Decentralized exchanges (DEX) like Raydium, Orca, and the newly launched PumpSwap have become the center of the meme coin storm thanks to fast transactions, low fees, and easy accessibility.

Meme coins have become an undeniable phenomenon in the crypto market. But is this a golden investment opportunity or just a bubble waiting to burst?

Will DEXs Be a Fertile Ground for Meme Coins?

DEXs have changed the ways meme coins are created and traded, especially on Solana—a blockchain renowned for handling over 65,000 transactions per second with fees of just a few cents. The launch of PumpSwap, the new DEX from token launchpad Pump.fun, is evidence of this trend.

Earlier, tokens from Pump.fun had to pay 6 SOL before being transferred to Raydium for trading. However, PumpSwap has eliminated this fee, allowing tokens to be traded immediately within its ecosystem. This reduces costs and retains liquidity within the Pump.fun ecosystem, fostering a stronger environment for meme coin growth.

Raydium has also now come up with meme coin launchpad LaunchLab to compete with Pump.fun.

Additionally, PumpSwap and other DEXs have adopted an Automated Market Maker (AMM) model similar to Uniswap v4 and Raydium v4, offering low trading fees (0.25%) and eliminating the need for liquidity pool creation fees. This encourages users to create new tokens with minimal costs and start trading instantly.

PumpFun accounts for the majority of tokens launched on Solana. Source: Dune

The developments have fueled an explosion of thousands of new meme coins each week. Dune data shows that over 8.7 million tokens have been created on Pump.fun. Since its launch, Pump.fun has averaged over 621,000 new tokens per month. The tokens from Pump.fun accounted for 61% of the tokens launched on Solana.

Moreover, PumpSwap also promises to share revenue with token creators, further incentivizing new projects and communities. Tools like Phantom Wallet make it easier for users to access DEXs, increasing liquidity and trading volume.

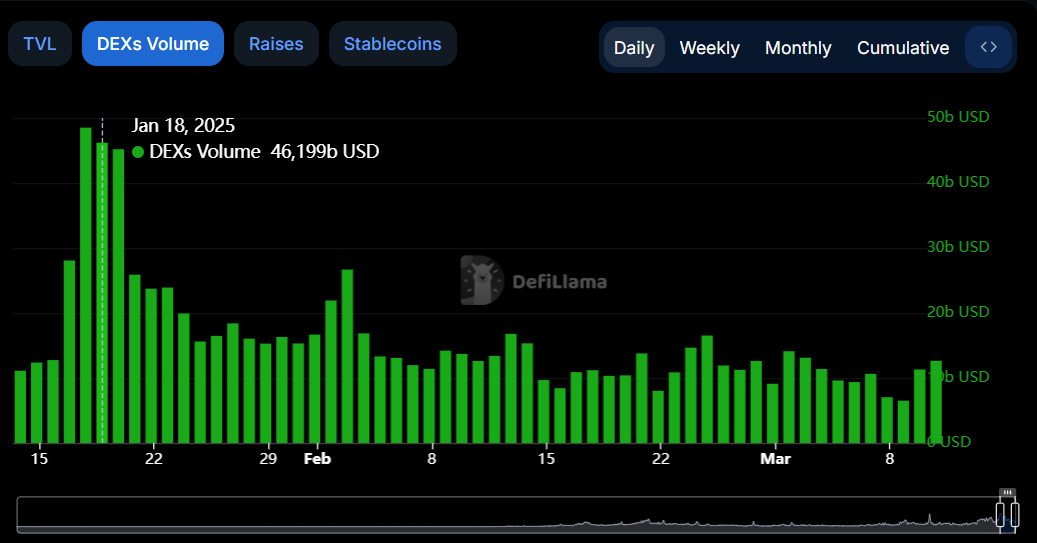

Total DEX volume as of March 21, 2025. Source: DefiLlama

With a total trading volume reaching $563 billion in January 2025, DEXs are facilitating meme coin trade and serving as a bridge to integrate them into the broader financial ecosystem.

BNB Chain dominates the DEX market, surpassing 30% market share and leading in trading volume and fees since March 15.

The Dark Side of Meme Coins—Rug Pulls and Volatility

The boom in meme coins on DEXs also comes with significant risks. Firstly, most meme coins lack intrinsic value and rely entirely on crowd FOMO and viral social media campaigns. When the hype fades, many tokens experience catastrophic crashes.

LIBRA, a Solana-based meme coin, once reached a market cap of hundreds of millions of dollars but nearly collapsed to zero after a massive crash in February 2025. During the same month, Solana’s meme coin trading volume plummeted from $206 billion to $99.5 billion, indicating a potential downturn in this trend.

Secondly, with such low token creation costs, Pump.fun and similar platforms have become a haven for scammers. “Rug pulls”—where developers drain liquidity and disappear—are increasingly common, eroding investor trust.

Lastly, regulatory pressures pose a major threat. As authorities tighten control over cryptocurrencies, DEXs and meme coins could face severe consequences.

DEXs like PumpSwap, Raydium, and Jupiter have been crucial in fueling the meme coins craze. PumpSwap could mark a turning point, helping meme coins on Solana recover after a period of decline. However, it remains a highly volatile space where the bubble could burst at any moment without thorough research and clear strategies.