According to a detailed CoinGecko report, sales of Ethereum by the Ethereum Foundation (EF) do not have as big an effect on the token’s price as is generally believed.

“Does Ethereum Foundation’s (EF) sell-offs trigger any significant market movements?” CoinGecko asked in a tweet, where it revealed its latest study that proves that Ethereum Foundation sell-offs of less than 9K ETH have no significant positive correlation on price changes.

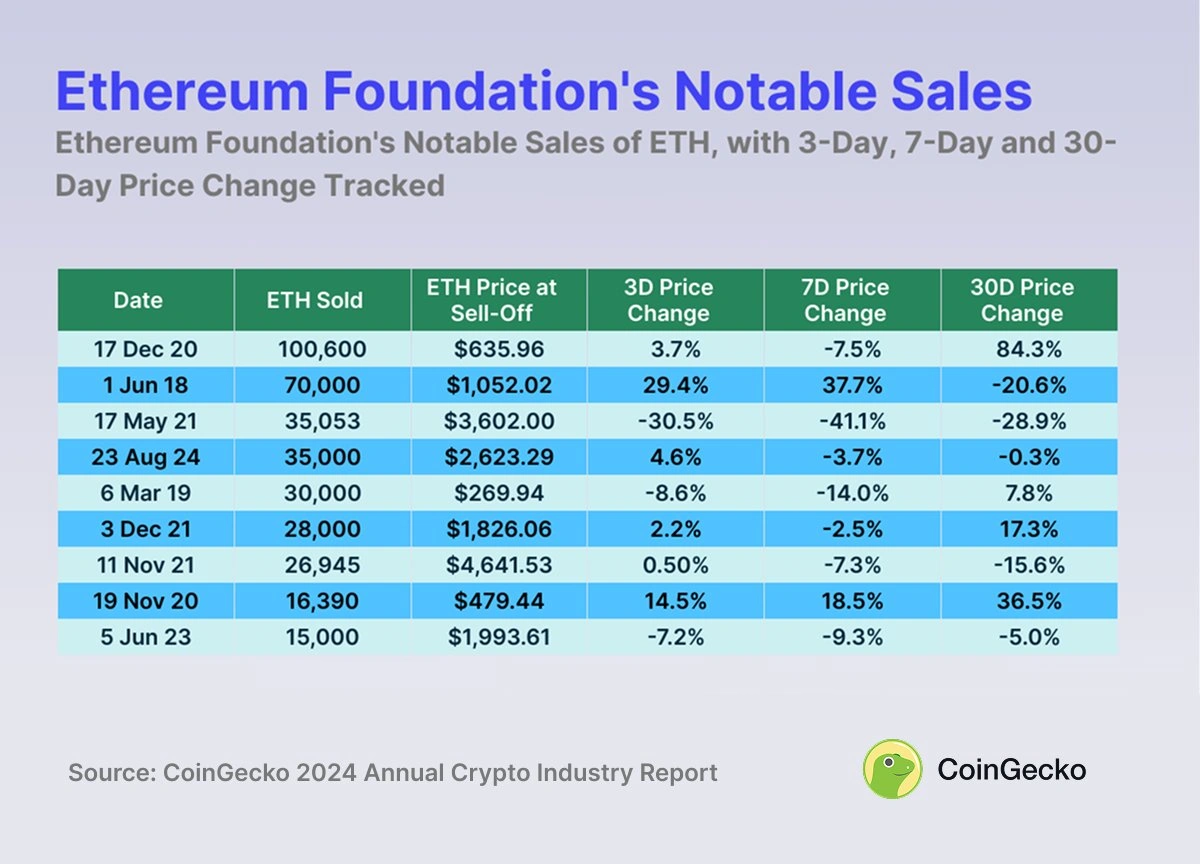

The same can not be said for sales of larger than 15K ETH. For instance, one instance where the foundation sold 70K ETH resulted in a 20.6% dip, while a sale of 16.3K ETH followed a 36.5% rise.

