[ad_1]

Ethereum’s performance has been inconsistent lately, negatively impacting its public perception. Continuous price drops, governance issues, and high gas fees have made the crypto community question whether these are temporary setbacks or signs of deeper problems.

BeInCrypto interviewed industry leaders from Wirex, Komodo Platform, BingX, KelpDAO, and RAAC to analyze the factors contributing to Ethereum’s decline, its current market position, and potential strategies for improvement.

Market Performance and Investor Sentiment

Ethereum’s 2025 is off to a rocky start. After a failed attempt to break through the $2,500 barrier, Ethereum has retreated to $2,090. Meanwhile, whale addresses have been on a selling spree, dumping a massive 640,000 ETH worth $1.5 billion and pushing the altcoin king further from its target.

The recent Bybit hack, which caused the theft of approximately $1.4 billion worth of Ethereum, didn’t help, either. Since then, the network recorded its highest weekly outflows, at $300 million.

Meanwhile, a wave of bearish sentiment and dwindling investor confidence sent ETH spot ETF outflows to a 30-day peak of $94.27 million last week. This surge, the third largest of 2025, followed Ethereum’s price dip to $2,251, signaling a clear investor retreat.

“Compared to Bitcoin, which has surged over 90% this year, Ethereum’s performance feels underwhelming, leading many holders to wonder when it will reclaim a new all-time high,” Vivien Lin, Chief Product Officer at BingX, told BeInCrypto.

Given these circumstances, several factors must be considered to understand Ethereum’s recent decline.

External and Internal Factors Affecting Ethereum

Recent price swings in the crypto sector have prompted speculation about the onset of a bear market. Though the market has experienced a reprieve following President Donald Trump’s announcement of a US Crypto Strategic Reserve, the long-term impact of this recovery remains uncertain.

Other factors have also contributed to the declines in prices across major cryptocurrencies. Trump’s recent tariffs on Canada, Mexico, and China have caused prices to plunge.

Meanwhile, crypto markets are beginning to feel the impact of inflation on the United States’ economy. In turn, traders are increasingly weary that the Federal Reserve will raise interest rates. All of these factors have affected Ethereum’s performance.

“The broader market remains highly sensitive to macroeconomic factors like tariffs, potential interest rate cuts, and geopolitical tensions, all of which have added to ETH’s price uncertainty,” Lin added.

While these factors provide insight into current market fluctuations, they do not fully explain the price performance of individual cryptocurrencies. Karlos Bujas, Graduate Trading Analyst at Wirex, gave a general overview of the struggles Ethereum currently faces:

“Ethereum’s price struggles can be attributed to internal challenges like governance issues, inefficient resource allocation, and waning market dominance. Critics point to the Ethereum Foundation’s large budget and underutilized treasury, which some argue have slowed innovation. Developer dissatisfaction has also played a role, while Ethereum’s lack of political engagement, especially compared to Solana and XRP, has left it at a disadvantage. Leadership divisions have added to the uncertainty, and with Ethereum losing ground in DeFi and maintaining high fees, its price has remained stagnant below $3,500 since January 7, 2025,” he told BeInCrypto.

Exploring each of these internal challenges in greater detail is crucial to truly understanding the root causes of Ethereum’s stagnation.

Ethereum’s DeFi Dominance and Challenges

Ethereum’s success largely hinges on its pioneering leadership in decentralized finance (DeFi), infrastructure, and developer ecosystem. Compared to its competitors, Ethereum is also perceived to be more decentralized.

The network continues to dominate the market in terms of DeFi, with a current total value locked (TVL) surpassing $48 billion. Solana, its runner-up, lags behind with a TVL of over $7 billion.

“58% of DeFi liquidity is on Ethereum and it dominates the market across stablecoin market share, liquid staking, restaking and several other sectors of DeFi. Overall, Ethereum has been the best chain for innovation in DeFi and most successful DeFi protocols are on Ethereum and L2s,” Amitej Gajjala, Co-founder of KelpDAO, told BeInCrypto.

Despite Ethereum’s dominance in DeFi, high gas fees and slow transaction speeds have deterred users from continued interaction with the network.

