[ad_1]

HIVE Digital plans to grow its hash rate 4x by September 2025, potentially placing it among the top 10 public Bitcoin miners by size. Simultaneously, it has $100M ARR target for HPC. Is this small-cap miner an overlooked opportunity?

HIVE Digital Sets Sights on Expansion and HPC Revenue

The following guest post comes from Bitcoinminingstock.io, the one-stop hub for all things bitcoin mining stocks, educational tools, and industry insights. Originally published on Feb. 27, 2025, it was penned by Bitcoinminingstock.io author Cindy Feng.

For a long time, Bitcoin mining’s biggest names get all the attention—but what about smaller ones? This year, I’m launching a new series to spotlight small-cap miners that often fly under the radar. Some of these companies have the potential to rise as future stars, while others may struggle to survive. Understanding them now can help uncover hidden opportunities or learn valuable lessons. In this series, I’ll break down their business fundamentals, financials, strategic direction, and market positioning—giving you a clear, unfiltered view of their strengths, weaknesses, and investment potential.

First up: Hive Digital Technologies, a multi-listed Bitcoin miner with exposure to both mining and High-Performance Computing (HPC).

Company Overview

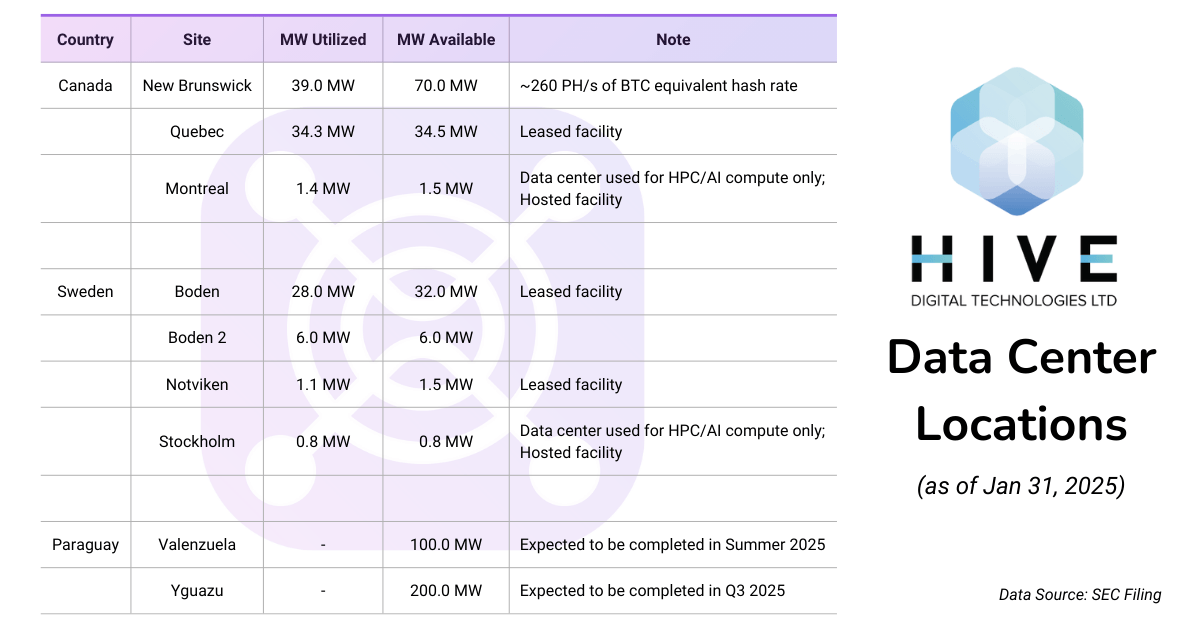

Hive Digital Technologies (TSX.V: HIVE; NASDAQ: HIVE ) is a publicly traded data center operator that focuses on digital asset mining and HPC. In December 2024, it announced the relocation of its head office to San Antonio, Texas, USA. The company has data centers across multiple geographies, including Canada, Sweden, and soon Paraguay. It is known for its commitment to green energy, primarily utilizing hydroelectric and geothermal to power its operations.

