In our first Tether Insights, we shared the data that a total of 330 million on-chain wallets and accounts, a proxy for users, had received USDT by the end of Q3 2024. This figure does not include the several tens of millions of people using USDT exclusively off-chain on centralized platforms, so USDT adoption is even more widespread.

We are proud that so many users have received USDT, but this is just the first step on a user’s adoption journey. The next step is to continue to hold USDT and that is the focus of this second Tether Insights.

A bank account for hundreds of millions of users

109 million on-chain wallets held USDT at the start of Q4 2024, which is more than double the number of wallets holding bitcoin and close to the 128 million wallets holding Ethereum — making USDT one of the most widely held digital assets.

There are also 86 million accounts on centralized platforms that have received on-chain USDT deposits. Centralized platforms are a core part of the ecosystem, with exchanges receiving 4.5 billion web visits in the first three quarters of 2024. Importantly, 46% of these web visits were from emerging markets. We know from our partners that many users of exchanges in emerging markets buy, hold, and send USDT entirely within the platform. So while only the platforms themselves know the current balances of these 86 million accounts — and the several tens of millions of users who exclusively use off-chain USDT — it is likely that many of them continue to hold USDT.

Putting this together, we estimate that at least a third (109 million), and likely half (adding in two thirds of the 84 million on-chain accounts that may hold balances), of all 330 million on-chain users who have ever received USDT continue to hold it today, highlighting the ongoing trust and utility of USDT as a store of value.

Users who have spent all their USDT often reactivate their wallets by receiving more USDT in the future, for example because they use USDT for repeated payments. In fact, 29% of wallets that currently hold less than one cent of USDT have been reactivated in the past. So while just over half of wallets currently holding USDT have a balance of less than one cent, a common pattern for digital asset wallets, many of these wallets are likely to become active again over time.

This brings the total number of wallets that either currently hold (109 million) or are likely to reactivate (56 million) to 165 million, in addition to the several tens of millions of accounts holding USDT on centralized platforms.

There are 18.7 million wallets that hold more than one cent and less than one dollar of USDT. While this may seem like a small balance to some, our work in emerging markets suggests this can be a significant sum for someone starting to adopt a new technology and who primarily uses USDT for payments rather than savings. 4.5 billion people, 59% of the world population, live on below $10 a day according to the World Bank. That so many people who would typically be unbanked can now use USDT demonstrates the importance of stablecoins in economic development.

There are then 31.5 million wallets that hold between $1 and $1,000 of USDT. As we’ll explore in a future Tether Insights, this bulk of USDT holders appear to be saving in USDT as they are holding their funds for longer and longer, and sending fewer and fewer of the USDT they receive.

Just over a million wallets hold more than $1,000 of USDT, with two thirds of these holding between $1,000 and $10,000 of USDT.