“Ethereum has been losing ground in DeFi, particularly to Solana, due to its high transaction fees and governance challenges. On-chain activity has dropped by 38%, and key protocols like Uniswap have seen significant declines. Meanwhile, Solana’s lower fees and faster transactions have attracted liquidity, further boosted by Trump’s memecoin launch in January 2025,” Bujas said.

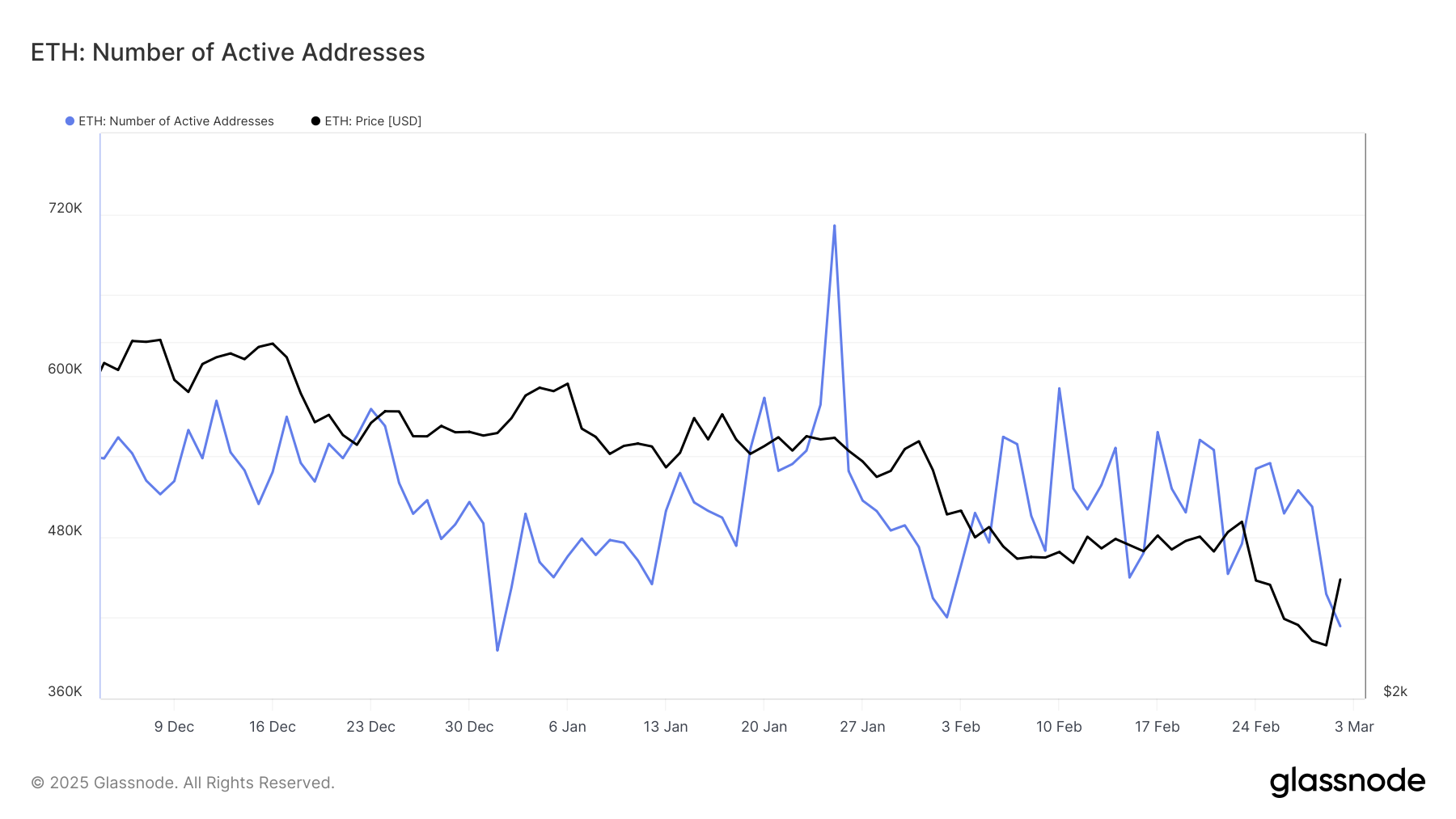

Generally speaking, Ethereum has seen a decline in user activity. According to data from Glassnode, the number of active Ethereum addresses has been particularly volatile over the past few months.

