[ad_1]

In this article, we see how to prepare for the next crypto airdrop of the restaking platform Symbiotic.

The project was launched on June 11 and in just 2 days it has already reached a TVL of approximately 240 million dollars.

The well-known VC company Paradigm is at the forefront among the investors of Symbiotic, which suggests a rich airdrop is coming given the backer’s history on platforms that have previously released a token like DyDx, Blur, Friend.Tech, Optimism, and Uniswap.

Let’s see everything in detail below.

Symbiotic crypto airdrop: how to be eligible?

Symbiotic is a restaking protocol, officially launched on June 11, that will very likely release a crypto airdrop by the end of the summer to all early adopters who from now on will deposit tokens on the platform, contributing to its expansion in the Ethereum ecosystem.

The project has launched an incentive campaign, where by staking LST coins such as wstETH, cbETH, wBETH, rETH, mETH, swETH, sfrxETH, and ETHX, you earn points that will later be converted into airdrops.

After 2 days from its inauguration, the platform has already achieved excellent milestones bringing the TVL of 240 million dollars and reaching the maximum cap of deposits set in this first phase.

To be eligible for the airdrop, the only thing to do is to deposit 1 or more assets among those indicated and wait a few months, until the Symbiotic team reveals new details regarding their native token.

Essendo però già state riempite le cap massime delle pool di Symbiotic, non possiamo operare direttamente su di esso (fino a che non verrà aperto lo stake senza limiti), ma dobbiamo usufruire di infrastrutture secondarie di appoggio LRT come ad esempio Mellow Protocol garantito da Lido Finance e CyberFund.

It is worth noting how this has become a member of Lido Alliance, benefiting from Lido’s marketing, integration support, and bootstrap liquidity.

La stessa Lido sta spingendo la propria community verso “strategy Defi” che includono il liquid restaking con Mellow.

Introducing advanced DeFi strategies for stETH with Mellow & Symbiotic ✨ https://t.co/dzmYEFY8dM

A new initiative to provide stETH holders with access to new DeFi opportunities, including restaking. pic.twitter.com/KRIqIPzvAa

