Investors are currently focused on the potential Federal Reserve interest rate cut and how the monetary policy will likely impact the price trajectory of major assets such as Bitcoin (BTC).

Indeed, Bitcoin has recently seen its price drop below the $60,000 mark, driven by concerns regarding the economy’s general health. The rate cuts are viewed as a potential course-altering move, especially amid recessionary fears.

Regarding how Bitcoin will likely react, cryptocurrency trading expert Trading Shot outlined possible scenarios for the maiden digital asset in a TradingView post on September 11. The expert focused on the correlation between the Global Liquidity Index (GLI) and Bitcoin’s price trajectory.

A representation of the GLI highlighted the projection, tracking major central banks, including the Federal Reserve, European Central Bank, People’s Bank of China, Bank of Japan, and Bank of England.

According to the analysis, when central banks cut interest rates, they inject more money into the economy, devaluing the current currency. This leads to increased access to loans for corporations and individuals, boosting their spending, buying, and investing capacities. Historically, riskier assets such as cryptocurrencies tend to rise in value when liquidity increases.

Bitcoin’s past breakouts in relation to GLI

The expert also drew attention to significant breakouts in the GLI that have historically led to Bitcoin rallies. For example, when liquidity previously dropped and flattened, it created a period of resistance. Once this resistance was broken, Bitcoin entered a bullish rally around 2016 and again in 2020.

Additionally, it marked the beginning of Bitcoin’s bear cycles whenever liquidity dropped and flattened. These drops typically created resistance zones that needed to be broken for Bitcoin to rally again. This pattern was observed in 2018 and 2022, which correlated with Bitcoin’s downturns.

Chart patterns show that the GLI is forming a wedge pattern with lower highs as resistance. The GLI is now precisely on this trendline. A breakout above could mirror previous cycles’ resistance breakouts, potentially initiating a parabolic rally for Bitcoin, similar to previous bull runs.

Bitcoin’s key price levels to watch

Therefore, the first target was $68,000, which could serve as a psychological barrier and a point of resistance where some investors may choose to take profits.

Another target is a new all-time high of $150,000. Additionally, if the chart pattern meets previous expectations, a long-term scenario of hitting $350,000 is possible. This target would likely require a sustained and significant increase in global liquidity, accompanied by continued favorable market conditions for cryptocurrencies.

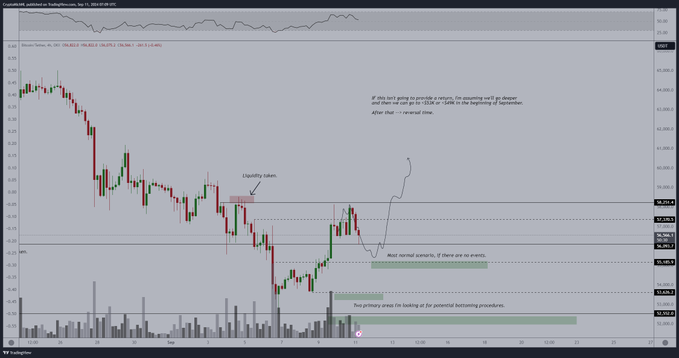

Overall, Bitcoin continues to be influenced by macroeconomic elements. With a focus on the interest rate cut, attention is on how the cryptocurrency will likely react to the the Consumer Price Index. In this regard, crypto trading expert Michaël van de Poppe noted on September 11 that investors should anticipate possible momentum after the data, provided Bitcoin holds between $55,000 and $56,000.

It’s worth noting that U.S. inflation slowed to 2.5% in August, showing signs of cooling but remaining stubbornly above the desired rate of 2%.

Bitcoin price analysis

By press time, Bitcoin was trading at $56,662, having corrected slightly by 0.4% in the last 24 hours. On the weekly chart, BTC is up almost 1%.

In summary, if Bitcoin were to mount a parabolic rally in the wake of the rate cuts, it needs to push past the current resistance and reclaim the $60,000 level, which is viewed as a base for new gains.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.