[ad_1]

Defying skeptics, Bitcoin (BTC) has nearly reached the once-unimaginable $100,000 milestone after trading at $0.0009 in 2009. Just a few years ago, only the most optimistic in the industry could have envisioned Bitcoin nearing $100,000—but now, that vision remains within striking distance despite a pullback from above $99,000 late last week.

Let’s examine past Bitcoin all-time high cycles and how the current stage compares in its growth trajectory. Understanding the patterns behind Bitcoin’s all-time high behavior is key to predicting whether history might repeat itself.

The real question is: will it repeat? Or are we at a unique moment—akin to futurist Ray Kurzweil’s vision of AI surpassing human intellect? What if Bitcoin, like AI in that scenario, has entered uncharted territory, challenging us to imagine a future beyond our current understanding?

Table of Contents

Bitcoin’s boom-and-bust cycles: a historical overview

Bitcoin’s price history has been defined by sharp rises to new all-time highs, followed by significant corrections. Here’s an overview of notable ATHs and their aftermath.

Let’s start with 2013, when the king of crypto hit $266 in April, only to fall by about 75% to around $65 within a matter of weeks. Later that year, it skyrocketed to $1,150 in December before entering a prolonged bear market, dropping by about 85% to $170 by January 2015. Market speculation, regulatory uncertainty, and the collapse of Mt. Gox were said to have driven that kind of price action.

Continuing along the road of peaks and troughs, in December 2017, Bitcoin reached an astonishing all-time high of $20,000, fueled by a frenzy of retail investment and the booming popularity of Initial Coin Offerings.

However, this was followed by a sharp correction, with Bitcoin plummeting by 84% by December 2018. Like a house of cards, the ICO bubble came crashing down as projects’ unrealistic promises went unfulfilled, leaving investors down in the dumps—pumped by hype only to be dumped as schemes unraveled.

While pump-and-dump schemes played a significant role, they were only part of the problem. What initially appeared to be a rapidly expanding market quickly turned unhealthy as the Securities and Exchange Commission declared many ICOs to be unregistered securities, leaving even standout ventures struggling to stay afloat.

Combined with market oversaturation and investor fatigue, these factors collectively led to the collapse of the once-booming ICO market. This correction not only wiped out billions of dollars in value but also dragged Bitcoin’s price to levels unseen since the previous cycle, leaving it at $3,200 by the end of 2018.

That kind of market exhaustion following the rapid growth contributed to the prolonged bear market, later labeled as the ‘crypto winter,’ which lasted until mid-2020, when Bitcoin and other cryptocurrencies began their next significant rally.

However, despite the severity of the downturn, it appeared to be a blessing in disguise, as the bear market encouraged serious projects to focus on building and refining blockchain technology. During that period, the groundwork was laid for innovations like decentralized finance and non-fungible tokens , which would emerge in later cycles.

In 2021, Bitcoin experienced a rollercoaster of highs and lows, marked by two significant all-time highs and sharp corrections. In April, Bitcoin reached an ATH of $64,000, backed by growing institutional adoption and excitement around the crypto market.

However, by July, it had plummeted 50% to $30,000, driven by profit-taking and concerns over regulatory crackdowns. The market rebounded later in the year, hitting another ATH of $69,000 in November, but this was short-lived.

A prolonged bear market followed, with Bitcoin declining 77% to $15,500 by November 2022. As we can see, external shocks consistently play a role in puncturing Bitcoin’s speculative bubbles. The 2021-2022 crash was a perfect storm of rising interest rates combined with spectacular crypto industry collapses, such as those of Terra and FTX.

It was a repeat of history once more, with the post-2022 bear market focusing on regulatory clarity, layer-2 solutions, and institutional-grade infrastructure, preparing the industry for the current growth phase.