Business Arms

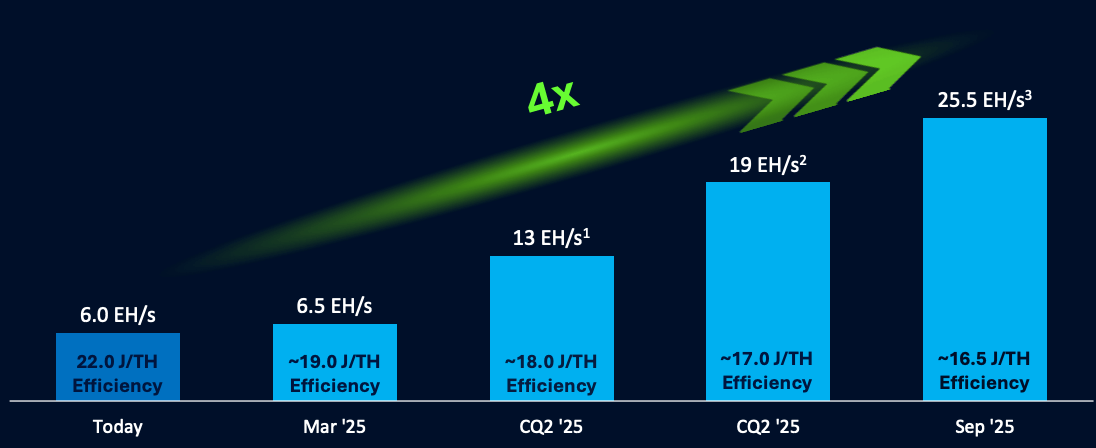

- Mining Operations: The company operates a total hashrate of 6 EH/s (as of Jan 31, 2025), with an aggressive expansion plan to reach 25 EH/s by September 2025.

HIVE plans for 4x hash rate growth by September 2025 (screenshot from the company presentation)

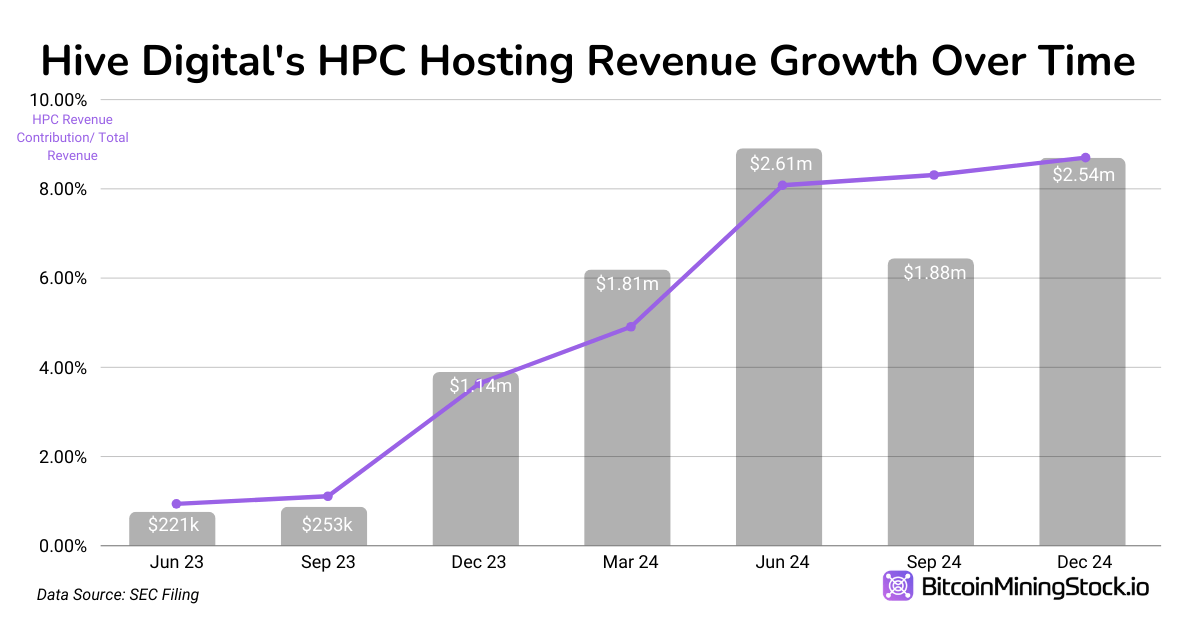

- HPC & AI Computing: HIVE was among the first public miners to pivot to HPC, leveraging its GPU-based Ethereum mining expertise. As early as 2023, the company reported $1.61 million in revenue from HPC hosting. Today, Hive continues to utilize its existing data centers in Montreal (Canada) and Stockholm (Sweden) for HPC services. Additionally, the company plans to offer GPU server rentals through marketplace aggregators and explore a new cloud service offering.

Financial Highlights: Revenue Decline and Profitability Improvement

Notes: HIVE presents financial comparisons across different periods in its latest report. The income statement follows a typical year-over-year comparison (Dec 31, 2024, vs. Dec 31, 2023), while the balance sheet is compared to March 31, 2024. Meanwhile, the cash flow statement uses a nine-month comparison (Dec 31, 2024, vs. Dec 31, 2023). To ensure consistency and facilitate meaningful analysis, this report primarily focuses on year-over-year comparisons where available.

