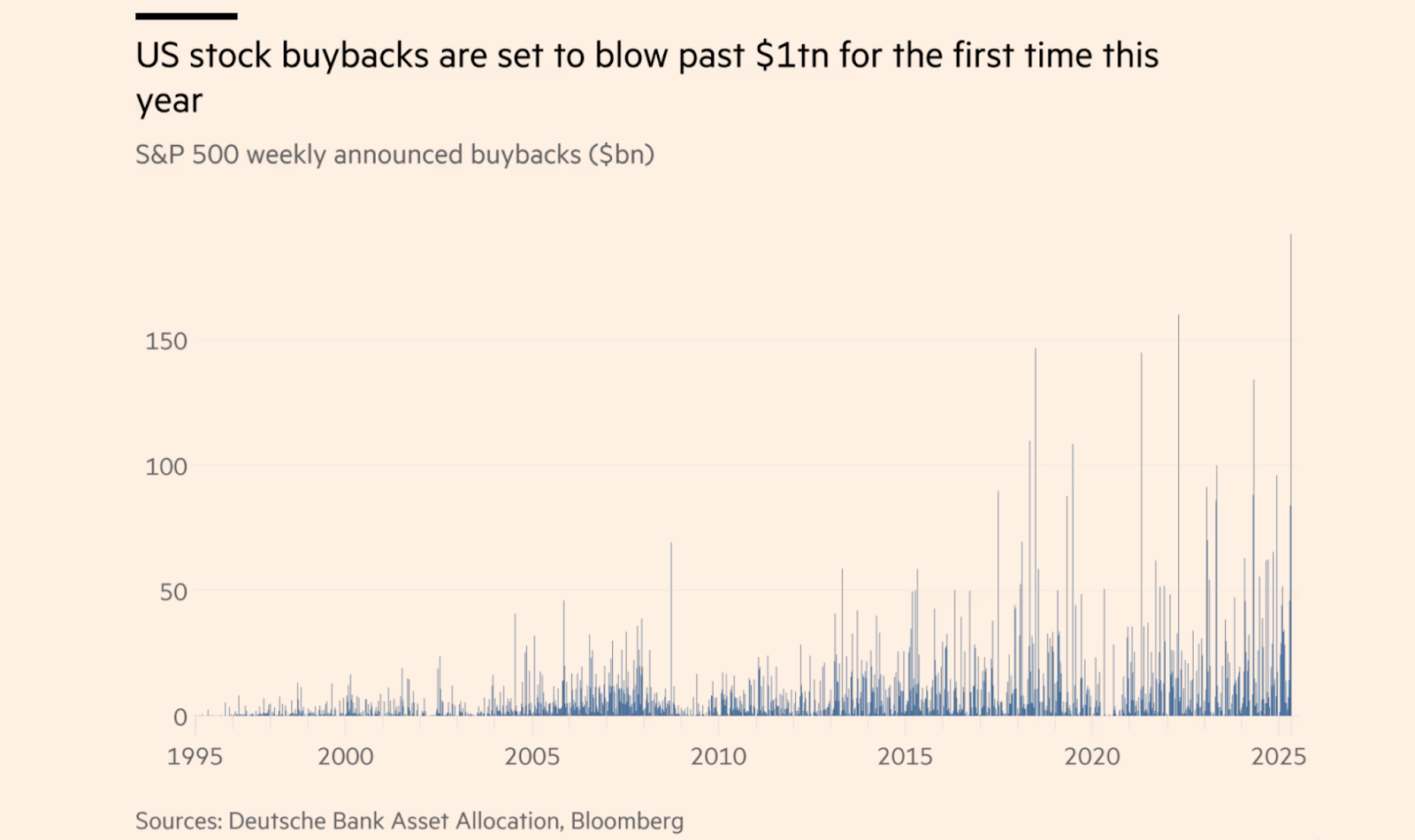

Companies are still buying:

The FT reports that US companies are on track to buy over $1 trillion of their own stocks this year.