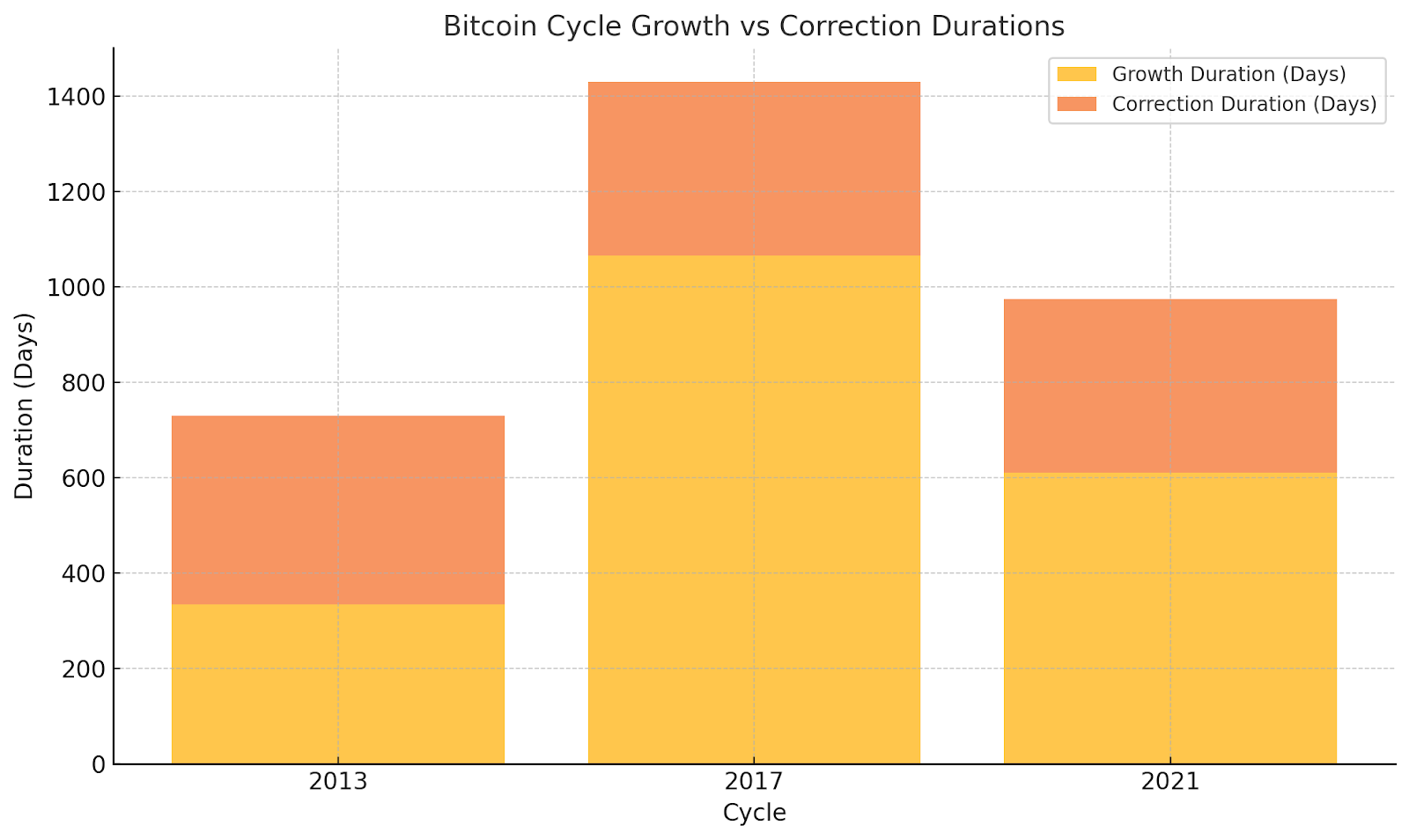

Bitcoin’s growth cycles progressively lengthened, with durations increasing from 334 days in 2013 to 1,065 days in 2017 and 610 days in 2021. Similarly, correction periods showed consistency at around one year for recent cycles, reflecting a trend toward longer and more stable market phases as the cryptocurrency market matures.

Though corrections remained steep, the magnitude of swings was decreasing as institutional players started to stabilize the market.

What sets the current cycle apart?

So, what are we witnessing now? Once dismissed as a scam, a fad, or something Wall Street would never touch, Bitcoin is now proving its critics wrong. There’s a clear shift in the Bitcoin narrative from being a speculative asset to becoming ‘digital gold’ or a long-term store of value.

