[ad_1]

The cryptocurrency industry is well acquainted with both price fluctuations and technological advancements, especially evident in the years following 2022. While spot bitcoin ETFs have garnered significant attention and investment, they represent just one instance of the sector’s swift evolution and maturation, offering a blueprint for how other crypto assets can achieve comparable success. Concurrently, apart from the ongoing price speculation that captivates investors, there is a continuous stream of rapid technical enhancements taking place. Let’s take a look at this Bitcoin halving 2024 article in more detail.

What is Bitcoin halving 2024?

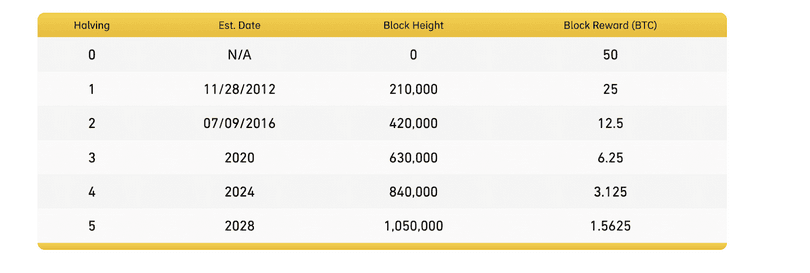

The fourth Bitcoin halving is expected to take place in mid-April 2024, marking a reduction in the block reward from 6.25 Bitcoins to 3.125 Bitcoins per block. This event is significant as it will further impact the issuance rate of new Bitcoins, potentially influencing market dynamics and miner incentives within the Bitcoin network.

The halving represents a fundamental shift in Bitcoin’s blockchain protocol aimed at slowing down the creation of new bitcoins. Satoshi Nakamoto, the pseudonymous creator of Bitcoin, designed the cryptocurrency with a finite supply of 21 million tokens from the outset. Nakamoto integrated the halving mechanism directly into Bitcoin’s code, which functions by decreasing the pace at which new bitcoins enter circulation over time.

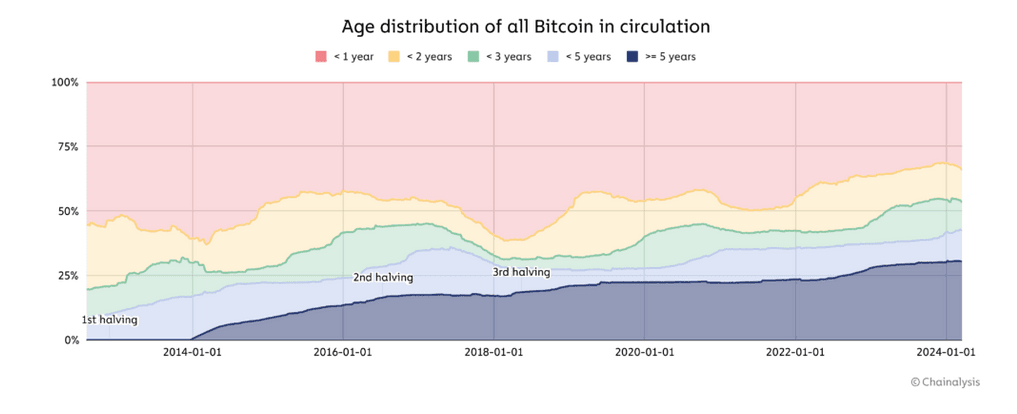

To date, approximately 19 million tokens have been mined and brought into circulation. This planned scarcity is a key aspect of Bitcoin’s value proposition, as it contrasts sharply with fiat currencies that can be subject to unlimited issuance by central authorities. The halving events, occurring roughly every four years, play a crucial role in maintaining the scarcity and ensuring a predictable issuance schedule for Bitcoin.

Bitcoin halving 2024: What are the effects on Bitcoin miners?

Bitcoin mining is the vital process through which new bitcoins are created and transactions are validated and recorded on the public ledger known as the blockchain.

Miners engage in solving complex mathematical problems using powerful computers to add transaction blocks to the blockchain. As a reward for their efforts, miners earn bitcoins and transaction fees.

This fundamental process not only generates new bitcoins but also helps secure the network against fraudulent activities. The issuance of new bitcoins decreases over time according to a predetermined schedule, contributing to the scarcity and value of Bitcoin.

The bitcoin halving, which reduces the number of bitcoins miners receive as rewards by 50%, naturally draws significant attention from analysts and the market due to its potential impact on bitcoin’s price.

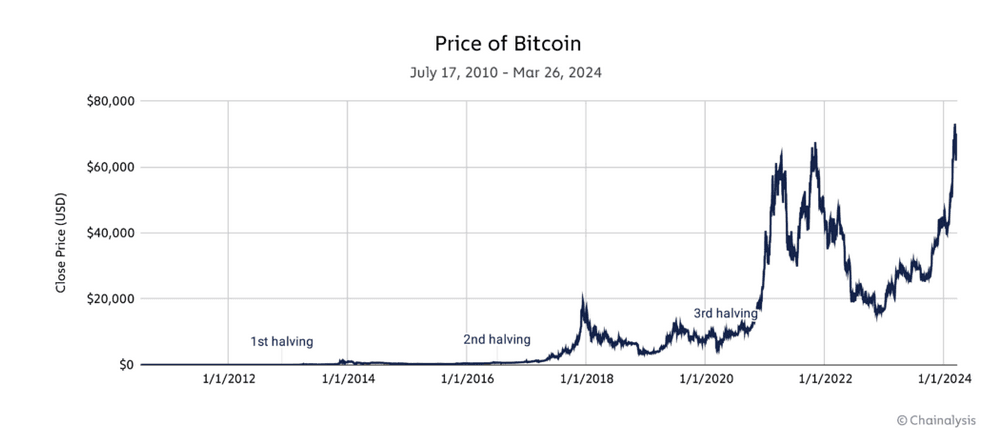

In each of the three previous halving events, the price of bitcoin at the end of the year in which the halving occurred exceeded the price at the time of the halving itself, including the most recent halving during the 2020-2021 bull market.

