[ad_1]

Yesterday, the US government had a particularly hard time selling treasuries to fund its operations. That was great news for bitcoin (BTC) as risk-on investment pushed crypto markets to all-time highs.

Surpassing $111,000 for the first time in its history, BTC benefited from one of the worst US bond auctions in recent memory. US Treasury Secretary Scott Bessent had to admit that the country’s 6.7% deficit-to-GDP ratio was its highest since the last war or recession.

Incredibly, Moody’s downgraded US creditworthiness this month from its highest Aaa tier to Aa1.

Extending a steep selloff in the multi-trillion dollar US Treasury bond market, yields on 30-year Treasury bonds stayed above 5% after a 20-year auction yesterday closed at an atrocious 5.047%.

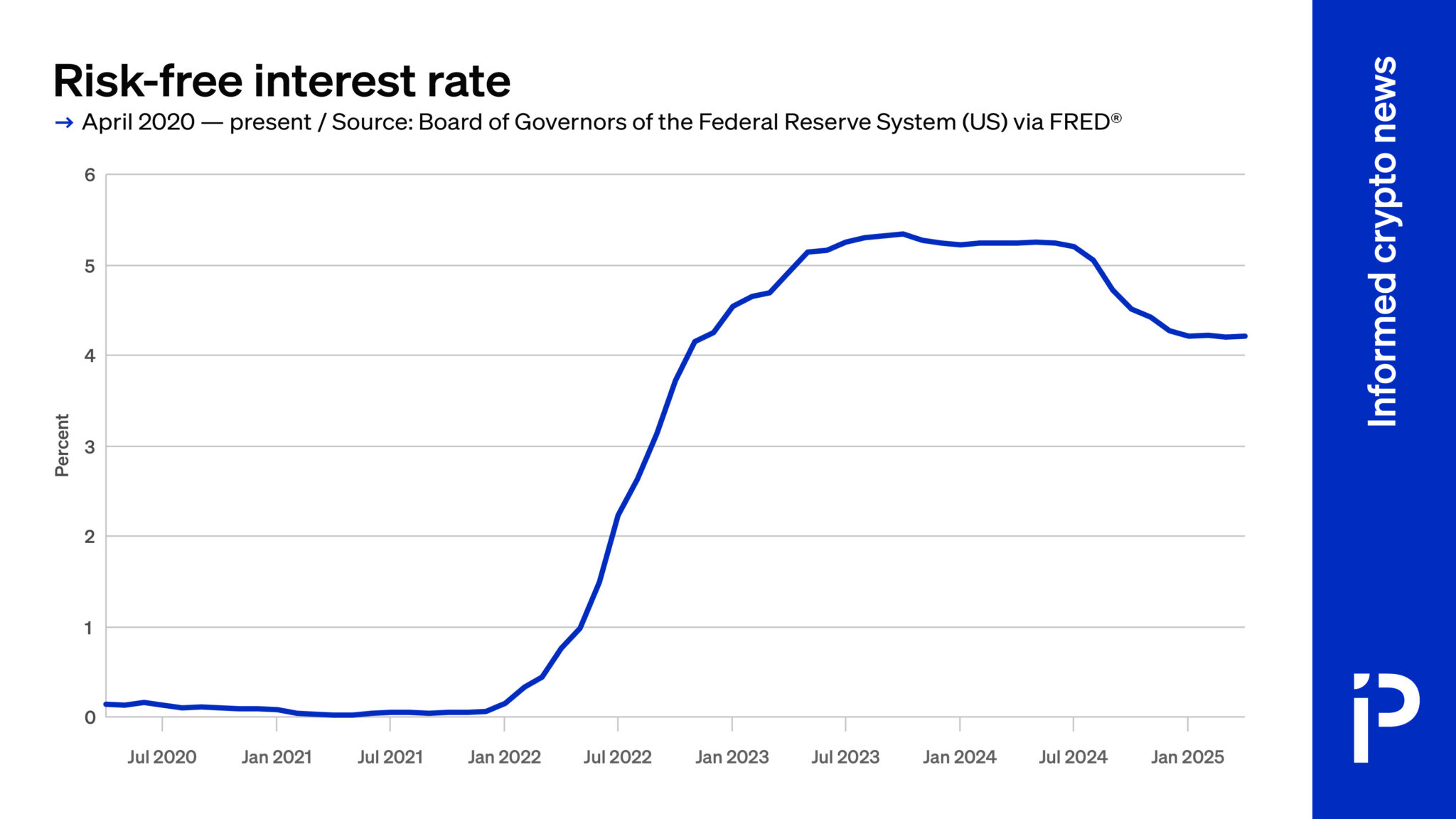

Whereas the US merely had to offer yields of 1% as recently as July 2020, it now must pay 400% higher interest to incentivize bond buyers. Quite literally, higher yields on Treasuries mean confidence in the world’s largest central bank is decreasing.

Bearishness in treasuries is bullish for Bitcoin’s goal of disintermediating central banks.

Read more: David Bailey explains why Nakamoto would sell bitcoin

Demanding 2,900% higher interest for risk-free bonds

As an example of Bitcoiners correctly forecasting the decreasing confidence in central banking, consider the instrument that defines the risk-free rate, three-month duration US Treasuries.

Defining the cost of money itself and offering the world’s highest creditworthiness, their risk-free yield has soared 2,900% in the past five years.

The bond is so secure that it has zero default risk in pricing models for tens of trillions of dollars worth of mortgages, $110 trillion worth of discounted cash flows, and $1 quadrillion worth of Black-Scholes options.

Nevertheless, the US government has had to increase its payouts substantially to incentivize buyers of these ostensibly risk-free bonds. Although traditional finance considers the US government’s ability to repay this debt as unassailable, the price of bitcoin yesterday told a different story.

As BTC hits new all-time highs, US bond prices — which trade inversely to their rising yields — have had a terrible week. Compounding problems of an aging population, rising military expenses, slowing GDP growth, and staggering entitlements have drawn equally terrible charts of US Treasuries over the last five years.

Even foreign sovereigns like Japan are reassessing their exposure to US government debt.

Falling Treasuries prices boost BTC

Using April’s three-month Treasury yield of 4.21%, the price of $1 due in three months is currently worth $0.9896 after discounting this supposedly risk-free rate.

Needless to say, the price of money is getting worse. As yields rise and bond prices fall, the discount applied to future cash flows is larger, depressing the present value or “price of money” ever lower.

As cheaper money flows out of fixed income markets into more speculative markets like crypto, BTC’s price and spot ETFs have benefited. Over the last 12 months, BTC has rallied 58%, and its spot ETFs have amassed 39% more BTC.

Companies have also been gobbling up BTC to add to their balance sheets. Over the same time period, BTC held in public and private company treasuries has increased an impressive 83%.

Although correlation doesn’t necessarily imply causation, BTC is hitting a new all-time high while the prices of US Treasuries are having a terrible week. The high debt-to-GDP ratio, soaring yields, and worldwide economic uncertainty explain much of the recent BTC rally.

In today’s macro environment, investors are increasingly willing to put their money into asset classes that aren’t completely dependent on governments, international politics, or mainstream economics.

[ad_2]