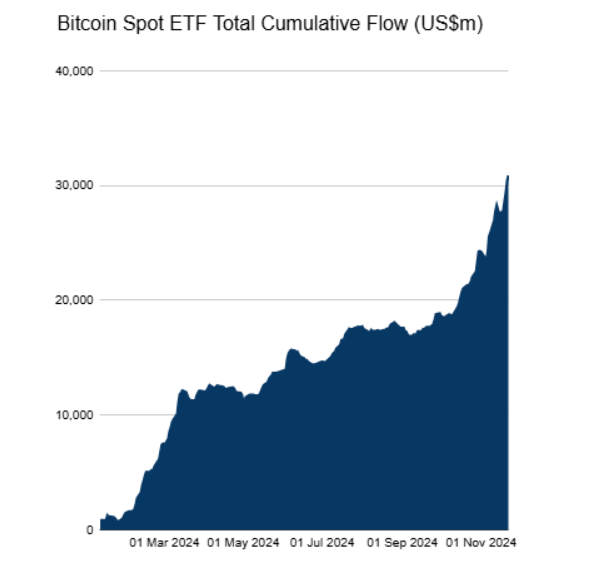

In November 2024 alone—and the month isn’t even over yet—spot Bitcoin ETFs have already attracted an astounding $30.814 billion in cumulative net inflows from BlackRock, Fidelity, Valkyrie, VanEck, Invesco, Bitwise, Franklin Templeton, WisdomTree, and ARK Invest.

These ETFs have demonstrated significant daily activity, with BlackRock leading the pack, accumulating $31.333 billion over the month, followed by Fidelity with $11.538 billion and Bitwise at $2.432 billion. Their presence has greatly reduced volatility and contributed to market stability.