The impact on investors from the halving event might seem straightforward, especially considering the continued significant inflows into bitcoin ETFs. However, it’s also important to consider the effects on miners.

With fewer bitcoins rewarded, miners may choose to invest more in capital equipment to increase their chances of earning rewards. This could potentially lead to greater centralization in the mining space. Additionally, when combined with existing political pressures on the industry, these changes could result in unexpected consequences.

For miners, halving events results in a direct reduction in the immediate rewards for mining new blocks. This reduction can temporarily lower profitability, particularly for miners with higher operational costs.

Despite this initial impact, historical trends show that the price of Bitcoin tends to increase following halving events. This price appreciation has historically allowed miners to regain and even surpass their previous revenue levels, compensating for the reduced block rewards. Therefore, while halving events may pose short-term challenges for miners, the subsequent price increases often mitigate these effects over time.

How did the past Bitcoin Halving events impact the Crypto market?

Historically, Bitcoin has exhibited a consistent pattern of price appreciation following each halving event. For instance, after the 2012 halving, Bitcoin’s price surged significantly, climbing from $12 in November 2012 to over $1,000 by November 2013.

Similarly, following the 2016 halving, Bitcoin’s price rose from around $650 in July 2016 to approximately $2,500 in July 2017, eventually peaking at a new record high of $19,700 in December 2017.

Following the 2020 halving, Bitcoin’s price surged from about $8,000 in May 2020 to an all-time high of over $69,000 in April 2021.

These historical trends suggest that typically, Bitcoin experiences a price increase within a year after each halving event, followed by a period of price consolidation or adjustment. Notably, unlike previous halving cycles, Bitcoin reached a new all-time high in March 2024, roughly a month prior to its upcoming fourth halving. This pattern underscores the potential impact of halving events on Bitcoin’s value and market dynamics. You can read more about the Bitcoin price predictions here.

How This Bitcoin Halving 2024 Will Impact the Crypto Market?

The Bitcoin halving has significant economic implications, highlighting its deflationary nature and its impact on how markets behave.

Historically, when Bitcoin undergoes a halving event, it tends to coincide with bullish trends in its price. This trend is mainly because the rate at which new Bitcoins are produced slows down, leading to a decrease in supply while demand either remains stable or increases.

The resulting scarcity often makes Bitcoin more attractive as a digital store of value, similar to precious metals such as gold. Additionally, the anticipation and speculation surrounding halving events typically drive increased market activity and investor interest, which in turn affects price movements.

This cyclical relationship between halving events and market dynamics demonstrates the delicate balance between supply and demand in Bitcoin’s economy, solidifying its status as an appealing investment option within the broader financial landscape.

As a Bitcoin halving approaches, the crypto market often becomes highly anticipatory and speculative. Investors engage in activities to account for the upcoming reduction in Bitcoin supply caused by the halving event. This increased activity tends to make the market more volatile, and sometimes leads to a rise in Bitcoin prices before the halving occurs. Essentially, investors are trying to predict and prepare for the impact of the halving on Bitcoin’s supply and its potential effect on prices.

As the crypto market continues to evolve and mature, Bitcoin maintains its dominant position across various metrics such as price-per-token, market capitalization, social media presence, investment products, and overall investment volume. Any significant developments or changes related to Bitcoin inevitably impact the sentiment and fund flows for other cryptocurrencies within the market.

For instance, the approval of spot Bitcoin exchange-traded funds (ETFs) triggered a bull market not only for Bitcoin but also for many other cryptocurrencies. The upcoming halving event is poised to similarly affect the crypto sector, both directly and indirectly.

Crypto investors should be prepared to monitor and assess the short-term and long-term effects of this halving event. Understanding and anticipating these impacts will be crucial.

Final Thoughts

Every Bitcoin halving event has historically had a significant impact on the price of Bitcoin, primarily for two reasons.

Firstly, during each halving, the rewards for miners are cut in half. This process is designed to ensure the sustainable growth of the Bitcoin network and to gradually approach the total cap of 21 million tokens. By reducing the rate at which new bitcoins are created, the halving helps control inflation within the Bitcoin ecosystem.

Secondly, the inflation rate of Bitcoin decreases after each halving due to the reduced issuance of new bitcoins. This decrease in supply growth, combined with a potentially increasing demand for Bitcoin, creates a classic supply-demand scenario. With fewer new bitcoins entering the market but a continued or growing interest in acquiring them, the price of Bitcoin tends to rise over time.

Bitcoin halving events impact price dynamics by moderating supply growth, ultimately influencing the supply-demand balance and leading to potential price appreciation as demand outpaces the reduced supply of new bitcoins.

[ad_2]