During Tuesday’s U.S. market session, the crypto market experienced a slight relief rally as Bitcoin bounced back above $95k. The surge in buying pressure bolstered most major altcoins, including Ethereum, to seek stable support. However, onchain data shows significant ETH transfer to exchange by major firms, signaling a potential sell-off and prolonging correction ahead.

Currently, the ETH price trades at $3,492 with an intraday gain of 2.18%. According to Coingecko, the global crypto market cap is at $419.5 Billion, while the 24-hour trading volume is at $28.2 Billion.

Key Highlights:

- Ethereum price breakdown from a double-top reversal pattern signals a possible correction to $2,900.

- Cumberland and Nexo have collectively deposited over $435 million worth of Ethereum to centralized exchanges (Coinbase and Binance) in December.

- The price sustainability above the 50% Fibonacci retracement level indicates that buyers are the dominant player in the market.

Institutional ETH Transfers Spark Concerns of Bearish Market Trends

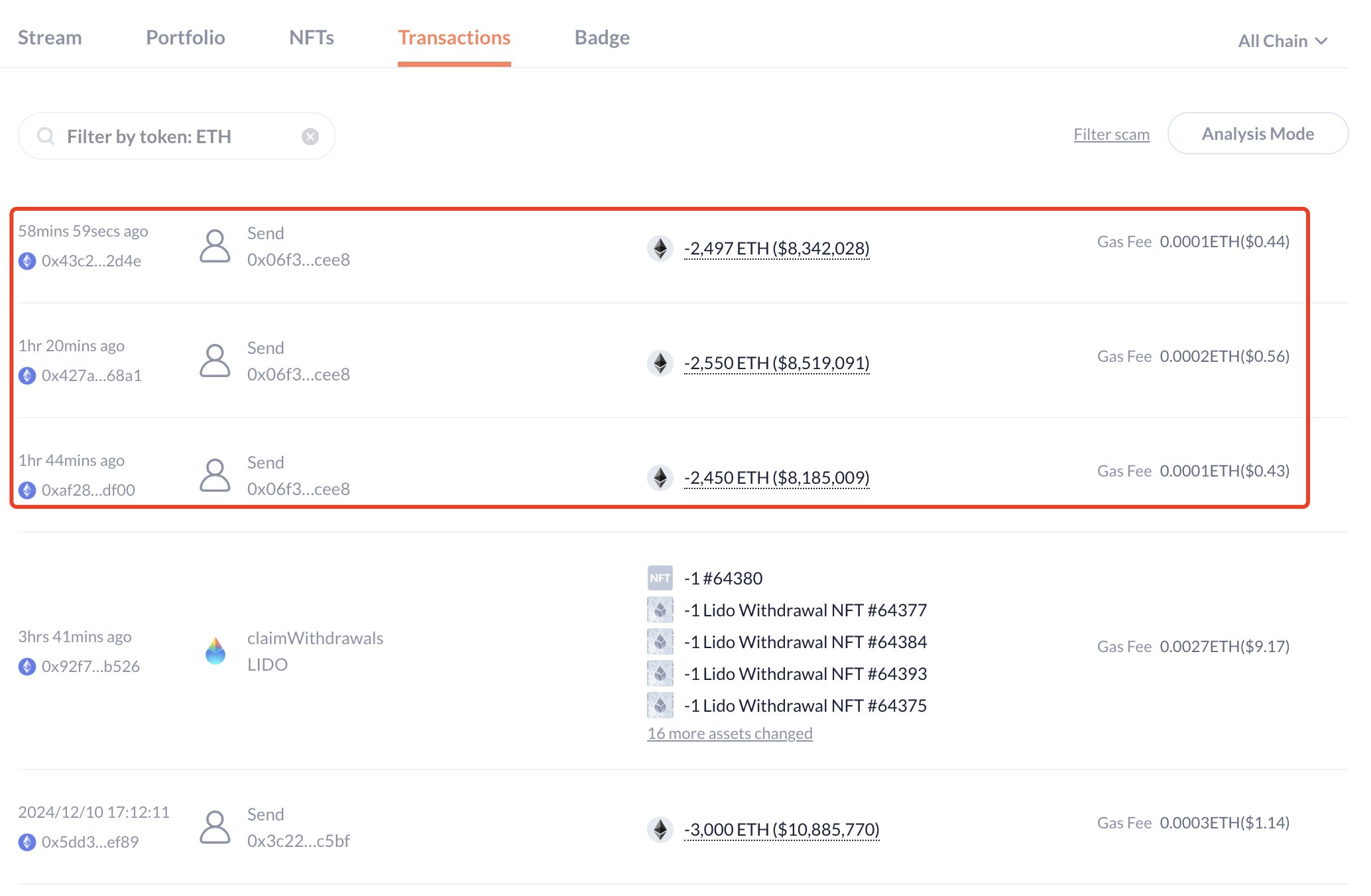

Blockchain analytics platform Lookonchain reported that Cumberland, a renowned trading firm, deposited 16,201 ETH (valued at $55 million) to Coinbase in a series of transactions on December 24.

The transaction breakdown shows multiple deposits, including 5,000 ETH, 5,601 ETH, and 5,600 ETH.

Lookonchain

Another onchain data shows crypto lending platform Nexo has deposited a staggering total of 101,756 ETH (approximately $380 million) into Binance since December 2. The average price of these deposits is reported at $3,737 per ETH. As of today, Nexo added another 7,495 ETH (valued at $25 million) to Binance.

Lookonchain

This significant movement of assets into a centralized exchange suggests that major institutions might be positioned to sell or trade these assets, potentially accelerating a bearish market sentiment.

Ethereum Price Faces Key Decision Point at $3,500 Neckline

On December 19th, the Ethereum price gave a bearish breakdown of the $3,500 neckline of the double top pattern. The chart setup is commonly spotted at a major market top, showcasing two sharp reversals as a signal for intense overhead supply.

However, the breakdown fall tested 50% FIB level and 100-day EMA at $3,200 before reverting to the neckline for potential resistance. If the daily chart price action shows sustainability below $3,500, the ETH price could plunge 16.8% to seek support at $2,900.

On the contrary, the Ethereum price bounce back above $3,500 will invalidate the bearish thesis and reattempt for a $4,000 breakout.

Also Read: Ethereum, XRP & Other Altcoins Poised For Major Rally as BTC Consolidates