The following guest post comes from Bitcoinminingstock.io, the one-stop hub for all things bitcoin mining stocks, educational tools, and industry insights. Originally published on Sept. 11, 2024, it was penned by Bitcoinminingstock.io author Cindy Feng. In the editorial, readers discover how MARA Holdings, the largest Bitcoin mining company by market cap, strategically accumulates BTC, outperforming traditional investments with its treasury strategy, while also exploring the risks and rewards of holding Bitcoin on the balance sheet.

Notes: On February 26, 2021, Marathon Patent Group announced its name change to Marathon Digital Holdings, reflecting its position as a leading digital asset technology company and one of the few pure-play Bitcoin investments. On September 10, 2024, the company transitioned again, this time from Marathon Digital Holdings to MARA, and its Nasdaq listing has been updated to MARA Holdings, Inc. In this article, we will use MARA for consistency.

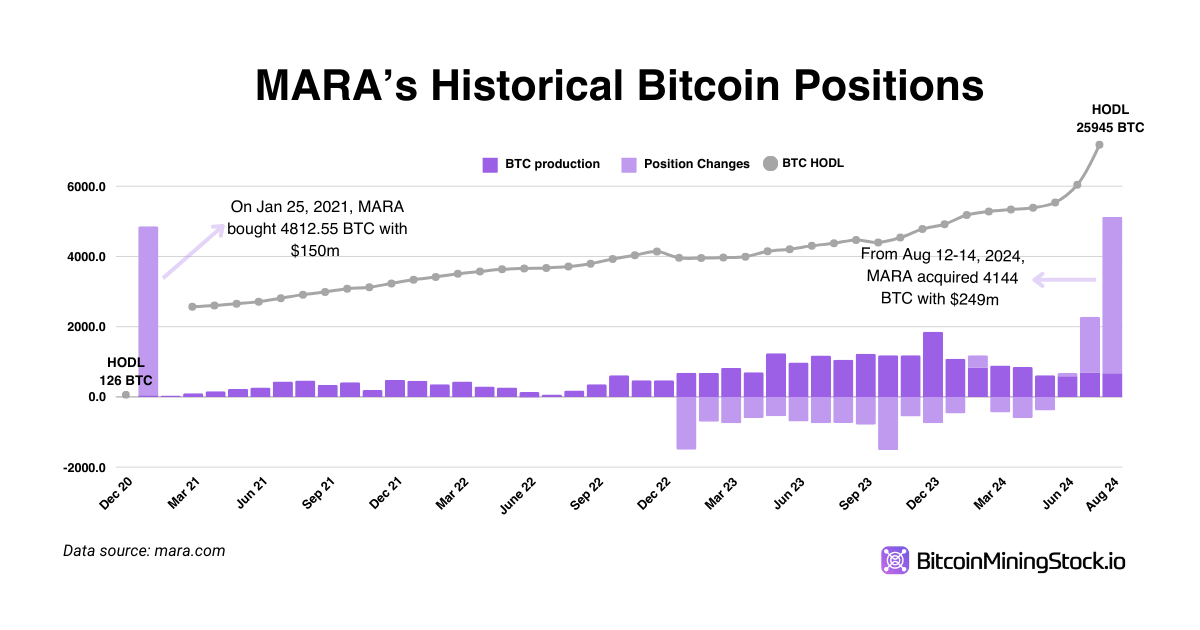

Public Bitcoin miners have increasingly adopted a strategy of holding Bitcoin on their balance sheets. Among them, MARA Holdings (MARA)stands out with the largest Bitcoin treasury, holding 25,945 BTC as of August 31, 2024. This is a significant lead over other peers in the industry.

Source: bitcoinminingstock.io/production

MARA’s Historical Bitcoin Positions

What makes MARA particularly interesting is its dual strategy: not only does the company HODL the Bitcoin it mines, but it also actively purchases Bitcoin from the market using funds raised from financial markets. In August 2024, MARA completed a $300m convertible senior notes offerings and acquired 4,144 BTC, valued at $245m. This wasn’t MARA’s first time accumulating Bitcoin with raised capital. Back in January 2021, the company had a $200m at-the-market (ATM) offering, allocating $150m to buy 4,812.66 BTC at an average price of $31,168 per BTC. Prior to this, when MARA was still known as Marathon Patent Group, the company held only 126 BTC in December 2020.

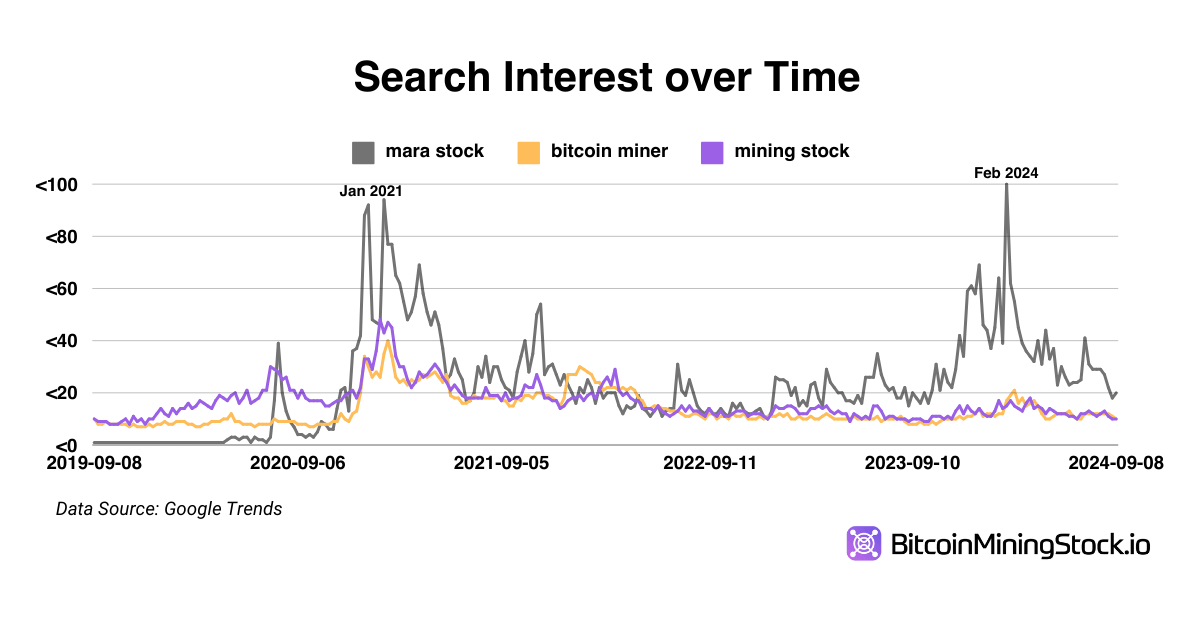

Since adopting the Bitcoin treasury strategy, MARA has successfully positioned itself as one of the top options for investors seeking exposure to Bitcoin through traditional financial markets. As a result, MARA stock has garnered more attention, often outpacing discussions about typical Bitcoin miners or mining stocks.

MicroStrategy and the Bitcoin Treasury Playbook

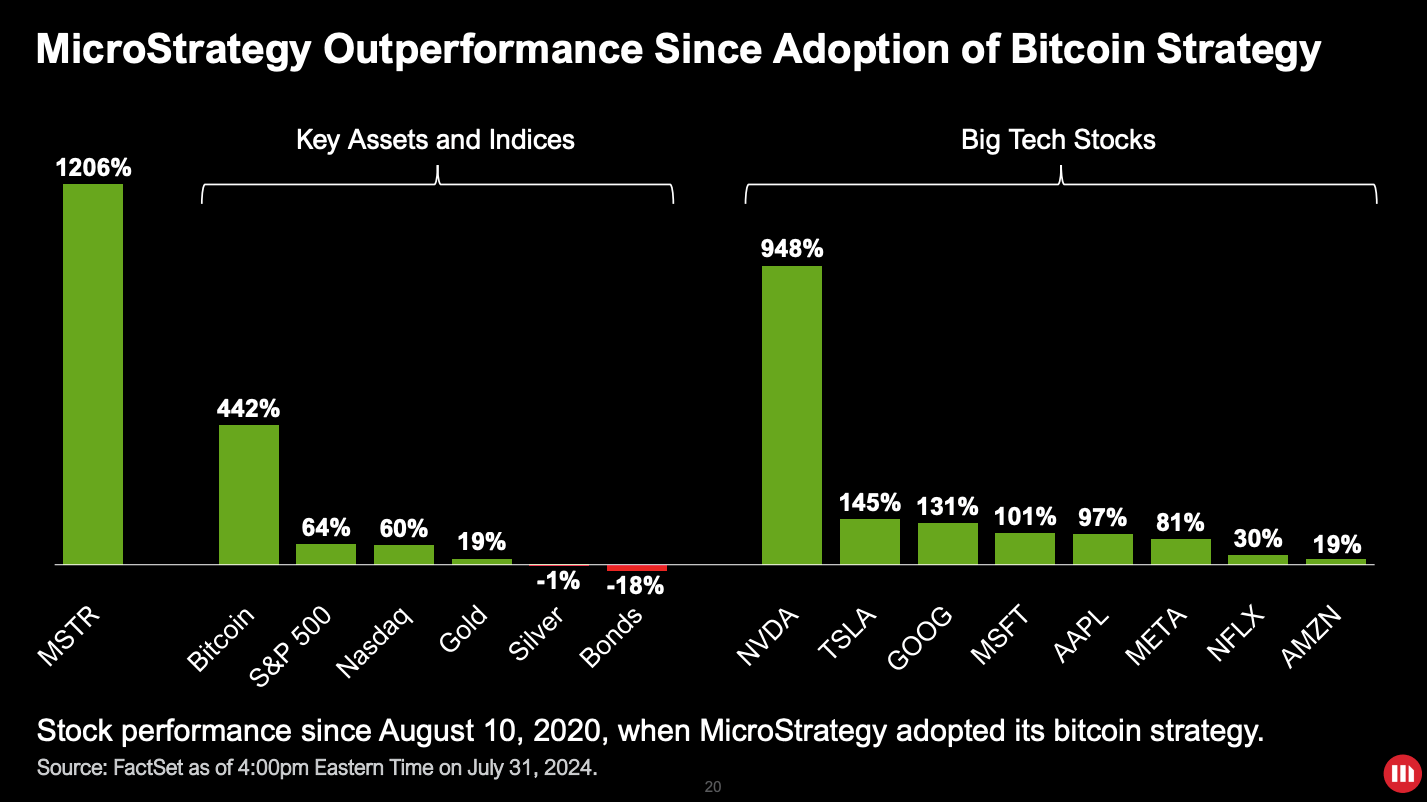

When discussing Bitcoin treasury strategies, Michael J. Saylor and his company MicroStrategy are impossible to ignore. Saylor has been vocal about his company’s Bitcoin strategy, which has resulted in substantial gains. As of August 10, 2024, MicroStrategy’s stock has dramatically outperformed key assets and indices, including big tech stocks. MicroStrategy’s cumulative returns reached 1,206%, compared to Nvidia’s 948%.

Screenshot from MicroStrategy’s Q2 2024 Presentation

This raises the question: why have companies like MARA and MicroStrategy found success with their Bitcoin treasury strategies and what are the associated risks? Here’s a breakdown.

Key Factors Behind the Bitcoin Treasury Strategy

Bitcoin’s Historical Outperformance

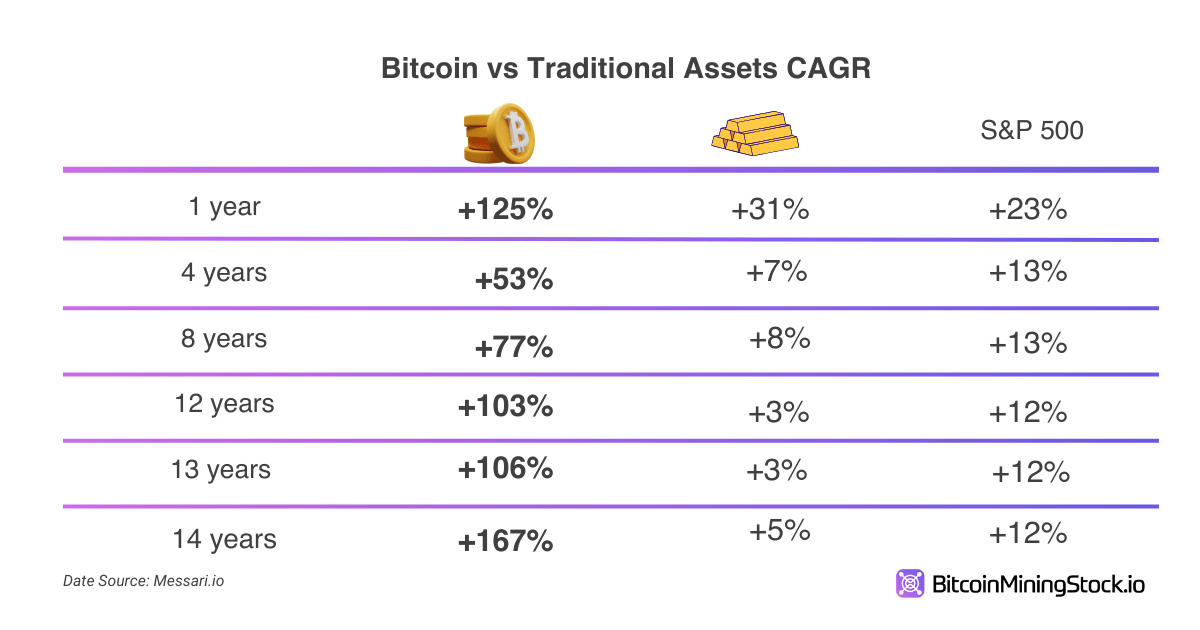

Historically, Bitcoin has delivered an impressive compounded annual growth rate (CAGR), making it one of the best-performing assets over any four-year period. For companies, particularly Bitcoin miners, holding Bitcoin on the balance sheet has become a hedge against rising operational costs, especially since the April 2024 halving, which has nearly doubled the cost of mining a single Bitcoin. As a result, Bitcoin on the balance sheet is a logical strategy during bullish markets, helping miners generate additional value.

Bitcoin as a Superior Store of Value

Bitcoin has proven to be a reliable store of value, especially during times of inflation and market uncertainty. As governments continue to print fiat currencies, leading to inflationary pressures, companies have increasingly viewed Bitcoin as a superior long-term store of value. With only 21 million BTC ever in existence, Bitcoin’s finite supply and decentralized nature provide a safeguard against the depreciation of fiat currency.

Bitcoin as an Investment Benchmark

Traditionally, companies return excess liquidity to shareholders via dividends or share buybacks. However, the double taxation of dividends and the lower returns of buybacks often make these options less efficient. Also, reinvesting in the business or acquiring competitors may also fail to match Bitcoin’s potential. As a result, BTC becomes an attractive investment to maximize shareholder value.

Maximizing BTC per Share

The ultimate goal of the Bitcoin treasury strategy is to maximize BTC per share. As Bitcoin’s value increases, companies with larger Bitcoin reserves will see their book value per share rise, driving up shareholder value. This explains why companies like MicroStrategy often trade at a premium to their net asset value (NAV) in Bitcoin.

How Bitcoin Miners Can Adopt Treasury Strategies

Miners have a few options when it comes to adopting a Bitcoin treasury strategy. One option is to hold a portion (or even all) of their daily mined Bitcoin as part of their Bitcoin reserves. Alternatively, they can use excess cash to purchase Bitcoin from the market. This approach depends on a miner’s liquidity and risk appetite, as they must ensure they can cover short-term liabilities.

Public miners, like MARA, can take this strategy a step further by raising capital through equity and debt markets specifically to acquire more Bitcoin. If Bitcoin’s expected return exceeds the cost of capital (interest rates or dilution from issuing equity), it makes sense to issue shares or take on debt to acquire BTC. For instance, MARA’s recent $300m convertible senior notes carry an interest rate of just 2.125% per annum, which is extremely low given Bitcoin’s volatility. In essence, MARA is leveraging its position in Bitcoin for potential future gains.

Risks Associated with Bitcoin Treasury Strategies

However, this approach does not come without risks. The Bitcoin price may take longer to reach target levels, and the competitive nature of Bitcoin mining could squeeze profit margins. Many miners are investing heavily in expanding their capacity or upgrading fleets, which incurs significant ongoing costs. If companies like MARA are unable to generate alternative revenue streams beyond mining and hosting, their cash positions could become unsustainable, particularly as the hash price hits new historic lows.

If market conditions force miners to sell their Bitcoin holdings during a bear market, it could negatively impact their enterprise value (EV) and stock prices. Moreover, this strategy essentially creates leveraged exposure to Bitcoin, amplifying returns in bull markets but increasing risks during downturns. Only miners with robust risk management strategies will be able to ride the wave comfortably and achieve long-term success in the financial market.

What do you think about MARA’s Bitcoin treasury strategy? Do you believe it’s a sustainable approach for Bitcoin miners in the long term, or does it carry too much risk? Share your thoughts on the potential rewards and challenges of this strategy in the comments below.