The U.S.-based Bitcoin and Lightning mobile wallet Zeus recently announced an alpha-release integration of Cashu. The move marks the first integration of ecash into a popular Bitcoin wallet, breaking new ground for potential user adoption to Bitcoin.

Cashu is a hot new implementation of Chaumian ecash, a form of digital cash invented by David Chaum in the ’90s that has incredible privacy and scalability properties, with the trade-off of being fundamentally centralized, requiring a significant amount of trust in the issuer.

In a counterintuitive move for Zeus, known as the go-to tool for advanced Lightning users seeking to connect to their home nodes, the integration of Cashu acknowledges a “last mile” challenge Lightning wallets face when delivering Bitcoin to the masses.

“We basically started off as the cypherpunk wallet, right? You got to set up your own Lightning node and connect to it with Zeus. The last two years, we put the node in the phone with one click, you can run it all in a standalone app without a remote node,” Evan Kaloudis, founder and CEO of Zeus, told Bitcoin Magazine.

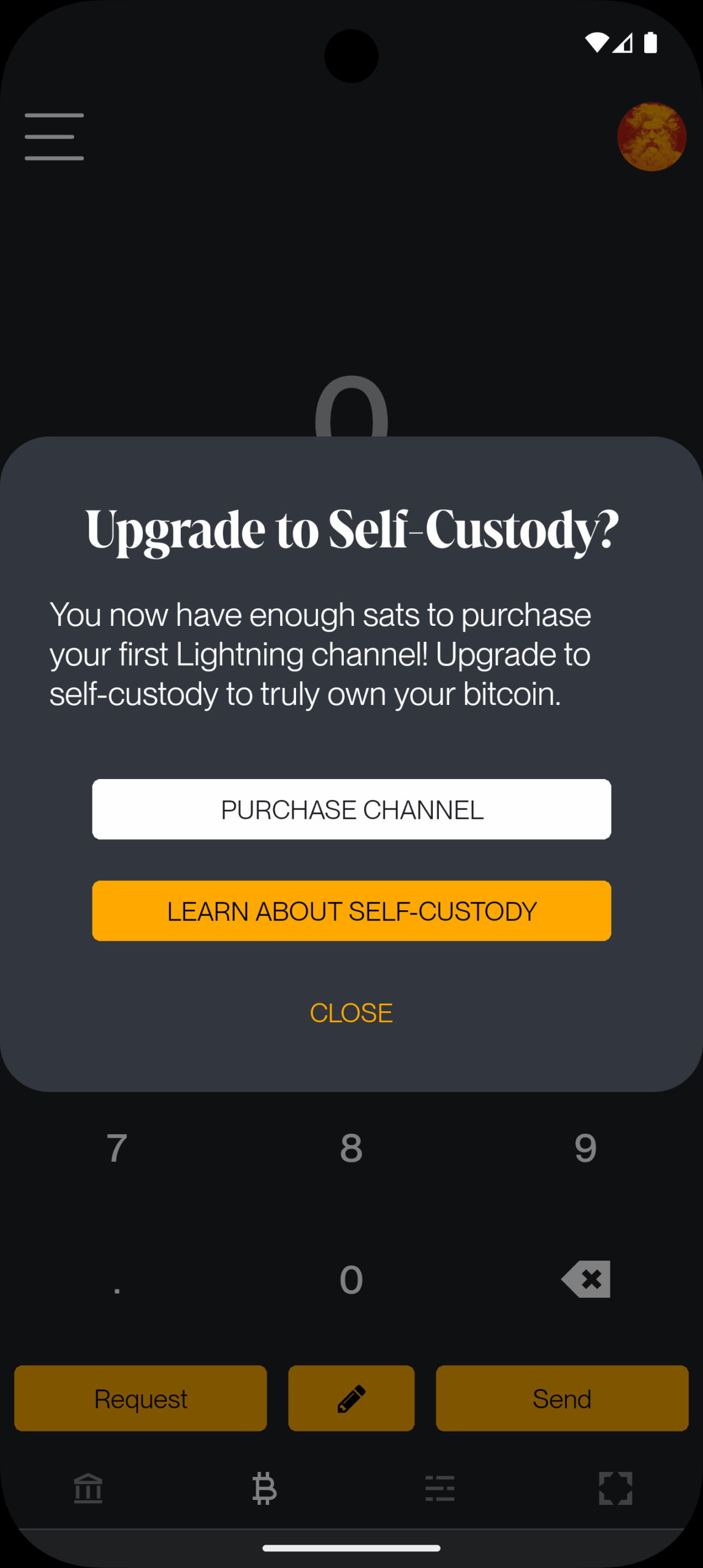

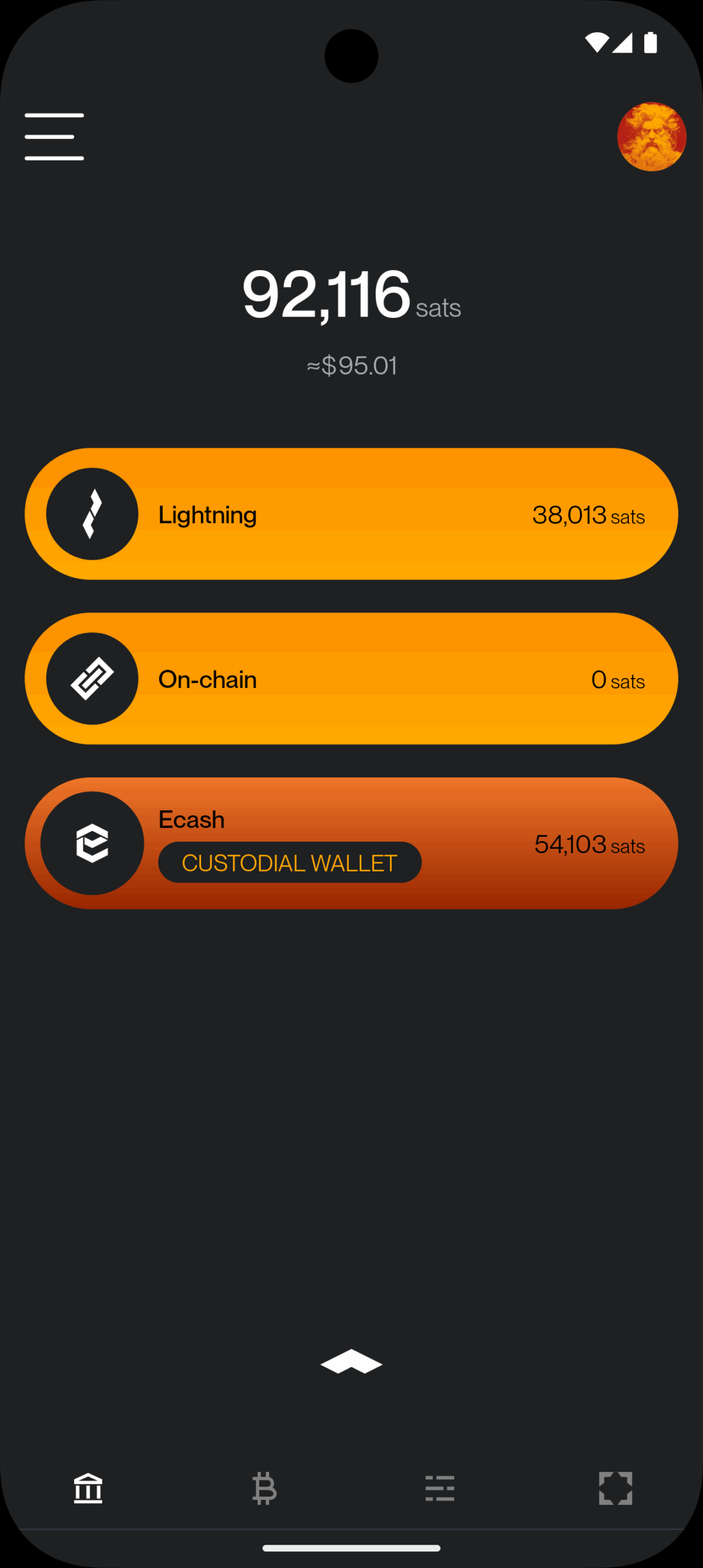

“Cashu addresses uneconomical self-custody for small bitcoin amounts. On-chain, the dust limit is 546 satoshis, and Layer two systems like Lightning have costs for channel setup or unilateral exits that aren’t widely discussed,” Evan explained, highlighting a major point of friction in noncustodial Lightning wallets: the need for liquidity and channel management. While these esoteric aspects of the Lightning Network have been mostly abstracted away since its invention in 2016, these fundamental trade-offs continue to manifest even in the most sophisticated and user-friendly wallets.

