[ad_1]

Cryptocurrency staking is a process where users are able to temporarily lock their tokens in exchange for a reward, most commonly in the form of interest.

Unlike blockchains, which are based on the Proof of Work (PoW) consensus algorithm, like Bitcoin, Polkadot makes use of an algorithm called Nominated Proof of Stake (NPoS).

NPoS comes with many intricacies centered around the interoperability of Polkadot’s parachains, which are essentially connected and secured by the main network, also known as the Relay Chain. Beyond its many features, NPoS also enables staking.

The following guide provides an in-depth explanation of how Polkadot staking works, the different types of DOT staking, their advantages and disadvantages, and potential risks, as well as a step-by-step guide on how to stake Polkadot immediately.

If you want to find more in-depth information, you can also check out our Polkadot guide.

Quick Navigation:

- Understanding Polkadot staking

- How to stake Polkadot

- Requirements for staking DOT

- Polkadot staking rewards and payouts

- Risks and considerations

- Frequently Asked Questions (FAQ)

Understanding Polkadot Staking

While simple, Polkadot staking is also a fairly technical process, especially when it comes to native DOT staking. Therefore, it’s essential to be well-educated on the fundamental principles that allow you to navigate staking systems without any challenges.

Let’s make sure you get the fundamentals down before proceeding with information on how to stake Polkadot based on your personal preference and level of understanding.

How does Polkadot staking work?

DOT staking is made possible through the network’s consensus algorithm – Nominated Proof of Stake.

In essence, the protocol relies on validators to verify transactions and secure the network. These validators are selected by nominators, and both of them receive a share of DOT in return for their work.

That said, regular users can stake their DOT in multiple ways, which include:

- Native Staking

- Third-Party Decentralized Protocols

- Centralized Exchanges

Each of these has several intricacies, and we will break down each in depth in the guide.

Benefits of staking Polkadot (DOT)

The benefits of staking Polkadot (DOT) stem from both economic, as well as protocol-level incentives.

- DOT holders can earn passive rewards for supporting validators. The reward will be dependent on the validators of choice, as well as how much DOT is staked in the system.

- The barrier to entry can be very low, depending on the choice of staking.

- Native Polkadot (DOT) staking is transparent and non-custodial.

- A lot of major centralized exchanges support DOT staking – users have a plethora of options.

It’s also worth noting that staking Polkadot comes with a certain number of risks and considerations, so make sure to read until the end to find out about them, too.

How to Stake Polkadot

As mentioned above, users can choose three avenues to stake their DOT, depending on their preferences. Let’s explore all three.

Native DOT Staking

Native DOT staking refers to the process of using your DOT natively within the network without having to turn to outside protocols or exchanges. Everything starts and ends on the Polkadot network.

Here, you are once again faced with a choice, depending on the number of tokens you hold, how many you want to stake, and your level of technical expertise.

You will need a Polkadot-compatible wallet. Here is an official guide with some recommended wallets.

Joining a Nomination Pool

This is appropriate for beginners.

It won’t require you to manage your nomination in any way. You will simply have to join a pool of other DOT holders. The most important thing to consider here is that there is a pool operator, and they will be responsible for making the nomination. In essence, you, as a DOT holder who’s joined a pool, won’t have to do anything—but this also means that you’re indirectly responsible for the choice made by the operator.

