[ad_1]

The potential approval of a Litecoin ETF in the United States is gaining attention following recent developments. Canary Capital, which filed the initial S-1 registration for its Litecoin ETF proposal in October 2024, has now submitted an amended version. This filing and industry insights point toward possible engagement from the U.S. Securities and Exchange Commission (SEC).

Amended Filing Indicates Progress in Litecoin ETF Proposal

The amended S-1 filing outlines key operational details for the proposed Litecoin ETF. U.S. Bancorp Fund Services is identified as the fund administrator, while Coinbase Custody Trust and BitGo would serve as custodians for the Litecoin held by the ETF.

Industry analysts, including Bloomberg’s Eric Balchunas, believe this amendment may indicate the SEC has provided feedback on the application. Fellow Bloomberg ETF analyst James Seyffart noted the absence of a 19b-4 filing, which formally initiates the SEC’s decision-making process. Despite this, the updated filing suggests that the application process is advancing.

https://x.com/JSeyff/status/1879659953822347736

Leadership Transition at the SEC Introduces Uncertainty

The timing of the Litecoin ETF’s approval process could hinge on upcoming changes in SEC leadership. Current SEC Chair Gary Gensler is set to step down, with former commissioner Paul Atkins nominated as his replacement. Atkins has previously supported cryptocurrency initiatives, but his Senate confirmation remains pending.

Analysts consider this leadership transition a critical variable in the approval process. Balchunas noted that leadership changes often bring shifts in regulatory focus, potentially impacting the timeline for ETF decisions.

Following the announcement of the amended filing, Litecoin experienced a price surge of over 18%, reaching $119.46. Open interest also rose by 29.58%, hitting $575.39 million, while trading volume increased by 277.25% to $1.65 billion within 24 hours. Analysts predict Litecoin could surpass the $130 level, with a potential price target of $170 in the near term.

The interest in Litecoin ETFs mirrors the broader growth of spot cryptocurrency ETFs in the U.S. market. Recent approvals of Bitcoin and Ethereum ETFs have sparked interest in altcoin ETFs, including those for Solana and XRP. A research note from JPMorgan and Hashkey projects that new Solana and XRP ETFs could attract $13.6 billion in investments within six to 12 months.

Litecoin’s Stability and Institutional Appeal

Litecoin’s established reputation for security and stability strengthens its case for ETF approval. Since its inception, Litecoin has maintained 100% uptime, a factor emphasized in Canary Capital’s original filing. This track record enhances its appeal to institutional investors, who prioritize reliability in cryptocurrency investments.

The approval of a Litecoin ETF could contribute to increased institutional participation in the cryptocurrency sector. By providing regulated exposure to Litecoin, the ETF would enable traditional investors to engage with the asset while mitigating risks associated with direct cryptocurrency holdings.

Next Steps for the Litecoin ETF Proposal

While the amended S-1 filing marks progress, the approval timeline remains uncertain. Submitting a 19b-4 application would officially initiate the SEC’s rule-change process. However, Canary Capital has not disclosed when to file this document.

Market participants are closely watching for the SEC’s next move, which will likely determine the pace of the approval process. If approved, the Litecoin ETF would join a growing list of cryptocurrency ETFs, potentially paving the way for more altcoin-focused investment products.

Ethereum ETF Records Gains

While Litecoin ETF is on the verge of approval, the dominant ETF market has recorded different market movements. As of January 17, data from SoSoValue indicates that Ethereum Spot ETF’s daily net inflow across these ETFs was $23.87 million, contributing to a cumulative total net inflow of $2.66 billion. The total value traded reached $393.43 million, while the total net assets stood at $12.66 billion, representing 2.99% of Ethereum’s market capitalization.

Source: SoSoValue

Grayscale’s ETHE leads in net assets with $4.89 billion, though it recorded no net inflow for the day. The ETF showed a 5.59% daily price increase, trading at $29.49 with a volume of 3.50 million. BlackRock’s ETHA followed with $4.04 billion in net assets and a daily net inflow of $7.38 million. It recorded a daily price increase of 5.54%, trading at $26.69 with a volume of 7.87 million.

Other ETFs like Fidelity’s FETH saw $3.99 million in daily inflows and $1.50 billion in net assets, trading at $35.22. Smaller ETFs like Franklin’s EZET and Invesco’s QETH reported daily net inflows of $24.67 million and $18.32 million, respectively. All ETFs recorded price gains above 5.4%, with cumulative activity reflecting strong investor interest.

What About Bitcoin ETFs?

