[ad_1]

Decentralized exchanges (DEXs) are growing in popularity among crypto users. In the past year, DEXs have generated significant competition for centralized exchanges (CEXs) that currently control trading.

In a conversation with BeInCrypto, industry experts from CoinGecko, Gate.io, and PancakeSwap said they expect DEXs to grow in 2025 but also suggested that CEXs will still be top contenders for newcomers.

The Success of CEXs and DEXs

Since the beginning of crypto trading, CEXs like Coinbase and Binance have dominated the crypto market. These exchanges currently amass over 300 million users combined, offering high liquidity, and serving as easy-to-use platforms for junior traders.

In the past year, DEXs have also gained momentum, providing users with a decentralized alternative to trading. With a higher layer of security to prevent fraud and less exposure to overregulation, DEXs challenge CEXs’ control over the crypto market.

But despite the growing adoption of decentralized exchanges, CEXs are nowhere near fading out.

“While DEXs are set to continue growing and evolving in 2025, CEXs will still play a pivotal role in the ecosystem, particularly in onboarding new users. Both types of exchanges have complementary roles, and together, they will contribute to the overall growth and adoption of crypto in the coming years,” said Chef Kids, Head Chef at PancakeSwap.

By leveraging these advantages, CEXs will continue to be in command of the sector.

The Initial Grip of CEXs

Centralized cryptocurrency exchanges are platforms that store digital assets on behalf of clients and enable them to trade, deposit, and withdraw their cryptocurrencies.

A central entity controls these exchanges and acts as an intermediary between buyers and sellers. This entity is also responsible for ensuring that user funds remain secure.

CEXs are the main avenue for cryptocurrency trading because they are easily accessible for first-time crypto investors. Binance, Coinbase, and Kraken are among the most-used centralized exchanges.

According to Shaun Lee, a research analyst at CoinGecko, 2024 was a very successful year for CEXs.

“Overall, CEXs have performed extremely well, with the top 10 showcasing volumes of over $2 trillion, over multiple months in the year. In 2023, the top 10 CEXs only managed to break above the $1 trillion mark once, in December,” he said.

CEXs also tend to attract certain investors because they are subject to rigorous regulatory oversight. This may act as a safeguard for traders looking to take the first step away from traditional finance sectors.

The Rise of DEXs

DEXs function as a peer-to-peer marketplace and don’t rely on intermediaries for crypto trading or custody over funds. Unlike CEXs, which are regulated by a central entity and require users to undergo Know Your Customer (KYC) processes, DEXs offer users the possibility to trade anonymously.

Their popularity has recently surged, providing traders and investors with a decentralized alternative to centralized exchanges. Built on blockchain technology, DEXs eliminate the need for intermediaries. Meanwhile, immutable smart contracts facilitate trading.