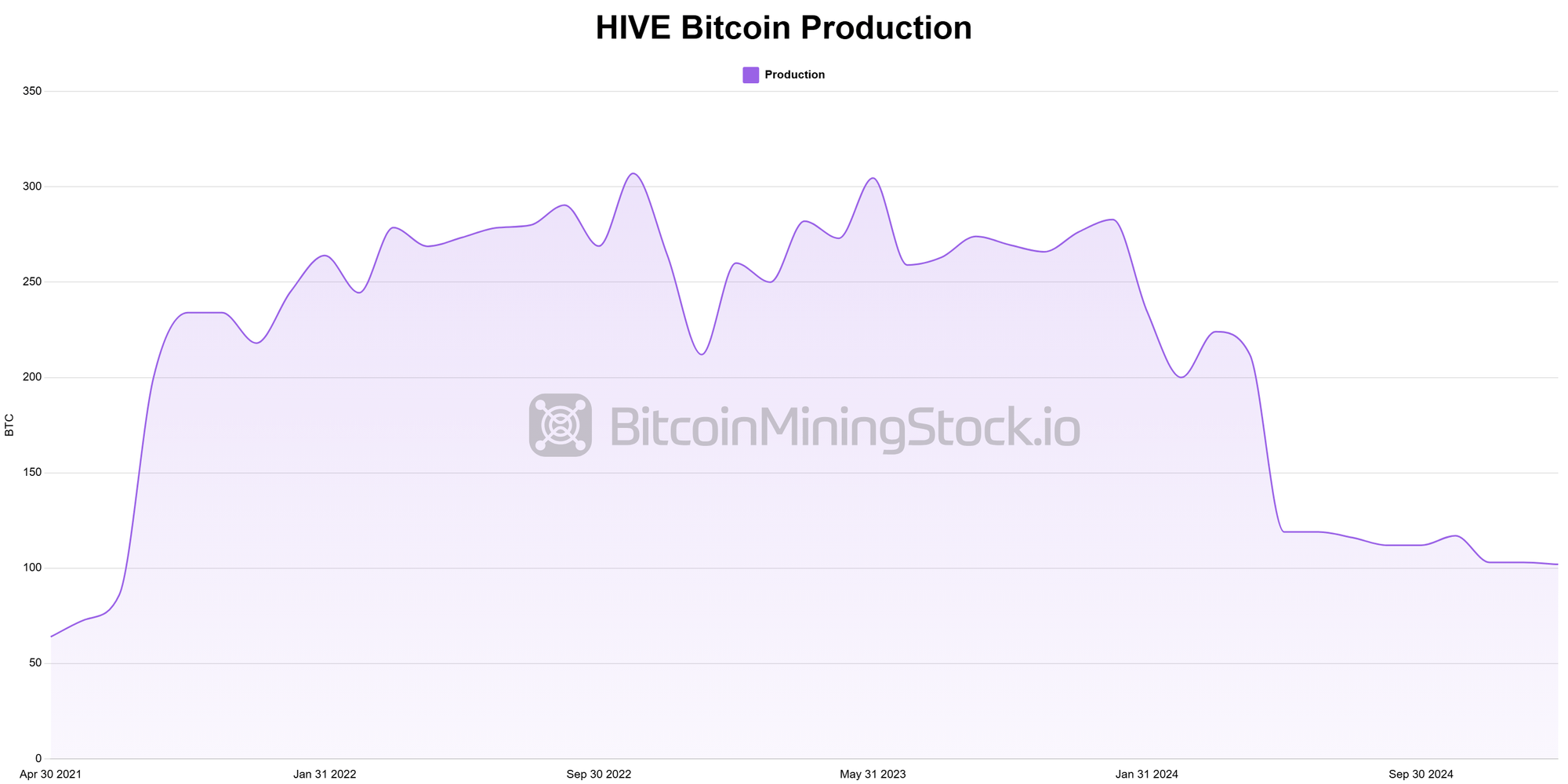

HIVE Digital Technologies’ fiscal Q3 2025 (Oct 1 – Dec 31, 2024) saw a decline in revenue compared to previous year. The primary factor of decline is less BTC production due to the Bitcoin halving event in April 2024. However, the company has a significant turnaround with net profit ($1.27 million vs -$6.95 million), benefiting from Bitcoin price appreciation, growing HPC business and cost optimizations.

Key Income Statement Metrics

- Revenue: $29.2 million (-6.5% YoY) vs. $31.3 million in Q3 2024. This decline was driven by a drop in Bitcoin mining revenue (-11.3% YoY) due to lower production (322 BTC vs. 830 BTC in Q3 2024), following the April 2024 Bitcoin halving. However, Bitcoin price appreciation and strong HPC revenue growth (+123.6% YoY, reaching $2.5M) helped offset the decline.

- Adjusted EBITDA: $17.3 million (vs. $17.4M in Q3 2024).

- Net Income: $1.3 million (vs. a $7.0 million net loss in Q3 2024). The swing to profitability was driven by a $6.9M gain on asset sales, $5.7M foreign exchange gain, and improved cost efficiencies, despite a lower gross margin compared to the previous year.

- Gross Margin: 21% (vs. 36% in Q3 2024), impacted by a sharp rise in network difficulty (99.9T vs. 64.1T YoY) and higher energy costs, particularly in Sweden, where tax policy changes led to increased electricity expenses.

- Bitcoin Production: 322 BTC (-61% YoY) vs. 830 BTC in Q3 2024. The Bitcoin halving event reduced mining rewards, despite improvements in HIVE’s overall hashrate and efficiency.

Historical data of public Bitcoin miners is now available on Bitcoinminingstock.io.

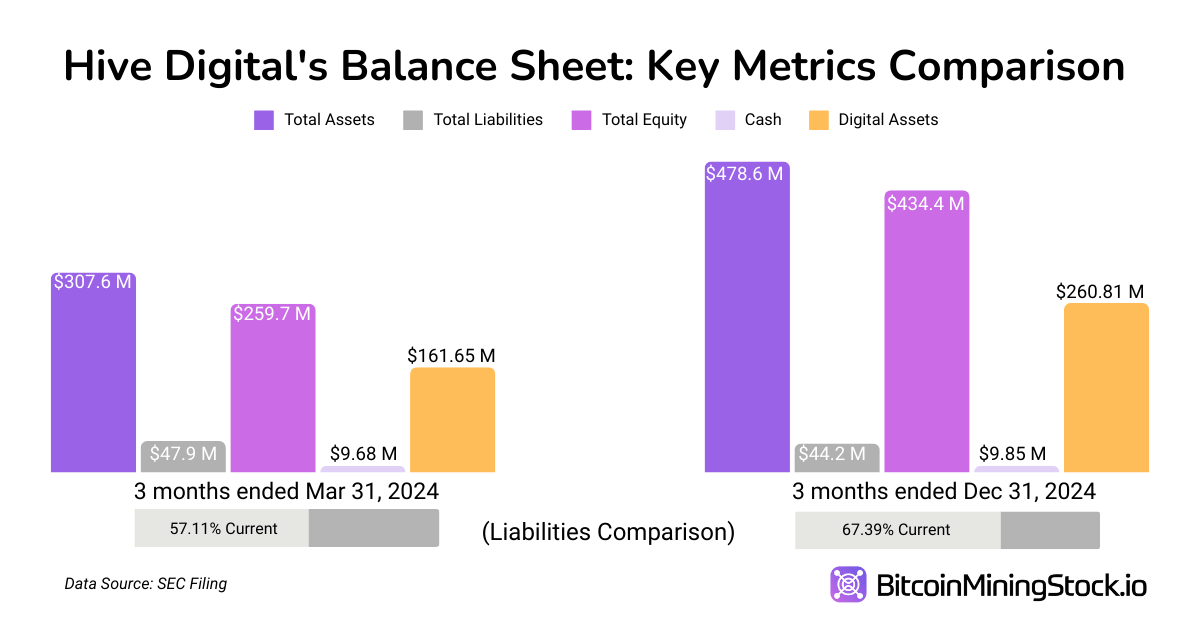

Key Balance Sheet Metrics (Three months ended December 31, 2024, vs. Three months ended March 31, 2024 )