Bitcoin spot ETF total cumulative flow | Source: Faside Investors

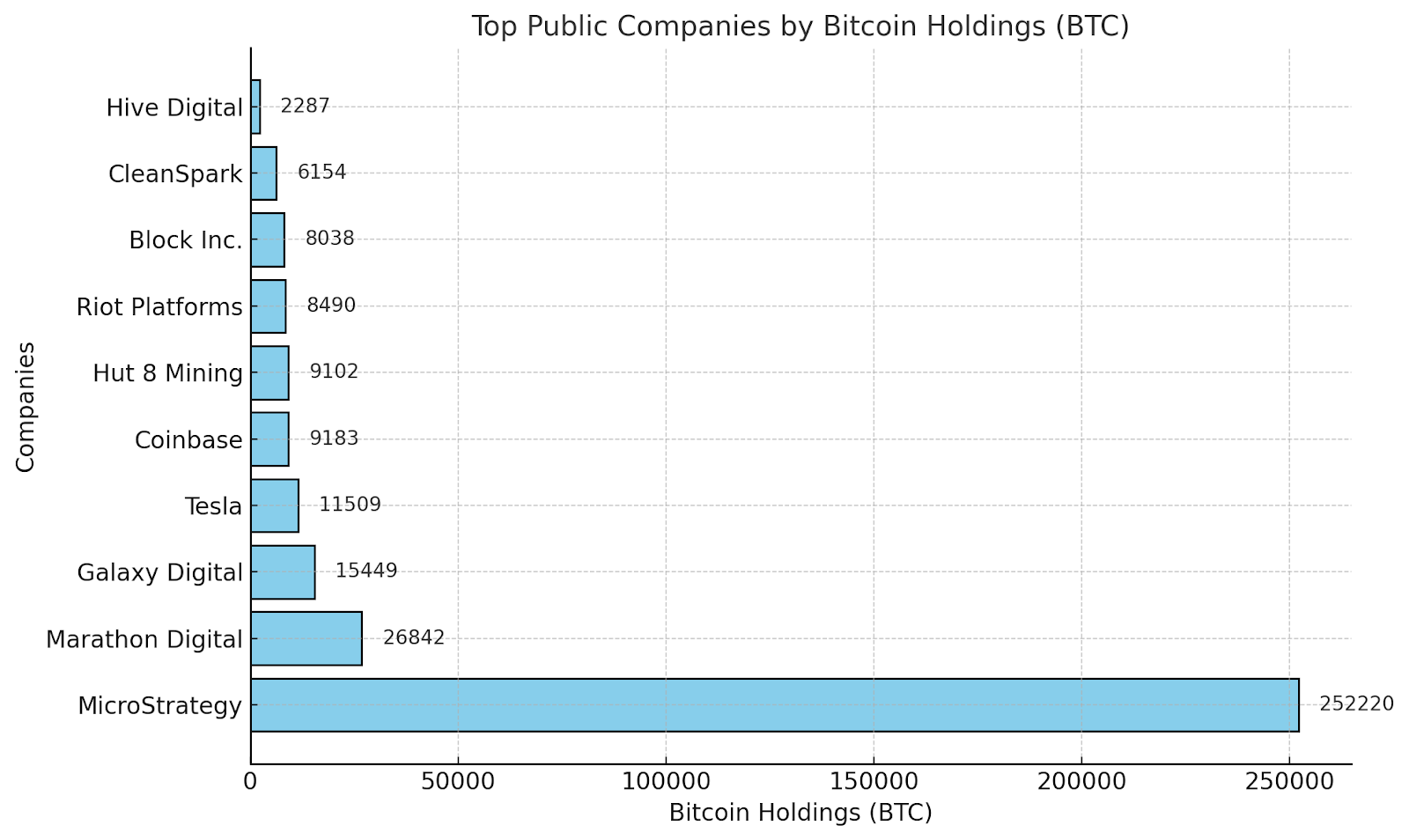

Additionally, public companies are increasingly incorporating Bitcoin into their corporate treasuries. Collectively, public companies—primarily U.S.-based corporations—now hold 361,991 BTC, which represents 1.83% of Bitcoin’s total supply, valued at approximately $34.76 billion, according to CoinGecko data.

MicroStrategy remains the clear leader, holding an impressive 252,220 BTC, accounting for over 70% of the total Bitcoin owned by public companies and representing 1.201% of Bitcoin’s total supply.

Following MicroStrategy, Marathon Digital Holdings ranks second with 26,842 BTC, while Galaxy Digital Holdings holds 15,449 BTC in third place. Tesla remains a significant player in fourth position with 11,509 BTC.

Top public companies by BTC holdings| Data sourced from CoinGecko

According to the Sygnum Future Finance 2024 survey, institutional investors are increasingly viewing digital assets as a critical component of their portfolios, with 57% planning further allocations and 81% seeking better information to guide their strategies.

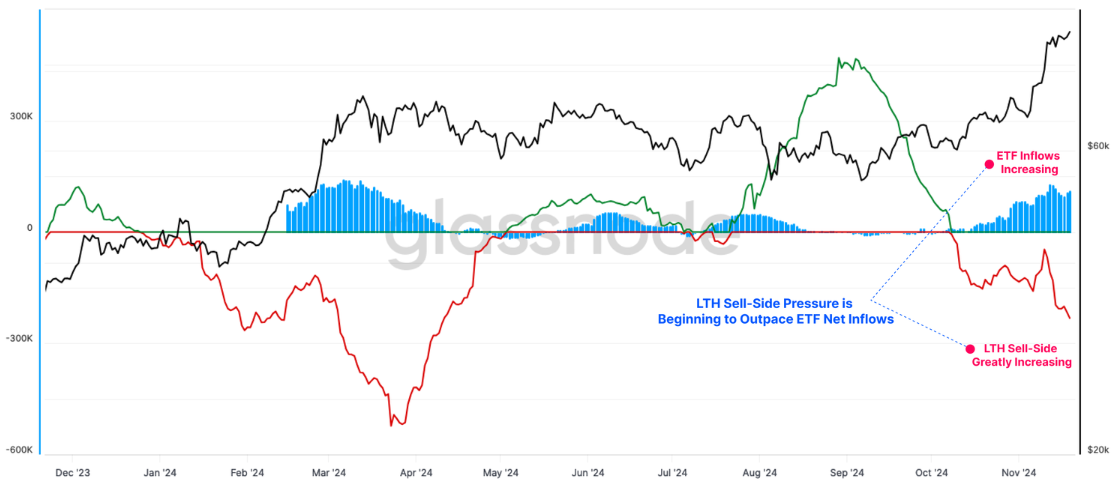

The Glassnode report emphasizes how institutional capital inflows, particularly through U.S. Spot ETFs, are reshaping the Bitcoin market by stabilizing price movements and absorbing sell pressure. Over the past 30 days, ETFs absorbed 128,000 BTC, accounting for 93% of the 137,000 BTC sold by long-term holders during this period. Weekly inflows into Bitcoin ETFs have surged to $1–2 billion, playing a pivotal role in maintaining liquidity and supporting the rally to $93,200.

Bitcoin long-term holder & US spot ETF balances position change | Source: Glassnode

However, as long-term holders still control 14 million BTC, their elevated profit-taking activity poses a challenge to institutional demand, which will be critical in determining whether the current rally can sustain its momentum.