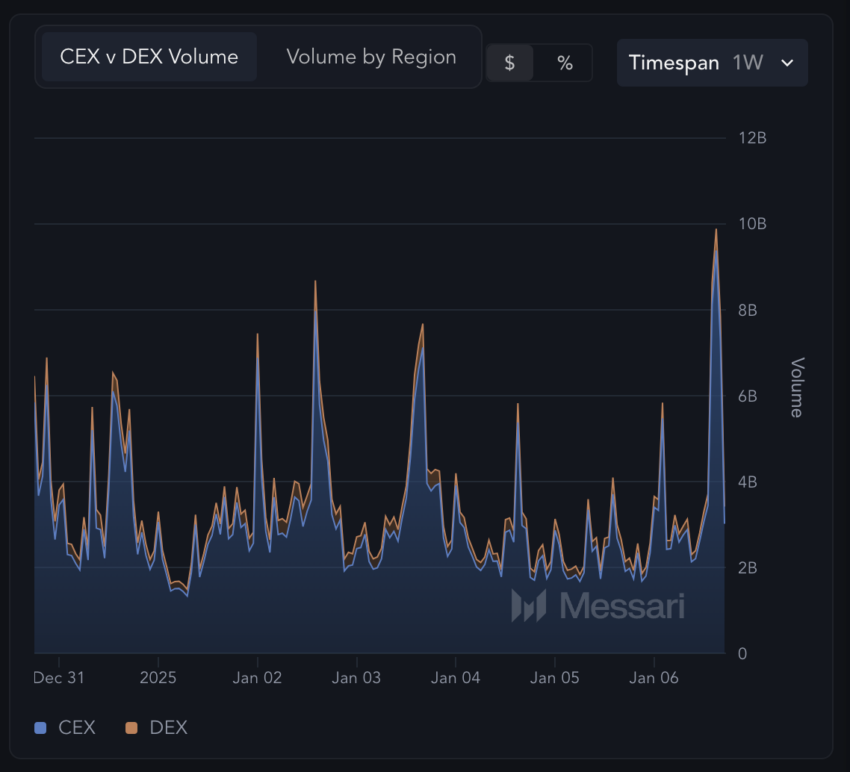

DEX and CEX Trading Volumes in the Past Week. Source: Messari.

These qualities have become increasingly appealing for traders looking to prioritize security and autonomy when exchanging assets.

DeFi platforms have become competitive rivals for CEXs. Hyperliquid, for example, is a layer-one blockchain for decentralized trading that enables high-performance, expeditive trading with reduced fees. The exchange has become widely adopted in the past year.

“Decentralized exchanges (DEXs) currently capture about 40% of the market share, and they’re steadily gaining ground on centralized exchanges (CEXs). Looking ahead to 2025, DEXs will have even more opportunities to grow. As DeFi matures and adoption rises, decentralized exchanges will play an increasingly central role in the broader financial ecosystem,” said Chef Kids.

While CEXs and DEXs operate within different frameworks, both platforms demonstrate signs of growing user adoption and success in the field.

Security and Overregulation Concerns in CEXs

CEXs tend to be scrutinized regarding security. Since the platform itself holds the private keys to its clients’ wallets, it’s fully responsible for the custody of user assets. Users become vulnerable to a potential loss of funds in case of hacks or sudden exchange closures.

Kevin Lee, chief business officer at Gate.io, explained that given their centralized nature, CEXs need to continue developing mechanisms that increase security and avoid potential security breaches.

“Centralized exchanges (CEXs) must prioritize security by employing comprehensive measures that protect both users and their assets. This involves utilizing advanced technologies such as multi-signature wallets, cold storage solutions for the majority of funds, and robust encryption to prevent breaches. Additionally, regular third-party audits of security systems and smart contracts are critical to identifying vulnerabilities proactively. Exchanges should also integrate real-time monitoring tools powered by AI to detect and respond to potential threats immediately,” he said.

Most centralized exchanges use KYC procedures to comply with regulatory requirements aimed at preventing illicit activities such as money laundering and terrorist financing. Users must provide identity information, submit supporting documentation, and await verification to fund their accounts and begin trading on the platform.

As a result, these platforms are subject to extensive oversight. This may involve stringent licensing requirements and compliance regulations imposed by authorities, which can potentially limit CEXs’ ability to support certain tokens or serve users in specific jurisdictions.

The Fall of FTX

Due to their centralized nature, several prominent CEXs, including FTX, Mt. Gox, and WazirX, have experienced significant security breaches, resulting in substantial financial losses for their users.

One of the most notorious cases is FTX, a prominent cryptocurrency exchange that ranked third globally by trading volume in 2022. FTX went bankrupt in November of that year amid allegations that its owners had embezzled and misused customer funds.

At the time, reports emerged that Alameda Research, an affiliated trading firm, derived a significant portion of its value from speculative cryptocurrency investments. This prompted concerns among FTX customers, who later withdrew their funds from the exchange en masse, sending FTX straight into bankruptcy.

A Cautionary Tale

The subsequent collapse of FTX had a significant impact on the cryptocurrency market and resulted in a 25-year prison sentence for then-CEO Sam Bankman-Fried.