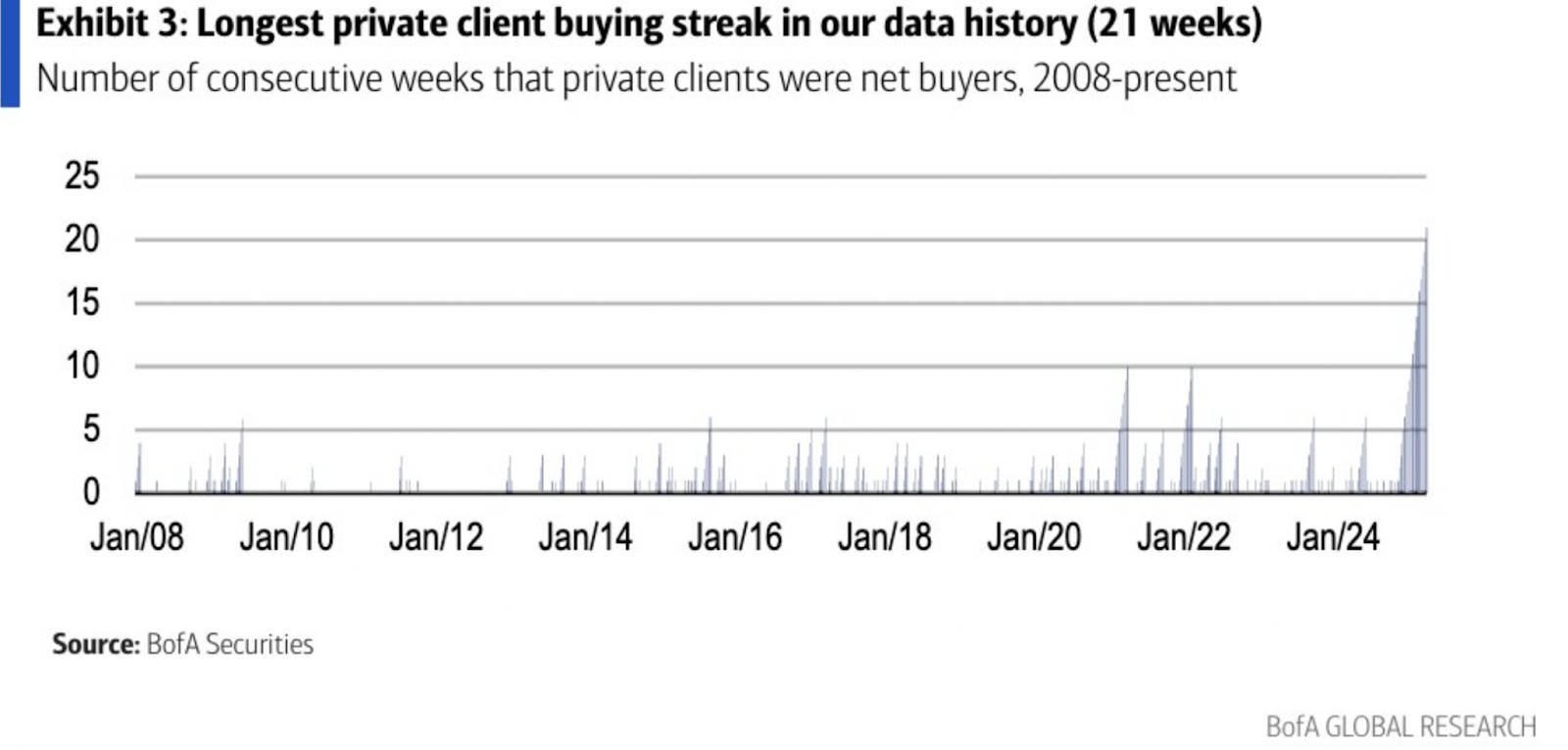

Retail investors are still buying: