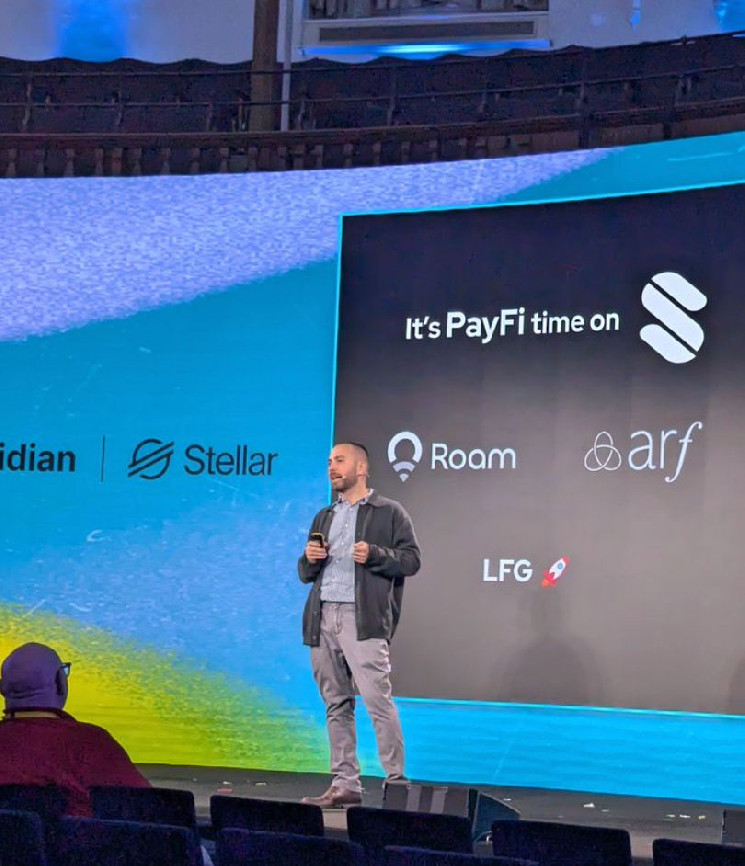

San Francisco, CA — Huma Finance, the first Payment Financing (PayFi) network that recently surpassed $2 billion in transactions, has officially launched its protocol on the Solana blockchain. This expansion marks a major milestone in Huma’s mission to provide powerful, on-demand liquidity solutions, revolutionizing payment financing for global businesses. (Cover photo: Huma Co-Founder Erbil Karaman)

—

With Solana’s high-speed, low-cost infrastructure, Huma is poised to scale its PayFi network and meet the rising demand for affordable, accessible, and secure on-chain payment financing. The addition of Solana, one of the fastest-growing blockchains in the world, is a strategic move to offer instant liquidity for decentralized applications and businesses across the globe.

A Major Milestone for the PayFi Ecosystem

Huma’s PayFi network is designed to address the significant gap in traditional payment financing systems. Currently, trillions of dollars are transacted annually through credit card merchant payments, trade finance, and remittances. However, these systems struggle to keep up with demand, hindered by high fees, slow processing times, and the need for pre-funded accounts.

By expanding its PayFi network to Solana, Huma aims to leverage the blockchain’s high throughput, low transaction costs, and rapid finality times to deliver the infrastructure businesses need to thrive.

“There has been an explosion in the popularity of crypto-based payment solutions,” said Huma Co-Founder Erbil Karaman. “From remittance companies to global trade networks, and even state governments, the demand for crypto payments has surged. However, most of these solutions lack the payment financing options available in traditional finance.”

“By expanding its PayFi network to Solana, Huma is able to leverage the chain’s exceptional speed and broad adoption to deliver the crucial infrastructure needed to support the exponential growth we are experiencing.”

Erbil Karaman, Co-founder of Huma

This announcement comes at a time when Solana is gaining traction in the global payments space, with notable partnerships from companies like Stripe, Shopify, and PayPal. PayPal’s PYUSD has already seen rapid growth, with 88% of its market cap—now over $1 billion—generated on Solana, further highlighting the blockchain’s efficiency and scalability for payment solutions.

Scaling PayFi for Global Impact

Huma’s platform, bolstered by its recent merger with Arf, a leader in on-demand liquidity for cross-border payments, has processed over $2 billion in transactions in 2024. This success has positioned Huma to surpass $10 billion in transaction volume by next year. The platform also plans to roll out DePIN financing use cases to accelerate the build-out of decentralized infrastructures—a sector where Solana’s ecosystem excels.

“PayFi is one of the most important movements in crypto due to its massive impact on businesses worldwide. To support the growth of the PayFi ecosystem, it’s critical to scale the Huma network. Solana’s toolkit for global payment and financing solutions is second to none.”

Erbil Karaman, Co-founder of Huma

To mark the launch, Huma and Arf are offering a limited-time campaign for accredited investors, providing double-digit stablecoin yields derived from cross-border payment financing solutions. This initiative underscores PayFi’s ability to disrupt traditional finance and accelerate Huma’s mission of bringing fast, accessible, and cost-effective payment financing to a global scale.

—

About Huma

Huma Finance is the first-ever PayFi network, designed to provide instant access to liquidity for global payments anywhere, anytime. For more information about Huma and the PayFi network, visit huma.finance.