“These cases serve as reminders of the importance of proactive regulatory compliance and sound risk management. Exchanges must ensure their leadership adheres to ethical practices,with robust internal controls to prevent systemic failures,” said Lee of Gate.io.

FTX’s sudden dissolution also raised concerns about the stability and resilience of the broader cryptocurrency ecosystem, shaking investor confidence. Lee added that central exchanges should use FTX as a reference point for measures to avoid users’ financial losses.

“The high-profile incidents at platforms like FTX and WazirX have taught the industry that transparency and strong governance are essential for the survival of centralized exchanges. These events underscored the importance of maintaining strict separation between user funds and operational funds to prevent misuse and mismanagement. They also highlighted the critical need for regular proof-of-reserves audits and public disclosures to foster user trust and accountability,” he said.

Situations like these raise questions about the centralized nature of an exchange’s operations. Experienced traders tend to adopt decentralized exchanges to have full control over their crypto wallet keys.

DEXs and Liquidity Issues

One significant disadvantage of DEXs compared to CEXs is lower liquidity. This lower liquidity can result in substantial price slippage, meaning that the actual price at which a trade is executed may deviate considerably from the expected market price.

Because most DEXs have a generally smaller user base and lower trading volumes, it’s sometimes more difficult to find immediate counterparties for trades.

“Liquidity is crucial for any DEX, big or small, as it directly impacts trading efficiency, slippage, and the overall user experience. For smaller DEXs, the lack of liquidity can be particularly challenging, as it limits active traders and available trading pairs,” said PancakeSwaps’ Chef Kids.

Since CEXs have access to a more extensive pool of buyers and sellers, users tend to trade on these exchanges to avoid liquidity issues. Chef Kids says DEXs must address this issue to become more competitive.

“For any DEX, more liquidity benefits the entire DeFi ecosystem by enabling better pricing, attracting more users, and ultimately creating a more vibrant and efficient market. This, in turn, strengthens the DeFi space as a whole, driving innovation and growth,” he said.

Addressing liquidity issues is crucial for DEXs to enhance their competitiveness and contribute effectively to the growth and development of decentralized exchanges.

Onboarding Obstacles for DEXs

DEXs often present a higher level of technical complexity than CEXs. Using a DEX typically requires some familiarity with blockchain technology since it involves using compatible wallets and the proper management of private keys.

This level of knowledge can present barriers for crypto newcomers trading on exchanges for the first time.

“The complexity of self-custodial wallets and bridging still presents a significant barrier for the average user, making mass adoption of DEXs challenging. To reach a broader audience, DEXs must simplify and make the user experience more accessible,” Chef Kids said.

This factor alone makes CEXs more appealing to junior traders.

“CEXs will remain a crucial part of the crypto ecosystem, especially when driving broader adoption. For many newcomers, centralized exchanges offer the most straightforward entry point, intuitive interfaces, fiat on-ramps, and easy onboarding processes,” he added.

By creating supportive educational resources and adoption-friendly initiatives, DEXs can facilitate adaptability for users interested in switching to decentralized exchanges.

Bridging Centralized and Decentralized Options

Kevin Lee of Gate.io says CEXs can leverage this advantage to fend off competition from increasingly popular DEXs like Hyperliquid, Uniswap, and PancakeSwap.

“CEXs can lead in user education and onboarding by simplifying access to blockchain technologies and creating intuitive user experiences. Collaborations with emerging projects and ecosystems help expand the scope of innovation on their platforms,” Lee explained.

Centralized exchanges should also integrate solutions that cater to the needs of investors who prioritize decentralized approaches to trading.

“By integrating hybrid models, such as non-custodial wallets and decentralized trading options, CEXs can provide users with a bridge between centralized convenience and decentralized autonomy. Moreover, offering value-added services like fiat on-ramps, advanced trading tools, staking, and institutional-grade products allows CEXs to cater to a wider range of users,” Lee explained.

As both CEXs and DEXs gain popularity, they are likely to learn from each other to overcome their respective challenges. Addressing these gaps will ensure cryptocurrency exchanges’ sustainable growth and long-term success.

[ad_2]