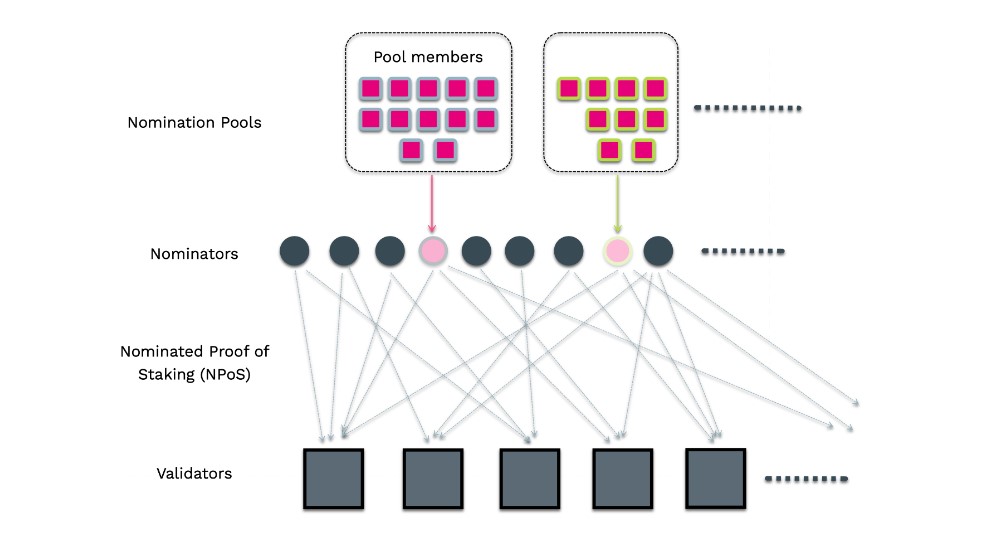

This is a visual representation of the process flow:

You only need 1 DOT to become a member of a nomination pool. You can also claim your rewards manually or bond them in the pool to compound. The unbonding period is 28 days.

To join a pool, follow the steps:

- Navigate to the Polkadot (DOT) staking dashboard.

- In the top left corner, you will see the “Pools” tab. Click on it.

- After that, you will see which nomination pools are available.

- Find the one that you want to join and click on “Join.”

- You will now be able to enter the amount you want to bond.

- Sign the extrinsic.

Opening a Nomination Pool

This is suited for intermediate users.

Operators of nomination pools (as mentioned above) are able to select validators. Therefore, if you’re confident in your ability to select trustworthy validators, you can open your own nomination pool and enable others to join by pooling their DOT.

As of writing these lines, you will need a minimum of 500 DOT to bond to create a nomination pool. This will be deposited in the pool’s account.

To open a nomination pool, follow the steps:

- Navigate to the Polkadot (DOT) staking dashboard.

- In the top left corner, you will see the “Pools” tab. Click on it.

- Find the “Create” button and click on it.

- Give your pool a name and continue.

- Choose up to 16 nominations. There is a built-in feature that allows you to choose certain validators automatically based on preset criteria.

- You can now edit roles such as Root, Nominator, and Bouncer.

- Choose the amount for the initial deposit. It has to be at least 500 DOT.

- Review all of the above, and if everything is correct, confirm it with the “Create pool” button.

Nominating Directly

This option is also suitable for intermediate users.

The process of nominating represents the action of choosing validators directly. It’s different from simply bonding tokens (participating in a nomination pool). It’s an active task and as such, it implies that you are actively participating in the ecosystem and monitoring that your staking is backing an active validator.

Typically, the minimum amount of DOT necessary for nominating is 250 DOT, but this fluctuates. At the time of this writing in April 2024, it’s 550.290 DOT.

As mentioned above, this process is more suited for intermediate users, who can find more information on nominating here.

That said, some of the key features include:

- You can send rewards to any account or compound them.

- The unbonding period is 28 days, but you can switch validators without unbonding.

- Bonded funds remain in your account and you can participate in governance with them.

- You manage the list of validators (up to 16) directly.

Running a Validator

This option is suitable for advanced users.

Validating is a task dedicated to those who possess sufficient technical knowledge and want to participate directly in securing the network and block production.

First and foremost, you have to be selected by nominators.

Second, you need to fit a number of important criteria that can be found here. In general, running your own validator node will require a lot of effort, as well as community trust.

Third-Party Decentralized Protocols

This is also referred to as Polkadot liquid staking, as you would generally receive a token that represents DOT. You can then use that synthetic token within certain ecosystems to carry out various activities.

Here are some of the key features of third-party staking:

- Generally able to stake any mount for a certain fee

- Unbonding is very flexibly

- You can tap into liquid markets through a third-party synthetic token

- Various protocols offer various benefits

However, it also comes with some additional risks.

- You would have to make some trust assumptions. Albeit medium, you’re still trusting a third-party to perform and remain operational.

- It may have an impact on network decentralization.

- Requires additional research.

Some of the more popular options for DOT liquid staking include Ankr, Acala, and others.