Number of active Ethereum addresses over the past three months. Source: Glassnode.

Ethereum’s most recent peak was on January 25, when the network registered 711,578 active addresses. On March 2, that number dropped to 413,754, representing a 53% decrease.

Scalability Issues and Layer-2 Solutions

Limited transaction capacity within Ethereum’s network architecture creates scalability issues, leading to congestion and high transaction fees. When user demand increases, transaction times slow, and fees rise for those interacting with dApps.

Over the years, Ethereum has introduced several reforms to try to curb the extent of these issues.

“Despite changes to Ethereum’s architecture, including a transition from proof-of-work to proof-of-stake, scaling issues remain, which has led to a crisis of confidence in Ethereum amongst crypto investors,” Kadan Stadelmann, Chief Technology Officer at Komodo Platform, told BeInCrypto.

When these changes proved insufficient, Ethereum also introduced a Layer-2 ecosystem. These protocols offer near-term scalability improvements by handling transaction processing outside the main Ethereum network. However, this solution has been met with criticism.

“The failure to make Ethereum scalable for the myriad dApps and DeFi applications being built upon the network has caused a proliferation of layer two technologies, which have their own tokens, which saps demand from the Ethereum mainnet. For instance, while Polygon is a layer two network, its token has outperformed ETH, making it in effect competition for Ethereum, at the same time it increases Ethereum’s scalability. What’s more, layer two protocols such as Polygon—as well as Optimism and Arbitrum—introduce centralization to a network built on the promise of decentralization,” Stadelmann added.

Over time, these issues have led to increased competition from other networks.

Competition and the Ethereum Foundation’s Response

Ethereum has explored other DeFi remedies to maintain its position, particularly as networks like Solana have started to challenge its DeFi dominance.

“Ethereum is losing ground to competitors—primarily Solana. Solana was built with scalability in mind, allowing massive DeFi projects to be launched on top of the network. Its success in the DeFi sector over Ethereum is evidenced by the fact that President Donald J. Trump launched his digital collectibles on Solana, not Ethereum,” Stadelmann said.

A few days after Trump launched his meme coin on Solana, the Ethereum Foundation transferred 50,000 ETH to a multi-signature wallet to support DeFi protocols.

This action was taken following public scrutiny of the Foundation’s treasury management. Supplying ETH into these protocols generates yield on DeFi deposits, effectively appreciating the treasury’s value without needing to sell assets.

Some members of the community lauded the move.

“This effort by the ETH Foundation to positively influence its reputation in the space and increase the price of Ethereum is an essential step in the right direction. Due to the sheer increase in DeFi competition, everyone is trying to make a product better than the last, so doing this was a good move. I believe this was a successful move as just a few hours after the deployment, Ethereum’s Relative Strength Index (RSI) went from 65 to 72, adding increased purchasing pressure,” Lin told BeInCrypto.

Gajjala agreed, adding:

“It is definitely a very positive move from the Foundation. It signifies trust in the DeFi protocols and also signals trust and credibility among DeFi protocols to the broader market including institutions,” he said.

However, others criticized the Ethereum Foundation for how long it took to make the move.

“It is great this happened but was long overdue. The whole value driver of ETH is DeFi and its financial applications. For whatever reason, this went over the ETH Foundation’s head and they’ve been dumping tokens for covering foundation expenses when the optimal solution would be taking a loan on a protocol like AAVE. To me, the idea of this move was to show support for the ‘niche’ that drives most of ETH’s value. After it had largely overlooked DeFi,it is nice to be acknowledged by the Ethereum Foundation. Although successful, the lateness of this move has, however, left a bad taste in some builders’ mouths,” Kevin Rusher, Founder of real-world asset platform RAAC, told BeInCrypto.

To that point, Bujas contended:

“While the move may have provided temporary liquidity support, it doesn’t fully address deeper concerns like high fees, competition, and governance issues. Its long-term impact will depend on whether it can drive sustained engagement in DeFi. However, without fundamental improvements, this capital injection alone is unlikely to reverse Ethereum’s downward trajectory,” he said.

The episode also illustrated the disagreement over the Ethereum Foundation’s management of the network’s future.