— Lido (@LidoFinance) June 11, 2024

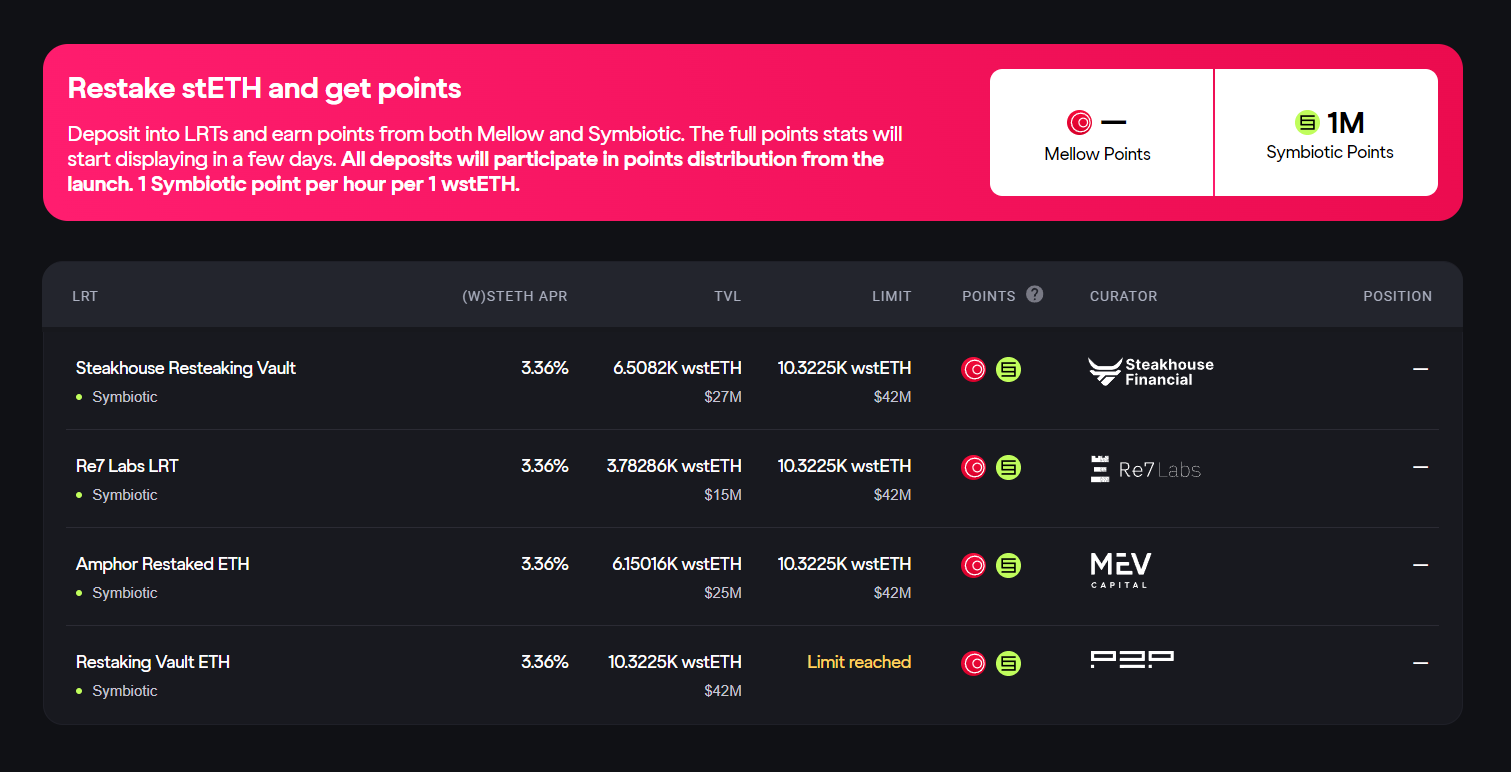

Mellow offers 1 million Symbiotic Points for restakers of stETH, wstETH, WETH, and ETH with a distribution of 1 point per hour for each ether or equivalent locked, in addition to the same share of Mellow Points that will be converted into the platform’s upcoming governance token.

Each pool is supported by a curator, chosen from Steakhouse Finance, Re7Labs, Mev Capital, and P2P.org, each tasked with managing their own vault and improving the Symbiotic ecosystem. For each pool, the APR is equal to 3.36%, in line with other restaking platforms.

Hurry up because even here there are cap limits: the early bird farms better!

Source: https://app.mellow.finance/restake

Keep in mind that the airdrop of the Symbiotic token, while not guaranteed, will most likely be one of the best around in terms of potential profit, as the project is funded by Paradigm, which is known for being the “VC of airdrops” having supported in the past the launches of the tokens of Uniswap, Blur, DyDx, Optimism, Opensea, and Ribbon Finance.

Furthermore, in the dashboard of the Symbiotic website, we can already notice the specific “delegate” section (currently unavailable) which will be used, as it happens on the EigeLayer site, to manage the delegation of stakes to various node operators, fueling a AVS ecosystem.

1/ Symbiotic fi

⭕✨ Go to : https://t.co/aX9aJzRxW7

➖ Restake $swETH here.

👉 By this method you can farm Swell & Symbioticfi.

➖ Symbioticfi raised $5.8M from tier 1 ventures & investors including paradigm.

