[ad_1]

Decentralized exchanges have first come into prominence during the DeFi boom, and they’ve been a staple of the on-chain experience ever since. But we’re nowhere close to their limit: DEXs might still look completely different from how they were before.

Currently, decentralized exchanges continue to gain strength in terms of spot volumes and funds locked. With the memecoin boom on Solana, Base and other platforms, DEXs have become the go-to platform for trading even for some people who never interacted with wallets before.

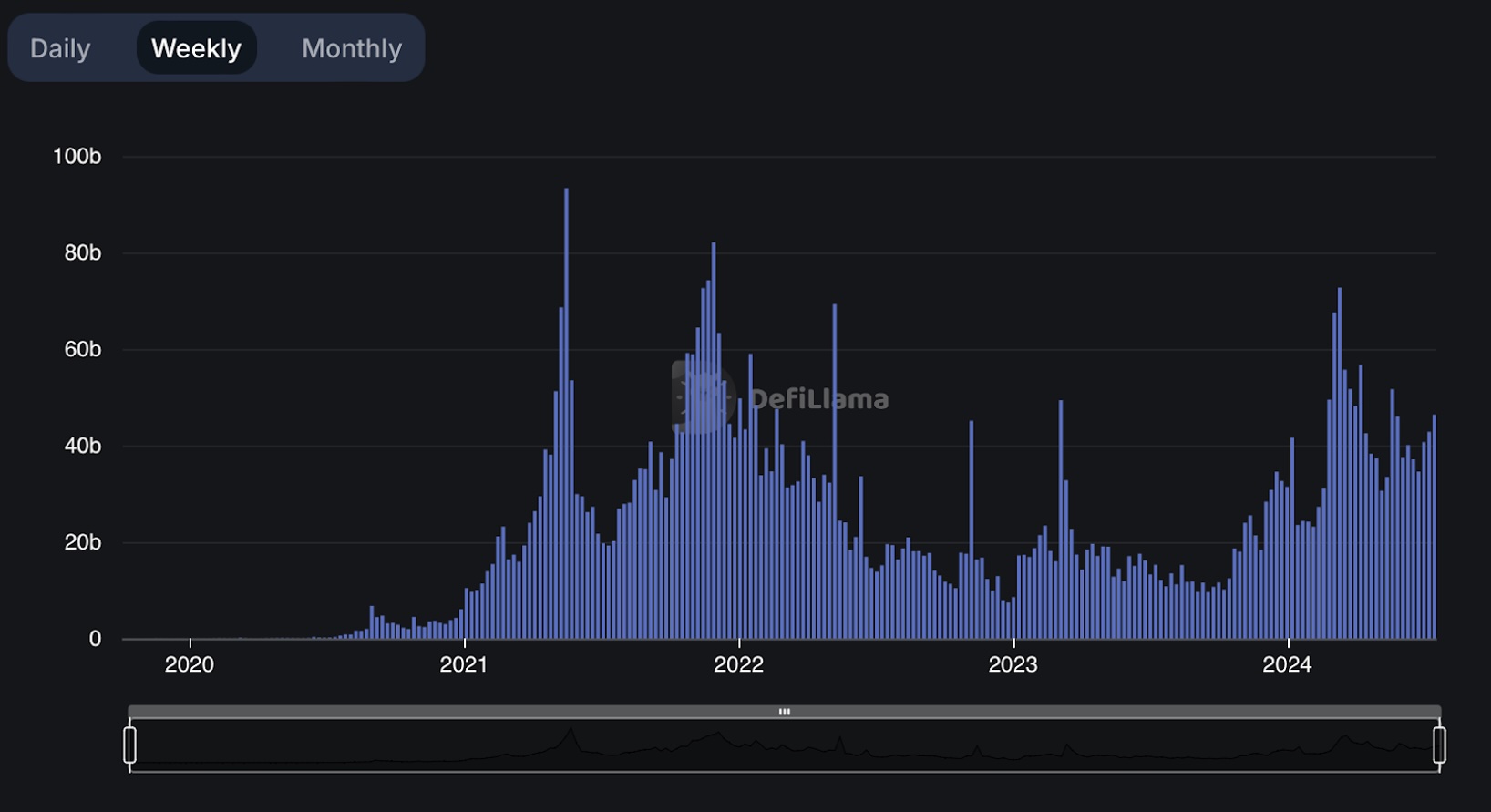

According to DefiLlama, DEXs cumulatively account for about $6B daily volume and about $45B weekly, spearheaded by Uniswap and Raydium on Solana.