The Bitcoin road to $100,000

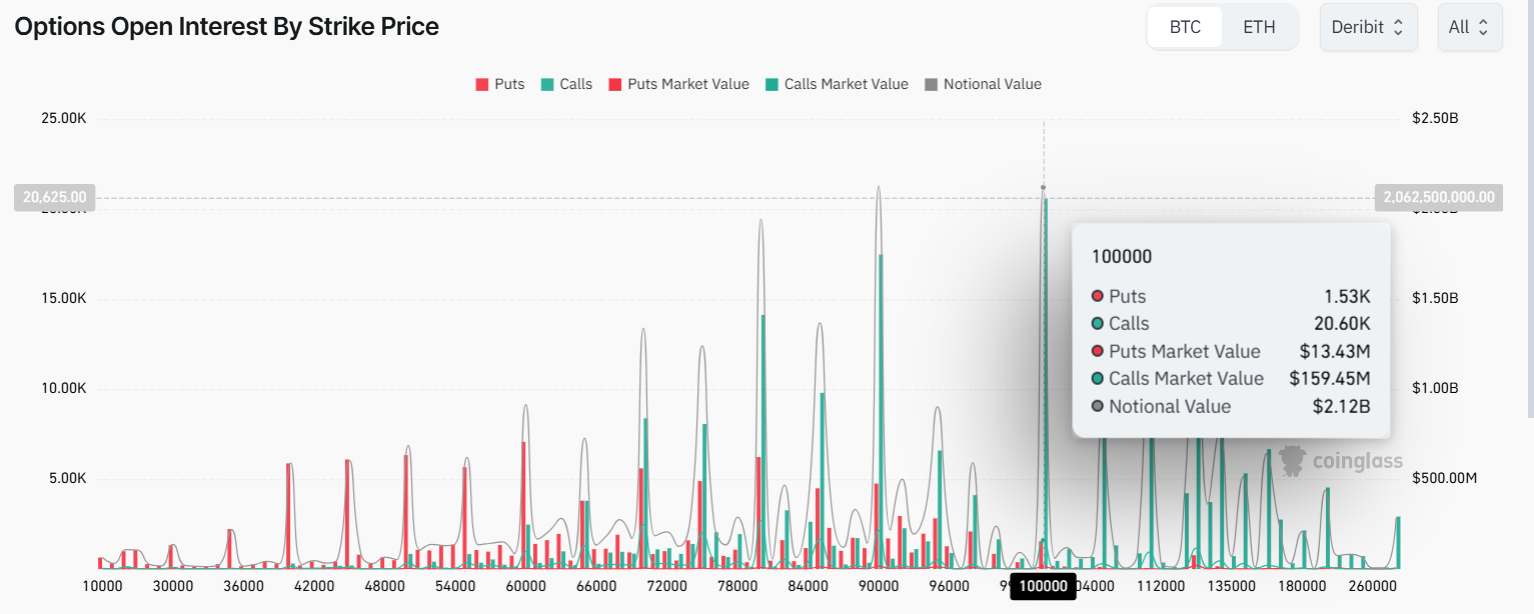

Based on Bitcoin options data, the open interest reflects a strong focus on high strike prices, with significant activity concentrated at the $100,000 and $120,000 levels. At the $100,000 strike price, the open interest shows 20.60K call options compared to 1.53K put options, indicating a strong bullish sentiment.

The calls market value stands at $159.45 million, significantly outweighing the puts market value of $13.43 million, with a total notional value of $2.12 billion.

Bitcoin options interest by strike price | Source: CoinGlass

Similarly, the $120,000 strike shows 18.31k call options versus 764.5 put options, with a total notional value of $1.83 billion and calls market value at $115.29 million. The overwhelming prevalence of calls at these high strike prices continues to reflect strong market optimism in Bitcoin’s ability to reach or exceed these levels.

Closing thoughts

Bitcoin’s journey toward the $100,000 mark showcases a remarkable evolution, blending historical patterns with unprecedented levels of institutional adoption and market maturity.

The impressive milestones reached—such as $30.814 billion in inflows into Bitcoin ETFs this November, the significant accumulation of 361,991 BTC by public companies, and the $2.12 billion in open interest at the $100,000 strike price—highlight a market evolving beyond speculation into a credible asset class.

Whether Bitcoin’s rally is fueled by repeating history or creating it anew, one thing is certain: the road to $100,000 is no longer a question of “if” but “when.” The real question is to what extent the world can go in embracing it as it continues to challenge the foundations of traditional systems.

[ad_2]