Ethereum ($ETH) now trades below the average entry levels of both accumulation addresses and exchange-traded fund (ETF) holders, leaving a significant portion of major holders underwater.

Yet current data points to continued structural commitment rather than broad exit activity, suggesting that capital remains engaged despite the drawdown.

Ethereum’s Decline Pushes Major Buyers Into Unrealized Loss Territory

Ethereum has extended its losses in 2026, shedding more than 30% year-to-date amid a broader crypto market downturn. The second-largest cryptocurrency by market capitalization fell below the $2,000 level last week. Although it briefly recovered that mark, the rebound proved short-lived, and $ETH has once again slipped beneath it.

According to BeInCrypto Markets data, Ethereum declined 4.58% over the past 24 hours. At press time, it was trading at $1,971.

Ethereum ($ETH) Price Performance. Source: BeInCrypto Markets

The price weakness has pushed many holders underwater. BeInCrypto previously reported that BitMine, the world’s largest Ethereum treasury, saw its unrealized losses swell to $6 billion last week. With the recent drawdown, those paper losses have now climbed to more than $7 billion, according to CryptoQuant data.

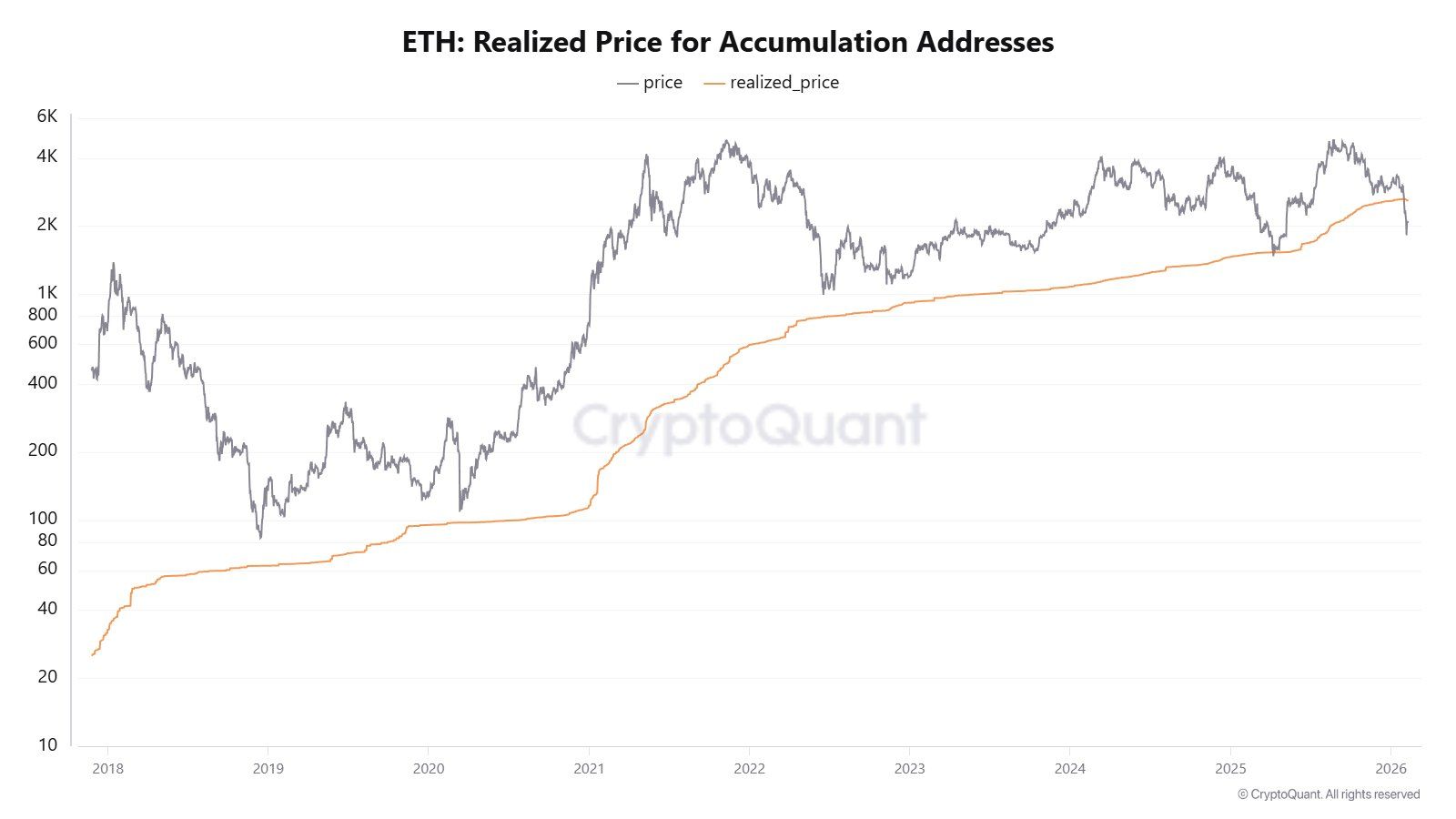

Moreover, on-chain data suggests that accumulation cohorts are under strain. In a recent post, a pseudonymous analyst, CW8900, noted that Ethereum has fallen below the realized price of accumulation addresses.

Large-scale whale accumulation began in June 2025. The current market price is now below the average level at which those wallets started building positions.

Ethereum Below The Realized Price of Accumulation Addresses. Source: CryptoQuant

At the same time, ETF investors are also under increasing pressure. James Seyffart, Senior Research Analyst at Bloomberg Intelligence, highlighted that Ethereum ETF holders are currently in a worse position than their Bitcoin ETF counterparts.

With $ETH hovering below $2,000, the asset trades well below the estimated average ETF cost basis of approximately $3,500.

“The drawdown went beyond 60% at the most recent bottom, which was roughly equivalent to the % drawdown we saw for $ETH in April of 2025,” Seyffart added.

Ethereum Drawdown Tests Investor Conviction

Despite the sharp downturn, investor confidence has not fully eroded. Analyst CW8900 noted that whales have not stepped back from the market and are still adding to their Ethereum positions.

“Their accumulation is proceeding even more aggressive. The current price will likely appear attractive to $ETH whales,” the analyst said.

BeInCrypto also reported that Ethereum’s exchange net position change indicator has turned negative. This means more $ETH is being withdrawn from exchanges than deposited. Such a pattern is typically associated with accumulation.

Meanwhile, Seyffart emphasized that most ETF investors have remained in place despite the drawdown. Net inflows into Ethereum ETFs have declined from roughly $15 billion to below $12 billion.

While this represents a sharper relative selloff compared to Bitcoin ETFs, he noted that the majority of ETF holders are still holding their positions.

“This is a much worse selloff than the Bitcoin ETFs on a relative basis but still fairly decent diamond hands in grand scheme (for now),” the analyst remarked.

BitMine further exemplifies this institutional optimism. The firm purchased 40,000 $ETH yesterday. Furthermore, Lookonchain reported that it staked another 140,400 $ETH.

This brings its total staked holdings to 2.97 million $ETH, valued at $6.01 billion. This accounts for 68.7% of Bitmine’s total $ETH, indicating a commitment to long-term network involvement rather than short-term trading.

For now, Ethereum appears to be in a phase of compressed conviction: prices reflect stress, but capital behavior suggests that major participants are choosing to hold and, in some cases, accumulate.

Whether that resilience translates into a durable recovery will likely depend on broader market conditions and Ethereum’s ability to reclaim key technical levels in the weeks ahead.

The post Ethereum’s 30% Slide Puts Big Money in the Red: Here’s What They’re Doing Next appeared first on BeInCrypto.