Weekly DEX volume, source: DefiLlama

Though by no means dominating, these figures would place both Uniswap and Raydium among the top-5 exchanges overall, and the sector as a whole would be the 2nd largest exchange by volume, just behind Binance (according to CoinGecko).

Nonetheless, DEXs tend to generate most of their high value volume from assets not listed on centralized exchanges, keeping the two as separate niches. This is where new technology might help DEXs gain an upper hand in the coming months and years.

On-chain Privacy to Fix MEV and More

Lack of privacy in DEXs is one of their most fundamental flaws, or features, depending on how you see them.

Everyone sees every trade you’ve made, making it easy to copy trade, to gather information and to discover nefarious activity. However, the flipside of this transparency is frontrunning, which makes you lose money by getting a guaranteed worse execution. In addition, sometimes you might want to have full privacy for your trading activity to keep your edge.

Ideally, we’d all have a choice, which is why privacy protocols and L1s would be a great boost to trading activity on DEXs.

Luckily, privacy is one of the more exciting L1 trends to finally come online this year or the next. Among them, we have many different approaches competing for the honor of launching a private blockchain.

This is important as currently, all the data submitted and stored in a blockchain is fully public, unless it’s encrypted separately. To add private transactions, blockchains need a way to verify that the transactions are safe without knowing their contents. This is where complex cryptography including zero knowledge (ZK), fully homomorphic encryption (FHE) and garbled circuits (GC) come into play.

On the ZK privacy side, we have projects like Aztec and Aleo due to come online soon.

While ZK is the one traditionally associated with privacy, competing solutions like GC are also solid contenders. In particular, COTI’s GC solution is expected to be less computationally intensive than ZK, while offering similar privacy guarantees. This means that, with all else equal, Coti’s garbled circuits should be more performant.

All three technologies can be used to offer privacy, but the devil is in the details. Whichever solution manages to offer the best-working platform, wins.

More chains, better performance

The past 12 months have seen the breakout of L2 solutions that bring fast and cheap scalability while bootstrapping safe blockchain. Many of the top chains by TVL are L2s for Ethereum and other platforms, while some DEXs are entirely hosted on their own L2 for speed.

Zk-rollups have been used extensively to build DEX appchains, such as dYdX or QuickSwap’s Citadels.

Still, there are many more possibilities for using L2s to deploy DEXs, including the up-and-coming space of Bitcoin L2s.

Here, connect solutions like exSat might unlock new technology for DEXs that simultaneously tap into the $1.3T+ Bitcoin network, which has so far been left out of the innovation in DeFi. ExSat helps bridge together Bitcoin L2s by using the EOS network as an additional storage of data and RAM. In essence, it lets people run protocols tapping into Bitcoin while retaining the advantage of a fast and EVM-compatible blockchain.

Improving the user experience

Without a doubt, the biggest upcoming trend for DEXs will be through improving usability and letting the user experience reach and surpass that of centralized exchanges.

Currently, going from fiat to trading on Raydium requires 5-6 different steps of converting fiat to SOL, setting up a wallet, setting up trading tools to see what’s going on, and using a third party app to actually use Raydium.

Many ecosystems are looking to improve on these flows, including Ethereum with its many account abstraction proposals. However, these efforts will take time to pay off as the infrastructure of older networks is deeply rooted in its ways.

A newer chain might offer a better chance of getting things right immediately. Vara, a new high performance network built on Gear, has recently made a lot of strides in creating better tools for developers to make using the network extremely simple.

Through their Gasless and Signless transaction architecture, developers can offer gas vouchers to their users in the backend, which lets them join the network without jumping through hoops to get their first wallet funded. It’s currently making a push to attract more traditional developers who might be used to WebAssembly, a framework often used for high performance web apps.

The future is rosy for DEXs

All the most profitable businesses in crypto were exchanges of some kind. They all differ by the kinds of assets they list and how they operate, but ultimately it’s all about bringing together buyers and sellers of assets.

DEXs are an expression of the freedom to transact that was inbuilt in the Bitcoin whitepaper. Coming from a time when no one believed they were practical in 2017, to becoming among the top by volume overall, the trend for DEXs has been one of spectacular growth despite all odds.

As crypto infrastructure matures, DEXs will be among the first to make heavy use of it. Over time, that might just make decentralized exchanges the global standard for trading.

[ad_2]