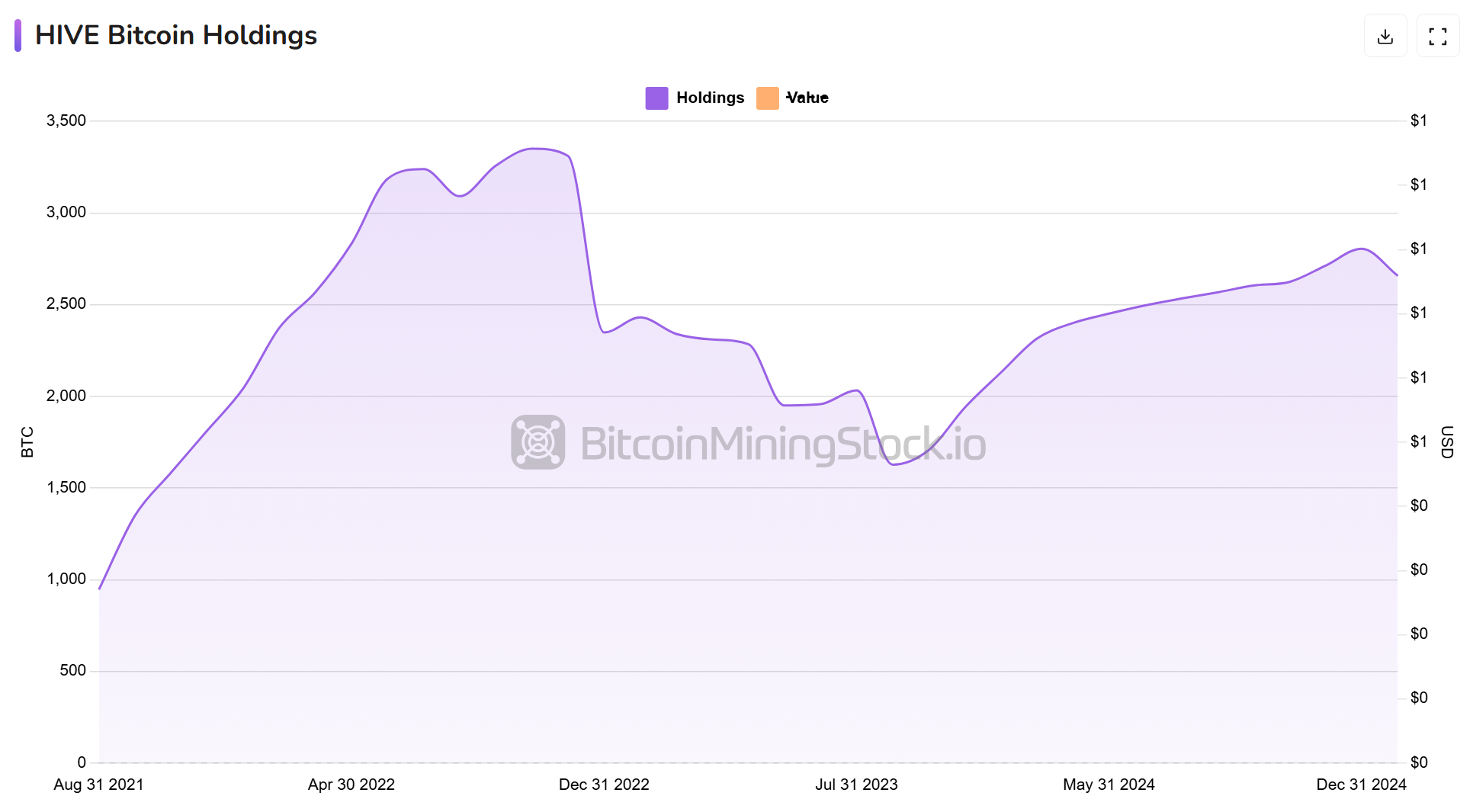

- Total Assets: $478.6 million (+55.6%) vs. $307.6 million. The increase was driven by higher Bitcoin holdings (2,805 BTC) and ongoing investments in mining infrastructure, particularly fleet upgrades and new data center expansions in Paraguay.

- Total Current Liabilities: $29.8 million (+8.8% ) vs. $27.4 million. The increase reflects higher short-term obligations linked to infrastructure investments.

- Long-term Liabilities: $14.4 million (-29.8%) vs. $20.5 million. The decrease is attributed to ongoing debt repayments, improving HIVE’s financial stability while maintaining sufficient liquidity for expansion.

- Stockholders’ Equity: $434.4 million (+67.3%) vs. $259.7 million. Growth in equity was fueled by successful equity offerings, higher asset valuations, and retained earnings.

- D/E Ratio: 0.10 (vs. 0.18 ). The company maintained a very low leverage, using equity raises rather than debt to fund expansion.

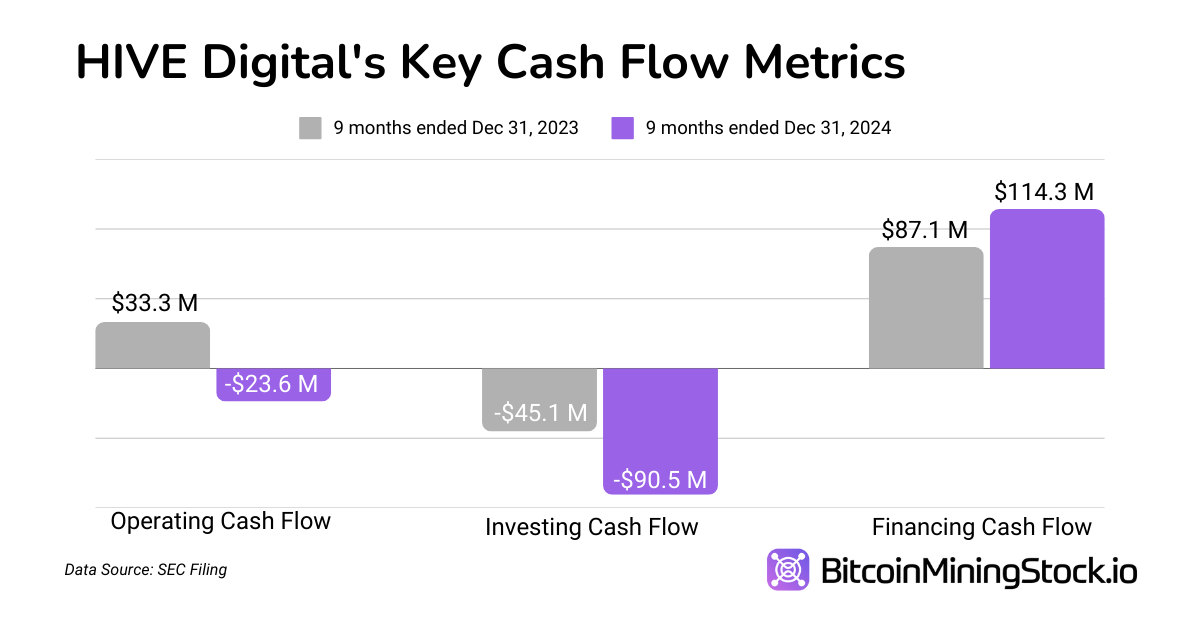

Key Cash Flow Metrics (Nine months ended Dec 31, 2024, vs. Nine months ended Dec 31, 2023)