In the case of both Phoenix and Zeus Wallet, two of the most popular noncustodial options in the market, users must pay up to 10,000 sats upfront to gain spending capacity. These fees are necessary to cover the on-chain fees spent to open a channel for the user against the wallet’s liquidity service provider, unlocking a noncustodial experience.

The required up-front fee is difficult to explain and represents a painful onboarding experience for new users who are used to fiat apps giving them money to join instead. The result is the proliferation of custodial Lightning wallets like Wallet of Satoshi (WOS), which gained massive adoption early on by leveraging the global, near-instant settlement power of Bitcoin combined with the excellent user experience centralized wallets can create. Major developments have been made over seven years after the Lightning Network’s inception, however, and Zeus Wallet is pushing the boundaries.

“With Ecash, we make it so easy that anyone can set up a wallet and start participating in our ecosystem, which I really think is going to become more and more prevalent,” Evan explained.

Today, at roughly $100,000 per bitcoin, 1,000 satoshis are equivalent to $1, transactions of these sizes are known as microtransactions — a popular example are Nostr social media tips known as zaps. But finding the right tool for this use case is not simple. Self custodied wallets like Phoenix charge transaction fees in the hundreds of satoshis, even with open channels, and on-chain fees often cost the same and are slower to settle. As a result, there’s an entire category of spending that is only served by cheaper alternatives such as custodial lightning wallets like WOS or Blink, but result in significant privacy tradeoffs, often requiring phone numbers from users and in some cases more advanced KYC and IP tracking. Cashu hopes to serve this market with lower privacy costs, the same ease of use, speed and competitive fees.

