This is a segment from the Supply Shock newsletter. To read full editions, subscribe.

Bitcoin has multiple personalities, equal parts money, freedom, resistance and hope.

MicroStrategy chairman Michael Saylor sits below all of them as bitcoin’s id — its rawest instincts, personified.

Thursday marked the 25th anniversary of Saylor losing $6 billion in one day ($11 billion adjusted for inflation) as the dot-com bubble burst. That event was among the biggest single-day personal losses in human history until that point.

This is his comeback story.

Premium domains

Saylor was not always the apex Bitcoin bull. He did, however, understand digital scarcity long before the first block was ever mined: in domain names.

After founding MicroStrategy in 1989 and spending years building it up as a data mining and business intelligence operation, Saylor in the ‘90s had the bright idea to start buying up “premium” domain names: simple, single-word domains with potentially universal appeal and, preferably, over 500 million hits on Google Search.

Angel.com. Alarm.com. Wisdom.com. Emma.com. Speaker.com. Alert.com. Voice.com. Hope.com. Only one person could ever own each one at a time, and MicroStrategy spent $2 million overall acquiring those types of premium domains — at an average of around $100,000 each — alongside thousands of less valuable secondary domains.

“I bought all these domains because I thought, ‘Wouldn’t it be great to own a part of the English language?’” Saylor said on the My First Million podcast. He personally owns Michael.com and one for his nickname, Mike.com.

“I mean, [as to] owning ‘hope’ or owning ‘voice’ — eventually, there’ll be a Google Voice, or some telecom company will want to launch a service. And what a great domain to launch on — a word like ‘Voice.com.’”

Alarm.com and Angel.com were later commercialized with real companies, respectively spun up by Saylor and MicroStrategy’s research and development division.

MicroStrategy eventually sold Alarm.com and its associated business for $27.7 million in 2009 to venture capital firm ABS Capital Partners. In 2013, software company Genesys acquired Angel.com with its business for $110 million cash, and quickly rebranded it under its own corporate umbrella.

Saylor, meanwhile, was adamant that Voice.com was worth $1 billion to the right buyer.

It was around this time, in December 2013, that Saylor first publicly commented on Bitcoin: “Lacking a credible sponsor, Bitcoin is in imminent danger of being regulated out of existence,” Saylor tweeted.

He posted again another week later, after bitcoin had fallen by up to two-thirds from an all-time high of $1,242:

Sunk cost

Saylor wouldn’t really return to Bitcoin until mid-2020, at least publicly, and going by the timeline of events, a premium domain sale to a crypto startup might’ve been his lightbulb moment, with a capital ₿.

In May 2019 — one year before MicroStrategy first showed intent to buy bitcoin — the company behind upstart blockchain EOS, Block.one, had announced a new social media app in the form of Voice, which promised to pay token payouts to users for posting and sharing content.

Block.one was previously calculated to have raised $4.1 billion in ETH during a year-long initial coin offering that started in mid-2017 and ended around a year before Voice was revealed.

“They [Block.one] contacted us, one of their domain brokers, and they asked, ‘Do you want to sell it? We’ll give you $150,000.’ I said no. I thought nothing of it, because I just couldn’t see the point,” Saylor recounted.

“They come back and say, ‘They doubled it to $300,000.’ I said, ‘Tell them no.’ So a couple days later they [Saylor’s colleagues] go, ‘Well the broker’s really insistent; they went to $600,000.’ I said no. So they said, ‘Well, what should we say?’ I said, ‘Don’t tell them anything. Tell them we’re not interested. It’s got to be something serious.’”