- Operating Cash Flow: $23.6 million outflow (vs. $33.3M inflow). This shift to negative operating cash flow was due to lower BTC sales volume and higher working capital needs, as the company HODL’d Bitcoin rather than selling at lower prices.

- Investing Cash Flow: $90.5 million outflow (vs. -$45.1 million). HIVE doubled capital investments, allocating $59.6M for new mining equipment and acquiring the Boden 2 data center in Sweden, as part of its long-term expansion strategy.

- Financing Cash Flow: $114.3 million inflow (vs. $87.1M). HIVE raised $121.0M through equity offerings, while repaying $3.0M in loans, maintaining a strong cash position for upcoming infrastructure.

Main Valuation Metrics

Hive’s market cap currently stands at $385.4 million (Marketing closing on Dec 31, 2024). To better understand its valuation, we compare it against key financial metrics:

- Enterprise Value (EV): $158.97 million (Market Cap + Debt – Cash & Bitcoin Holdings). Hive trades at an EV per BTC mined of $89,834, close to BTC’s market price. If Hive successfully executes its expansion and HPC strategy, its current undervaluation presents a potential re-rating opportunity.

- EV/EBITDA Ratio: 7.6x ($158.97M / $20.7M)

- Shares Outstanding: 140.20M (+32%)

- EPS: $0.00988 (improving from previous −$0.0788)

- P/S Ratio: 13.2x ($385.4M / $29.2M)

- BTC Holding per Market Cap: 67.5%, meaning a large portion of its valuation is tied directly to BTC reserves.

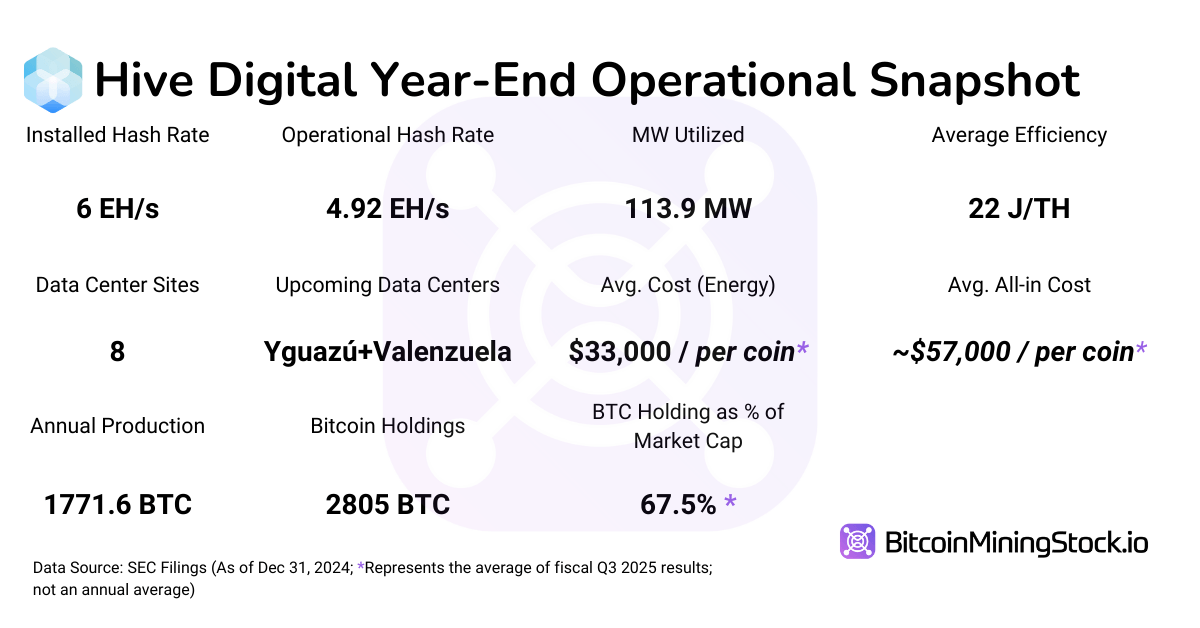

Operational Metrics: Hash Rate & Efficiency

Key Hash Rate & Efficiency Metrics:

- Hash Rate: 6 EH/s, with a target of 25 EH/s by September 2025.