For the research, CoinGecko analyzed EF sell-offs from October 16, 2017, to January 15, 2025, using publicly available on-chain data from Dune, Etherscan and CoinGecko. Note that only ETH transactions above 100 ETH were taken into consideration, and the analysis does not consider any market trends or macroeconomic events.

Ethereum Foundation ETH sales had different effects on price over the 3, 7, and 30-day time frames. Source: CoinGecko

CoinGecko’s findings confirm relationship between EF sales and ETH price action

According to the report, ETH’s average 7-day price change following an EF sell-off is +1.3%. The report does not disprove the claim that large Ethereum Foundation (EF) sell-offs trigger immediate market reactions. However, it argues that these moves aren’t uniformly negative.

The percentage of cases that saw ETH’s price decline within 7 days of an EF sell-off is -47.6%, and it suggests that less than half of EF sell-offs result in an immediate price decline. In fact, CoinGecko claimed that in most cases, EF’s sales activities do not cause Ethereum’s price to take a deep dive.

Since the sell-offs have been happening, the largest single-week drop on record after an EF sale was -41.1%.

Some sell-offs lead to pronounced short-term reactions; for example, the sale that happened on May 17, 2021, led to a price plummet of -41.1% within a week.

CoinGecko claims such a level of decline is not universal, as other large transactions sometimes coincide with price increases instead. Also, in spite of the huge sell-offs, ETH’s price witnessed a pump in 164 cases, while it declined in 149 cases.

The mixed outcome is proof that the EF’s spending is not a sure ticket to bloody ETH charts.

Over the 30-day range, the average ETH price change post-Ethereum Foundation sell-off is +8.9%.

Ethereum Foundation spending affects ETH price differently across various timeframes

To further explore the relationship between EF’s spending and ETH price action, CoinGecko analyzed rolling correlations over three timeframes: 3-day, 7-day, and 30-day.

Notable Ethereum Foundation sales. Source: CoinGecko

The data revealed that the 3-day rolling correlation fluctuates widely, ranging from -0.999 to +0.999. This demonstrates extreme volatility, suggesting that short-term price movements may not be strongly influenced by EF’s spending but rather by broader market conditions.

One case that confirms this happened on Nov 19, 2020, when the rolling correlation reached 0.9998 after the EF sold 16,390 ETH, and ETH’s price rose from $479 to $560 in four days.

Of course, there have also been cases where the EF sold and ETH suffered a price drop in the following three days.

However, both cases prove that short-term correlations are highly susceptible to market sentiment and liquidity rather than what the Ethereum Foundation is doing with its ETH reserves.

Unlike the 3-day correlation, the 7-day rolling correlation exhibits less volatility, with values generally fluctuating between -0.7 and +0.7. This indicates a more stable yet inconsistent relationship between EF spending and ETH price over a weekly timeframe.

The 30-day rolling correlation provides insights into broader market trends. For instance, it shows that between 2018 and 2020, the correlation was predominantly positive, often exceeding 0.3.

This implies that EF’s funding activities may be linked to market confidence and growth during early ecosystem expansion phases, particularly in bear markets.

However, since 2021, the correlation has gradually trended towards neutral or negative values, a shift that reflects Ethereum’s market maturation and the influence of larger macroeconomic forces.

As far as sales distribution is concerned, there is no significant positive correlation between ETH price changes and sales of less than 9K ETH. However, when larger amounts of ETH are sold, a stronger positive correlation reportedly emerges in most cases.

CoinGecko analysis also revealed that the 30-day rolling correlation between EF spending and ETH price is mostly concentrated between -0.3 and 0.5, indicating a weak to moderate relationship.

The 7-day rolling correlation follows a similar distribution but shows more fluctuations, while the 3-day rolling correlation is more extreme, with high concentrations, highlighting sharp but inconsistent short-term reactions to EF sales.

All these findings confirm that even though Ethereum Foundation sell-offs often impact price movement in the short-term time frame, longer-term correlations are weak and inconsistent.