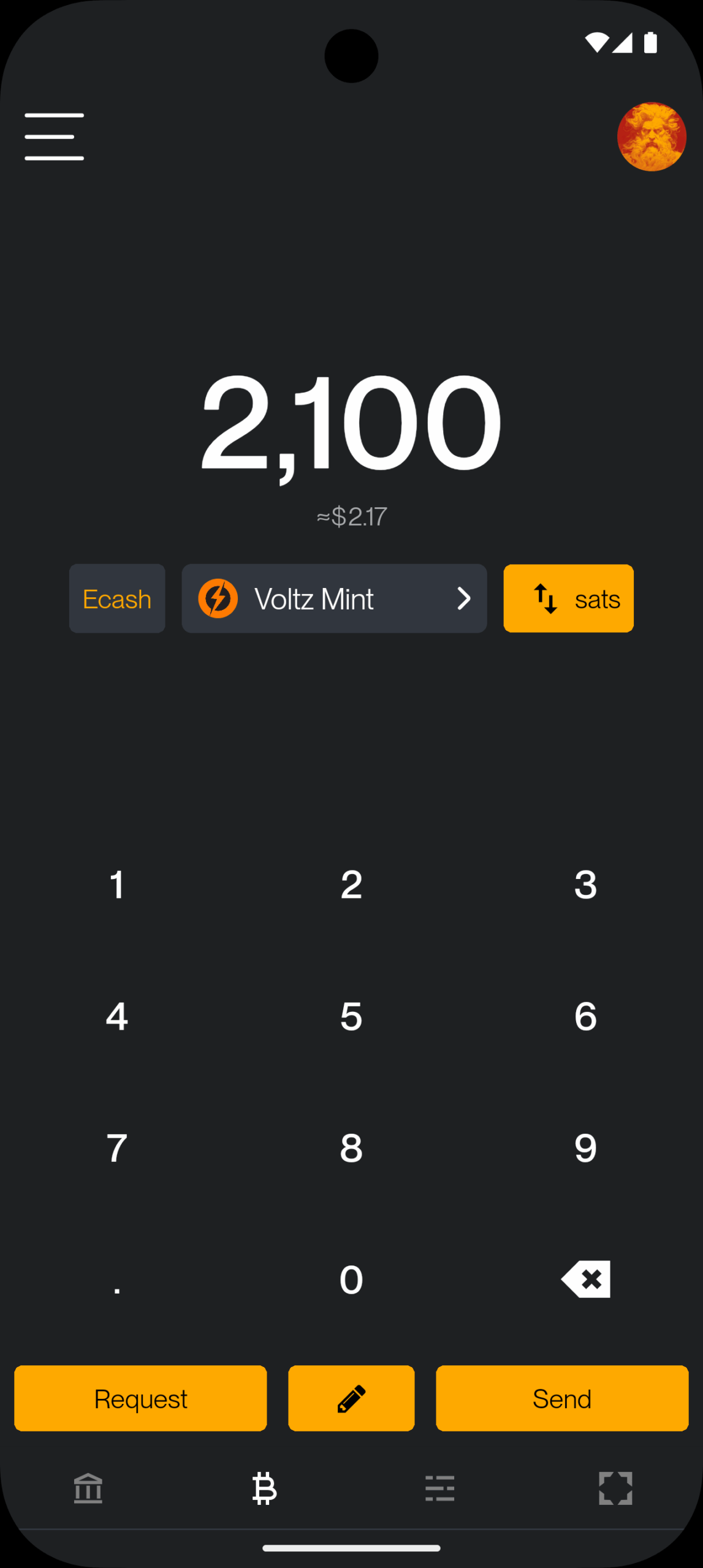

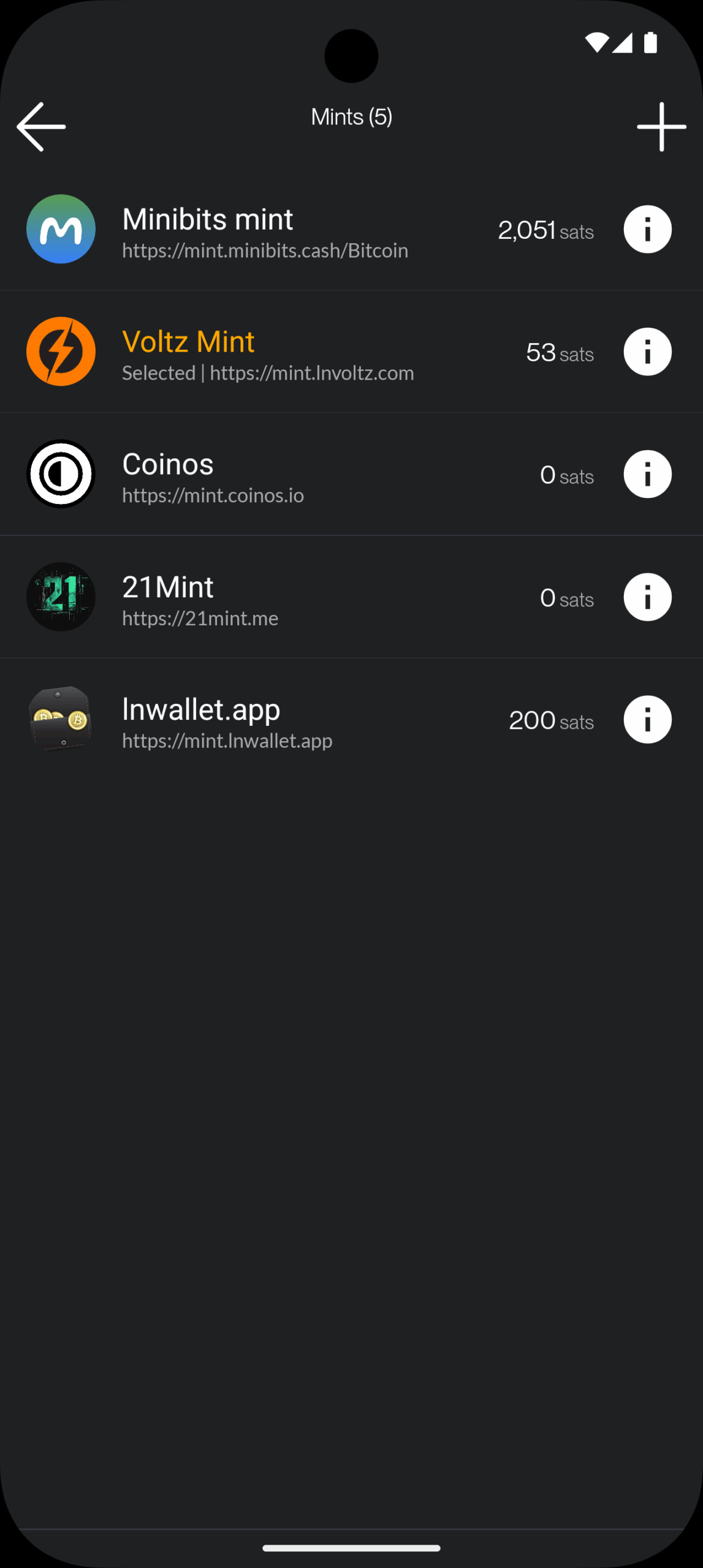

Digging deeper into the Cashu integration, Evan explained that “For users this means being able to pick and switch between custodians in a single app. For developers this means being able to defer custodial responsibilities to third parties and not have to wire up a new integration when your current custodian halts operations.”

Zaps are satoshi-denominated rewards delivered as “likes” or micro-tips for content in the Nostr social media ecosystem. A zap can be as small as one satoshi, the smallest amount of bitcoin that can be technically transferred, equivalent today to about a tenth of a penny. “But I think if we look at Nostr and you’re seeing how many people are zapping and how big a part of that ecosystem it is. It’s like, people are willing to do it,” Evan explained.