- Fleet Upgrades: 11,500 units of Avalon A1566 ordered in Oct and Nov 2024 (6,500 of which has been deployed by Feb 11, 2025)

- Average Efficiency: 22 J/TH, expected to improve to 16.5 J/TH by September 2025.

- Direct Energy Cost Per BTC: $33,000

- Total Cost Per BTC (Including Depreciation & Financing): ~$57,000

Key Digital Assets Holding & Sales Data:

- Total Bitcoin Held: 2,805 BTC (unencumbered, mined with clean energy).

- BTC Sold During the Quarter: ~$8.4M vs. ~$30.7M in 2023

- Funding Operations: Equity financing of $121M instead of excessive BTC sales.

- Coins are stored with Fireblocks Inc., not on exchanges

- No pledge or staking on BTC holdings

*Hive still holds $371k worth of other coins (ETC+ others)

Strategic Moves

Bitfarms Site Acquisition in Paraguay: The Core Growth Engine

Acquiring Bitfarm’s facility is “a formative step towards our strategy to have 25 EH/s by September.” The deal includes a 200MW hydro-powered mining site (still under construction) in Yguazú, Paraguay.Upon completion, Hive’s operational capacity in Paraguay will total 300MW, which will be one of the largest Bitcoin mining operations in Latin America.

Management also has reinforced that Paraguay remains the company’s primary focus for scaling operations. As CEO Aydin Kilic stated, “We see opportunities in the U.S. due to a more favorable regulatory environment, but our primary focus remains on scaling operations in Paraguay for now.”

Expansion Roadmap:

- 100MW Yguazú Phase 1 (April 2025): Adding 6 EH/s.

- 100MW Valenzuela (June 2025): Adding 6.5 EH/s.

- 100MW Yguazú Phase 2 (September 2025): Adding 6.5 EH/s.

- Target fleet efficiency: 16.5 J/TH by September 2025.

Hive Digital’s Expansion Roadmap in Paraguay (screenshot from the company website)