Leadership Changes and Community Reactions

Over the past year, the Ethereum Foundation has faced increased scrutiny over its passivity and concerns among community members about its spending and operational priorities. So, its current efforts aim to strengthen the Foundation’s ties within the Ethereum ecosystem and rebuild trust.

The Ethereum Foundation’s transfer of 35,000 ETH to Kraken, revealed by Lookonchain, sparked community criticism due to a lack of transparency. While the Foundation cited budget needs and regulatory constraints, the community remained divided on how to handle financial decisions.

Several other issues also divided the community over the Foundation’s influence in Ethereum’s ecosystem. Criticisms include the Foundation’s leadership being held accountable for Ether’s relative underperformance compared to other cryptocurrencies. Furthermore, the Ethereum network has experienced a reduction in new developer acquisition, with Solana exceeding Ethereum’s developer growth.

Some within the Ethereum community called for the resignation of then-Executive Director Aya Miyaguchi as they held her responsible for Ethereum’s challenges.

“There has been criticism that Miyaguchi is not handling the challenges with general operations well, leading to some of the team leaving. There have also been efforts to create a more even leadership structure with dual leaders, taking more control away from just one individual. On the contrary, some are happy with her leadership and the Foundation’s roadmap. It is truly difficult to make all players in an ecosystem happy, so there have been leadership shifts and discussions to address these issues for long-term success,” Lin explained.

Though Ethereum Co-founder Vitalik Buterin announced on January 18 that the Ethereum Foundation was undergoing a significant leadership transformation, these changes were only announced last week.

After seven years as Executive Director, Miyaguchi became President on February 25. Shortly after, the Ethereum Foundation formed the Silviculture Society, a 15-member council, to address leadership concerns and uphold core values.

Yesterday, the Foundation appointed Hsiao-Wei Wang and Tomasz Stanczak as co-Executive Directors. Although community opinions on the new leadership remain split, Gajjala stressed that these changes need time to produce effects.

“Change management would take time and I would urge the community to stay patient as some of these take time to implement,” he said.

In anticipation of this new chapter in Ethereum’s leadership, industry experts emphasized priority areas for improvement.

Experts’ Recommendations for Ethereum’s Future

Stadelmann and Bujas agreed that Ethereum needs to improve its scalability to maintain its competitive edge over other networks that provide relief in this area.

“The perceived obstacles to scalability on the Ethereum network have led to a decline in Ethereum’s dominance in the crypto markets. Whereas discussions in the past revolved around a flippening between Ethereum and Bitcoin, whereby Ethereum would overtake Bitcoin’s market share, discussions today revolve around a flippening of Ethereum by Solana. Largely driven by memecoins, Solana has surged against Ethereum in terms of market share in recent years. Solana’s average daily transaction volume has grown far beyond Ethereum’s— a shocking indictment of Ethereum’s growth or lack thereof,” Stadelmann said.

If Ethereum doesn’t resolve these issues now, it will face a snowball effect in the future.

“While Ethereum is likely to benefit from the general growth of the crypto market, its struggles with fees, governance, and innovation may limit its future upside. The ETH/BTC price has been bearish since 2022, with Ethereum lagging behind Bitcoin, signaling challenges in its growth potential. As Ethereum’s competitors improve their networks and capitalize on political opportunities, Ethereum must evolve to maintain its position,” Bujas said.

Meanwhile, other leaders remain bullish, declaring that Ethereum has the resources and resilience to maintain its status as the second-largest cryptocurrency decisively.

“We need look only at the explosion of stablecoins on ETH and World LibertyFi buying ETH en-masse to understand Ethereum’s vital role and undeniable value throughout the crypto ecosystem. For more examples we can look to Blackrock launching stablecoins and partnering with Elixir to utilize Curve Finance as infrastructure. Sure, competitors to Ethereum are going to eat into some of its market share- this is the sign of a healthy, non-monopolistic market– but look at where the bulk of liquidity and serious players lie– it is in ETH on Ethereum. Ethereum is a decentralized, credibly neutral network–something that cannot be said for many chains,” Rusher said.

The network’s sustained success will depend significantly on how the Ethereum Foundation manages its leadership during this period of intense competition in the cryptocurrency sector and whether it is sufficient to retain investor confidence.

[ad_2]