Centralized Exchanges

Many cryptocurrency exchanges also allow their users to stake their DOT on the platform. This tends to be the option with the highest trust assumption because these platforms can freely censor and block addresses or wallets.

Some of the options here include US heavyweights like Coinbase and Kraken, as well as the world’s leading exchange – Binance.

Requirements for Staking DOT

As mentioned above, the requirements for staking DOT would depend on the system you choose. Let’s try to break them down.

For Native DOT Staking:

- 1 DOT to join a nomination pool

- 500 DOT to create a nomination pool

- 550 DOT to nominate directly

For staking using a third-party application or a centralized exchange, these requirements will vary based on your choice.

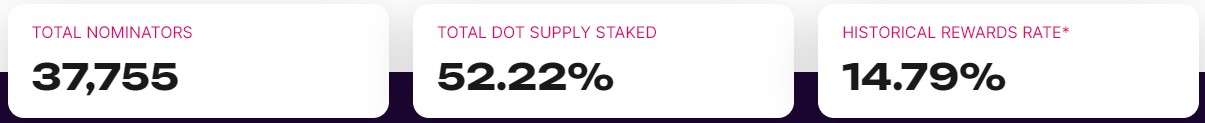

H2 Polkadot Staking Rewards and Payouts

Staking rewards vary depending on your system of choice, and the way they are calculated is also different.

H3-4 How are rewards calculated

For native DOT staking:

- The rewards are calculated every single era. This happens once every six hours on Kusama and once every 24 hours on Polkadot (approximation).

- The rewards are also calculated based on era points. These have a probabilistic component.

For third-party DOT staking:

- Rewards are determined by the third-party staking provider

For DOT staking on centralized exchanges:

- Rewards are determined and calculated by the exchange of choice.

Risks and Considerations

As with everything, DOT staking also comes with certain risks and considerations to account for. These can be attributed to the specific staking system that you use, so let’s break them down for all three.

Risks associated with staking (slashing and potential penalties)

Risks associated with native DOT staking

First things first, there is a protocol-level risk when it comes to native staking. Polkadot is an established network with a long history when it comes to security, but as with literally any other blockchain protocol, there’s a non-zero chance of failure.

Second and more importantly, there’s the risk of slashing.

Slashing refers to a mechanism that Polkadot and Kusama use to deter malicious behavior and penalize validators who act against the established interests of the network and their nominators.

Validators who engage in malicious activities might lose a portion of their staked tokens. Thereby, and by extension, those who participate in a nomination pool or nominate directly also run the risk that the validator they have chosen might get slashed.

Risks associated with third-party DOT staking

When it comes to using a third-party decentralized protocol for liquid DOT staking, the protocol-level risk is generally higher compared to native options.

The degree of risk will vary based on the platform of choice, but usually – the higher the APY is, the higher the risk.

Risks associated with DOT staking through centralized exchanges

As we mentioned before, the trust assumption is the highest when it comes to staking your DOT on a centralized exchange because it’s a company that runs it.

This company has absolute control over what happens on the platform, and it can freeze and censor your account more or less at will.

Unbonding period and market volatility

Unbonding your tokens takes 28 days if you nominate or participate in a nomination pool. This is a long period to wait, especially in turbulent market conditions.

This is why Polkadot staking is generally recommended for those who have a long-term vision for their holdings and do not intend to dispose of them during the first market correction.

Frequently Asked Questions

How to unstake DOT?

You can unstake DOT directly from the Polkadot staking dashboard and trigger the unbonding period. If you are using a third-party decentralized protocol, you can unstake it through its interface. If you’re using a centralized exchange, you can unstake DOT directly on the platform. Make sure you’re not breaking the staking terms because you might forfeit the staking rewards.

Can you stake dot on Coinbase?

Yes, Coinbase allows users to stake DOT and earn APY based on the number of tokens they stake and the selected period.

Can I stake Polkadot in the USA?

Yes, both Coinbase and Kraken – the largest and most popular US-based cryptocurrency exchanges – allow their users to stake DOT. The conditions for both exchanges are different, so make sure to read in advance and make your choice based on your preferences.

Is there a Polkadot stake calculator?

There are multiple third-party services that provide estimates of the current rewards for Polkadot staking. The best is to refer to the Polkadot staking dashboard and get information from official sources.

[ad_2]