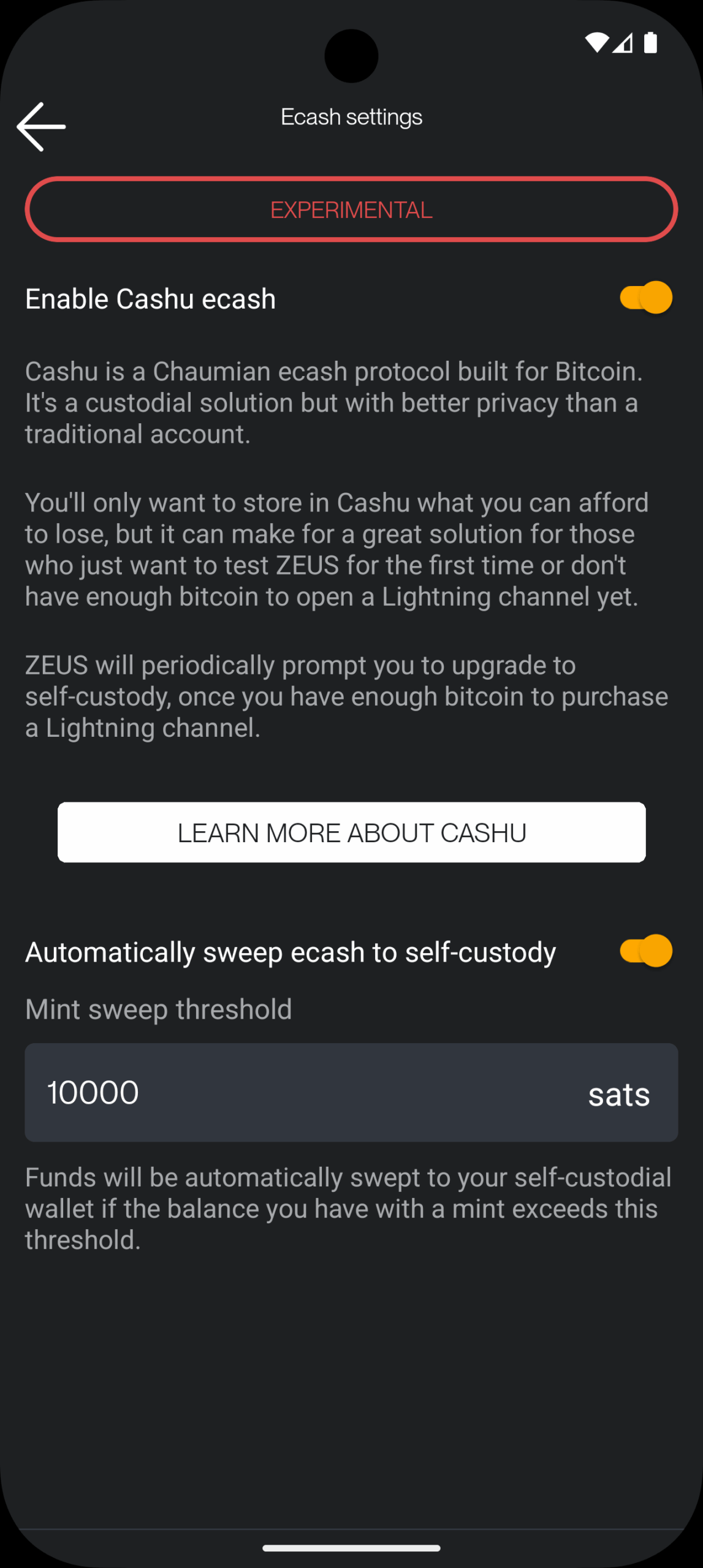

“Cashu, while custodial, lets users accumulate small amounts — say, via Nostr zaps — without needing 6,000 satoshis to open a Lightning channel. ZEUS prompts users to upgrade to self-custody as their balance grows,” he concluded, explaining that the wallet will effectively annoy users into self custody, one of several design choices made to mitigate the risks introduced by Cashu.

The trade-offs introduced by Cashu challenge the common understanding of custody as an either-or in Bitcoin. Historically you were either a centralized — custodial — exchange, or you were a noncustodial Bitcoin wallet. In the former, you entrust the coins to a third party; in the latter you take personal responsibility for those coins and their corresponding private keys. Cashu changes this paradigm by introducing bitcoin-denominated ecash notes or “nuts,” which are bearer instruments that should be backed by a full bitcoin reserve and Lightning interoperability for instant withdraw.

Similar to fiat cash, you must take control and responsibility over these notes, but there’s also counterparty risk. In the case of Cashu, there are certain things the issuing mint can theoretically do to exploit their users — akin to how a bank can run on a fractional reserve.

The big difference between Cashu or custodial Bitcoin exchanges and fiat currency is that Cashu is open source, is designed around user privacy, and scales very well. It makes the cost of running a mint lower than either alternative, a feature that makes mint competition easier, in theory countering the centralizing network effects of specific mints.

Finally, the user experience of storing Cashu tokens has been attached to known forms of Bitcoin self custody such as the download of 12-words seeds via various mechanisms, though implementations still vary from wallet to wallet and the whole ecosystem is in its early stages.

To further mitigate the custodial risk of Chaumian-style ecash in Bitcoin, the Cashu community has developed various methods for automatically managing custody risk.

“Users can split risk by using multiple mints, switching between them in the user interface. Soon, ZEUS will guide users to select five or six reputable mints, automatically balancing funds to minimize exposure,” Evan explained, referring to a particular approach called automated bank runs. The idea is that as some Cashu mints may hold more of your funds, Zeus de-ranks them and rotates value out to minimize risk.

“I think the idea is going to be that we guide users to pick five or six reputable mints… And from there, users will be able to have the wallet automatically switch between those mints and determine which mint should be receiving the balance depending on the balance of all the mints presently. So you’ll be like, OK. MiniBits has way too much money. Let’s switch the default to one of the mints that doesn’t have a lot. So that way you can sort of mitigate or rather distribute the rug risk there,” Evan explained, adding, “Our Discover Mint feature pulls reviews from bitcoinmints.com, showing vouch counts and user feedback, like mint reliability or longevity,” he explained, describing the reputation layer stacked on top of the various other risk management mechanisms.

There is no known way to use Chaumian-style ecash in an entirely noncustodial way. So as long as the custody risk can be minimized, the scaling and privacy upside becomes remarkable.

One of the opportunities that ecash unlocks is microtransactions, the most popular example of which are Nostr Zaps often in single dollar ranges of value transferred, though it applies to small Lightning transactions as well. This use case triggers an important technical question that predates Bitcoin, do microtransactions actually make economic sense?

There’s a long-standing argument about the user experience friction inherent in microtransactions. The term dates back to 1999, when Nick Szabo, one of the intellectual fathers of Bitcoin, wrote a thesis on “Micropayments and Mental Transaction Costs,” explaining that if a payment is too small, it becomes hard to calculate, and the mental cost of calculating it becomes higher than the value at stake.

In his paper, Szabo recommended that developers focus on minimizing these cognitive costs from a design perspective, as the user interface posed a much more serious challenge to the theorized use case of microtransactions than anything else. Szabo’s thesis has stood as a key explanation for the failure of microtransactions to gain adoption. However, Bitcoiners have been thinking about the problem for a long time, and some believe they might have solved it.