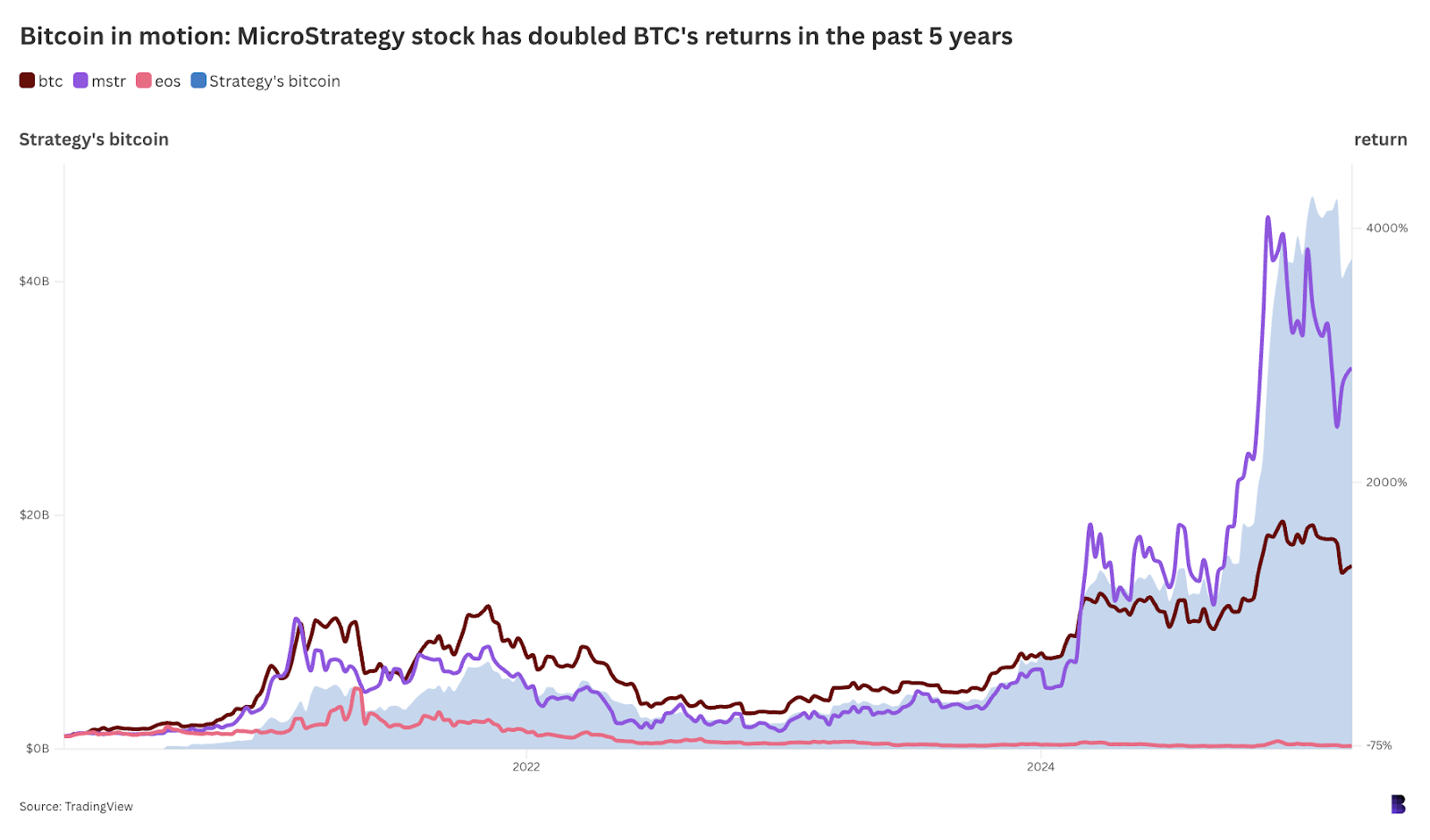

MSTR returned to all-time highs last November after more than two decades — thanks to its Bitcoin plan. EOS is down 75% in the past five years. Source: TradingView.

Block.one then offered $1.2 million, which Saylor rejected. Then $2.5 million. Then $5 million. Then around $10 million.

“When it got to $12 million, I said I’d get on the phone for half an hour. That call started with someone saying, ‘Well, how about $22 million?’ And I said, “Let me explain. This is like my daughter. I’m willing to marry her off, but only to a man that values her more than I value her.”

MicroStrategy closed the deal in June 2019 for $30 million — 200 times above Block.one’s initial offer. It’s still the largest known pure domain name sale in history, nearly doubling the previous record of $17 million, which Qihoo paid for 360.com in 2015.

Block.one went on to sink another $150 million into Voice.com’s development over the next two years before shutting it down in late 2023. Voice stated that “the ongoing uncertainty in the crypto and NFT market will continue for more time than we have.”

Conversely, Saylor and MicroStrategy began buying bitcoin, positioning themselves to capitalize immensely on an impending bitcoin rally fueled by anticipation of ETFs from BlackRock, Fidelity and others.

How it started

One year after the domain sale closed, in July 2020, Saylor said in a quarterly earnings call that MicroStrategy may start buying bitcoin over the next year as part of a new capital allocation strategy.

The plan was to invest $250 million over the next 12 months in alternative assets — “which may include stocks, bonds, commodities such as gold, digital assets such as bitcoin, or other asset types,” while buying back $250 million in company stock from shareholders.

Except it didn’t take a year. MicroStrategy bought 21,454 BTC for $250 million in less than two weeks, and in August 2020 declared bitcoin its primary treasury reserve asset.

Bitcoin was then trading for under $12,000, and within four months had broken its $20,000 price record, which had previously held for almost three years.

Corner the market

By December 2020, MicroStrategy had opened its first debt sale since opting into bitcoin — $400 million with 0.75% interest — which it pledged to spend on buying more coins. Then a second raise two months later, and a third four months after the second.

So by the time Block.one wound down Voice in September 2023, MicroStrategy was sitting on $4.2 billion in BTC at the very early stages of a monster bull run.

Since then, MicroStrategy has spent almost $27.8 billion to acquire an additional 340,860 BTC ($28.7 billion). Bitcoin has more than tripled in price in that time, while MicroStrategy has dropped the “Micro” from its name and only goes by Strategy these days.

Strategy now holds a total of 499,096 BTC — 2.5% of the circulating supply — and is valuable enough to be included in the benchmark Nasdaq 100 stock market index. Saylor has relentlessly bull-posted the entire time, picking up where former evangelists such as Roger Ver left off.

Of course, Strategy has raised billions of dollars across nine completed debt sales to help fund the bitcoin acquisition plan.

How it’s going

Right now, the firm has $9.3 billion in convertible debt against $41.8 billion in BTC, and is this year responsible for 30% of the US convertible market, all “powered by Bitcoin.”

Strategy has spent $33.2 billion on bitcoin in total, and the napkin math puts Strategy effectively ahead by $700 million at time of writing. Saylor’s personal net worth is estimated at $6.6 billion, and in January, the firm openly promised to raise $42 billion over the next three years to buy a whole lot more.

Whether it’s conviction that Voice.com is really worth $1 billion, or that bitcoin is “going up forever,” Saylor’s career has been marked by the same base instinct to corner the market on long-lasting digital assets, particularly ones that serve as foundational structures for internet economies.

Saylor simply expanded from one highly-illiquid digital asset class in domain names — a niche space where he’s also considered a legend — to one deeply liquid digital asset in bitcoin.

Amazingly, what followed the Voice.com deal doubles as a near-perfect allegory for crypto investing. Block.one sunk nine figures into a token project that pivoted to NFTs, only to go zero before it even started, defeated by a bear market.