4x more USDT wallets than all other stablecoin wallets combined

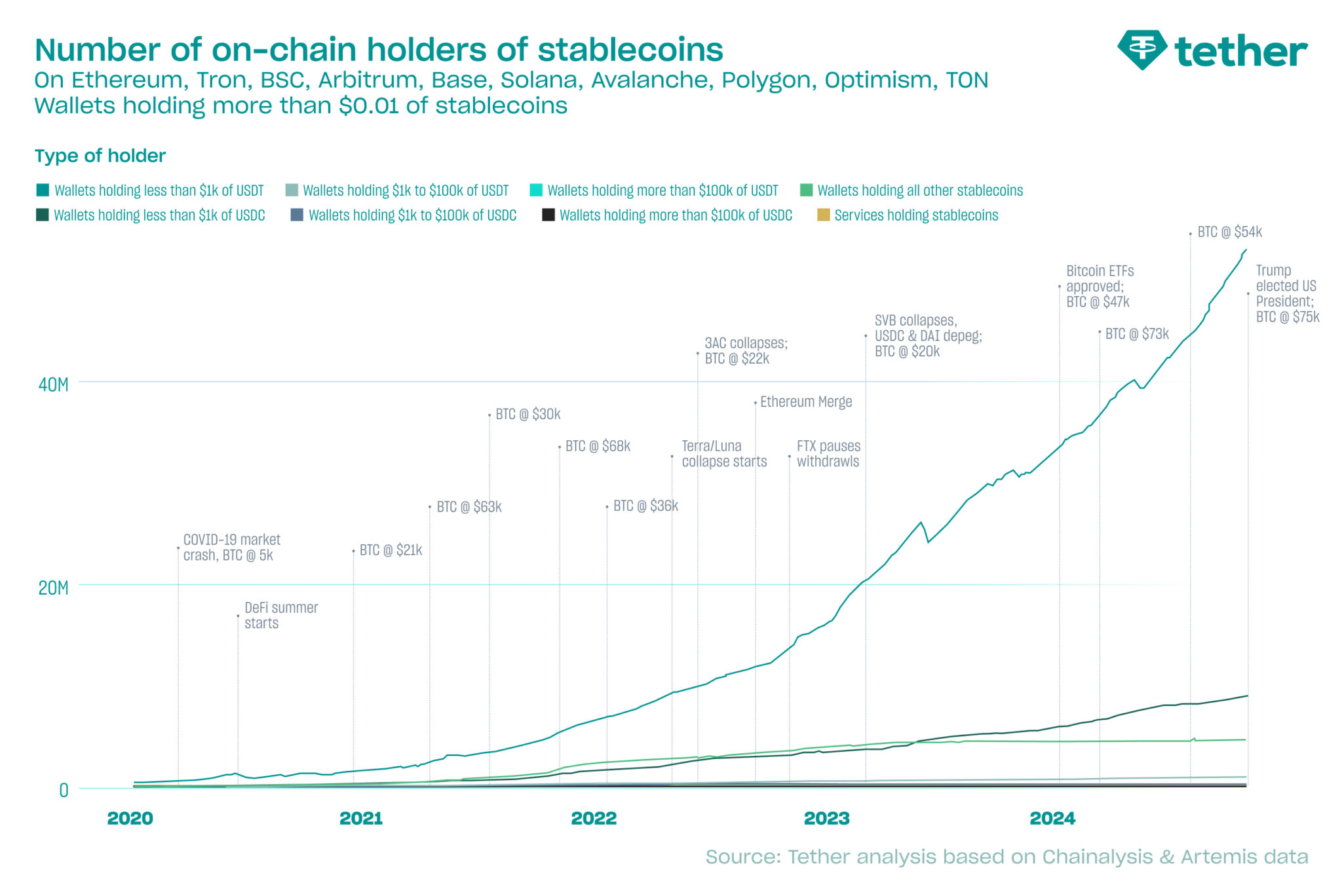

USDT continues to dominate the stablecoin market with four times more wallets than all other stablecoins combined. As of 1 November, 54 million on-chain wallets held more than one cent of USDT, compared to just 13.8 million wallets for all other stablecoins, a 4:1 ratio. This comprehensive analysis spans 25 stablecoins across 10 blockchains, covering 97.5% of the total stablecoin supply.

The growth of USDT wallets has been extraordinary, increasing 71% in the past year and 129% the year before, driven primarily by wallets holding less than $1,000. This surge accelerated after the collapse of FTX, when users chose to self-custody their USDT rather than keep it on centralized platforms. USDT’s momentum continued even after competitors like USDC and DAI de-pegged during the Silicon Valley Bank collapse, reinforcing its position as the stablecoin of choice for users worldwide.

Other stablecoins have not seen the same growth in holders as USDT. The 24 other stablecoins aside from USDC have experienced just a 3% growth in holders in the last 12 months. USDC has seen growth in the number of holders, particularly on Solana and Base, although even on Solana, USDC’s leading chain, USDT accounts for over 30% of holders.

Conclusion

At Tether our mission is to provide technology that empowers people around the world to live in a self-sustainable and independent way. USDT, as a technology of financial freedom, is the first step. The fact that over a hundred million users choose to hold USDT in their own wallets and choose USDT four times more often than any other stablecoin, demonstrates the real world demand for this. In addition, USDT is held by several tens of millions of users on centralized platforms.

The prevalence of low-balance wallets is a feature, not a bug, highlighting USDT’s accessibility to users who might otherwise be unbanked. Moreover, the 29% reactivation rate of these wallets demonstrates that many users return to holding USDT whenever they have the funds, underscoring its reliability as a financial tool for those with limited access to traditional banking.

Philip Gradwell, Head of Economics at Tether

Methodology

We source blockchain data from Chainalysis for the Ethereum, Tron, Binance Smart Chain, Polygon, Optimism, Arbitrum, and Avalanche blockchains, and from Artemis for the Solana, Base, and TON blockchains.

See the methodology of Tether Insights 1 for more details on how these data providers process their data so we can identify on-chain wallets and accounts.

On-chain holders are the wallets that hold a stablecoin on a blockchain on a particular day.

Web visits are the sum of visits to a website to 513 exchanges. These are not unique visits. Web visits to each exchange website are provided per country. Countries are grouped by World Bank Income Group with all countries other than high income countries (so with a Gross National Income per person of less than $14,005) considered as emerging markets.

The 29% of wallets that currently hold less than one cent of USDT that have reactivated in the past are wallets that have had a balance of less than one cent in the past then increased their balance above one cent at least once before reducing their balance to below one cent currently. This analysis is from our collaboration with the team at Pometry.

The population of people who live on below $10 a day is in 2019, the year of the latest available data, in 2017 Purchasing Power Parity US dollars. The source is the World Bank Poverty and Inequality Platform (2024) – with major processing by Our World in Data.