Zeus’s integration of Cashu could mark an important moment in bringing Bitcoin to the mainstream via zaps. Echoing the proliferation of emojis and Facebook’s iconic “like” button, entrepreneurs like Evan and Calle, the founder of Cashu, believe zaps could make bitcoin easy to use. Zaps present a specific opportunity, a new way for the public to acquire and experience bitcoin that doesn’t come from exchanges or brokerages as a legacy-wrapped investment product.

Rather than a $100,000 asset, zaps are internet-tipping technology. It means sending a few satoshis to a friend for posting a funny meme on a Nostr app or producing high-quality content, knowing you could be rewarded directly with bitcoin from those who find it valuable.

Evan believes that with the right interface, it is possible, and Nick Szabo’s warning about microtransactions may have been addressed.

“If it’s as mindless as one click, like pressing the heart button — you press the zap button, it doesn’t require you to fire up your wallet and choose the destination. If it’s just a press away, then I think a lot of that mental burden Szabo talks about gets pushed aside because you don’t have time to think about it. Nostr’s zap feature shows people are willing to send small amounts — like 1,000 satoshis for a good post — if the UX is seamless, with a single click.”

Delivering a Wallet of Satoshi-style user experience via a fully open-source and trust-minimized software stack is no easy feat; in fact, it’s arguably the hard path.

When WOS first launched, it made waves in the Bitcoin world. No 12-word seed download? No account creation page? Just receive and send sats with instant settlement and barely any transaction fees?

The experience was so amazing it is still one of the most popular Bitcoin wallets. But this was only possible at the time due to the centralized, entirely custodial and closed source approach taken by the creators of WOS. They defined the standard and set the bar of user experience, but now open source is catching up.

Zeus Wallet has been walking this fine line between working in public and running a profit-motivated start-up, and so far so good.

“The wallet is fully open-source, verifiable on GitHub, with 50+ external contributors. Open-source builds trust, attracts users to our paid services, and prevents black-box risks,” Evan explained about why open source matters when it comes to Bitcoin software.

While the downsides of open source are self-evident to many developers — others may copy your code and outcompete you, and the code has to be good enough that hackers can’t easily break it — the upsides have now started to snowball.

“We have a few employees right now that are hacking on the Zeus code every day, but we’ve got 50+ external code contributors that have worked on the project,” Evan explained when asked about the upsides of open source, adding that “being open source also allows you to iterate on the wallet and the feature set and that attracts more users too. And meanwhile, we’re able to plug in our paid services like the default options.”

From a business model perspective, they are following the industry path of becoming liquidity providers for the lightning network:

“Revenue comes from our LSP, where users lease channels for two weeks to a year, renewable indefinitely. Our White Glove service supports clients like PubKey with node management,” Evan explained.

However, Zeus’s greatest challenge came during the spring of 2024 with the arrest and prosecution of the Samourai Wallet developers — a shot across the bow that intimidated many Bitcoin entrepreneurs out of the U.S., inducing Zeus’ top competitors, Phoenix Wallet and WOS. Many companies had already hedged their bets by incorporating offshore. Zeus, founded and built in the U.S., was not one of them; they said they would be going down with the ship.

“It was a scary time, with Wallet of Satoshi and Phoenix pulling out, causing panic. I was about to have my first kid and feared the consequences, but folding out of fear felt worse. We wanted to push back and give users confidence that ZEUS wouldn’t abandon them,” Evan recalled. And the courage it took to stay in the U.S. under such hostility paid off. With the top competitors out of the U.S., Bitcoiners looking for noncustodial software and good user interfaces had very few options.

“It was insane — at the time the LSP was just getting started, but at that time, probably 250 to 300% growth in the first six months. So we saw a ton of activity on the LSP,” Evan recalled, “So looking back at it, I wouldn’t change a thing… That was peanuts. We are going to have to make some much more difficult decisions down the road, potentially. And we need to be prepared for when those days happen. So, I think, in a lot of ways, this was just like a trial run and we passed.”

This post How Zeus is Redefining Bitcoin with Cashu Ecash Integration first appeared on Bitcoin Magazine and is written by Juan Galt.