➖ It has a point system. Study Eigenlayer. pic.twitter.com/knJbDWnSZe

— Maran’s Crypto (@MaransCrypto) June 13, 2024

Restaking protocol: how Symbiotic differs from Eigenlayer

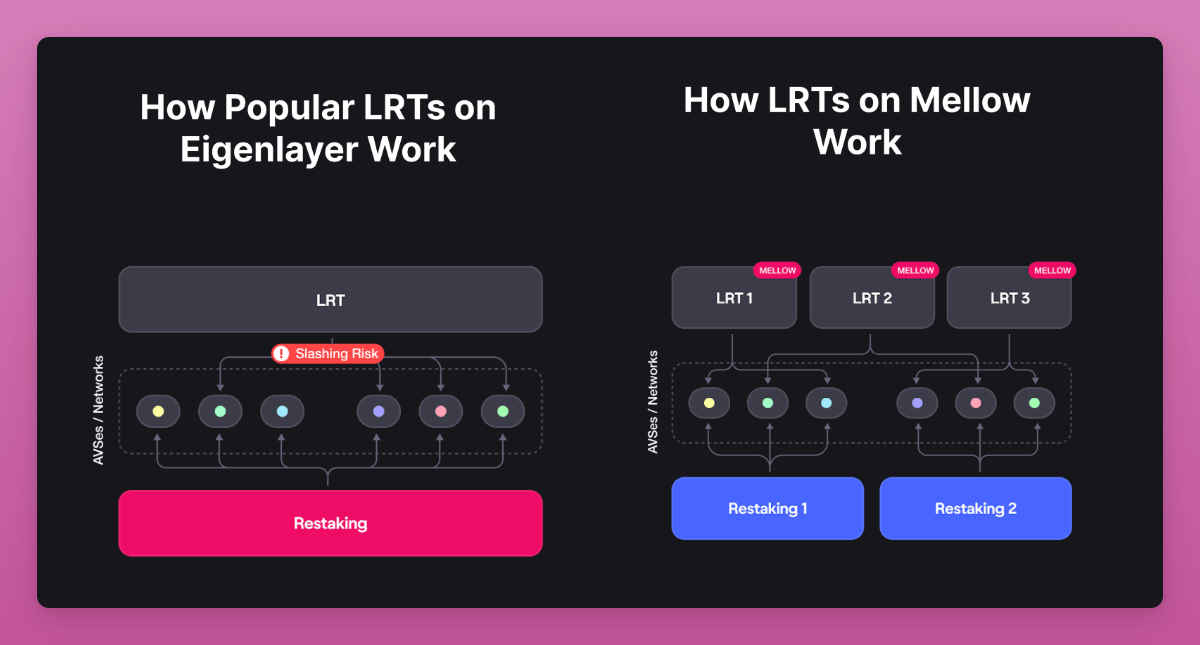

Symbiotic presents itself as the direct competitor of the leading platform in the field of restaking EigenLayer, with a very similar infrastructure but at the same time different in terms of on-chain architecture.

The challenge between the two top protocols will also be played partly on the airdrop level, with both projects motivated to release the richest token distribution for their respective communities in order to attract more users.

In this regard, Symbiotic could release its own crypto through airdrop, before the TGE of the token EIGEN set for September 30, taking advantage of the time factor.

Indicatively this could arrive by the end of the summer.

I have absolutely zero insider insight into Symbiotic.

But it seems they’ll launch by the end of summer and potentially a Symbiotic airdrop might become tradable before $EIGEN. pic.twitter.com/tVcAcdVeMX

— Ignas | DeFi Research (@DefiIgnas) June 11, 2024

In the world of finance, the terms “bull” and “bear” are often used to describe market trends. A “bull” market is characterized by rising prices, while a “bear” market is marked by falling prices. Understanding these concepts is crucial for investors.

From a technical point of view, Symbiotic stands out mainly for its modular design and its flexibility, offering multi-asset support to all users: the platform indeed plans to accept any direct deposits of ERC-20 tokens, while EigenLayer only supports deposits in ETH and its derivatives (if you use something else, it is actually converted to ETH on EigenLayer).

Additionally, the first one allows setting customizable parameters such as collateral activities, node operators, rewards, and slashing mechanisms. Then, it uses immutable contracts, meaning non-upgradable, reducing related risks of governance but offering less malleability in community decisions.

In general Symbiotic uses a trustless approach, aiming for an open, decentralized, and accessible ecosystem for everyone.

EigenLayer, instead, while performing the same tasks as Symbiotic, leverages a more established approach, focusing on the security of Ethereum stakers to support various dApps (AVS).

The management of protocol no. 1 in the restaking sector, which boasts a TVL of 18.6 billion dollars, is rather centralized with EigenLayer itself managing the delegation to node operators, while navigating a dynamic environment that allows developers to use the aggregated ETH security to launch new protocols and applications.

Furthermore, the governance of the project is less open and flexible and includes specific mechanisms to manage rewards and slashing.

Source: https://www.ignasdefi.com/p/the-restaking-wars-eigenlayer-vs

Regarding the competition between the two protocols, Misha Putiatin, co-founder and CEO of Symbiotic, stated in a recent interview with the newspaper Blockworks that in reality, the objective of her project is different from that of EigenLayer. Here is what was reported verbatim:

“Symbiotic will not compete with other market participants —, so no native staking, rollup, or data availability offering. The goal of our project is to shift the narrative — you don’t have to launch natively — it will be safer and easier to launch on top of us, in addition to shared security.”

Implicitly, however, the desire to grow and establish itself as the major restaking protocol of the Ethereum ecosystem is noticeable, supported by the VC Paradigm which was previously rejected by EigenLayer as the lead investor, preferring the firm a16z.

Even wanting to provide a moderate interpretation of the clash that is underway, using politically correct terms, it is undeniable that the challenge between Symbiotic and EigenLayer is played out on 3 different fields:

- challenge to those who will be able to attract the best LRTs and the best AVS (capable of collecting the largest share of fees);

- challenge between the VC Paradigm and a16z, between who will support the largest crypto airdrop;

- challenge in competing for the TVL and the larger market share of the restaking sector.

There will be fun in the coming months.

[ad_2]