[ad_1]

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

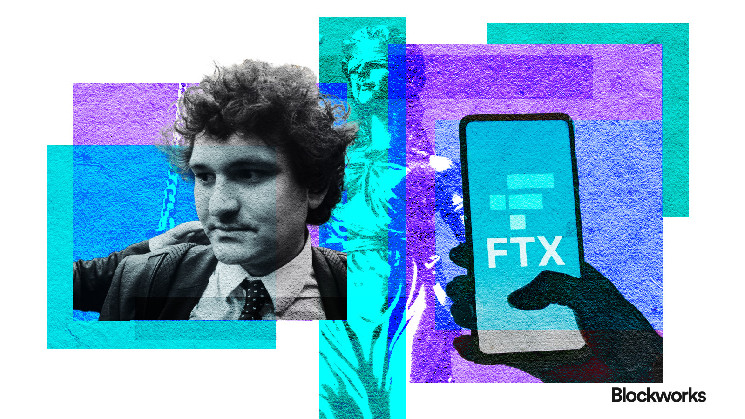

Today marks two years since the eventful day FTX filed for bankruptcy. Sam Bankman-Fried is in jail for 25 years, Ryan Salame likewise for 7.5 years, Caroline Ellison just commenced a two-year jail term and the FTX bankruptcy estate is making progress.

Though the story was widely publicized across mainstream media as a colossal failure of crypto writ large, that was never actually true. The specific areas of failure in the FTX debacle were in fact the kinds of centralized institutions that cryptocurrency was designed to upend.

Recall the commingling of funds — about $14.6 billion of FTX’s native FTT token — between FTX and its trading arm, Alameda Research. When the value of FTT plummeted, Alameda’s loans that were borrowed against FTT effectively fell underwater.

At the same time, Alameda also held an outstanding loan of 20 million MIM (the stablecoin of Abracadabra protocol) against $5 million FTT.

Source: Abracadabra

Alameda fully paid that debt as FTT cratered on Nov. 9 — two days before FTX filed bankruptcy — to avoid automatic smart contract liquidations. In sum, DeFi worked.

Today, Abracadabra seems to be pretty much dead. Its MIM stablecoin still has a market cap of about $44 million, but hasn’t seen any growth since FTX’s collapse.

Abracadabra’s founder, the infamous Daniele Sesta, has apparently moved on from his once popular “Frog Nation” cult to…memecoins on the Sonic (previously Fantom) chain. The Abracadabra-affiliated project Wonderland, which at one point passed more than $2 billion in TVL, was also stealth-rebranded into a lending protocol, Volta, in late 2023. The move occurred after the project was scandalized with news that its pseudonymous treasury manager turned out to be Michael Patryn, the previously convicted co-founder of the failed Canadian crypto exchange QuadrigaCX.

Today, Abracadabra and Wonderland have turned out to be just another series of ghost projects in the ethereal graveyard of crypto’s history.

When FTX collapsed, there were concerns that Binance would effectively monopolize the centralized crypto exchange market. At that time, its BUSD stablecoin was the third largest, and BNB Chain was also the second biggest L1 by TVL.

Today, Binance retains its position as the largest global cryptocurrency exchange, but fears of a “monopoly” haven’t come to pass.

The BUSD stablecoin was deprecated after the New York Department of Financial Services (NYDFS) ordered its closure in February 2023. Binance then switched to a little known stablecoin, FDUSD, for stablecoin liquidity on its exchange, which has seen growth from $350 million to about $2.3 billion today.

As for BNB Chain, it’s still fourth by TVL, overtaken only by Solana’s meteoric rise in the past year.

Under FTX Ventures, SBF was also a major investor in dozens of crypto projects. Some of these included LayerZero, Yuga Labs, Near, as well as MoveVM chains like Aptos and Sui — whose mainnets weren’t yet launched — and of course, Solana.

FTX’s large token holdings cast a looming shadow over the future of these projects. Today, most of these projects seem to be doing just fine.

Finally, a post-FTX crypto industry quickly consolidated around the standard of “proof of reserves” as a minimum security standard for centralized crypto product offerings, as seen in newer efforts like Coinbase’s cbBTC or Kraken’s annual audits.

The failure of FTX undoubtedly set the industry back. But two years out, it seems like crypto has at least learned a few lessons.

[ad_2]