Investment in HPC & AI Infrastructure: Small but Growing

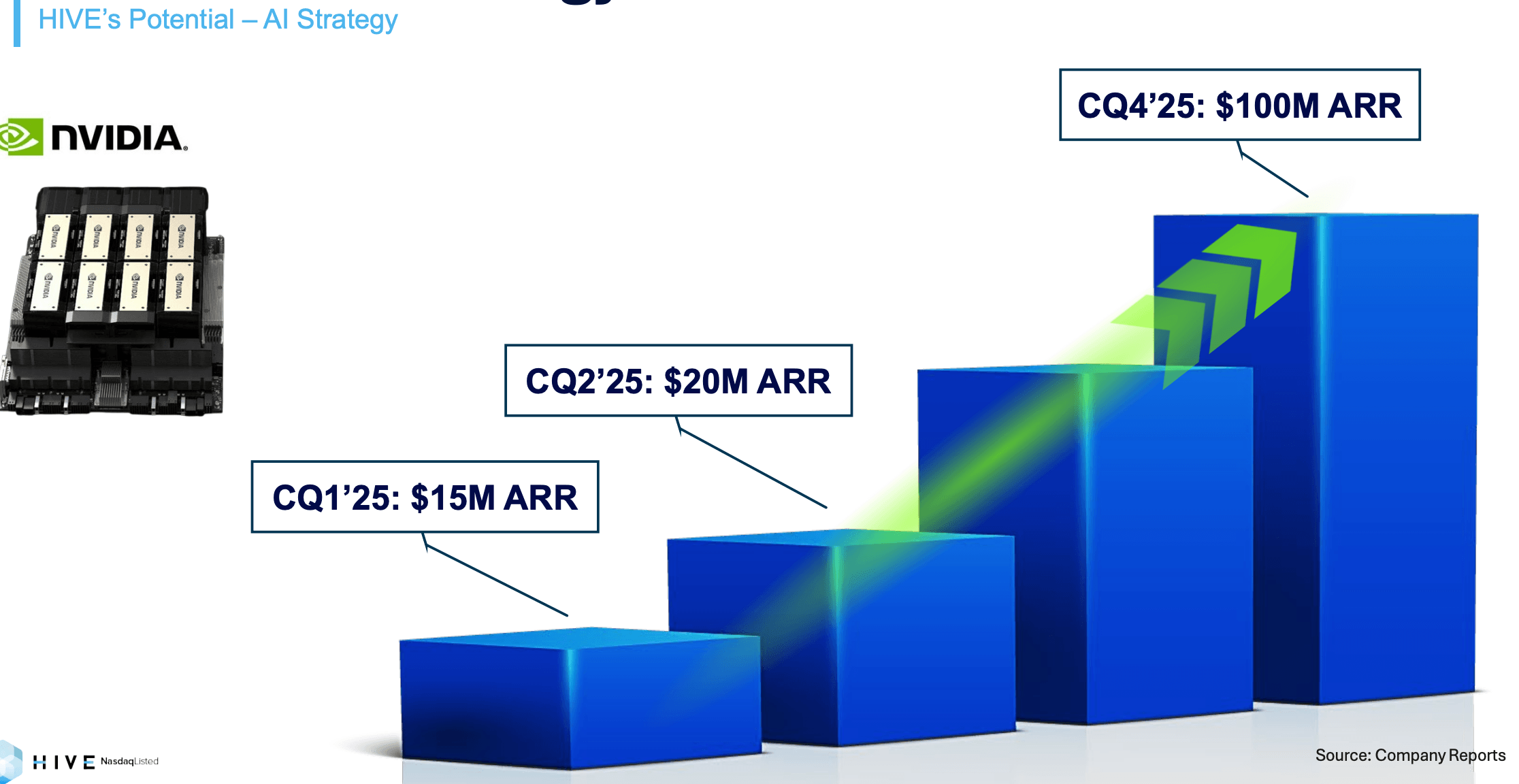

While still small, AI/HPC revenue is growing rapidly. Hive reached $2.5 million revenue in fiscal Q3 2025 (up 124% YoY) from its HPC operations, and the company projects to reach $20 million next quarter and $100 million annualized revenue by the end of 2025.

Hive’s HPC/AI Revenue Growth Projection (screenshot from the company presentation)

Current infrastructure:

- 4,000 GPUs in use (including NVIDIA A4000, A5000, A40, and H100 )

- 508 Nvidia H200 GPUs expected by Q1 2025 (add $9 million in top-line revenue once deployed)

- In preparation to position themselves for next-generation liquid-cooled Nvidia Blackwell GPUs

- Nvidia Cloud Partner status secured, improving credibility.

Unlike peers who focus on partnerships with hyperscalers, Hive plans to rent directly to end-users for LLM computations through on-demand marketplace aggregators, in addition to offering HPC hosting. This business segment continues to develop and expand.

Other Notable Changes:

- Head office relocation to San Antonio, Texas. According to Frank Holmes, the Executive Chairman, “HIVE feels safer operating in the U.S., given the shift in government support toward Bitcoin mining, blockchain networks, and self-custody of digital assets.”

- Transitioning to the U.S. GAAP reporting in fiscal year-end March 31st to improve transparency and comparability with other Bitcoin miners.” Personally I really like this move as it will help standardize financial reporting and make cross-company analysis more reliable.

For example, HIVE’s latest investor presentation highlights “best-in-class ROIC” and the “lowest corporate G&A,” but my manual calculations yield different results. The main difference is that HIVE uses adjusted non-IFRS metrics, excluding costs such as depreciation, stock-based compensation, and Bitcoin fair value adjustments, which can present a more favorable financial picture.

To ensure objective comparisons, this report excludes such metrics and focuses on standardized financial data. The transition to GAAP should enhance clarity for investors assessing HIVE against its industry peers.

Final Thoughts

Hive offers a dynamic blend of bitcoin mining and HPC services, positioning it for both substantial growth and inevitable volatility. From a balance sheet perspective, the company remains financially conservative with a low D/E ratio, but it does rely heavily on equity raises to fund its capital-intensive expansion plan (4x by September 2025). Its development in Paraguay could significantly increase mining capacity and position it among the top 10 public miners in terms of size, enhancing its industry visibility. Combined with the shift to U.S. GAAP reporting and the relocation of headquarters to Texas, this transition may help attract investors seeking regulatory clarity and transparency.

HIVE’s Bitcoin mining business presents both strengths and challenges. The company currently benefits from a lower average Bitcoin production cost, even in comparison to CleanSpark, one of the most efficient miners. With improved fleet efficiency, greater scale, and access to lower electricity costs in Paraguay, its mining operations could become more competitive across the industry. However, the development of its Paraguay sites is subject to potential delays from unforeseen circumstances, and Bitcoin’s price remains highly volatile. Given its current low gross margin, any downturn in Bitcoin’s price could put significant pressure on profitability.

At the same time, HIVE’s HPC business, though still a small contributor, is gaining traction and has the potential to become a meaningful revenue driver. The company is actively expanding this segment by introducing new cloud service offerings and scaling its AI computing operations. If HIVE successfully attracts high-value AI customers and reaches its goal of $100 million in annualized revenue by the end of 2025, its HPC business could provide a stable, high-margin revenue stream, helping to offset the volatility of Bitcoin mining. However, this target is highly ambitious, as the company generated only $8.84 million from HPC in 2024, meaning it would need to grow nearly 10x within a year.

For investors with a high tolerance for risk—particularly those optimistic about long-term Bitcoin price trends and the evolving AI ecosystem—HIVE may be an attractive high-risk, high-reward speculative opportunity. However, its success will depend on the Bitcoin price, the effective execution of its expansion plans in Paraguay, and the growth of its HPC business. Investors should closely monitor these factors, as they will be crucial in determining HIVE’s future performance.

[ad_2]