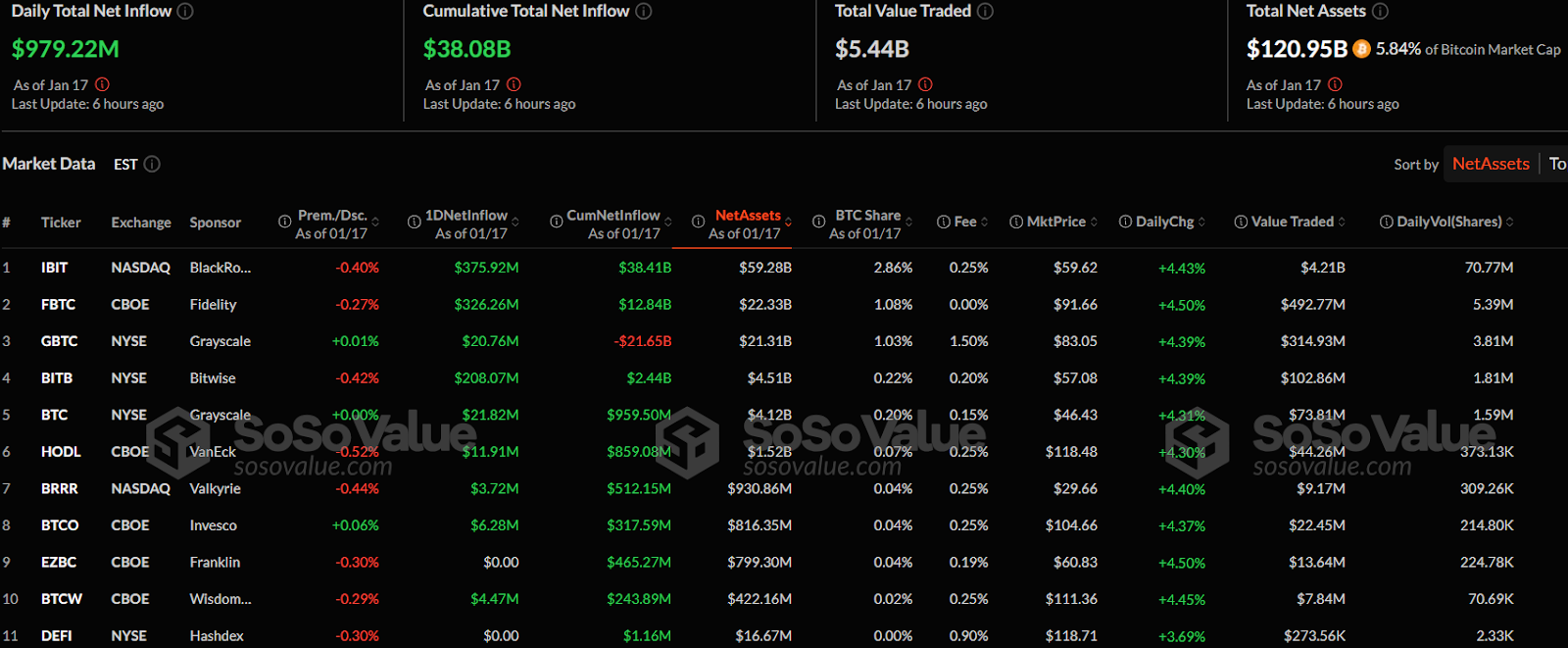

Bitcoin has not been left behind. The daily net inflow totaled $979.22 million, contributing to a cumulative inflow of $38.08 billion. The total value traded for the day reached $5.44 billion, with total net assets amounting to $120.95 billion, representing 5.84% of Bitcoin’s market capitalization.

Source: SoSoValue

BlackRock’s IBIT ETF leads in net assets with $59.28 billion, showing a daily net inflow of $375.92 million. Its daily price increased by 4.43%, trading at $59.62, with a trading volume of 70.77 million shares. Fidelity’s FBTC ETF follows with $22.33 billion in net assets and a daily inflow of $326.26 million. It recorded a 4.50% price increase, trading at $91.66 with 5.39 million shares traded.

Grayscale’s GBTC ETF holds $21.31 billion in net assets, with a 4.39% daily price increase, trading at $83.05. Bitwise’s BITB ETF reported $208.07 million in daily inflows, totaling $4.51 billion in net assets, trading at $57.08. Other ETFs, including VanEck’s HODL and Invesco’s BTCO, experienced smaller daily inflows but recorded price increases above 4.3%.

Developing a Litecoin ETF represents a significant milestone in the evolution of cryptocurrency investment opportunities. The combination of an amended filing, market response, and institutional interest positions Litecoin as a strong candidate for the next U.S.-approved cryptocurrency ETF, joining Bitcoin and Ethereum ETFs on the list. As the SEC’s leadership transition unfolds, the cryptocurrency industry awaits further updates on the application’s progress.

[ad_2]